Speciality Packaging Market Size (2024-2030)

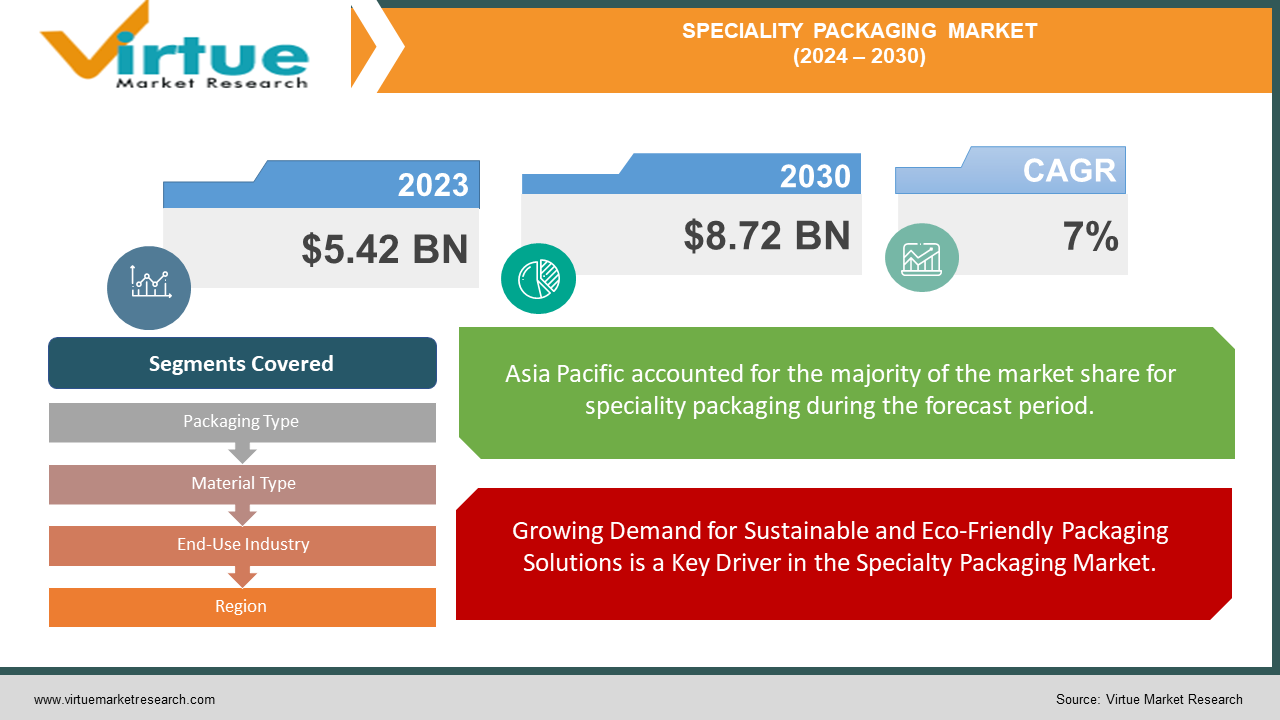

The Speciality Packaging Market was valued at USD 5.42 billion in 2023 and is projected to reach a market size of USD 8.72 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7%.

The specialty packaging market is witnessing significant growth due to the rising demand for innovative and sustainable packaging solutions across industries like food and beverage, pharmaceuticals, and personal care. Technological advancements and new materials are enabling more efficient and eco-friendly packaging. Additionally, the growth of e-commerce and consumer preference for convenient and attractive packaging are key drivers. This market is projected to expand further with ongoing investments in research and development.

Key Market Insights:

There is a noticeable trend in the specialty packaging sector toward environmentally friendly and sustainable packaging options. Consumer desire for environmentally friendly packaging is estimated to be 60%, which is increasing demand for recyclable, compostable, and biodegradable choices. Over the next five years, it is anticipated that this tendency would drive market growth by an estimated 15-20%.

Specialty packaging now has more opportunities thanks to the growth of e-commerce. Demand has increased by 25–30% as a result of the necessity of protective packaging to guarantee product safety during transit. This has sparked creativity in packing designs and materials, leading to the development of void fillers, cushioning materials, and environmentally friendly shipping options.

