Specialty Drug Distribution Market Size (2024 – 2030)

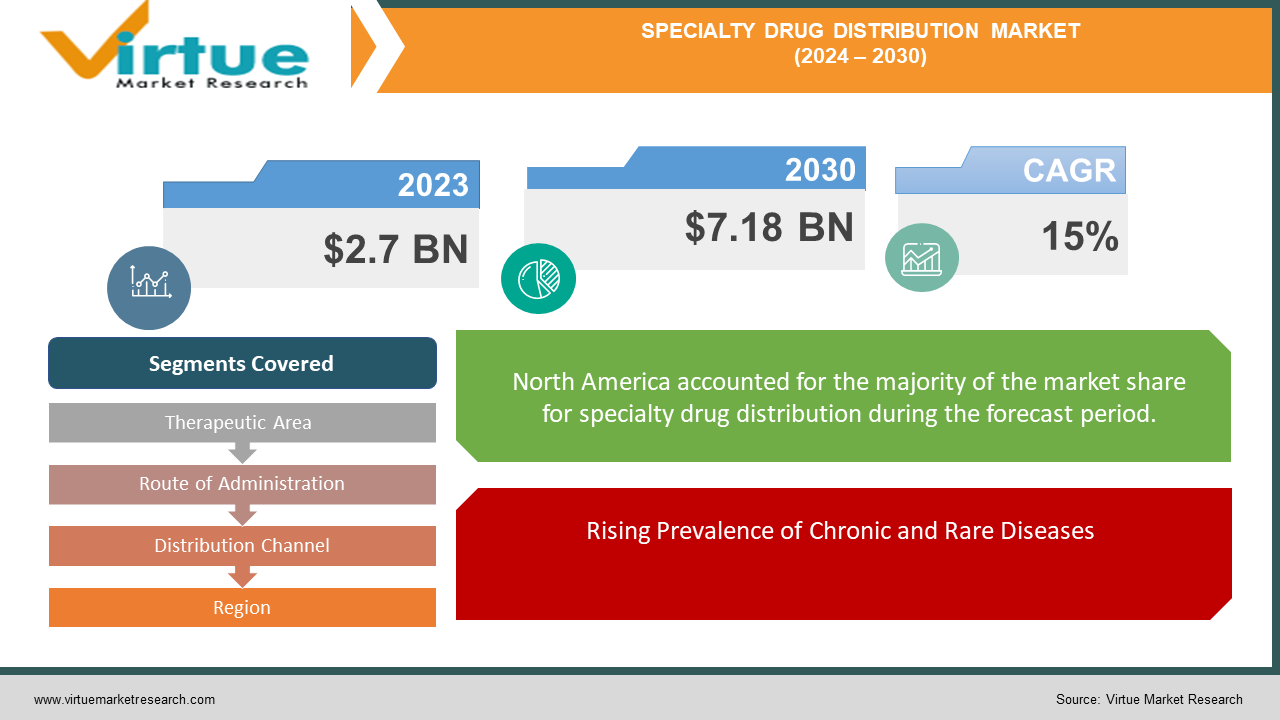

The Global Specialty Drug Distribution Market was valued at USD 2.7 billion in 2023 and is projected to reach a market size of USD 7.18 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 15% between 2024 and 2030.

The Global Specialty Drug Distribution Market plays a crucial role in the healthcare ecosystem by providing specialized services for the distribution of complex, high-cost medications used to treat chronic and rare diseases. These drugs, often requiring special handling, storage, and administration, cater to conditions such as cancer, autoimmune disorders, and genetic diseases. The market has experienced substantial growth driven by the increasing prevalence of such conditions, advancements in biotechnology, and the rising number of personalized medicines. Specialty drug distributors offer comprehensive support, including patient education, reimbursement assistance, and adherence programs, ensuring that patients receive the necessary treatments efficiently and effectively. Additionally, the rise in biologics, orphan drugs, and advanced therapies has fueled the demand for specialized distribution networks capable of managing intricate supply chains. Stringent regulatory frameworks, coupled with a focus on cost containment, have further shaped the market, driving innovation in distribution strategies. As healthcare systems globally emphasize patient-centric care and value-based models, the role of specialty drug distributors is becoming increasingly significant in ensuring the timely delivery of critical medications, enhancing patient outcomes, and optimizing healthcare costs. The ongoing advancements in pharmaceutical innovation will continue to propel the market forward, making it a pivotal component in modern healthcare delivery.

