Split Air Conditioning Market Size (2025 – 2030)

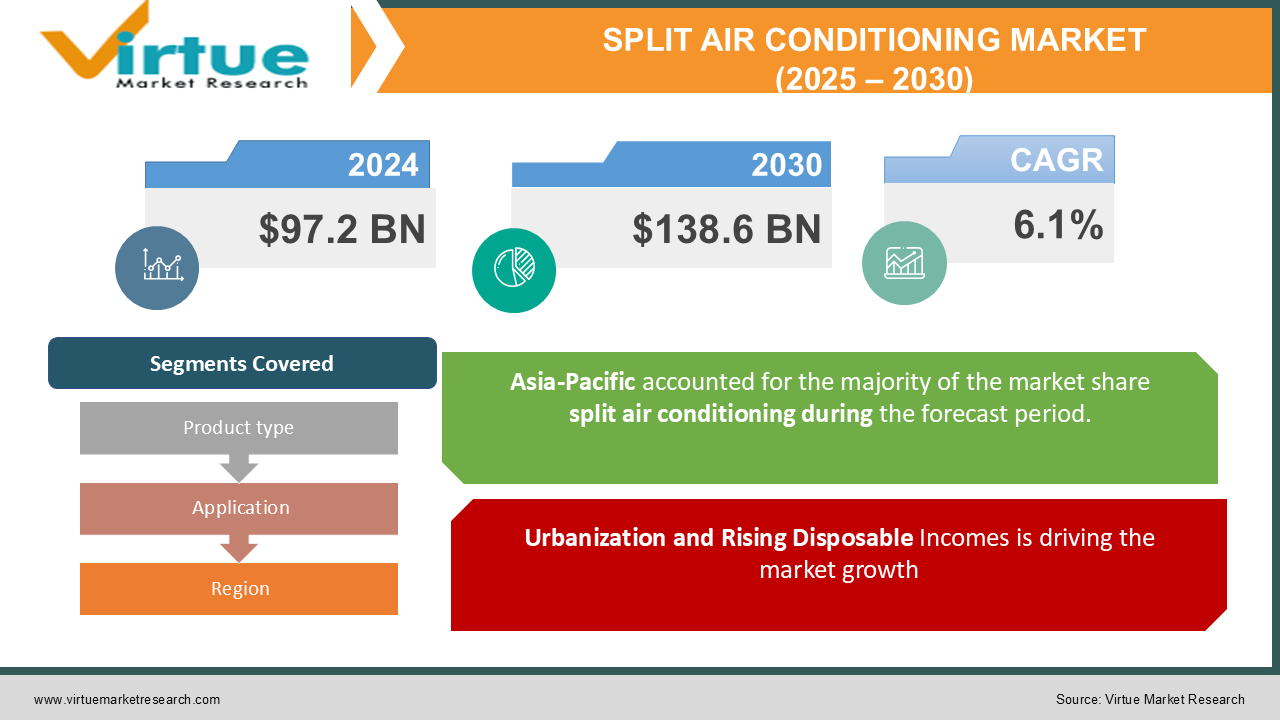

The Global Split Air Conditioning Market was valued at USD 97.2 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030, reaching approximately USD 138.6 billion by 2030.

Split air conditioners (ACs) have become the preferred choice for residential, commercial, and industrial applications due to their energy efficiency, ease of installation, and ability to provide effective cooling in diverse climatic conditions. Rising disposable incomes, growing urbanization, and increasing demand for energy-efficient cooling solutions are driving market growth. Additionally, innovations such as smart ACs and inverter technology are further boosting the adoption of split air conditioners globally.

The split air conditioning market is a thriving sector driven by the increasing demand for efficient and comfortable cooling solutions. Split systems, comprising separate indoor and outdoor units, offer flexibility, energy efficiency, and quiet operation. The growing urbanization and rising disposable incomes in emerging economies are major factors driving market growth. The residential sector is a significant contributor, with wall-mounted split ACs being the most popular choice due to their ease of installation and affordability. Commercial establishments, including offices, hotels, and retail spaces, also rely on split ACs to create comfortable indoor environments. As technology advances, split ACs are incorporating smart features like Wi-Fi connectivity, voice control, and energy-saving modes, further enhancing their appeal. With a focus on energy efficiency, eco-friendly refrigerants, and innovative designs, the split air conditioning market is poised for continued growth in the coming years.

Key Market Insights

Wall-Mounted Split ACs accounted for the largest market share in 2024, driven by their cost-effectiveness and widespread residential use.

The Residential segment leads in terms of application, accounting for over 45% of the market share in 2024, fueled by rapid urbanization and rising demand for home comfort solutions.

The adoption of inverter technology is revolutionizing the market, enabling energy savings and reduced operational costs.

Asia-Pacific dominated the market in 2024, holding over 50% of the revenue share, driven by high demand in countries like China and India.

Increasing focus on environment-friendly refrigerants such as R-32 and R-290 is driving innovation among manufacturers.

