Spray Drying Equipment Market Size (2025 – 2030)

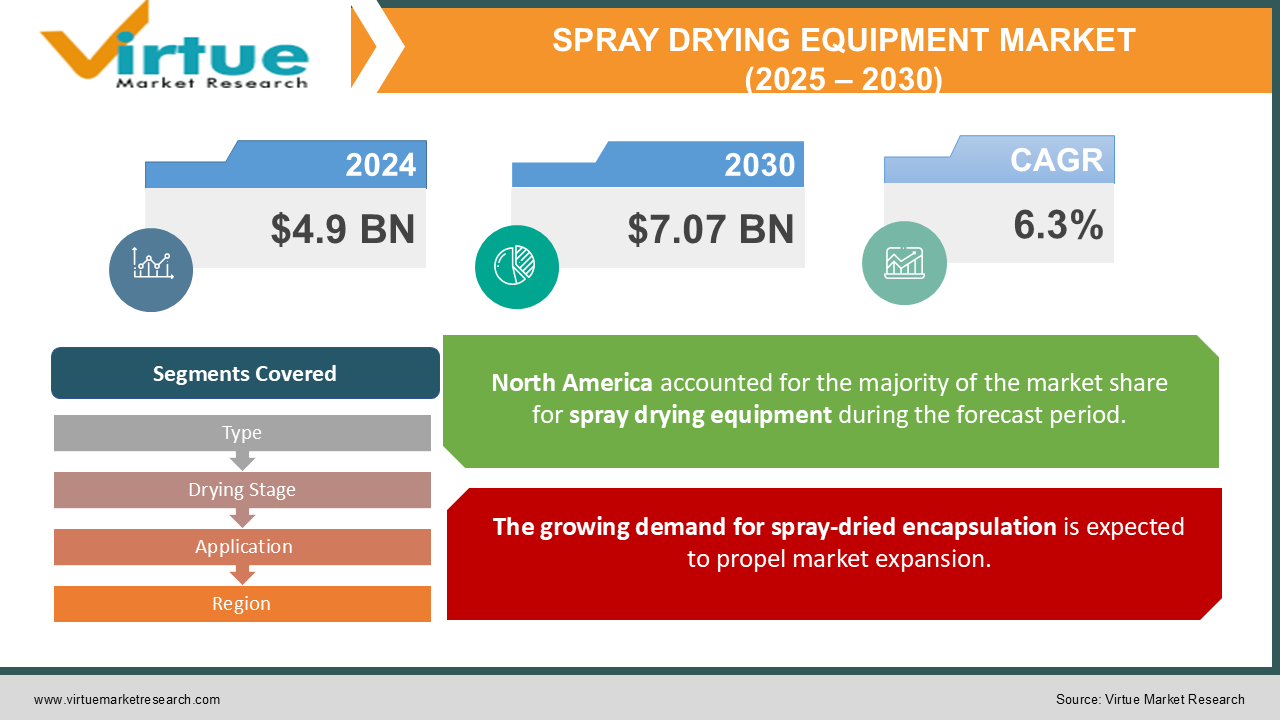

The Spray Drying Equipment Market was valued at USD 4.9 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 7.07 billion by 2030, growing at a CAGR of 6.3%.

Spray drying technology is employed to transform liquid or slurry-based materials into a dry powder form. The process involves spraying the liquid feed into a hot gas flow, causing the liquid to evaporate and leaving behind dry powder particles. This method is widely used across industries like food, chemicals, pharmaceuticals, and ceramics, primarily to create powdered products with enhanced characteristics, including extended shelf life, greater stability, and improved solubility. Key components of spray drying equipment include dryers, atomizers, and air filters, among others. The market for this equipment is witnessing steady growth, driven by the increasing demand for processed food products and the expanding use of spray drying techniques across various industries.

Key Market Insights:

-

The growth of the spray drying equipment market is fueled by the escalating demand for processed food products and the growing use of spray drying technologies across industries such as food, pharmaceuticals, and chemicals.

-

With advantages such as extended shelf life, lower transportation costs, and improved product quality, spray drying is becoming increasingly favored by manufacturers globally.

-

Consequently, the market for spray drying equipment is set to experience substantial growth in the near future, offering opportunities for industry participants to innovate and address the needs of an expanding market.

Spray Drying Equipment Market Drivers:

The growing demand for spray-dried encapsulation is expected to propel market expansion.

The encapsulation process is gaining popularity due to the continuous development of value-added products in the food and pharmaceutical sectors. Numerous studies have been conducted globally to explore and innovate this technology. Volatile and chemically unstable liquid foods, such as cardamom essential oil, are often processed using this method. Cardamom essential oil is widely used in Scandinavian, Arabic, and Indian cuisines, as well as in the perfumery and pharmaceutical industries. However, the instability of the ingredient has been a concern. The introduction of encapsulation effectively addresses this issue by stabilizing the ingredient. Amorphous Solid Dispersions (ASDs) are becoming increasingly popular in the pharmaceutical industry to enhance the bioavailability of poorly soluble active pharmaceutical ingredients (APIs), thus creating opportunities for the development and production of ASDs.

