Standard Aerosol Market Size (2024 –2030)

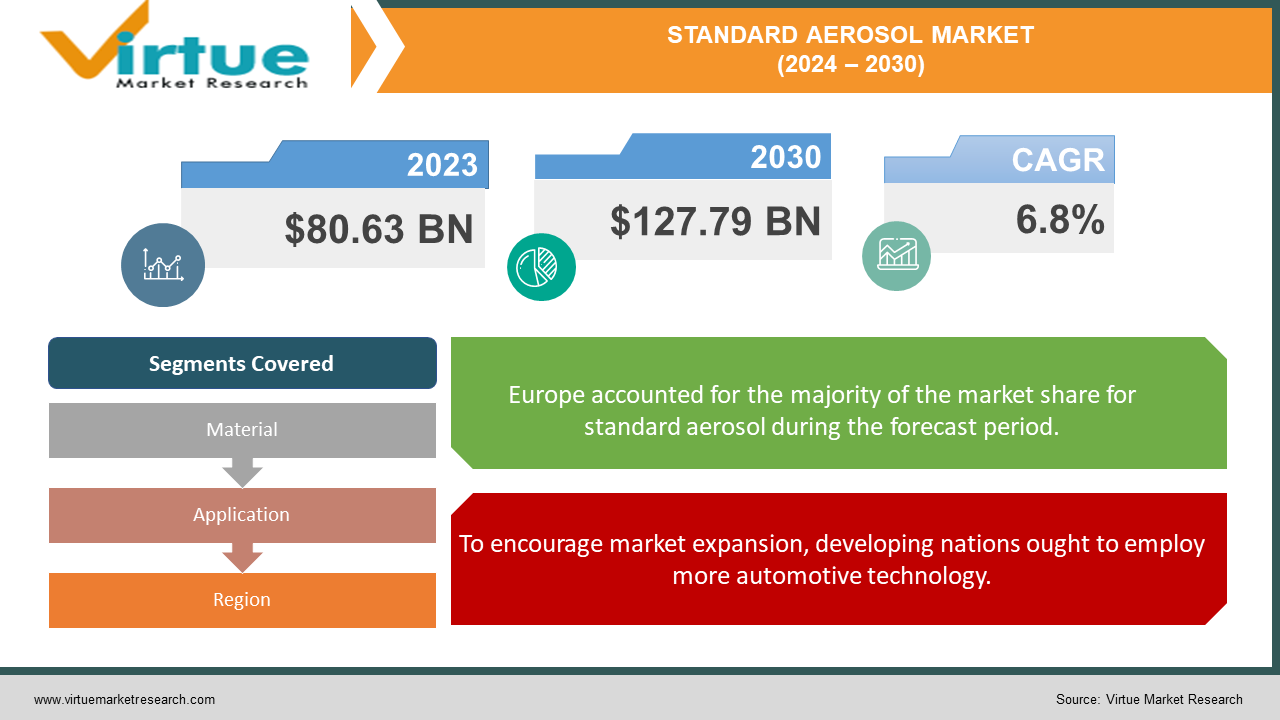

The Global Standard Aerosol Market is estimated to be worth USD 80.63 billion in 2023 and is projected to reach a value of USD 127.79 billion by 2030, growing at a steady CAGR of 6.8% during the outlook period 2024-2030.

With a wide range of products to suit different industries, the aerosol market is expanding. Aerosols are liquid drops or microscopic particles sprayed into gases such as air or nitrogen. They can be found in home goods like air fresheners and cleaning sprays, as well as in personal care items like deodorants and hairsprays. Aerosols are used in cooking sprays, insect repellents, and even in the production of whipped cream and fizzy beverages. Aerosols come in many useful forms in daily life!

Key Market Insights:

The global standard aerosol market is estimated to be around 6 billion units in terms of volume, with personal care and household products being the major consumers.Europe accounts for nearly 30% of the global standard aerosol market share, driven by the region's stringent regulations and consumer preferences for aerosol-based products.The personal care segment holds a market share of over 45% in the standard aerosol market, with hairsprays, deodorants, and shaving foams as the major products.Aluminum cans dominate the standard aerosol packaging market, capturing a share of around 70%, owing to their lightweight, recyclability, and cost-effectiveness.The food and beverage segment is expected to grow at a rate of 5-6% annually, driven by the increasing demand for aerosol-based whipped cream and cooking sprays.