The rise of smart homes is fueling demand for Wi-Fi-enabled and voice-controlled split ACs.

Stringent regulations on energy efficiency standards are reshaping product development and market strategies.

Growing concerns over climate change and rising temperatures globally are spurring demand for efficient cooling solutions.

Global Split Air Conditioning Market Drivers

1. Rising Demand for Energy-Efficient Cooling Solutions is driving the market growth

Energy efficiency has become a primary consideration for consumers and governments alike, leading to increased adoption of split ACs with advanced energy-saving technologies. Products with inverter technology, which optimize compressor performance to adjust cooling power based on ambient conditions, are in high demand. For example, companies such as Daikin Industries and Mitsubishi Electric have introduced split ACs with seasonal energy efficiency ratings (SEER) above industry norms. Government incentives, such as rebates for energy-efficient appliances in the U.S. and Europe, are further accelerating market growth.

2. Urbanization and Rising Disposable Incomes is driving the market growth

Rapid urbanization in emerging economies, coupled with rising disposable incomes, has significantly increased the adoption of split air conditioners in residential and commercial sectors. As more consumers prioritize comfort and convenience, demand for compact and aesthetically pleasing split ACs has surged. In countries like India and Indonesia, where temperatures are rising and middle-class populations are expanding, split AC sales are growing rapidly. Real estate development in urban areas has also fueled demand for these systems in newly constructed residential and commercial buildings.

3. Advancements in Smart and Connected Technologies is driving the market growth

The integration of smart technologies, such as IoT and AI, into split ACs has enhanced their functionality and appeal. Smart ACs allow users to remotely control and monitor temperature settings via smartphones and voice-activated systems like Amazon Alexa or Google Assistant. For instance, LG Electronics and Samsung have launched Wi-Fi-enabled split ACs with features such as geofencing, real-time power consumption monitoring, and predictive maintenance alerts. These innovations are attracting tech-savvy consumers and contributing to market growth.

Global Split Air Conditioning Market Challenges and Restraints

1. High Initial Costs and Maintenance Expenses is restricting the market growth

Despite their benefits, split air conditioners have higher initial purchase and installation costs compared to other cooling solutions such as window ACs or portable units. Professional installation is required, which increases upfront expenses. Additionally, periodic maintenance, including cleaning filters and servicing compressors, can be costly and time-consuming. These factors limit adoption among cost-conscious consumers, particularly in developing regions where affordability is a critical concern.

2. Environmental Concerns and Regulatory Challenges is restricting the market growth

The use of hydrofluorocarbon (HFC) refrigerants in split ACs has raised significant environmental concerns due to their high global warming potential (GWP). Regulatory frameworks like the Kigali Amendment to the Montreal Protocol mandate the gradual phasing out of HFCs, compelling manufacturers to invest in alternative refrigerants such as R-32 and natural gases. While these transitions create opportunities for innovation, they also impose compliance costs and technical challenges for manufacturers, potentially slowing market expansion.

Market Opportunities

The rising global focus on sustainable and eco-friendly cooling solutions presents significant opportunities for growth in the split air conditioning market. Innovations in refrigerants with low GWP, such as R-290 (propane) and R-600a (isobutane), are expected to drive product development. Governments and organizations are offering incentives for adopting green cooling solutions, further propelling the market. The proliferation of smart city projects across regions like Asia-Pacific, the Middle East, and North America also creates opportunities for split AC manufacturers. Smart cities prioritize energy-efficient infrastructure, and split ACs with inverter and IoT-enabled technologies align perfectly with these goals. For instance, China’s focus on developing low-carbon cities under its 14th Five-Year Plan is expected to boost demand for energy-efficient AC systems. In addition, the growing hospitality and tourism industry is a lucrative avenue for the adoption of split air conditioners. Hotels and resorts, especially in tropical regions, are investing in premium split ACs with air purification features to enhance customer experiences.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Daikin Industries, Ltd., Mitsubishi Electric Corporation, LG Electronics, Samsung Electronics Co., Ltd., Panasonic Corporation, Carrier Corporation, Hitachi, Ltd., Trane Technologies, Fujitsu General Limited, Gree Electric Appliances, Inc. |

Split Air Conditioning Market Segmentation - By Product Type

-

Wall-Mounted

-

Floor-Mounted

-

Ceiling-Mounted

-

Cassette

Wall-mounted split air conditioners dominate the market, favored for their ease of installation, affordability, and widespread suitability for residential applications. These units offer a sleek and compact design, making them easy to fit into various interior aesthetics. Their split system configuration, with separate indoor and outdoor units, ensures efficient cooling and quiet operation. The installation process is relatively straightforward, involving mounting the indoor unit on a wall and connecting it to the outdoor unit via refrigerant lines. This simplicity, coupled with their competitive pricing, has made wall-mounted split ACs the preferred choice for many homeowners. Furthermore, advancements in technology have led to the integration of energy-efficient features like inverter technology and smart controls, further enhancing their appeal. As a result, wall-mounted split ACs continue to be the dominant force in the residential air conditioning market.

