Spirulina Market Size (2024-2030)

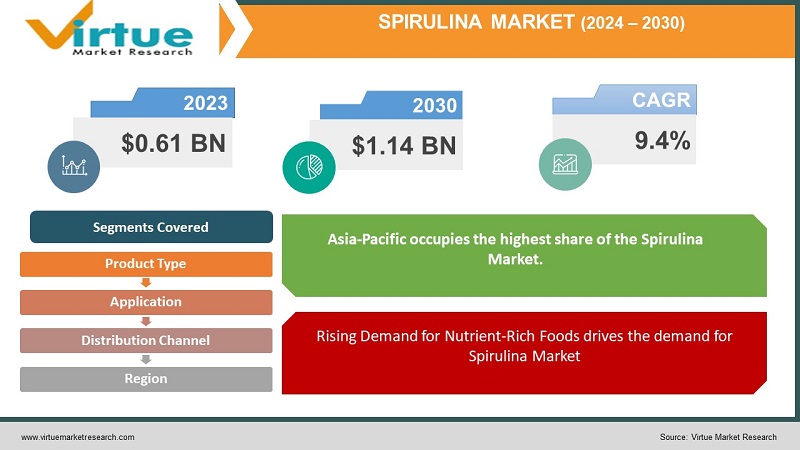

The Global Spirulina Market was valued at USD 0.61 billion in 2023 and is projected to reach a market size of USD 1.14 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.4%.

Spirulina is a type of blue-green algae and a widely consumed dietary supplement due to its nutritional benefits. Spirulina is rich in protein, vitamins, minerals, and antioxidants. Spirulina has been used for centuries as a food source, particularly in some African and Mexican cultures. The Spirulina Market is expected to grow significantly in the coming years due to increasing consumer awareness of its health benefits and the rising demand for natural and plant-based products. The major well-established key players in the Spirulina Market are Cyanotech Corporation, DIC Corporation, Parry Nutraceuticals, NOW Foods, and Sensient Technologies Corporation.

Key Market Insights:

Spirulina contains high protein content, essential amino acids, vitamins (such as B vitamins), minerals (iron, calcium, magnesium), and antioxidants. Consumers are increasingly seeking nutrient-dense and functional foods. This contributes to the popularity of spirulina as a dietary supplement. Spirulina is also finding applications in the cosmetic and personal care industry. This is due to its antioxidant properties and potential benefits for skin health. The increasing demand for nutrient-rich foods, the popularity of plant-based diets, health and wellness trends, and ongoing research and development efforts. are propelling the Spirulina Market.The restraints to the Spirulina Market include taste and flavor concerns, quality control issues, supply chain vulnerability, regulatory compliance, limited awareness in certain regions, competition with other superfoods, and environmental impact concerns. North America occupies the highest share of the Spirulina Market.Asia-Pacific is the fastest-growing segment during the forecast period.

Spirulina Market Drivers:

Rising Demand for Nutrient-Rich Foods drives the demand for Spirulina Market

Consumers are increasingly seeking foods that offer high nutritional value. Spirulina, being rich in protein, vitamins, minerals, and antioxidants, aligns with this demand. Spirulina's nutrient profile includes essential amino acids. This makes it a popular choice for individuals looking to supplement their diets with a natural and sustainable source of nutrition. The awareness of spirulina as a "superfood" has grown rapidly. This drives its inclusion in various food and beverage products and dietary supplements.

The growing popularity of Plant-Based Diets is propelling the Spirulina Market

The global shift towards plant-based diets and vegetarian/vegan lifestyles has significantly impacted the food industry. Spirulina gains attention as a plant-based protein source. Spirulina serves as an alternative to traditional protein sources, such as meat and dairy. This appeals to consumers seeking environmentally sustainable and cruelty-free dietary options. Spirulina's plant-based nature also aligns with broader societal trends emphasizing ethical and sustainable consumption. This contributes to its adoption in various food and beverage categories.

Spirulina Market Restraints and Challenges

The major challenge faced by the Spirulina Market is the Supply Chain Vulnerability. The spirulina supply chain often involves cultivation in specific regions. This may be vulnerable to disruptions caused by environmental factors, climate change, or natural disasters. These events can impact the availability and pricing of spirulina. Another main challenge is the Taste and Flavor Concerns. Spirulina has a distinct taste and odor. This might be challenging for some consumers. The earthy or seaweed-like flavor can affect the palatability of products containing spirulina. This limits its use in certain food and beverage applications.

