Stationary Gas Analyzer Market Size (2025-2030)

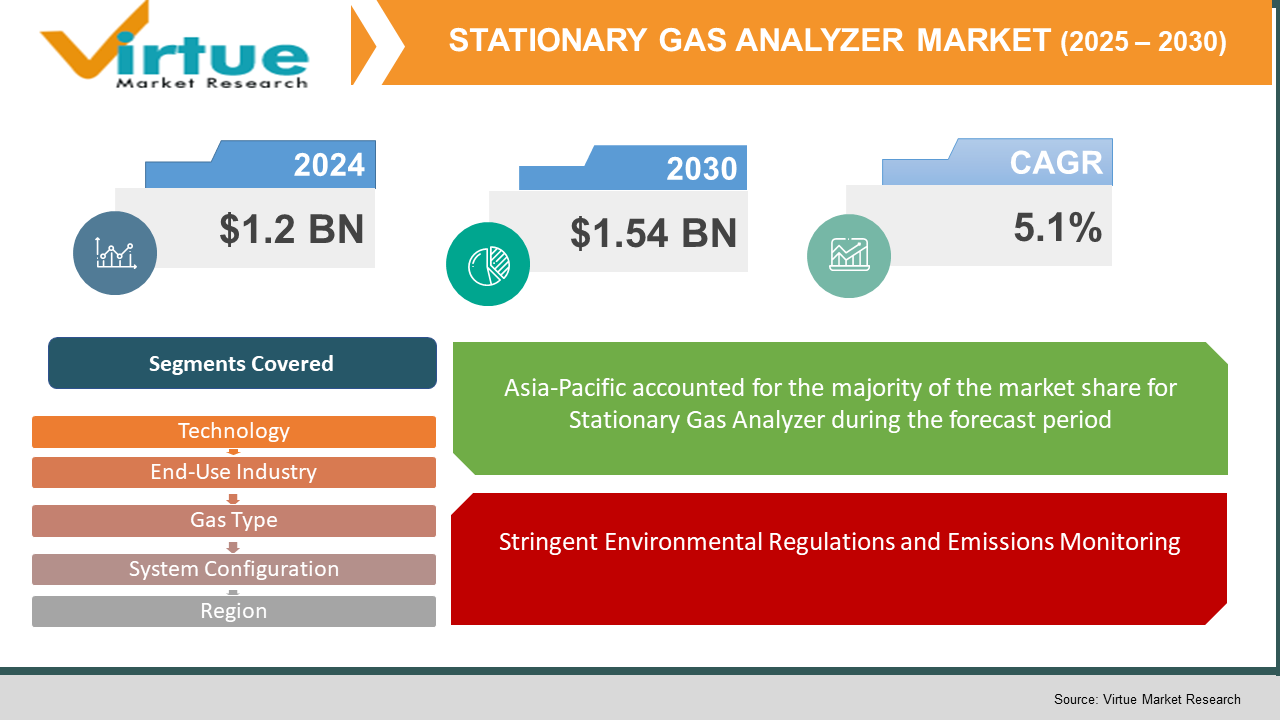

The Stationary Gas Analyzer Market was valued at USD 1.2 billion in 2024 and is projected to reach a market size of USD 1.54 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.1%.

The Stationary Gas Analyzer Market forms the bedrock of safety, process optimization, and environmental compliance across a multitude of heavy industries. Unlike their portable counterparts, stationary gas analyzers are permanently installed systems designed for uninterrupted, long-term operation, providing real-time data on the composition and concentration of various gases. The fundamental purpose of these systems is to detect hazardous leaks, ensure efficient combustion, control industrial processes, and monitor emissions to adhere to stringent regulatory standards. The market's significance has been amplified by a global paradigm shift towards heightened industrial safety protocols and a collective, cross-industry commitment to reducing environmental footprints. The technological landscape of the stationary gas analyzer market is diverse and sophisticated, encompassing a range of detection principles such as infrared, electrochemical, zirconia oxide, and photoionization detectors, each tailored for specific gases and applications. This technological heterogeneity allows end-users to select systems that offer the optimal balance of sensitivity, selectivity, response time, and cost for their unique operational contexts. The evolution of this market has been characterized by a relentless pursuit of greater accuracy, reliability, and lower maintenance requirements. Modern systems are increasingly integrated with digital communication protocols, enabling seamless data transmission to central control rooms and distributed control systems (DCS). This connectivity is pivotal for creating a holistic view of plant operations, facilitating predictive maintenance, and enabling swift, data-driven responses to process deviations or safety incidents.

