Starter Culture Market Size (2025 – 2030)

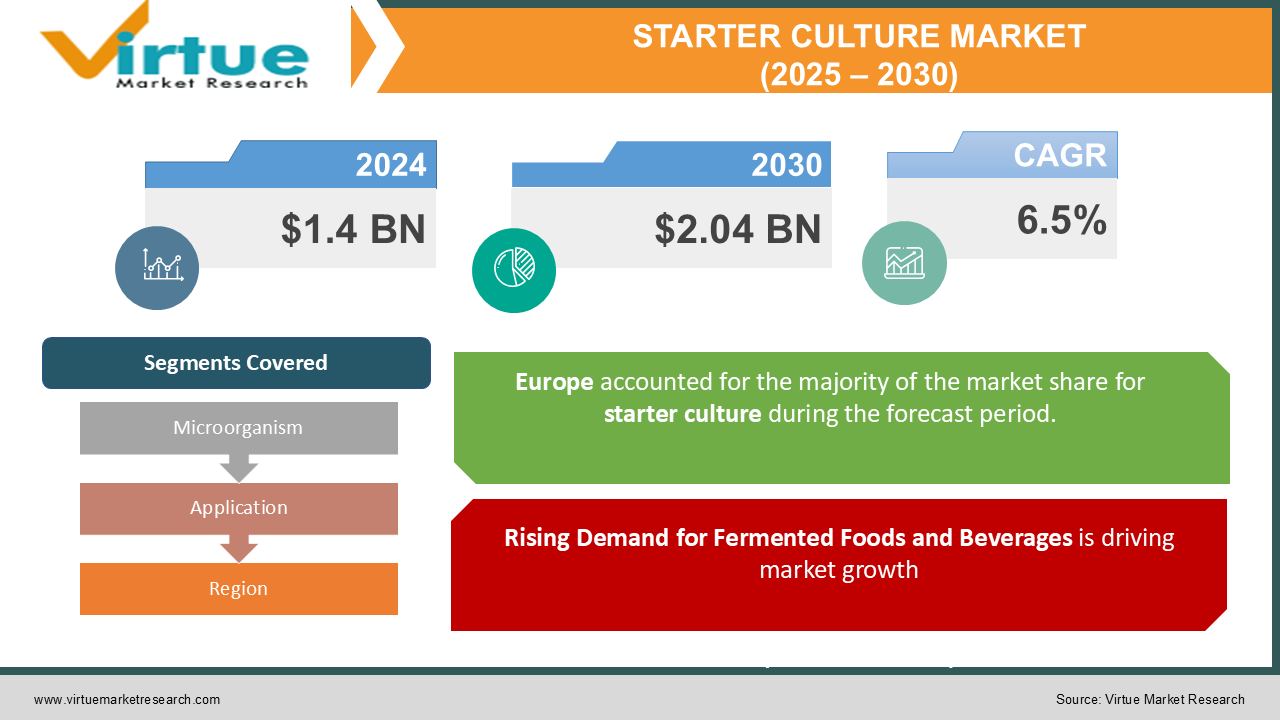

The Global Starter Culture Market was valued at USD 1.4 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. By 2030, the market is expected to reach USD 2.04 billion.

Starter cultures, composed of specific strains of microorganisms, are widely used in the production of fermented food and beverages, including dairy products, baked goods, and alcoholic drinks. These cultures enhance flavor, texture, and shelf life while ensuring product consistency. The growing popularity of fermented food and beverages and increased consumer awareness about the health benefits of probiotics are driving significant growth in this market.

Key Market Insights

-

The increasing demand for fermented dairy products such as yogurt and cheese is driving the growth of starter cultures, with dairy being the dominant application segment contributing to over 45% of the market share in 2024.

-

The global focus on functional foods has bolstered the use of starter cultures in non-dairy applications, including plant-based alternatives, which saw a growth rate of 7.8% in 2024.

-

North America and Europe accounted for over 60% of the market in 2024, driven by high consumption of fermented foods and beverages in these regions. Asia-Pacific is emerging as a lucrative market, with countries like India and China experiencing significant growth in probiotic-enriched and traditional fermented foods.

Global Starter Culture Market Drivers

Rising Demand for Fermented Foods and Beverages is driving market growth:

Starter cultures are critical for the production of these products, contributing to improved flavor, texture, and nutritional value. The probiotic benefits offered by fermented foods such as yogurt, kefir, and kombucha are driving their popularity among health-conscious consumers. Additionally, the rise of the "clean label" trend, emphasizing natural ingredients and reduced chemical preservatives, aligns perfectly with the use of natural starter cultures. Consumers are increasingly looking for products that not only taste good but also contribute to gut health and overall well-being. The dairy industry, in particular, continues to dominate this space, with innovations in lactose-free and low-fat fermented products boosting demand for advanced starter cultures.