Split Air Conditioning Market Segmentation - By Application

-

Residential

-

Commercial

-

Industrial

The Residential segment dominates the air conditioning market, driven by the increasing urbanization and rising disposable incomes in middle-income households. As more people migrate to urban areas, the demand for comfortable living spaces, especially in regions with hot and humid climates, has surged. Air conditioning systems have become essential appliances for maintaining optimal indoor temperatures and humidity levels, improving overall comfort and productivity. Moreover, the growing awareness of the health benefits of clean air has fueled the demand for air conditioners with advanced air purification features. The residential segment is further propelled by the increasing preference for energy-efficient and smart air conditioning solutions, which offer cost savings and convenience. As urbanization continues to accelerate, the residential segment is expected to remain a key growth driver for the air conditioning market.

Split Air Conditioning Market Segmentation - By Region

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

-

Middle East & Africa

Asia-Pacific is the largest market, accounting for over 50% of global revenue in 2024. The region’s dominance is driven by high population density, rising disposable incomes, and rapidly growing urbanization. Countries such as China, India, and Japan are key contributors, with significant investments in infrastructure development and the adoption of energy-efficient technologies. China, the world’s largest producer and consumer of air conditioners, leads the region in both production and sales, fueled by government programs promoting energy-efficient appliances. Meanwhile, India’s split AC market is growing at a notable pace, driven by increasing awareness of energy-saving technologies and rising household incomes.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly influenced the global split air conditioning market. Supply chain disruptions and manufacturing halt during lockdowns temporarily affected production and sales. However, the pandemic also highlighted the importance of indoor air quality, driving demand for split ACs equipped with air purification and ventilation features. As work-from-home trends surged, residential demand for cooling solutions increased, partially offsetting declines in the commercial and industrial segments. Manufacturers adapted by introducing products with anti-microbial filters and energy-efficient features tailored to home use. The post-pandemic recovery, supported by government incentives and infrastructure investments, has further revitalized the market, with a renewed focus on sustainable cooling technologies.

Latest Trends/Developments

The air conditioning industry is undergoing a significant transformation, driven by a growing emphasis on sustainability, technological innovation, and evolving consumer preferences. Manufacturers are increasingly adopting eco-friendly refrigerants with low Global Warming Potential (GWP) to comply with stringent environmental regulations and reduce their carbon footprint. Smart ACs, powered by IoT, AI, and voice-assistance technologies, are gaining traction, offering enhanced user convenience and energy efficiency. Inverter technology, which enables precise temperature control and energy savings, is becoming a standard feature in modern air conditioners. Additionally, the focus on air quality has led to the integration of advanced features like HEPA filters, anti-microbial coatings, and UV-C sterilization, addressing concerns about indoor air pollution. To cater to the diverse needs of emerging markets in Asia and Africa, manufacturers are introducing affordable and energy-efficient models tailored to price-sensitive consumers. These trends are shaping the future of the air conditioning industry, promoting sustainable cooling solutions and improving indoor comfort

Key Players

-

Daikin Industries, Ltd.

-

Mitsubishi Electric Corporation

-

LG Electronics

-

Samsung Electronics Co., Ltd.

-

Panasonic Corporation

-

Carrier Corporation

-

Hitachi, Ltd.

-

Trane Technologies

-

Fujitsu General Limited

-

Gree Electric Appliances, Inc.

Chapter 1. Split Air Conditioning Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Split Air Conditioning Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Split Air Conditioning Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Split Air Conditioning Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Split Air Conditioning Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Split Air Conditioning Market – By Product Type

6.1 Introduction/Key Findings

6.2 Wall-Mounted

6.3 Floor-Mounted

6.4 Ceiling-Mounted

6.5 Cassette

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Split Air Conditioning Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Split Air Conditioning Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Split Air Conditioning Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Daikin Industries, Ltd.

9.2 Mitsubishi Electric Corporation

9.3 LG Electronics

9.4 Samsung Electronics Co., Ltd.

9.5 Panasonic Corporation

9.6 Carrier Corporation

9.7 Hitachi, Ltd.

9.8 Trane Technologies

9.9 Fujitsu General Limited

9.10 Gree Electric Appliances, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 97.2 billion in 2024 and is projected to reach USD 138.6 billion by 2030, growing at a CAGR of 6.1%.

Rising demand for energy-efficient cooling solutions, urbanization, and advancements in smart technologies are driving market growth.

Segments include Product Type (Wall-Mounted, Floor-Mounted, Ceiling-Mounted, Cassette) and Application (Residential, Commercial, Industrial).

Asia-Pacific dominates the market, holding over 50% of the revenue share in 2024, driven by high demand in China and India.

Major players include Daikin Industries, LG Electronics, Samsung Electronics, Mitsubishi Electric, and Carrier Corporation.