Key Market Insights:

Specialty drugs account for 55% of total drug spending in the U.S. despite comprising only 2% of all prescriptions.

Biologics make up 30% of the specialty drug market, driven by the rising prevalence of chronic diseases.

The global specialty drug market is expected to grow at a CAGR of 8-10% over the next few years.

Over 60% of newly approved drugs in recent years fall into the specialty category.

More than 40% of specialty drugs require cold chain logistics due to their complex nature.

90% of specialty pharmacies provide patient support services, enhancing adherence and outcomes.

Oncology drugs represent 40% of the global specialty drug market by therapeutic area.

Global Specialty Drug Distribution Market Drivers:

Rising Prevalence of Chronic and Rare Diseases

The increasing prevalence of chronic and rare diseases is a major driver of the Global Specialty Drug Distribution Market. Conditions such as cancer, multiple sclerosis, rheumatoid arthritis, and rare genetic disorders require advanced treatments that often involve high-cost, complex specialty drugs. With an aging global population and the growing incidence of lifestyle-related health conditions, the demand for these specialty medications is rapidly rising. Specialty drugs are designed to target specific disease mechanisms, offering more effective treatments where traditional therapies fall short. As healthcare providers increasingly rely on these medications, specialized distribution networks are critical for ensuring safe handling, storage, and delivery. This trend is fueling the growth of the specialty drug distribution market, as it meets the specific requirements of these medications while also providing patient support services such as adherence programs and education.

Advancements in Biopharmaceuticals and Personalized Medicine

Technological advancements in biopharmaceuticals and personalized medicine are significantly boosting the specialty drug distribution market. The rise of biologics, biosimilars, and gene therapies has led to the development of highly specialized drugs that target individualized patient needs. Personalized medicine, which tailors treatments based on a patient’s genetic makeup, is gaining traction as it offers more precise and effective therapies. However, these innovative treatments require sophisticated logistics and distribution solutions, often involving cold chain management, to maintain drug efficacy. The need for specialized services in the distribution of these high-value drugs, alongside the growing pipeline of biopharmaceutical innovations, is driving the demand for specialty drug distribution networks, ensuring the efficient delivery of personalized treatments to patients worldwide.

Global Specialty Drug Distribution Market Restraints and Challenges:

The Global Specialty Drug Distribution Market faces several restraints and challenges, primarily due to the high cost and complexity associated with specialty drugs. These medications often require specific handling, storage, and transportation, including cold chain logistics, which increase operational expenses for distributors. Additionally, the reimbursement landscape for specialty drugs is complex and varies across regions, making it difficult for patients and healthcare providers to access these treatments. Regulatory hurdles also pose significant challenges, as stringent guidelines for the handling and distribution of biologics, gene therapies, and other advanced medications require compliance with strict standards, adding to the administrative and logistical burden. Furthermore, the rising cost of specialty drugs has created affordability issues for patients, limiting market growth. Payers and insurance companies are increasingly implementing cost-containment strategies, such as prior authorization and formulary restrictions, which can delay or restrict access to these critical therapies. The challenge of balancing high-quality service with cost-efficiency, while navigating evolving regulatory frameworks, remains a significant barrier for specialty drug distributors. Moreover, the fragmented nature of global healthcare systems and the disparity in access to advanced treatments across different regions further complicates the market, hindering the widespread adoption of specialty drug distribution services.