Spirulina Market Opportunities:

The Spirulina Market has various opportunities in the market. The growing interest in plant-based diets and the demand for alternative protein sources present an opportunity for spirulina. Spirulina is popular as a sustainable and nutrient-rich plant-based protein. Opportunities exist for developing innovative spirulina-based products, such as snacks, beverages, and functional foods. This caters to diverse consumer preferences and incorporates spirulina into mainstream diets. Spirulina's antioxidant and anti-inflammatory properties offer opportunities for its application in cosmetics and skincare products. Government initiatives promoting healthy lifestyles, sustainable agriculture, and research and development in the food and nutrition sector can also create opportunities for Spirulina Market. Other Opportunities in the market include innovative product development, a focus on sustainable and organic production, market expansion in developing regions, collaborations and partnerships, and the growth of online retail and e-commerce.

SPIRULINA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.4% |

|

Segments Covered |

By Product Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cyanotech Corporation, DIC Corporation, Parry Nutraceuticals (A Division of EID Parry), NOW Foods, Sensient Technologies Corporation, Naturex (now part of Givaudan), Algene Biotech, Earthrise Nutritionals, Döhler Group, Sun Chlorella Corporation |

Spirulina Market Segmentation

Spirulina Market Segmentation: By Product Type:

- Arthrospira Platensis

- Arthrospira Maxima

In 2023, based on market segmentation by Product Type, Arthrospira Platensis occupies the highest share of the Spirulina Market. This is due to the growth in healthcare awareness. Consumers increasingly recognize the health benefits of Spirulina. This leads to higher adoption of products containing Arthrospira Platensis.

Arthrospira Platensis is also the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 20%. This is due to the incorporation of Spirulina into diets as a superfood globally. The perception of Spirulina as a nutrient-dense and health-promoting ingredient has likely driven its popularity in various food, beverage, and supplement formulations. This is another factor contributing to the strong market presence of Arthrospira Platensis.

Spirulina Market Segmentation: By Application:

- Dietary Supplements

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Animal Feed

In 2023, based on market segmentation by Application, the Dietary Supplements segment occupies the highest share of the Spirulina Market. This is mainly due to its rich content of proteins, vitamins, and antioxidants. The global interest in health and wellness has also driven the demand for Spirulina in supplement form.

However, Food and Beverages are the fastest-growing segment during the forecast period. This is mainly due to the increasing incorporation of Spirulina in various food and beverage products. Spirulina's nutritional profile makes it appealing for use in snacks, drinks, and other food items for consumers who seek functional and natural ingredients.

Spirulina Market Segmentation: By Distribution Channel:

- Direct Sales/B2B

- Retail Stores

- Online Retail/E-commerce

In 2023, based on market segmentation by Distribution Channel, the Retail Stores segment occupies the highest share of the Spirulina Market. This is mainly due to its physical presence for consumers to purchase Spirulina products directly. Retail Stores include supermarkets, health food stores, and pharmacies. Traditional retail stores have often represented the largest distribution channel for Spirulina.

However, Online Retail/E-commerce is the fastest-growing segment during the forecast period. This is mainly due to the increasing digitalization and the convenience of online shopping enabling consumers to browse and purchase Spirulina products from the comfort of their homes. The e-commerce platform also allows for a wider reach of consumers. This has driven the rapid growth of Spirulina sales through e-commerce platforms.

Spirulina Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, based on market segmentation by region, Asia-Pacific occupies the highest share of the Spirulina Market. This growth is due to the historical and cultural use of Spirulina in some Asian countries and the region's growing health and wellness trends. The largest producer of spirulina globally is Asia, especially with countries such as China, and India. These countries have favorable climate conditions for spirulina cultivation. These countries have been actively engaged in large-scale production. China is a major player in the spirulina market, being one of the world's leading producers. Spirulina cultivation is well-established in various provinces of China due to suitable environmental conditions. China has been a significant contributor to global spirulina supply. India is also a key producer, with several spirulina farms and producers. This contributes to both domestic consumption and export markets.

Europe is also a significant market for Spirulina due to increasing interest in natural and organic products.

However, North America is the fastest-growing segment during the forecast period. This is mainly due to the rising health consciousness, the popularity of superfoods, and a trend toward plant-based diets. Countries like the U.S. and Canada have a higher growth rate for the spirulina market. Manufacturers are including spirulina in a wide range of food products. Some of them include baked goods, dairy items, and sweet items.