Spray Drying Equipment Market Restraints and Challenges:

The high installation and operational costs are expected to limit the growth of the market.

The high cost of spray drying equipment and its ongoing operation presents a significant challenge. These dryers typically have low thermal efficiency due to the large volume of hot air circulating in the chamber without coming into direct contact with the particles. Additionally, dryers that use dual-fluid nozzles require compressed gas, further increasing energy and pressure demands, which drives up overall costs, excluding labor and maintenance expenses. Moreover, issues related to the explosive nature of materials and dust formation can quickly impact the material integrity of spray dryers. These factors are likely to hinder market growth during the forecast period.

Spray Drying Equipment Market Opportunities:

Investments in both Greenfield and Brownfield developments are expected to support market growth.

Significant investments have been made in both brownfield and Greenfield sites across various industries. Both developed and developing economies are showing considerable interest in the specialized field of spray drying equipment, particularly in over 900 abandoned fields and green food, chemical, and pharmaceutical plants.

The growing demand for products in the pharmaceutical and nutritional sectors, such as antibiotics, penicillin, enzymes, and whey proteins, is expected to drive market growth during the forecast period. Additionally, advancements in technology enable manufacturers to develop energy-efficient products that are free from hazardous gases, creating substantial growth opportunities for the spray dryer industry.

SPRAY DRYING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Type, Drying Stage, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GEA Group , Aktiengesellschaft, European Spray, Dry Technologies SPX FLOW, Dedert Corporation , Buchi Labortecknik AG, Larsson Starch Technology AB, Advanced Drying System , Yamato Scientific America, Tetra Pak Group, Swenson Technology, Inc |

Spray Drying Equipment Market Segmentation: By Type

-

Rotary Atomizer

-

Nozzle Atomizer

-

Fluidized

-

Closed Loop

-

Centrifugal

The nozzle atomizer segment holds the largest market share, driven by the widespread use of nozzle-based equipment to produce free-flowing and coarser powders. These atomizers can be configured to offer a wide range of flow rates, making them ideal for applications that require precise flow control and the production of flexible particles. The increasing need to reduce moisture content while processing pharmaceutical products to achieve optimal quality and fine granular particles is expected to further drive the adoption of spray dryers in the forecast period.

The rotary atomizer segment is projected to register the highest compound annual growth rate (CAGR) during the forecast period. Rotary atomizers are known for their versatility, making them suitable for a broad range of products. They typically produce a narrower particle size distribution and looser powder compared to dual fluid nozzles.

Additionally, the fluidized segment is expected to experience significant growth in the coming years. This growth is attributed to factors such as the rising demand for drying processes that improve product quality while reducing energy consumption, an increasing number of industries adopting this technology, and growing demand from emerging economies worldwide.

The closed loop and centrifugal segments are anticipated to see moderate growth during the forecast period. Closed-loop dryers can reduce energy consumption in milk powder production by up to 60% compared to current practices, while centrifugal sprayers are most effective for producing solid powders or particles from liquid materials like solutions, emulsions, suspensions, and pumpable pastes.

Spray Drying Equipment Market Segmentation - By Drying Stage

-

Single Stage

-

Two Stage

-

Multi Stage

The two-stage segment currently holds a significant market share and is expected to maintain its dominance in the future. This can be attributed to the decreasing manufacturing costs and the rising demand for these dryers across various industrial applications, all while maintaining high product quality.

Furthermore, the multi-stage segment is anticipated to exhibit the highest compound annual growth rate (CAGR) during the forecast period. This is due to its ability to directly control the pressure between the first and final stages of the spray drying process, as well as its capacity to produce dust-free agglomerated solutions with optimal spreadability.

Spray Drying Equipment Market Segmentation - By Application

-

Food & Dairy

-

Pharmaceutical

-

Chemica

-

Others (Animal Feed))

The food and dairy segment holds the largest market share, driven by the widespread adoption of spray drying equipment for the production of egg powder, baby products, and coffee powder. Spray drying plays a crucial role in the food industry, facilitating the production of essential ingredients like fine-grained flavors. Additionally, favorable government policies in emerging economies such as India and China, including the increase in Foreign Direct Investment (FDI) limits in the food sector, are encouraging dairy companies to establish processing plants in these countries.

The pharmaceutical segment is projected to register the highest compound annual growth rate (CAGR) during the forecast period, driven by the rising demand for drugs across regions such as North America and Europe. Moreover, government initiatives aimed at boosting the pharmaceutical industry are expected to contribute to an increase in the demand for pharmaceutical products in India over the next eight years.

The chemical segment is anticipated to experience significant growth due to increased product development in the chemical industry, particularly for the spray drying of polymers, resins, and other chemical intermediates.

