Sponge Applicator Market size (2025-2030)

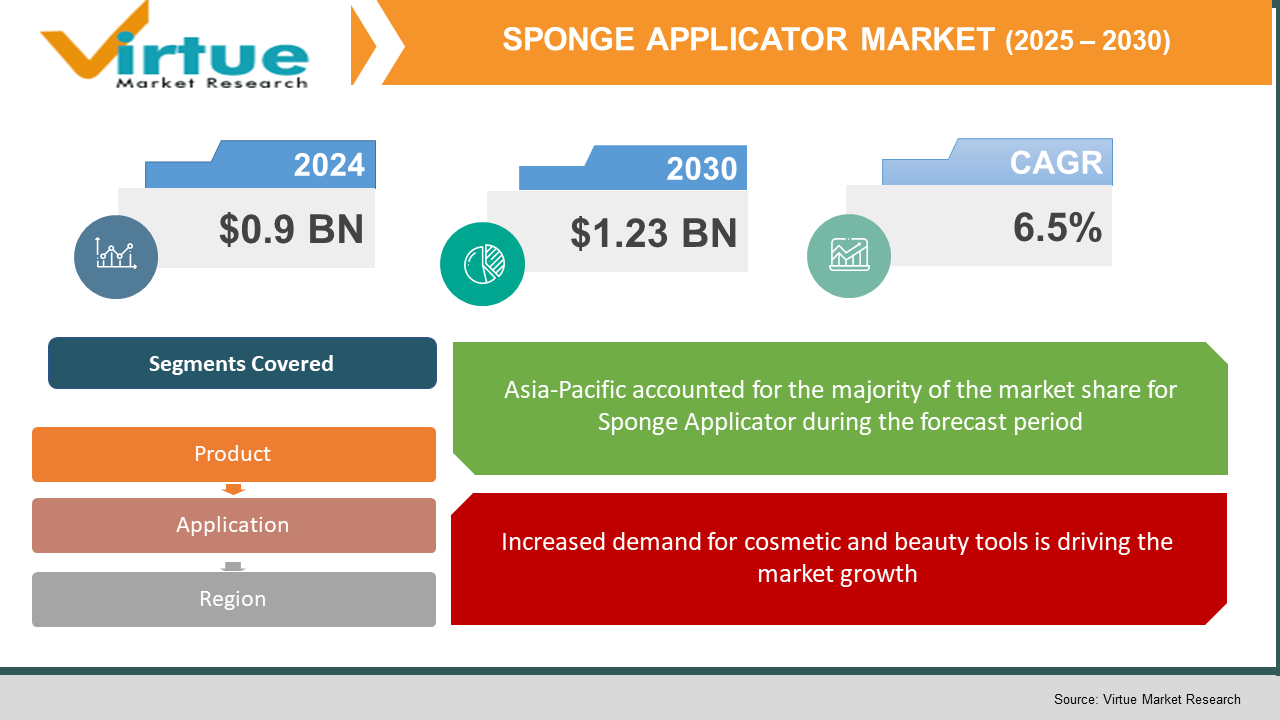

The Global Sponge Applicator Market was valued at USD 0.9 billion in 2024 and will grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 1.23 billion by 2030.

The Sponge Applicator Market focuses on applicators made from various types of sponges used primarily in cosmetics, skincare, painting, cleaning, and other industrial or consumer applications. These applicators are valued for their softness, absorbency, reusability, and ease of use. The market is being driven by an increasing global demand for makeup and personal care tools, advancements in material quality, and the growing preference for precision application in both beauty and industrial sectors. Furthermore, rising disposable income, urbanization, and the influence of social media on grooming and beauty standards contribute significantly to market expansion. Innovations in ergonomics and design, along with eco-friendly sponge materials, are also shaping the landscape of this sector. The market is expected to witness further growth as manufacturers continue to invest in product development, sustainable alternatives, and brand differentiation strategies.