Global Specialty Drug Distribution Market Opportunities:

The Global Specialty Drug Distribution Market presents significant opportunities, particularly as the demand for advanced therapies and personalized medicine continues to rise. One key opportunity lies in the growing focus on rare diseases and orphan drugs, which are gaining attention due to advancements in biotechnology and regulatory incentives for their development. As the pipeline for these drugs expands, distributors have the chance to establish specialized networks to manage the unique logistics and handling requirements of these therapies. Additionally, the increasing adoption of digital health technologies and data analytics in the pharmaceutical industry opens avenues for enhancing efficiency in the supply chain. Through real-time tracking, predictive analytics, and automated processes, distributors can optimize inventory management, reduce waste, and ensure timely deliveries. Another opportunity is the expansion of specialty pharmacies, which provide critical patient support services such as education, adherence programs, and assistance with reimbursement. By partnering with healthcare providers and payers, specialty drug distributors can play a crucial role in improving patient outcomes and reducing healthcare costs. Furthermore, as global healthcare systems emphasize value-based care and patient-centered models, specialty drug distributors have the opportunity to position themselves as essential players in delivering innovative, life-saving medications to patients worldwide, driving long-term market growth.

SPECIALTY DRUG DISTRIBUTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Therapeutic Area, Route of Administration, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cardinal Health, Inc., Cencora, Inc., CuraScript Specialty Distribution, Walgreens Boots Alliance, Inc., Express Scripts Holding Company, Alliance Healthcare, Procare Pharmacy, LLC, EnvoyHealth (Diplomat Specialty Pharmacy), Accredo Health Group, Inc., OptumRx, Medline Industries, Inc. |

Global Specialty Drug Distribution Market Segmentation: By Therapeutic Area

-

Oncology

-

Rheumatology

-

Neurology

-

Hematology

-

Infectious Diseases

In 2023, based on market segmentation by Therapeutic Area, Oncology had the highest share of the Global Specialty Drug Distribution Market. Cancer remains one of the leading causes of death worldwide, driving significant demand for oncology treatments and specialty drug distribution. The prevalence of cancer continues to rise, which has created an ever-growing need for advanced medications, including chemotherapy, immunotherapies, and targeted therapies. Continuous innovation in the oncology drug landscape has resulted in the development of new, highly effective treatments that address specific cancer types and genetic profiles. This rapid evolution is increasing the market share of oncology drugs, as healthcare providers seek the most cutting-edge therapies to improve patient outcomes. Moreover, oncology medications are often high-value due to their complexity in development and manufacturing, with many of these treatments coming at a premium price. The substantial cost of oncology drugs, combined with their critical role in saving lives, further solidifies their dominance in the specialty drug distribution market. However, this dominance is not static and can fluctuate based on various factors. New drug approvals, shifts in cancer prevalence, regulatory changes, and economic conditions can influence market dynamics over time. As a result, specialty drug distributors must remain agile and responsive to changes in the oncology sector to maintain their position in this competitive and rapidly evolving market.

Global Specialty Drug Distribution Market Segmentation: By Route of Administration

-

Oral

-

Injectable

-

Infusion

In 2023, based on market segmentation by Route of Administration, Injectable had the highest share of the Global Specialty Drug Distribution Market. Complex therapies are a hallmark of the specialty drug market, particularly for treating chronic conditions like cancer, autoimmune diseases, and rare disorders. Many of these therapies require injectable administration to deliver precise dosages directly into the bloodstream or target specific tissues, which is often necessary for achieving optimal therapeutic outcomes. The development of advanced injectable technologies has significantly enhanced the convenience and accessibility of these medications. Innovations such as pre-filled syringes, auto-injectors, and infusion pumps have streamlined the administration process, making it easier for patients to manage their treatments at home or in clinical settings. These advancements not only simplify the injection process but also improve patient adherence by reducing the burden of complex dosing regimens. Additionally, injectable therapies often exhibit superior efficacy compared to oral medications for certain conditions, as they ensure that the drug is absorbed effectively and reaches its intended target with higher precision. The ability to administer high-potency drugs directly into the bloodstream allows for more controlled and effective treatment, addressing the specific needs of patients with challenging medical conditions and contributing to the ongoing growth of the specialty drug distribution market.