Expanding Applications Across Non-Dairy and Plant-Based Alternatives is driving market growth:

The demand for starter cultures in non-dairy applications has seen unprecedented growth, particularly within the plant-based food sector. With the global rise of veganism and plant-based diets, manufacturers are developing starter cultures suitable for plant-based milk, yogurt, and cheese alternatives. These products rely on starter cultures for fermentation, flavor enhancement, and preservation. The versatility of starter cultures in producing soy-based yogurt, almond-based cheese, and fermented tofu has unlocked significant growth opportunities. Furthermore, alcoholic beverages such as beer, wine, and cider are leveraging starter cultures for precision fermentation, enhancing both quality and yield.

Technological Advancements in Microbial Strains is driving market growth:

Ongoing research and development in microbial strains and fermentation processes are revolutionizing the starter culture industry. Scientists are engineering strains with enhanced functionalities, including improved resistance to antibiotics, shorter fermentation times, and better adaptability to specific environmental conditions. Advanced technologies such as CRISPR and genetic engineering are allowing the customization of starter cultures for niche applications. For instance, strains with high tolerance to extreme pH levels are being developed for acidic beverages like kombucha. Additionally, microbial cultures with extended shelf lives and compatibility with large-scale industrial production processes are gaining traction among manufacturers.

Global Starter Culture Market Challenges and Restraints

High Costs and Complexity in R&D is restricting market growth:

While technological advancements are a boon for the starter culture market, the cost of research and development remains a significant challenge. Developing new strains involves extensive testing, including stability analysis, performance in different substrates, and compliance with food safety regulations. Furthermore, the complexity of maintaining live microorganisms during storage and transportation adds to operational challenges. The need for cold-chain logistics and specialized packaging solutions increases the overall cost of production, limiting the accessibility of advanced starter cultures for smaller manufacturers.

Stringent Regulatory Landscape is restricting market growth:

The starter culture market operates within a highly regulated framework, especially in developed regions such as North America and Europe. Governments and regulatory bodies impose strict guidelines on the use of microbial cultures in food and beverages to ensure safety and quality. Compliance with these standards often involves costly certifications and time-consuming approval processes. For instance, manufacturers must demonstrate the non-pathogenic nature of their microbial strains and their effectiveness under various conditions. These regulatory hurdles can delay product launches and limit the ability of companies to innovate freely. Additionally, any deviations from regulatory standards can lead to significant financial penalties and reputational damage.

Market Opportunities

The increasing consumer preference for natural and functional foods presents a significant opportunity for the starter culture market. As more consumers prioritize gut health and immunity, the demand for probiotics and fermented products is rising globally. Manufacturers are capitalizing on this trend by introducing starter cultures tailored for specific health benefits, such as improved digestion or enhanced nutrient absorption. Additionally, the growing popularity of ethnic and artisanal foods, including kimchi, sauerkraut, and sourdough bread, is expanding the application scope of starter cultures. Developing markets such as Asia-Pacific and Latin America offer untapped potential, with rising urbanization and disposable incomes fueling the demand for processed and convenience foods. Collaborations between food companies and biotechnology firms can further accelerate innovation in this space, enabling the development of customized starter cultures for diverse culinary traditions and dietary preferences.

STARTER CULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Microorganism, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Chr. Hansen, DuPont, DSM, Sacco System, Lallemand, Bioprox, Biena, Codexis, Dalton Biotechnologies |

Starter Culture Market Segmentation - By Microorganism

-

Yeast

-

Thermophilic

-

Mesophilic

-

Bacteria

-

Mold

The bacteria segment is the most dominant, contributing over 60% of the market share in 2024. This dominance is attributed to the widespread use of bacterial strains like Lactobacillus and Streptococcus in dairy fermentation, ensuring consistent quality and probiotic benefits.

Starter Culture Market Segmentation - By Application

-

Dairy Products

-

Beverages

-

Bakery Products

-

Meat Products

-

Others

Dairy products lead the market, accounting for nearly 45% of the revenue share in 2024. The use of starter cultures in yogurt, cheese, and kefir production remains a key growth driver due to the increasing global consumption of these products.

Starter Culture Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe is the most dominant region in the global starter culture market, contributing over 40% of the total revenue in 2024. The high consumption of fermented foods, coupled with advanced food technology infrastructure, drives the market in this region. Countries like Germany, France, and Italy are leading markets for dairy and bakery applications. The region’s strong regulatory support for natural and organic food ingredients further fosters growth. Additionally, Europe’s tradition of fermented products, such as sourdough bread and aged cheese, ensures consistent demand for starter cultures.