Key market insights:

The personal care and cosmetics segment accounted for over 45% of the global sponge applicator demand in 2024 due to increased makeup usage across all age groups

Reusable and washable sponge applicators are gaining traction, capturing approximately 32% market share in 2024, reflecting consumer demand for sustainable products

The demand for antimicrobial sponge applicators rose by 21% in 2024 compared to 2023, driven by heightened hygiene concerns post-pandemic

Online sales channels grew by 18% year-over-year in 2024, highlighting the shift in consumer buying behavior toward e-commerce platforms

Asia-Pacific held over 35% of the global market share in 2024 due to booming cosmetic industries in countries like China, Japan, and South Korea

Industrial sponge applicators used in painting and cleaning witnessed a 7.2% CAGR from 2020 to 2024, driven by the construction and automotive sectors

Natural sponge materials such as cellulose and sea sponge saw a 16% increase in preference over synthetic alternatives in 2024 due to eco-conscious buying

Customized and multi-functional sponge applicators emerged as a trend in 2024, with brands offering dual-texture and hybrid applicators for versatile use

Global Sponge Applicator Market Drivers

Increased demand for cosmetic and beauty tools is driving the market growth

The rise in global beauty consciousness and self-grooming habits, fueled by social media influencers, beauty tutorials, and the availability of a wide range of beauty products, has significantly increased the demand for cosmetic tools. Sponge applicators, in particular, have seen increased adoption due to their ability to offer precise and even application of foundation, concealer, and skincare products. These tools have become a staple in makeup routines across demographics. The affordability, reusability, and skin-friendliness of sponge applicators make them attractive to both amateur and professional users. Furthermore, the cosmetics industry continues to innovate with product launches, which in turn creates a parallel demand for complementary application tools. For instance, new types of foundations or serums are often accompanied by recommendations for specific applicators, many of which include sponges. As the global personal care market is projected to grow robustly from 2025 to 2030, the sponge applicator segment is expected to mirror this trajectory. Urbanization, rising disposable income, and the growing middle class, especially in emerging economies, support this trend. The influence of beauty subscription boxes, digital marketplaces, and influencer-led campaigns are further boosting this growth.

Rise in sustainable and reusable product preference is driving the market growth

Consumer preferences are rapidly shifting toward sustainable and eco-conscious products, which has become a key growth driver for the sponge applicator market. Environmental awareness has influenced consumers to seek out products that reduce waste and promote reusability. This trend has triggered manufacturers to develop sponge applicators that are biodegradable, recyclable, or made from natural materials like konjac, cellulose, or sea sponge. Reusable applicators that are washable and long-lasting also appeal to cost-conscious yet environmentally aware buyers. Several brands now market their sponge applicators not only on performance but also on sustainability credentials, including minimal packaging and ethical sourcing. These innovations not only cater to consumer demand but also meet tightening regulatory standards related to plastic use and landfill waste, particularly in regions like Europe and North America. Furthermore, product labeling such as “cruelty-free,” “vegan,” and “zero-waste” have enhanced market visibility for eco-friendly sponge applicators. As sustainability continues to be a core value for Gen Z and millennial consumers, the demand for these types of products is expected to maintain a steady growth pace over the forecast period, especially in premium product categories.

Technological innovations and product design is driving the market growth

Technological innovation has had a considerable impact on the evolution of sponge applicators. Manufacturers are now using advanced materials that improve durability, elasticity, and the ability to hold and distribute liquids evenly. The integration of ergonomic design has made applicators more user-friendly, ensuring ease of grip and precision, which is especially beneficial in professional settings. Innovations include antimicrobial coatings, dual-layer textures, temperature-reactive sponges, and applicators with built-in serum or foundation reservoirs. These developments enhance both user experience and product efficacy. Additionally, customization has become a significant trend; brands are offering applicators tailored to specific skin types, makeup formulations, or application techniques. This not only boosts product appeal but also allows for brand differentiation in a competitive market. Furthermore, advanced manufacturing technologies such as injection molding and 3D printing have enabled intricate shapes and designs that were previously not feasible. As companies invest more in R&D, the sponge applicator segment is expected to diversify further, accommodating a wide array of beauty and industrial needs. Over the next five years, smart applicators embedded with skincare tracking sensors or temperature control may also emerge, driven by growing consumer demand for smart beauty tools.