The market is also witnessing a trend towards multi-gas analysis, where single units are capable of monitoring several different gases simultaneously, offering a more cost-effective and space-efficient solution compared to deploying multiple single-gas detectors. This innovation is particularly valuable in complex industrial environments where a variety of gaseous hazards or process components must be monitored concurrently.

Key Market Insights:

The adoption rate of infrared-based analyzers for hydrocarbon monitoring in the oil and gas sector stood at a significant 75% in 2024.

In the power generation industry, nearly 85% of all coal-fired plants utilized stationary analyzers for continuous emissions monitoring systems (CEMS) to comply with environmental mandates in 2024.

The market for electrochemical sensors used in toxic gas detection represented a value of over USD 600 million in 2024. It was noted that systems integrated with IIoT capabilities for remote monitoring and diagnostics saw a 40% increase in demand in 2024. The chemical industry's investment in stationary analyzers for process control applications was valued at approximately USD 550 million in 2024.

Furthermore, the installation of open-path gas detection systems, which monitor gas concentrations over long distances, grew by 25% in facilities with large, open process areas in 2024.

The market for zirconia oxide sensors, primarily used for oxygen analysis in combustion control, was estimated to be worth USD 300 million in 2024. In the same year, about 60% of new water treatment facilities incorporated stationary analyzers for monitoring gases like hydrogen sulfide and methane.

The average replacement cycle for electrochemical sensors in these systems was found to be approximately 2.5 years in 2024.

The demand for analyzers capable of detecting volatile organic compounds (VOCs) using photoionization detectors (PIDs) accounted for 15% of new installations in the petrochemical sector in 2024.

Spending on after-sales services, including calibration and maintenance, constituted nearly 20% of the total market revenue in 2024.

Approximately 30% of all installed systems in 2024 were multi-point configurations, monitoring several locations with a single central unit.

The food and beverage industry's use of CO2 analyzers for modified atmosphere packaging (MAP) processes represented a market segment of USD 150 million in 2024.

Systems with SIL-2 (Safety Integrity Level) certification constituted over 50% of purchases for critical safety applications in 2024.

Market Drivers:

Stringent Environmental Regulations and Emissions Monitoring

A primary driver for the stationary gas analyzer market is the escalating pressure from governmental and international bodies to curtail industrial pollution. Regulations concerning greenhouse gases, nitrogen oxides (NOx), sulfur oxides (SOx), and other pollutants are becoming increasingly stringent worldwide. Industries such as power generation, cement manufacturing, and chemicals are mandated to install Continuous Emission Monitoring Systems (CEMS) to ensure their emissions remain within legally prescribed limits. Stationary gas analyzers are the core component of these systems, providing the accurate, reliable, and continuous data required for compliance reporting. Failure to comply with results in severe financial penalties and reputational damage, making investment in high-quality analyzers a non-negotiable operational necessity.

Heightened Focus on Industrial Safety and Process Optimization

The unwavering focus on protecting personnel, assets, and the surrounding community from hazardous gas leaks is a powerful market catalyst. Industries like oil and gas, chemical processing, and mining operate in environments where the accidental release of toxic or flammable gases can have catastrophic consequences. Stationary gas analyzers provide the first line of defense, offering early warnings that enable timely evacuations and mitigation measures. By precisely monitoring gas concentrations, operators can optimize processes like combustion for maximum fuel efficiency, ensure product quality in chemical synthesis, and prevent conditions that could lead to equipment failure.

Market Restraints and Challenges:

The stationary gas analyzer market faces restraints primarily from the high initial capital expenditure required for system procurement and installation, which can be a significant barrier for small and medium-sized enterprises. The inherent complexity of integrating analyzers with existing plant control systems and the challenge of ensuring long-term sensor stability and accuracy in harsh industrial environments also pose significant hurdles for widespread adoption.

Market Opportunities:

Substantial market opportunities are emerging from the integration of Industrial Internet of Things (IIoT) and artificial intelligence (AI) with gas analysis systems. This creates avenues for developing smart analyzers capable of predictive maintenance, self-calibration, and providing deeper process insights through data analytics. The growing hydrogen economy presents a massive opportunity for specialized analyzers designed for hydrogen production, storage, and transportation infrastructure. Additionally, expansion into emerging applications like biogas production, carbon capture and storage (CCS), and indoor air quality monitoring in commercial buildings offers significant potential for market growth.