Global Specialty Drug Distribution Market Segmentation: By Distribution Channel

-

Hospitals

-

Retail Pharmacies

-

Specialty Pharmacies

-

Home Delivery

In 2023, based on market segmentation by Distribution Channel, Hospitals had the highest share of the Global Specialty Drug Distribution Market. Hospitals play a crucial role in the administration of complex treatments and procedures that rely on specialty drugs. These healthcare settings are equipped to manage the intricate demands of administering high-potency medications, particularly for conditions such as cancer, rare diseases, and chronic illnesses. Hospitals typically maintain direct relationships with pharmaceutical manufacturers and distributors, which ensures the timely and efficient delivery of specialty medications required for patient care. This direct delivery system is essential for meeting the immediate needs of patients undergoing complex treatments, where delays or interruptions can significantly impact treatment outcomes. Additionally, hospitals are subject to stringent regulatory oversight, which mandates rigorous protocols for the handling, storage, and administration of specialty drugs. This regulatory compliance is vital for ensuring the safety and efficacy of medications and protecting patients from potential risks associated with these high-value therapies. By adhering to these strict guidelines, hospitals ensure that specialty drugs are managed properly, thus maintaining high standards of care and supporting the overall effectiveness of complex treatments. The combination of direct relationships with suppliers and robust regulatory practices underscores the critical role hospitals play in the specialty drug distribution ecosystem.

Global Specialty Drug Distribution Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Specialty Drug Distribution Market. The United States benefits from advanced healthcare infrastructure, featuring a vast network of hospitals, clinics, and specialty pharmacies that collectively enhance the accessibility and delivery of specialty drugs. This robust infrastructure supports the effective management of complex treatments, ensuring that patients receive timely and precise care. Additionally, the U.S. market is known for its high drug prices, which often exceed those in other regions, contributing to a larger market size for specialty drugs. The premium prices of these medications reflect the costs associated with their development, manufacturing, and distribution. Furthermore, North America serves as a major hub for pharmaceutical research and development, driving innovation in the specialty drug sector. The significant investments in R&D led to the introduction of cutting-edge therapies and advanced drug delivery systems, further expanding the market. This combination of sophisticated healthcare infrastructure, high drug prices, and a strong R&D presence positions the United States as a key player in the global specialty drug distribution market, influencing trends and shaping the future of specialty therapies.

COVID-19 Impact Analysis on the Global Specialty Drug Distribution Market.

The COVID-19 pandemic had a profound impact on the Global Specialty Drug Distribution Market, both positively and negatively. On one hand, the pandemic disrupted supply chains globally, leading to logistical challenges, delays in drug deliveries, and increased operational costs. Specialty drugs, which often require cold chain logistics and precise handling, were particularly affected due to transportation restrictions and workforce shortages. However, the pandemic also highlighted the critical role of specialty drug distribution networks in ensuring the timely delivery of life-saving medications to patients with chronic and rare conditions, even in the face of global disruptions. The surge in demand for certain specialty drugs, such as those used to treat COVID-related complications or support immunocompromised patients, created new opportunities for distributors. Moreover, the rapid development and distribution of vaccines and advanced therapies during the pandemic underscored the importance of robust, flexible distribution systems capable of scaling up and adapting to urgent needs. The increased adoption of telemedicine and digital health platforms further accelerated the shift towards patient-centered care, driving demand for home delivery and remote monitoring of specialty drugs. While the pandemic posed challenges, it also catalyzed innovation in the specialty drug distribution sector, paving the way for more resilient and efficient models in the future.