Global Standard Aerosol Market Drivers:

To encourage market expansion, developing nations ought to employ more automotive technology.

Aerosols are used in the automotive industry for a variety of products, including wipes, oil cans, and ignition sealers. They are also used to clean automotive components like brakes, electric motors, and battery terminals. Aerosols come in handy for lubricating and cleaning engines, tires, and other automotive components. Moreover, aerosol cans hold items like polishes and lubricants!

Market expansion is driven by rising demand for personal care and pharmaceutical packaging.

Numerous household and personal care items, including hair sprays, deodorants, insecticides, and cleaning supplies, contain aerosols. Because more people are using products like hair sprays and deodorants, the market for aerosols is expanding. The market is being driven even more by the promotion of beauty products by major corporations like L'Oréal and Unilever. People are purchasing more cosmetics and personal hygiene products as their disposable income increases. By 2028, the global market for personal care and beauty products is anticipated to be very valuable. Since aerosols are used in many personal care products, including hairspray, deodorant, and shaving cream, this is good news for the aerosol market. More people want to style their hair, which is contributing to the growth of the hair care industry. Men are also purchasing more deodorant and other grooming products because they are paying more attention to these things. Men love Axe and Old Spice, and new products are always being developed to cater to their needs.

Standard Aerosol Market Challenges and Restraints:

Because aerosol cans are more expensive than conventional packaging, the finished goods cost more. Other alternatives are being discovered by manufacturers, such as bag-in-bottle containers, which spray continuously without the need for aerosol propellants. These sprayers are reasonably priced and more environmentally friendly. Reusable spray bottles are less expensive than aerosol cans since they don't need to be thrown away after use. They become greener as a result.

Standard Aerosol Market Opportunities:

The Standard Aerosol Market offers numerous chances for expansion and creativity. First, businesses should concentrate on creating novel, aesthetically pleasing, and environmentally friendly packaging. Second, there's a chance to grow into developing nations where increased consumer spending presents fresh chances for development. Thirdly, businesses can reach niche markets and adapt to changing consumer demands by broadening their product offerings by adding new aerosol products or branching out into associated categories. Additionally, by creating aerosol products with particular uses like air purification and disinfection, there's a chance to address health and safety issues. Finally, using digital technologies to improve customer experience and streamline operations includes using online platforms and smart packaging. All things considered, the Standard Aerosol Market offers a variety of chances for businesses to develop, grow, and maintain their competitiveness in the market.

STANDARD AEROSOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Henkel AG & co., KGaA, S. C. Johnson & Son, Inc., Procter & Gamble, Unilever, Honeywell International Inc., Akzo Nobel N.V., Beiersdorf AG, Estée Lauder Inc., Oriflame Cosmetics Global SA |

Global Standard Aerosol Market Segmentation: By Material

-

Steel

-

Aluminum

-

Others

Aluminum is anticipated to continue expanding quickly due to its significant market share, which will account for 60.6% of sales in 2022. It's excellent for packaging because it presents well, is highly recyclable, and gives the impression that the products are robust. However, the cost of aerosol products has increased recently due to a significant global increase in the price of aluminum. This could cause businesses to search for less expensive solutions, which would impede the aluminum market's expansion. Because plastic is lightweight, inexpensive, and simple to recycle, it has also become increasingly popular, particularly PET plastic. However, there are stringent laws prohibiting the use of plastic packaging, particularly in Europe, which may limit the future growth of this market.

Global Standard Aerosol Market Segmentation: By Application

-

Personal Care

-

Household

-

Automotive & Industrial

With 34.7% of total sales in 2022, the personal care category was the best-selling category. The primary reason for this growth is the increase in the sales of deodorants and hair care items. There is also a greater need for gender-specific products in developing nations where people are spending more money and leading more varied lifestyles. Due to improved living standards and increased concern for hygiene, particularly in developing nations, the home market is expanding swiftly as well. More people are purchasing household goods like disinfectants, cleansers, and air fresheners. Because these products last longer and produce less waste, it is better for the environment when they are sold in smaller packages.

Global Standard Aerosol Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

With 36.1% of the global aerosol market revenue share and the highest aerosol production in 2023, Europe dominated the aerosol market. The personal care industry is largely to blame for this dominance. However, laws governing emissions known as volatile organic compounds (VOCs) imposed by organizations like the European Commission and EPA restrict market expansion in Europe. One of the fastest-growing regions is Asia Pacific, where annual growth is predicted to be 8.0%. The governments of China and India are opening up investment opportunities, particularly in sectors like paint, personal care, and automobiles because of rising consumer spending. Significant growth is also expected in the Middle East and Africa, primarily due to high hair care product spending in Saudi Arabia and the United Arab Emirates. Aerosol products are being distributed to consumers by major retailers such as Carrefour and Lulu Hypermarket in countries like Kuwait, Saudi Arabia, and the United Arab Emirates.