The market is being shaped by strict laws governing packaging safety, hygienic practices, and environmental effect. The typical percentage of overall packing costs is made up of compliance costs (10–15%). Businesses who spend money on R&D to comply with these restrictions get a competitive advantage and are able to charge higher fees.

Customers are looking for solutions for packaging that are distinctive and customized. About 40% of buyers are prepared to pay more for specialized packaging. This trend is spurring innovation in printing technology, materials, and packaging design, opening up new avenues for brand building and uniqueness.

Speciality Packaging Market Drivers:

Growing Demand for Sustainable and Eco-Friendly Packaging Solutions is a Key Driver in the Specialty Packaging Market.

The increasing consumer awareness and regulatory pressure towards sustainability have significantly driven the specialty packaging market. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that are not only effective but also eco-friendly. This shift has encouraged manufacturers to innovate and develop sustainable packaging materials, such as biodegradable plastics, recycled paper, and other green alternatives. Companies are investing in research and development to produce packaging that reduces environmental impact while meeting the functional and aesthetic needs of the market.

Advancements in Digital Printing Technology Fuel Customization and Market Growth in Specialty Packaging.

Technological advancements, particularly in digital printing, have revolutionized the specialty packaging industry by enabling high levels of customization. Digital printing allows for more flexible, cost-effective production runs, and can cater to specific branding requirements with greater precision and speed. This capability has been particularly beneficial for companies seeking to differentiate their products through unique and eye-catching packaging designs. Customization not only enhances brand recognition but also helps in meeting diverse consumer preferences, thereby driving market growth.

The Rise of E-Commerce Necessitates Innovative and Secure Specialty Packaging Solutions.

The surge in e-commerce has necessitated the development of specialized packaging solutions to ensure safe and efficient product delivery. With more consumers shopping online, there is a heightened need for packaging that can protect products during shipping while also being attractive and easy to handle. Innovations in tamper-evident and durable packaging materials are critical to maintaining product integrity and customer satisfaction in the e-commerce sector. The specialty packaging market has responded to these demands with solutions that balance security, functionality, and visual appeal.

Increasing Use of High-Barrier Packaging Sacks and Intermediate Bulk Containers for Specialty Chemicals.

In the chemical industry, the use of high-barrier packaging sacks and Intermediate Bulk Containers (IBCs) has become increasingly popular due to their ability to safely transport hazardous and sensitive materials. High-barrier sacks provide excellent protection against moisture and oxygen, extending the shelf life of specialty chemicals. Similarly, IBCs are favored for their robust construction and ability to handle a wide range of liquid and solid chemicals safely. This trend towards specialized packaging solutions in the chemical sector is a significant driver for the market, ensuring safe handling and compliance with stringent safety regulations.

Speciality Packaging Market Restraints and Challenges:

Particularly in price-sensitive industries, high production costs linked to complex designs, unique materials, and specialist manufacturing techniques might impede market penetration. Furthermore, it might be challenging to strike a balance between the needs of specialist packaging and sustainability goals because ecologically friendly solutions aren't always practical or affordable. Furthermore, because to the complex nature of specialty packaging, large research and development costs are frequently necessary, which lengthens the time to market and may make it more difficult for new competitors to enter the market.

Manufacturers may face substantial costs due to strict rules regarding safety requirements, labeling, and packaging materials. Furthermore, changes in the price of raw materials and interruptions in the supply chain can affect manufacturing costs and reduce profit margins. It is challenging for new entrants to succeed in this fiercely competitive market because existing businesses have strong market positions.

Speciality Packaging Market Opportunities:

The market for customized packaging is expected to increase significantly due to changing customer tastes and industry trends. Biodegradable, recyclable, and compostable packaging materials have a substantial market potential due to the growing need for environmentally friendly and sustainable packaging solutions. Furthermore, the increased emphasis on product safety and security drives the need for child-resistant, barrier-free, and tamper-evident packaging solutions. In addition, the demand for protective packaging solutions to maintain product integrity during transit has increased due to the expansion of e-commerce.