Latest trends / Developments:

The Global Specialty Drug Distribution Market is witnessing several key trends and developments that are reshaping the industry. One prominent trend is the increasing use of technology, such as artificial intelligence (AI) and data analytics, to optimize supply chain operations. These technologies enable distributors to predict demand, manage inventories efficiently, and ensure timely deliveries while minimizing waste. Another notable development is the growing focus on patient-centric services, with specialty pharmacies and distributors offering enhanced support programs, including home delivery, telehealth consultations, and medication adherence monitoring, to improve patient outcomes. The rise of personalized medicine, particularly in oncology and gene therapies, is also driving the demand for specialized distribution networks capable of handling complex therapies that require cold chain logistics and specialized storage conditions. Furthermore, the expansion of specialty drug distribution networks into emerging markets presents new opportunities as healthcare infrastructure improves and the demand for advanced treatments grows. Regulatory changes, particularly in the U.S. and Europe, are influencing market dynamics, with increased scrutiny on drug pricing and access driving innovation in distribution models. These trends, combined with the rising number of biologics and orphan drugs, are shaping the future of specialty drug distribution, emphasizing flexibility, efficiency, and patient-centered care.

Key Players:

-

Cardinal Health, Inc.

-

Cencora, Inc.

-

CuraScript Specialty Distribution

-

Walgreens Boots Alliance, Inc.

-

Express Scripts Holding Company

-

Alliance Healthcare

-

Procare Pharmacy, LLC

-

EnvoyHealth (Diplomat Specialty Pharmacy)

-

Accredo Health Group, Inc.

-

OptumRx

-

Medline Industries, Inc.

Chapter 1. Specialty Drug Distribution Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Specialty Drug Distribution Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Specialty Drug Distribution Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Specialty Drug Distribution Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Specialty Drug Distribution Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Specialty Drug Distribution Market – By Therapeutic Area

6.1 Introduction/Key Findings

6.2 Oncology

6.3 Rheumatology

6.4 Neurology

6.5 Hematology

6.6 Infectious Diseases

6.7 Y-O-Y Growth trend Analysis By Therapeutic Area

6.8 Absolute $ Opportunity Analysis By Therapeutic Area, 2024-2030

Chapter 7. Specialty Drug Distribution Market – By Route of Administration

7.1 Introduction/Key Findings

7.2 Oral

7.3 Injectable

7.4 Infusion

7.5 Y-O-Y Growth trend Analysis By Route of Administration

7.6 Absolute $ Opportunity Analysis By Route of Administration, 2024-2030

Chapter 8. Specialty Drug Distribution Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Retail Pharmacies

8.4 Specialty Pharmacies

8.5 Home Delivery

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Specialty Drug Distribution Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Therapeutic Area

9.1.3 By Route of Administration

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Therapeutic Area

9.2.3 By Route of Administration

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Therapeutic Area

9.3.3 By Route of Administration

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Therapeutic Area

9.4.3 By Route of Administration

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Therapeutic Area

9.5.3 By Route of Administration

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Specialty Drug Distribution Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cardinal Health, Inc.

10.2 Cencora, Inc.

10.3 CuraScript Specialty Distribution

10.4 Walgreens Boots Alliance, Inc.

10.5 Express Scripts Holding Company

10.6 Alliance Healthcare

10.7 Procare Pharmacy, LLC

10.8 EnvoyHealth (Diplomat Specialty Pharmacy)

10.9 Accredo Health Group, Inc.

10.10 OptumRx

10.11 Medline Industries, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Specialty Drug Distribution market is expected to be valued at US$ 2.7 billion.

Through 2030, the Global Specialty Drug Distribution market is expected to grow at a CAGR of 15%.

By 2030, the Global Specialty Drug Distribution Market is expected to grow to a value of US$ 7.18 billion.

North America is predicted to lead the Global Specialty Drug Distribution market.

The Global Specialty Drug Distribution Market has segments By Therapeutic Area, Route of Administration, Region, and Distribution Channel.