COVID-19 Impact on the Global Standard Aerosol Market:

The global supply chains were disrupted and the purchase of personal care products decreased as a result of the COVID-19 pandemic. Essential items have been in high demand since the outbreak, but supplies have been scarce. The pandemic also made it difficult to obtain the materials needed to produce goods. On the other hand, during COVID-19, pharmaceutical aerosols have been crucial. Many more patients required mechanical ventilation support as a result of the virus's widespread illness. These patients received medication via aerosols, which also helped them breathe more easily while using the machines.

Latest Trend/Development:

Numerous advancements and trends are reshaping the standard aerosol market. First, there's a strong focus on sustainability, with businesses developing reusable and recyclable packaging to minimize their negative effects on the environment. Second, the market for aerosol products like sanitizers and disinfectants is being driven by worries about health and safety. Thirdly, developing novel and inventive aerosol product formulations with distinct smells and tailored uses is a major area of focus. Furthermore, businesses are providing a range of options to accommodate individual preferences, meaning that personalization and customization are becoming increasingly significant. Finally, the use of online platforms and smart packaging technologies to improve consumer engagement is driving an increase in digital integration. All things considered, the standard aerosol market is embracing innovation, digitalization, sustainability, and adaptation to satisfy shifting consumer demands.

Key Players:

-

Henkel AG & co.

-

KGaA

-

S. C. Johnson & Son, Inc.

-

Procter & Gamble

-

Unilever

-

Honeywell International Inc.

-

Akzo Nobel N.V.

-

Beiersdorf AG

-

Estée Lauder Inc.

-

Oriflame Cosmetics Global SA

Market News:

-

At its Louisiana facility, Honeywell boosted production of the environmentally benign Solstice ze technology in December 2022. Foam insulation, aerosol sprays, air conditioning systems, and refrigeration all use this technology.

-

The Chinese division of Sherwin-Williams' Decorative Paints was fully acquired by AkzoNobel in August 2023. With this action, AkzoNobel can fortify its position in China and increase its market share beyond luxury goods.

-

The company Beiersdorf, which owns brands like NIVEA and 8X4, declared in September 2023 that their deodorant cans in Europe will now be 11.6% lighter and composed of at least 50% recycled aluminum. This adjustment will contribute to a 58% reduction in CO2 emissions, or about 30 tons less CO2 annually.

-

Colep Packaging and Envases Group decided to construct a new aerosol packaging facility in Mexico in October 2023. Three production lines for aluminum aerosol cans will be present in this plant. Customers from Mexico and Central America will be served by it.

Chapter 1. Standard Aerosol Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Standard Aerosol Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Standard Aerosol Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Standard Aerosol Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Standard Aerosol Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Standard Aerosol Market – By Application

6.1 Introduction/Key Findings

6.2 Personal Care

6.3 Household

6.4 Automotive & Industrial

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Standard Aerosol Market – By Material

7.1 Introduction/Key Findings

7.2 Steel

7.3 Aluminum

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Material

7.6 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Standard Aerosol Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Material

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Material

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Material

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Material

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Material

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Standard Aerosol Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Henkel AG & co.

9.2 KGaA

9.3 S. C. Johnson & Son, Inc.

9.4 Procter & Gamble

9.5 Unilever

9.6 Honeywell International Inc.

9.7 Akzo Nobel N.V.

9.8 Beiersdorf AG

9.9 Estée Lauder Inc.

9.10 Oriflame Cosmetics Global SA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Standard Aerosol Market is estimated to be worth USD 80.63 billion in 2023 and is projected to reach a value of USD 127.79 billion by 2030, growing at a steady CAGR of 6.8% during the outlook period 2024-2030.

Developing countries should use more automotive technology to boost market expansion and Growing Pharmaceutical and Personal Care Packaging Demand Fuels Market Growth are the factors driving the Global Standard Aerosol Market.

Alternatives that are accessible and dangers associated with product recalls.

Steel material is the fastest growing in the Global Standard Aerosol Market.

Asia-Pacific region is the fastest growing in the Global Standard Aerosol Market.