In addition, the healthcare and pharmaceutical industries present significant opportunities for expansion because of the strict laws governing packaging and the requirement for customized packaging solutions for patient compliance and medication administration. The personal care and cosmetics sector also offers chances for creative container designs that improve the usability and appeal of products. Specialty packaging suppliers may see significant expansion as a result of the rising demand for personalized and customized packaging solutions brought on by the ongoing evolution of customer expectations.

SPECIALITY PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Packaging Type, Material Type, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor, Berry Global, Mondi, Sealed Air, Sonoco, Smurfit Kappa |

Speciality Packaging Market Segmentation: By Packaging Type

-

Rigid packaging (bottles, jars, blisters)

-

Flexible packaging (pouches, bags, films)

-

Corrugated packaging (boxes, cartons)

-

Aerosol cans

-

Tubes

-

Closures and seals

The dominant segment is likely Flexible packaging, encompassing pouches, bags, and films, reigns as the dominant segment within the specialty packaging industry. Its versatility, cost-effectiveness, and ability to accommodate a wide range of product types have contributed to its substantial market share. The format's adaptability to diverse industries, from food and beverages to personal care and pharmaceuticals, has fueled its growth. Moreover, the increasing adoption of flexible packaging for its lightweight and efficient use of materials has solidified its position as a market leader. The fastest-growing segment is Rigid packaging, including bottles, jars, and blisters, is experiencing rapid growth due to increasing demand from the pharmaceutical, cosmetics, and food & beverage industries. The segment benefits from its ability to provide product protection, visual appeal, and consumer convenience.

Speciality Packaging Market Segmentation: By Material Type

-

Plastic (PET, HDPE, PP, PVC)

-

Paper and paperboard

-

Glass

-

Metal (aluminum, tin)

-

Bio-based materials (bioplastics, biodegradable films)

Plastic remains the dominant material in the specialty packaging market. Its extensive application across sectors has been facilitated by its adaptability, affordability, and capacity to be molded into a wide range of forms and sizes. The material is a popular option for packing a variety of goods because of its barrier qualities, robustness, and lightweight design.

However, the fastest-growing segment is Bio-based materials, Growing consumer demand for sustainable packaging solutions and environmental concerns have led to a rapid increase in bio-based materials, such as bioplastics and biodegradable films. The use of these materials has been fueled by the need to minimize environmental effect and reduce plastic pollution. Even though the market for bio-based materials is still tiny when compared to plastic, its growth trajectory is noteworthy and points to a move toward more environmentally friendly packaging solutions.

Speciality Packaging Market Segmentation: By End-Use Industry

-

Pharmaceuticals

-

Cosmetics and personal care

-

Food and beverages

-

Electronics

-

Healthcare

-

Industrial

The food and beverage industry is the largest consumer of specialty packaging. A diversity of packaging solutions are required due to the items' varied spectrum, which includes processed foods and beverages as well as fresh produce. In this industry, the need for specialty packaging has been pushed by the emphasis on consumer convenience, brand distinctiveness, and product preservation.

The pharmaceutical industry is experiencing rapid growth in specialty packaging due to stringent regulations, increasing product complexity, and the need for tamper-evident, child-resistant, and barrier packaging. The need for creative packaging solutions in this industry has been stoked by the emphasis on patient safety, product integrity, and brand protection. Further driving the pharmaceutical packaging market's expansion are the aging population and the rising incidence of chronic illnesses.

Speciality Packaging Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The largest market for specialty packaging at the moment is Asia Pacific. With their expanding populations and swift economic development, nations like China and India are creating a large need for packaging solutions in a variety of industries. The region's dominance has also been aided by its cost-competitive environment and manufacturing capabilities.

Asia Pacific is the specialty packaging industry's fastest-growing region, despite being the largest market. The demand for new packaging solutions is being driven by the region's changing lifestyles, rising disposable incomes, and greater emphasis on brand image. Furthermore, the expansion of environmentally friendly packaging solutions is being driven by government efforts that support sustainable packaging.

COVID-19 Impact Analysis on the Speciality Packaging Market:

The COVID-19 epidemic has had a significant impact on the specialty packaging business, presenting both opportunities and challenges. The worldwide supply chain was severely disrupted at first, which resulted in a shortage of materials and production delays. Lockdowns and labor shortages made these problems much worse, making it harder for the sector to meet demand. The epidemic did, however, also quicken a number of earlier trends.