COVID-19 Impact Analysis on the Global Spirulina Market :

The COVID-19 pandemic had a significant impact on the Spirulina Market. There were lockdowns, travel restrictions, and other measures. The pandemic led to disruptions in global supply chains. This affected the production and distribution of various goods, including spirulina-based products. Delays in raw material sourcing and transportation impacted the availability of spirulina supplements. During the pandemic, sectors like healthcare have seen increased demand. The interest in health and wellness has generally increased during the pandemic. The pandemic accelerated the adoption of immune-boosting products. There was an increased demand for spirulina due to its potential immune-boosting properties. Thus, the pandemic accelerated certain trends in the Spirulina Market.

Latest Trends/ Developments:

One of the developments, in the Spirulina Market is the innovative product formulations. This includes spirulina-infused snacks, beverages, and plant-based protein products. There is an ongoing trend towards clean label products with transparent ingredient lists. This aligns with the natural and organic image of spirulina. Consumers increasingly seek products with fewer additives and natural ingredients. There is an increased emphasis on sustainable cultivation practices for spirulina. This addresses environmental concerns and appeals to eco-conscious consumers. Ongoing research and innovation in the field of algae-based products leads to new discoveries, applications, and production methods for spirulina.

Key Players:

- Cyanotech Corporation

- DIC Corporation

- Parry Nutraceuticals (A Division of EID Parry)

- NOW Foods

- Sensient Technologies Corporation

- Naturex (now part of Givaudan)

- Algene Biotech

- Earthrise Nutritionals

- Döhler Group

- Sun Chlorella Corporation

Market news:

- In 2022, DIC Corporation, a Japanese company, acquired Earthrise Nutritionals, a major producer of spirulina based in the United States. This collaboration aimed to strengthen DIC's position in the global market.

- In 2022, Parry Nutraceuticals, a division of EID Parry, collaborated with Synthite Industries to develop a natural blue colorant derived from spirulina. This collaboration aimed to meet the growing demand for natural food colorants.

- In 2022, Döhler Group collaborated with Parabel, a plant-based protein company, to develop a range of plant-based food and beverage products, including those containing spirulina. This collaboration aimed to meet the increasing consumer demand for plant-based and functional foods.

- In 2022, Sensient Technologies Corporation partnered with Earthrise Nutritionals to develop natural blue and green colorings for use in the food and beverage industry. This collaboration aimed to address the demand for clean-label and natural ingredients.

- In 2022, Algene Biotech, a Chinese spirulina producer, collaborated with Chitose Group, a Japanese biotechnology company, to enhance spirulina cultivation technology. This collaboration aimed to improve the efficiency and sustainability of spirulina production.

Chapter 1. GLOBAL SPIRULINA MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL SPIRULINA MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL SPIRULINA MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL SPIRULINA MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL SPIRULINA MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL SPIRULINA MARKET– BY PRODUCT TYPE

6.1. Introduction/Key Findings

6.2. Arthrospira Platensis

6.3. Arthrospira Maxima

6.4. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL SPIRULINA MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Dietary Supplements

7.3. Food and Beverages

7.4. Pharmaceuticals

7.5. Cosmetics and Personal Care

7.6. Animal Feed

7.7. Y-O-Y Growth trend Analysis By APPLICATION

7.8. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL SPIRULINA MARKET– BY Distribution Channel

8.1. Introduction/Key Findings

8.2. Direct Sales/B2B

8.3. Retail Stores

8.4. Online Retail/E-commerce

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. GLOBAL SPIRULINA MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By APPLICATION

9.1.3. By Product Type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By APPLICATION

9.2.3. By Distribution Channel

9.2.4. By Product Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By APPLICATION

9.3.3. By Product Type

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Product Type

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Product Type

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL SPIRULINA MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Cyanotech Corporation

10.2. DIC Corporation

10.3. Parry Nutraceuticals (A Division of EID Parry)

10.4. NOW Foods

10.5. Sensient Technologies Corporation

10.6. Naturex (now part of Givaudan)

10.7. Algene Biotech

10.8. Earthrise Nutritionals

10.9. Döhler Group

10.10. Sun Chlorella Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Spirulina Market was valued at USD 0.61 billion in 2023 and is projected to reach a market size of USD 1.14 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.4%.

The increasing demand for nutrient-rich foods and the popularity of plant-based diets are the main market drivers of the Global Spirulina Market.

Dietary Supplements, Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, and Animal Feed are the segments under the Global Spirulina Market by Application.

Asia-Pacific is the most dominant region for the Global Spirulina Market.

Cyanotech Corporation, DIC Corporation, Parry Nutraceuticals, NOW Foods, and Sensient Technologies Corporation. are the key players in the Global Spirulina Market.