Global Sponge Applicator Market Challenges and Restraints

Limited product lifespan and hygiene concerns is restricting the market growth

One of the major challenges in the sponge applicator market is its limited lifespan, especially among disposable or low-quality variants. Regular usage can lead to rapid wear and tear, which not only compromises performance but also poses hygiene concerns. Makeup sponges, when used frequently without proper cleaning, can accumulate dirt, oils, and bacteria. This becomes a health hazard, leading to skin infections, acne, or allergic reactions. Despite manufacturer instructions on cleaning and maintenance, a large segment of consumers either neglects or fails to clean applicators properly. This has led some users to shy away from sponge applicators altogether, choosing alternatives such as brushes or silicone-based tools. Moreover, professional makeup artists often require frequent replacement of sponges to comply with hygiene protocols, which increases operational costs. These concerns can dampen consumer confidence, especially among those with sensitive skin or dermatological conditions. While antimicrobial coatings and washable variants are addressing some of these issues, the perception of sponges as high-maintenance products continues to be a restraint in mass-market adoption. Manufacturers must invest in education and awareness campaigns to promote safe usage while also innovating longer-lasting and self-cleaning materials to mitigate this challenge.

Intense market competition and price pressure is restricting the market growth

The sponge applicator market faces significant price pressure due to intense competition from numerous local and global players. With relatively low entry barriers, many small manufacturers are flooding the market with low-cost alternatives, leading to commoditization. This makes it challenging for premium or mid-tier brands to maintain pricing power, especially in price-sensitive markets. The high availability of counterfeit or generic products also undermines brand equity and erodes consumer trust. Additionally, e-commerce platforms have enabled direct-to-consumer sales from offshore manufacturers, further intensifying price-based competition. Retailers are often compelled to stock a wide variety of brands, including unbranded low-cost products, which dilutes the visibility of established names. As a result, brands must spend significantly on marketing, influencer collaborations, and packaging to differentiate themselves. The high cost of innovation, combined with the pressure to keep prices competitive, squeezes profit margins and limits R&D investments. Over the forecast period, this dynamic is expected to persist, making brand loyalty and product innovation critical for sustained growth. Strategic partnerships, quality assurance certifications, and targeted marketing will become necessary tools to counteract pricing and competitive pressures.

Market Opportunities

The sponge applicator market is poised for multiple growth opportunities across emerging and mature markets, especially with the continued evolution of consumer preferences and product technologies. One of the foremost opportunities lies in expanding into underpenetrated regions such as Africa, Southeast Asia, and parts of Latin America, where the adoption of cosmetic tools is still in its early growth phase. As income levels rise and urbanization continues, consumers in these regions are increasingly inclined toward personal grooming products, including sponge applicators. E-commerce platforms are playing a crucial role in this trend by making such tools accessible beyond urban centers. Another significant opportunity lies in the expanding male grooming segment. Traditionally targeted toward women, sponge applicators are now being marketed to men for skincare, concealer, and other grooming needs. Similarly, the demand from the professional makeup industry—including salons, film production, and theatrical makeup—continues to grow. Collaborations with beauty influencers and makeup artists offer a direct channel to promote sponge applicators to a wider and more engaged audience. Additionally, the integration of biodegradable and zero-waste applicators is opening opportunities for brands looking to establish strong sustainability credentials. With regulatory bodies encouraging environmentally friendly practices, eco-friendly sponges are expected to see increased adoption. Furthermore, technology-driven products such as applicators with temperature sensitivity or anti-bacterial features are gaining popularity among tech-savvy consumers. Also, product diversification into dual-purpose or multi-functional sponges—such as those combining exfoliation and application—offers brands new avenues to cater to a broad range of skincare needs. As demand grows, brands that can successfully combine affordability, sustainability, and innovation are likely to capture a significant market share over the forecast period.