Strong packaging methods were required to preserve products during delivery due to the rise in e-commerce caused by stay-at-home orders and social distancing measures. As a result, there was a rise in the need for padding, void fillers, and secure closures among other protective packaging materials. The demand for specialized packaging solutions for pharmaceuticals, medical gadgets, and personal protective equipment increased along with the healthcare sector's unparalleled expansion.

Additionally, there was a notable change in the behavior of consumers, with a heightened Furthermore, a notable change in consumer behavior was seen, with an increased focus on sustainability, safety, and hygiene. This led to a rise in the need for packaging solutions that are child-resistant, barrier-proof, and tamper-evident. The use of environmentally friendly packaging materials, such as recyclable and biodegradable alternatives, was accelerated at the same time as environmental awareness increased. Even though the pandemic presented many difficulties in the beginning, the specialty packaging sector showed tenacity and flexibility, eventually emerging with creative solutions and a fresh emphasis on customer needs.

Latest Trends/ Developments:

A few major developments are driving the rapid evolution of the specialty packaging business. Sustainability is a top priority, with a focus on less packaging waste, eco-friendly products, and circular economy ideas. The need for packaging solutions that disclose the product's origin, ingredients, and sustainability credentials is being driven by consumers' growing demands for transparency and traceability. Furthermore, the e-commerce boom is still reshaping the business, calling for creative package designs that minimize environmental effect while protecting goods throughout transit.

The specialty packaging industry is changing as a result of technological advancements. Solutions for smart packaging, augmented reality, and digital printing are becoming more popular. Improved product identification, supply chain visibility, and brand engagement are made possible by these technologies. Personalized packaging is also becoming more and more popular as customers look for solutions that represent their unique.

Key Players:

-

Amcor

-

Berry Global

-

Mondi

-

Sealed Air

-

Sonoco

-

Smurfit Kappa

Chapter 1. Speciality Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Speciality Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Speciality Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Speciality Packaging Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Speciality Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Speciality Packaging Market – By Packaging

6.1 Introduction/Key Findings

6.2 Rigid packaging (bottles, jars, blisters)

6.3 Flexible packaging (pouches, bags, films)

6.4 Corrugated packaging (boxes, cartons)

6.5 Aerosol cans

6.6 Tubes

6.7 Closures and seals

6.8 Y-O-Y Growth trend Analysis By Packaging

6.9 Absolute $ Opportunity Analysis By Packaging, 2024-2030

Chapter 7. Speciality Packaging Market – By Material Type

7.1 Introduction/Key Findings

7.2 Plastic (PET, HDPE, PP, PVC)

7.3 Paper and paperboard

7.4 Glass

7.5 Metal (aluminum, tin)

7.6 Bio-based materials (bioplastics, biodegradable films)

7.7 Y-O-Y Growth trend Analysis By Material Type

7.8 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 8. Speciality Packaging Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Pharmaceuticals

8.3 Cosmetics and personal care

8.4 Food and beverages

8.5 Electronics

8.6 Healthcare

8.7 Industrial

8.8 Y-O-Y Growth trend Analysis By End-Use Industry

8.9 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Speciality Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Packaging

9.1.3 By Material Type

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Packaging

9.2.3 By Material Type

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Packaging

9.3.3 By Material Type

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Packaging

9.4.3 By Material Type

9.4.4 By Material Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Packaging

9.5.3 By Material Type

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Speciality Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Amcor

10.2 Berry Global

10.3 Mondi

10.4 Sealed Air

10.5 Sonoco

10.6 Smurfit Kappa

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Speciality Packaging Market was valued at USD 5.42 billion in 2023 and is projected to reach a market size of USD 8.72 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7%.

Increasing consumer focus on product safety, Sustainability, and Brand experience Additionally, the growth of e-commerce, stringent regulations, and advancements in packaging technology are key drivers.

Pharmaceuticals, Cosmetics and personal care, food & beverage, electronics, Healthcare, and Industrial.

Asia Pacific is the most dominant region in the specialty packaging market, driven by rapid economic growth, increasing population, and rising disposable incomes.

Amcor, Berry Global, Mondi, Sealed Air, Sonoco, Smurfit Kappa.