COVID-19 Impact Analysis on the Starter Culture Market

The COVID-19 pandemic had a mixed impact on the starter culture market. On the positive side, the pandemic led to an increased focus on health and wellness, which significantly boosted the demand for probiotics and fermented foods. As consumers became more conscious of their immunity and overall health, they actively sought out foods like yogurt, kefir, and kombucha. This surge in health-driven consumption benefitted the starter culture market, particularly in the retail segment, where these products saw greater visibility and sales. The demand for starter cultures, which are essential for the fermentation process in these products, thus experienced a notable uptick. However, the pandemic also brought about significant challenges. Supply chain disruptions and restrictions on industrial operations affected large-scale manufacturers, particularly in the initial stages of the pandemic. The closure of restaurants and foodservice outlets further compounded the situation, leading to a temporary decline in demand for fermented foods and beverages in these sectors. This, in turn, impacted overall sales volumes for starter cultures in the foodservice industry. Despite these challenges, the market showed resilience. As economies began to reopen and restrictions eased, consumer interest in health-focused foods remained strong, driving a recovery in demand for fermented products. By 2022, the market had begun to rebound, with growth expected to continue as consumer habits shifted toward wellness-oriented food choices. The recovery trajectory appears steady, with the market showing positive momentum moving forward. The ongoing trend toward health-conscious consumption is expected to further fuel the growth of the starter culture market in the coming years.

Latest Trends/Developments

The starter culture market is experiencing several noteworthy trends that are shaping its future. One of the key developments is the creation of multifunctional starter cultures, which not only aid in fermentation but also offer health benefits, such as boosting immunity or improving digestion. This dual-purpose functionality is appealing to health-conscious consumers seeking more than just a tasty product. Another significant trend is the adoption of precision fermentation techniques. These advanced methods allow manufacturers to craft specific flavor profiles and textures in fermented foods, giving them greater control over product quality and consistency. Additionally, the rise of plant-based and vegan diets is driving innovation in starter cultures that are suitable for plant-based substrates. As more consumers shift toward plant-based foods, manufacturers are developing cultures tailored to meet the unique challenges of fermenting plant-based products. The growing interest in these diets is leading to the creation of new, vegan-friendly fermented foods, expanding the market's offerings. The increased use of freeze-dried starter cultures is another trend in the market. Freeze-dried cultures provide extended shelf life and are easier to store and transport, making them particularly attractive to manufacturers looking to streamline production and reduce waste. Finally, collaborations between food manufacturers and biotech companies are playing a key role in advancing starter cultures. These partnerships are paving the way for the development of specialized cultures tailored to regional and cultural cuisines, allowing for more diverse and customized fermented products that cater to a wider range of consumer preferences. These trends are driving the evolution of the starter culture market, opening up new opportunities and innovations.

Key Players

-

Chr. Hansen

-

DuPont

-

DSM

-

Sacco System

-

Lallemand

-

Bioprox

-

Biena

-

Codexis

-

Dalton Biotechnologies

Chapter 1. Starter Culture Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Starter Culture Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Starter Culture Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Starter Culture Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Starter Culture Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Starter Culture Market – By Microorganism

6.1 Introduction/Key Findings

6.2 Yeast

6.3 Thermophilic

6.4 Mesophilic

6.5 Bacteria

6.6 Mold

6.7 Y-O-Y Growth trend Analysis By Microorganism

6.8 Absolute $ Opportunity Analysis By Microorganism, 2025-2030

Chapter 7. Starter Culture Market – By Application

7.1 Introduction/Key Findings

7.2 Dairy Products

7.3 Beverages

7.4 Bakery Products

7.5 Meat Products

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Starter Culture Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Microorganism

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Microorganism

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Microorganism

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Microorganism

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Microorganism

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Starter Culture Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Chr. Hansen

9.2 DuPont

9.3 DSM

9.4 Sacco System

9.5 Lallemand

9.6 Bioprox

9.7 Biena

9.8 Codexis

9.9 Dalton Biotechnologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Starter Culture Market was valued at USD 1.4 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. By 2030, the market is expected to reach USD 2.04 billion.

Key drivers include rising demand for fermented foods, expanding applications in non-dairy products, and technological advancements in microbial strains.

The market is segmented by product (bacteria, yeast, molds) and by application (dairy products, beverages, bakery products, meat products, others).

Europe is the most dominant region, contributing over 40% of the market revenue, driven by high consumption of fermented foods and advanced food technology infrastructure.

Key players include Chr. Hansen, DuPont, DSM, Sacco System, Lallemand, Bioprox, Biena, Codexis, and Dalton Biotechnologies.