SPONGE APPLICATOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Beautyblender, Real Techniques, EcoTools, Fenty Beauty, and Morphe. |

Sponge Applicator Market Segmentation

Sponge Applicator Market segmentation By Product:

• Round Sponge Applicators

• Wedge-Shaped Sponge Applicators

• Flat Sponge Applicators

• Silicone-Infused Sponge Applicators

• Antibacterial Sponge Applicators

Round sponge applicators dominated the product segment in 2024 and are expected to maintain their lead through 2030. Their versatility, ease of use, and ergonomic shape make them the preferred choice for both consumers and professionals. These sponges are ideal for blending liquid and cream-based products, offering seamless coverage with minimal product wastage. Their rounded edges provide smooth application around contours of the face, such as under the eyes or near the nose. Brands also offer variations in density and texture within round sponges, enhancing their appeal across different skin types and makeup techniques. As a result, round applicators remain a staple item in cosmetic kits globally.

Sponge Applicator Market segmentation By Application:

• Personal Care and Cosmetics

• Household Cleaning

• Industrial Use

• Arts and Crafts

• Automotive Maintenance

The personal care and cosmetics application segment accounted for the largest market share in 2024 and is anticipated to remain dominant over the forecast period. The surge in daily beauty routines, increased product launches in foundation and skincare categories, and the growing influence of makeup tutorials have made sponge applicators essential tools in cosmetic usage. Furthermore, consumer preference for tools that enhance product performance and minimize wastage has further propelled this segment. The cosmetics industry’s push toward portable and travel-friendly application tools has also favored sponge applicators. Their utility across foundation, primer, contouring, and blending makes them indispensable for makeup users worldwide.

Sponge Applicator Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific was the dominant region in the global sponge applicator market in 2024 and is expected to continue leading through 2030. Countries such as China, South Korea, Japan, and India have shown a remarkable increase in personal care and beauty product consumption, directly fueling demand for sponge applicators. South Korea and Japan, known for their beauty innovation and skincare routines, have helped drive the trend toward precision tools, while China’s growing middle class and e-commerce expansion support consistent market growth. Moreover, domestic brands in the Asia-Pacific region are increasingly focusing on R&D and sustainable manufacturing practices, aligning with global trends and enhancing product appeal. Local influencers and celebrities also play a strong role in product marketing, helping brands achieve quick market penetration. The affordability and wide availability of these products across both premium and budget ranges also contribute to their popularity. Asia-Pacific's dynamic consumer base, along with favorable governmental policies supporting the beauty and cosmetic sector, ensures continued growth in this market. The region's rising influence in global beauty trends makes it a strategic focus for international sponge applicator manufacturers looking to expand their market presence.

COVID-19 Impact Analysis on the Sponge Applicator Market

The COVID-19 pandemic had a mixed impact on the global sponge applicator market. On the negative side, supply chain disruptions, manufacturing shutdowns, and decreased consumer spending during the peak lockdown periods led to a temporary dip in production and sales. Particularly in the beauty and personal care segments, store closures and reduced social interactions led to a decline in makeup usage, which in turn affected the sales of cosmetic sponge applicators. However, as the pandemic evolved, consumer behavior began to shift. There was an increased focus on hygiene, personal grooming, and self-care routines, which sparked interest in applicators that were washable, reusable, or made with antimicrobial materials. Additionally, as people began to engage more with digital content and beauty influencers during lockdowns, online sales of beauty tools including sponge applicators saw significant growth. E-commerce became a key distribution channel, helping brands maintain consumer engagement. The professional segment suffered setbacks due to reduced activity in salons, fashion shows, and film production, but this was partially offset by do-it-yourself makeup trends. Some manufacturers adapted quickly by promoting sponge applicators as essential personal care tools with hygienic benefits. As lockdowns eased and economic recovery began, the market witnessed a rebound, especially with pent-up demand in the personal care and beauty segment. In the post-pandemic landscape, the sponge applicator market is expected to benefit from heightened hygiene consciousness, digital shopping habits, and the increasing focus on home-based grooming routines. This sets the stage for resilient growth from 2025 to 2030.