STATIONARY GAS ANALYZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By technology, end use industry, gas type, system configuration, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, ABB Ltd., Emerson Electric Co., Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Teledyne Technologies Incorporated, Servomex, and Yokogawa Electric Corporation |

Stationary Gas Analyzer Market Segmentation:

Stationary Gas Analyzer Segmentation by Technology:

- Infrared (IR)

- Electrochemical

- Zirconia Oxide

- Catalytic Bead

- Photoionization Detector (PID)

- Flame Ionization Detector (FID)

Infrared (IR) technology is the fastest-growing segment, prized for its long-term stability, minimal maintenance requirements, and ability to detect a wide range of hydrocarbon and other gases. Its non-contact measurement principle means sensors are not consumed or poisoned, leading to a lower total cost of ownership and making it increasingly popular.

Electrochemical sensors remain the most dominant technology due to their cost-effectiveness, high sensitivity, and compact size, making them ideal for detecting a vast array of toxic gases like carbon monoxide and hydrogen sulfide. Their widespread use in life safety applications across numerous industries solidifies their market dominance.

Stationary Gas Analyzer Segmentation by End-Use Industry:

- Oil & Gas

- Power Generation

- Chemicals & Petrochemicals

- Water & Wastewater Treatment

- Food & Beverage

- Metals & Mining

- Pharmaceuticals

The water and wastewater treatment sector is the fastest-growing end-use segment. Increased urbanization and stricter regulations on odor control and worker safety are driving the demand for continuous monitoring of gases like hydrogen sulfide, methane, and chlorine, fueling investment in stationary analysis systems.

The oil and gas industry are the most dominant end-user, commanding the largest market share. The absolute necessity of monitoring flammable gases (like methane) and toxic gases (like H2S) at every stage—from extraction and refining to transportation—makes stationary gas analyzers a fundamental safety and operational requirement.

Stationary Gas Analyzer Segmentation by Gas Type:

- Oxygen (O2)

- Carbon Monoxide (CO)

- Methane (CH4)

- Nitrogen Oxides (NOx)

- Hydrogen Sulfide (H2S)

- Volatile Organic Compounds (VOCs)

- Carbon Dioxide (CO2)

Methane detection is the fastest-growing segment, driven by a dual focus on safety in industries handling natural gas and environmental concerns regarding its potent greenhouse effect. Global initiatives to reduce methane emissions from industrial and agricultural sources are accelerating the deployment of dedicated methane analyzers.

Oxygen (O2) analysis remains the most dominant segment. Its critical role in both safety (detecting oxygen deficiency in confined spaces) and process control (optimizing combustion efficiency in boilers and furnaces) makes it a universally required measurement across nearly every industrial sector, ensuring its leading market position.

Stationary Gas Analyzer Segmentation by System Configuration:

- Single-Point Systems

- Multi-Point Systems

- Open-Path Systems

Open-path systems are the fastest-growing configuration, favored for monitoring large perimeter areas or long fence lines at industrial facilities. Their ability to detect gas clouds over hundreds of meters with a single system offers superior coverage and a faster response to large leaks compared to multiple point detectors.

Single-point systems continue to be the most dominant configuration. Their simplicity, lower cost, and ease of installation make them the default choice for monitoring specific, critical locations such as pump seals, valve manifolds, or areas with a high likelihood of a leak, ensuring their widespread and foundational use.

Stationary Gas Analyzer Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- Middle East & Africa

- South America

Asia-Pacific is both the fastest-growing and on the verge of becoming the most dominant region, driven by rapid industrialization in countries like China and India, massive infrastructure development, and the progressive implementation of stringent environmental and safety regulations, creating immense demand for new gas analysis systems.

COVID-19 Impact Analysis:

The COVID-19 pandemic introduced initial disruptions to the stationary gas analyzer market through supply chain delays and deferred project investments. However, the crisis also underscored the importance of operational resilience and automation, accelerating the adoption of systems with remote monitoring capabilities. Furthermore, a heightened global focus on air quality and respiratory health spurred interest in advanced gas monitoring technologies, particularly in pharmaceutical manufacturing and critical infrastructure sectors, ultimately reinforcing the market's long-term growth trajectory as industrial activity resumed.