Spray Drying Equipment Market Segmentation - by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America leads the market, driven by strong demand for pharmaceutical products and technological advancements in the region. The region is expected to maintain its dominance in terms of revenue throughout the forecast period. North America boasts a well-established manufacturing sector that relies heavily on water usage in production processes, owing to the high demand for dry products from industries such as food and beverages, pharmaceuticals, and chemicals. This has increased pressure on industry participants to develop cost-effective, energy-efficient solutions for industrial applications.

The U.S. is projected to experience the fastest growth, driven by a high demand for powdered milk as a substitute for liquid milk. Additionally, the extraction and use of food additives, coupled with the rising demand for ready-to-eat foods such as instant coffee and soup mixes, has expanded the role of spray drying in enabling faster production processes.

In Europe, the market saw stable growth, driven by increased demand for processed food and dairy products. According to the Food and Agriculture Organization, total milk production in Europe reached 236 million tons in 2020. Technological advancements in food production and the growth of large dairies have significantly contributed to market revenue in the region. Moreover, trade and technology agreements such as the European Union (EU) and the Japan Economic Partnership Agreement (EPA) are broadening business opportunities, which in turn is expanding the market share in Europe.

The Middle East and Africa region is expected to experience steady growth during the forecast period. The industrial sector plays a major role in the regional economy, with many large-scale chemical and pharmaceutical production facilities. This is driving the demand for spray dryers, which is fueling market growth in the region.

COVID-19 Pandemic: Impact Analysis

The demand for pharmaceutical spray drying has surged due to the COVID-19 pandemic. Pharmaceutical spray drying is a process in which hot gas is used to rapidly dry a drug product, converting a liquid or suspension into a dry powder. This technique is frequently employed to enhance the bioavailability of medications. It ensures the distribution of particles of uniform size, which is essential for the production of industrial products such as catalysts. While air is the most commonly used drying agent, ethanol may be used as an alternative when the liquid is flammable. The introduction of new medicines, including vaccines and biological substances that require spray drying technology, is expected to create significant market opportunities, thereby driving the growth of the spray drying market.

Latest Trends/ Developments:

In February 2023, EUROAPI launched a new spray dryer in Haverhill to support the scaling up of pharmaceutical processes for its Contract Development and Manufacturing Organization (CDMO) clients across Germany, France, Italy, and Hungary.

In June 2022, Dedert Corporation launched a new spray dryer for food ingredients in Indonesia. Additionally, the company installed new equipment at a recently established plant in China, which has a manufacturing capacity of 15,000 tons per year and is focused on producing soluble dietary fiber.

Key Players:

These are top 10 players in the Spray Drying Equipment Market :-

-

GEA Group

-

Aktiengesellschaft

-

European Spray

-

Dry Technologies SPX FLOW

-

Dedert Corporation

-

Buchi Labortecknik AG

-

Larsson Starch Technology AB

-

Advanced Drying System

-

Yamato Scientific America

-

Tetra Pak Group

-

Swenson Technology, Inc

Chapter 1. Spray Drying Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Spray Drying Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Spray Drying Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Spray Drying Equipment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Spray Drying Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Spray Drying Equipment Market – By Type

6.1 Introduction/Key Findings

6.2 Rotary Atomizer

6.3 Nozzle Atomizer

6.4 Fluidized

6.5 Closed Loop

6.6 Centrifugal

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Spray Drying Equipment Market – By Drying Stage

7.1 Introduction/Key Findings

7.2 Single Stage

7.3 Two Stage

7.4 Multi Stage

7.5 Y-O-Y Growth trend Analysis By Drying Stage

7.6 Absolute $ Opportunity Analysis By Drying Stage, 2025-2030

Chapter 8. Spray Drying Equipment Market – By Application

8.1 Introduction/Key Findings

8.2 Food & Dairy

8.3 Pharmaceutical

8.4 Chemica

8.5 Others (Animal Feed))

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Spray Drying Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Drying Stage

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Drying Stage

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Drying Stage

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Drying Stage

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Drying Stage

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Spray Drying Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 GEA Group Aktiengesellschaft

10.2 European SprayDry Technologies

10.3 SPX FLOW

10.4 Dedert Corporation

10.5 Buchi Labortecknik AG

10.6 Larsson Starch Technology AB

10.7 Advanced Drying System

10.8 Yamato Scientific America

10.9 Tetra Pak Group

10.10 Swenson Technology, Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the spray drying equipment market is fueled by the escalating demand for processed food products and the growing use of spray drying technologies across industries such as food, pharmaceuticals, and chemicals.

The top players operating in the Spray Drying Equipment Market are - European SprayDry Technologies, SPX FLOW, Dedert Corporation and Buchi Labortecknik AG.

The demand for pharmaceutical spray drying has surged due to the COVID-19 pandemic. Pharmaceutical spray drying is a process in which hot gas is used to rapidly dry a drug product, converting a liquid or suspension into a dry powder.

Advancements in technology enable manufacturers to develop energy-efficient products that are free from hazardous gases, creating substantial growth opportunities for the spray dryer industry.

The Middle East and Africa is the fastest-growing region in the Spray Drying Equipment Market.