Latest trends/Developments

Recent developments in the sponge applicator market reflect innovation, sustainability, and personalization. One of the most notable trends is the integration of natural and biodegradable materials such as sea sponge, konjac, and cellulose, replacing traditional synthetic foams. Brands are responding to growing environmental concerns by launching sponge applicators that are fully compostable and come in minimal packaging. Another emerging trend is antimicrobial technology in sponge surfaces, offering users added hygiene protection, particularly appealing in a post-pandemic world. Customization is also gaining traction, with brands offering sponges designed for specific skin types, foundation types, or even facial zones. Some companies have launched dual-texture sponges—one side for application, the other for exfoliation or skincare product infusion. Temperature-sensitive sponges that expand or change texture when wet are being used to enhance product performance and user experience. Additionally, smart beauty tools are beginning to influence the market. Concepts such as applicators with integrated sensors or vibration mechanisms for deeper skincare penetration are in early-stage development. Furthermore, the use of bold colors, ergonomic designs, and limited-edition collaborations with influencers is driving consumer engagement. Brands are also leveraging augmented reality (AR) and virtual try-on features to market these products online. Overall, the sponge applicator market is becoming more tech-savvy, environmentally responsible, and design-focused, positioning itself as a modern-day essential in both cosmetic and skincare routines. These evolving trends indicate a strong future trajectory for the market, fueled by innovation and consumer-centric product strategies.

Key Players:

- Beautyblender

- Real Techniques

- EcoTools

- Fenty Beauty

- Morphe

- Sephora Collection

- EmaxDesign•

- Juno & Co.

- L'Oréal

- Shiseido

Chapter 1. Sponge Applicator Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Application

1.5. Secondary Application

Chapter 2. SPONGE APPLICATOR MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SPONGE APPLICATOR MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SPONGE APPLICATOR MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Sponge Applicator of Suppliers

4.5.2. Bargaining Risk Analytics s of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SPONGE APPLICATOR MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SPONGE APPLICATOR MARKET – By Product

6.1 Introduction/Key Findings

6.2 Round Sponge Applicators

6.3 Wedge-Shaped Sponge Applicators

6.4 Flat Sponge Applicators

6.5 Silicone-Infused Sponge Applicators

6.6 Antibacterial Sponge Applicators

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. SPONGE APPLICATOR MARKET – By Application

7.1 Introduction/Key Findings

7.2 Personal Care and Cosmetics

7.3 Household Cleaning

7.4 Industrial Use

7.5 Arts and Crafts

7.6 Automotive Maintenance

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. SPONGE APPLICATOR MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SPONGE APPLICATOR MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Beautyblender

9.2 Real Techniques

9.3 EcoTools

9.4 Fenty Beauty

9.5 Morphe

9.6 Sephora Collection

9.7 EmaxDesign

9.8 Juno & Co.

9.9 L'Oréal

9.10 Shiseido

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 0.9 billion in 2024 and is expected to reach USD 1.23 billion by 2030.

Key drivers include rising demand for cosmetic tools, sustainable and reusable product trends, and technological innovations in applicator design.

Segments include product types like round and flat sponge applicators, and applications such as personal care, cleaning, and industrial use.

Asia-Pacific is the dominant region due to high cosmetic consumption, strong e-commerce infrastructure, and growing personal care awareness.

Leading players include Beautyblender, Real Techniques, EcoTools, Fenty Beauty, and Morphe.