Latest Trends and Developments:

The latest trends are centered on digitalization and intelligence. The integration of IIoT allows for real-time data access from anywhere, while AI-driven analytics enable predictive maintenance, forecasting sensor lifespan before failure. There is a significant push towards miniaturization without compromising performance, and the development of laser-based technologies like Tunable Diode Laser Absorption Spectroscopy (TDLAS) is offering higher selectivity and faster response times. The demand for certified systems that comply with international safety standards (e.g., SIL, ATEX) is also becoming standard practice.

Key Players in the Market:

- Siemens AG

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Teledyne Technologies Incorporated

- Servomex

- AMETEK, Inc.

- Yokogawa Electric Corporation

Chapter 1. Stationary Gas Analyzer Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Stationary Gas Analyzer Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Stationary Gas Analyzer Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Stationary Gas Analyzer Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Stationary Gas Analyzer Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Stationary Gas Analyzer Market– By Technology

6.1 Introduction/Key Findings

6.2 Infrared (IR)

6.3 Electrochemical

6.4 Zirconia Oxide

6.5 Catalytic Bead

6.6 Photoionization Detector (PID)

6.7 Flame Ionization Detector (FID)

6.8 Y-O-Y Growth trend Analysis By Technology

6.9 Absolute $ Opportunity Analysis By Technology , 2025-2030

Chapter 7. Stationary Gas Analyzer Market– By End-Use Industry

7.1 Introduction/Key Findings

7.2 Oil & Gas

7.3 Power Generation

7.4 Chemicals & Petrochemicals

7.5 Water & Wastewater Treatment

7.6 Food & Beverage

7.7 Metals & Mining

7.8 Pharmaceuticals

7.9 Y-O-Y Growth trend Analysis By End-Use Industry

7.10 Absolute $ Opportunity Analysis By End-Use Industry , 2025-2030

Chapter 8. Stationary Gas Analyzer Market– By Gas Type

8.1 Introduction/Key Findings

8.2 Oxygen (O2)

8.3 Carbon Monoxide (CO)

8.4 Methane (CH4)

8.5 Nitrogen Oxides (NOx)

8.6 Hydrogen Sulfide (H2S)

8.7 Volatile Organic Compounds (VOCs)

8.8 Carbon Dioxide (CO2)

8.9 Y-O-Y Growth trend Analysis Gas Type

8.10 Absolute $ Opportunity Analysis Gas Type , 2025-2030

Chapter 9. Stationary Gas Analyzer Market– By System Configuration

9.1 Introduction/Key Findings

9.2 Single-Point Systems

9.3 Multi-Point Systems

9.4 Open-Path Systems

9.5 Y-O-Y Growth trend Analysis System Configuration

9.6 Absolute $ Opportunity Analysis System Configuration , 2025-2030

Chapter 10. Stationary Gas Analyzer Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Technology

10.1.3. By Gas Type

10.1.4. By End-Use Industry

10.1.5. System Configuration

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Technology

10.2.3. By Gas Type

10.2.4. By End-Use Industry

10.2.5. System Configuration

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Technology

10.3.3. By System Configuration

10.3.4. By End-Use Industry

10.3.5. Gas Type

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By System Configuration

10.4.3. By End-Use Industry

10.4.4. By Technology

10.4.5. Gas Type

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Gas Type

10.5.3. By System Configuration

10.5.4. By End-Use Industry

10.5.5. Technology

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. STATIONARY GAS ANALYZER MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Siemens AG

11.2 ABB Ltd.

11.3 Emerson Electric Co.

11.4 Honeywell International Inc.

11.5 Drägerwerk AG & Co. KGaA

11.6 MSA Safety Incorporated

11.7 Teledyne Technologies Incorporated

11.8 Servomex

11.9 AMETEK, Inc.

11.10 Yokogawa Electric Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The primary growth drivers are the enforcement of stringent environmental regulations that mandate continuous emissions monitoring and a heightened global focus on industrial safety, requiring the reliable detection of toxic and flammable gases to protect personnel and assets.

The main challenges include the high initial investment and installation costs, the ongoing expenses related to maintenance and calibration, and the need for skilled technicians to operate and service the complex systems effectively, which can be a barrier for smaller companies.

Key players include Siemens AG, ABB Ltd., Emerson Electric Co., Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Teledyne Technologies Incorporated, Servomex, and Yokogawa Electric Corporation

North America currently holds the largest market share, estimated at around 35%, due to its mature industrial base and long-standing enforcement of strict safety and environmental laws.

The Asia-Pacific region is expanding at the highest rate. This growth is fueled by rapid industrialization, significant government and private investment in new infrastructure, and the adoption of global safety and environmental standards.