Sparkling Tea Market Size (2024 – 2030)

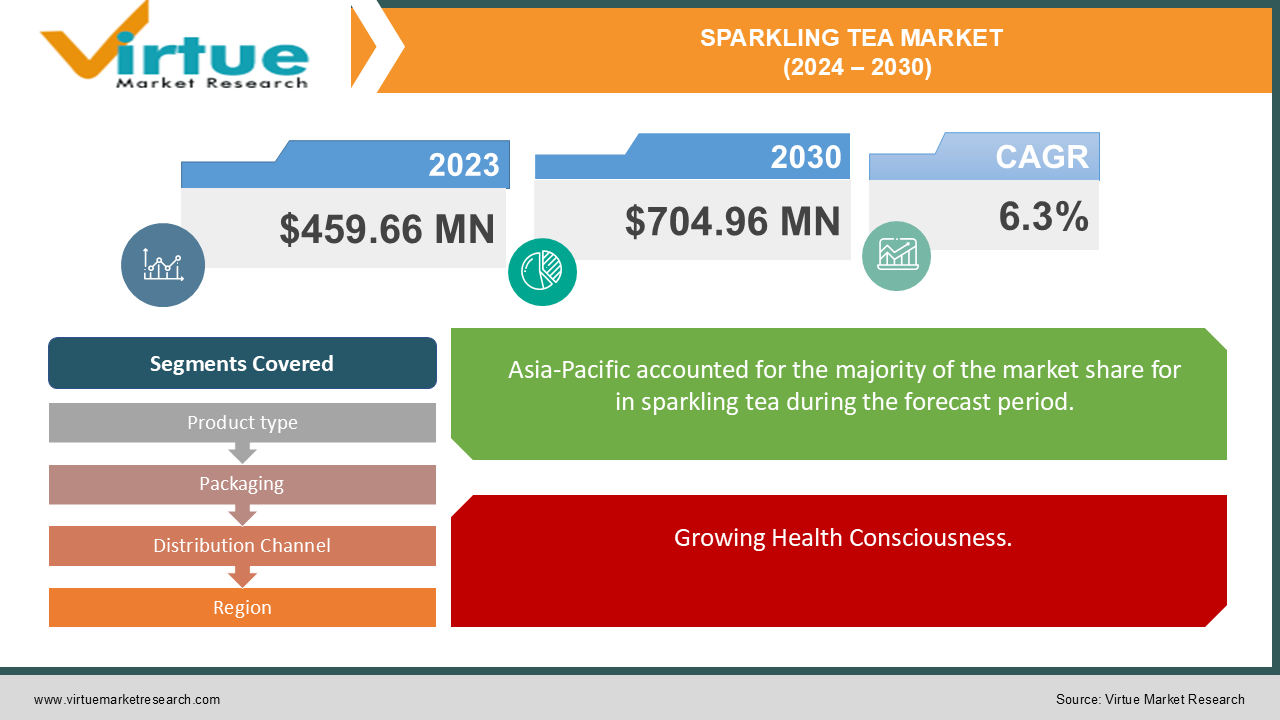

The Global Sparkling Tea Market was valued at USD 459.66 million in 2023 and is projected to reach a market size of USD 704.96 million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.3% between 2024 and 2030.

The Global Sparkling Tea Market has emerged as a dynamic and rapidly growing segment within the beverage industry, driven by increasing consumer preference for healthier, low-calorie alternatives to traditional soft drinks. Sparkling tea, which combines the refreshing effervescence of carbonated beverages with the nuanced flavors of tea, offers a unique and appealing option for health-conscious consumers seeking a flavorful yet mindful choice. This innovative category has gained traction due to its perceived health benefits, including antioxidants and lower sugar content compared to many other carbonated drinks. The market is further buoyed by the rise in demand for functional beverages, with sparkling tea being recognized for its potential digestive and wellness benefits. The expansion of this market is also supported by the introduction of diverse flavors and formulations, catering to a broad range of taste preferences and dietary needs. Additionally, the growing trend of premiumization in the beverage sector has led to the development of artisanal and gourmet sparkling tea options, enhancing consumer interest and driving market growth. As a result, the global sparkling tea market is experiencing robust growth, with a wide array of products becoming increasingly available across various retail channels.

Key Market Insights:

-

Approximately 60% of sparkling tea offerings feature fruit-infused flavors, catering to diverse consumer preferences.

-

About 45% of sparkling tea consumers are driven by health benefits, such as lower sugar content and antioxidants.

-

The premium segment of the sparkling tea market is growing at a rate of around 20% annually, reflecting increased consumer interest in high-quality products.

-

Nearly 70% of sparkling tea sales occur through specialty and natural food stores, highlighting the market’s niche positioning.

-

North America accounts for approximately 40% of the global sparkling tea market, driven by growing health trends and innovative product offerings.

Global Sparkling Tea Market Drivers:

Growing Health Consciousness.

The surge in health consciousness among consumers is a significant driver of the Global Sparkling Tea Market. As people increasingly prioritize wellness and seek healthier alternatives to traditional sugary soft drinks, sparkling tea has emerged as a popular choice. Sparkling tea combines the refreshing qualities of carbonated beverages with the health benefits of tea, such as antioxidants and lower calorie content. This dual appeal meets the demand for both flavorful and health-conscious options, making sparkling tea an attractive alternative. Consumers are drawn to its potential benefits, including improved digestion and reduced sugar intake, which align with broader dietary trends favoring natural and functional ingredients. The emphasis on wellness has also led to the introduction of various formulations that cater to specific health needs, such as detoxifying or energizing blends. As awareness of health and wellness continues to grow, the demand for sparkling tea is expected to increase, driving market expansion and encouraging brands to innovate with new flavors and functional benefits.

Innovation and Premiumization.

Innovation and premiumization within the beverage industry are fueling the growth of the Global Sparkling Tea Market. The market is witnessing a surge in artisanal and gourmet sparkling tea options that offer unique flavors and high-quality ingredients. This trend towards premiumization is driven by consumer desire for exclusive and high-end products that provide a superior sensory experience. Beverage companies are investing in developing new and exotic flavors, incorporating premium ingredients such as organic teas and natural fruit extracts, and offering artisanal brewing methods. This innovation not only caters to the evolving taste preferences of consumers but also aligns with the broader trend of premiumization in the food and beverage sector. Additionally, the rise of premium sparkling tea products is being supported by an increased focus on packaging aesthetics and branding, further enhancing the appeal of these products to discerning consumers. As a result, the market is expanding as premium and innovative offerings attract a growing segment of consumers willing to pay a premium for unique and high-quality sparkling tea experiences.

Global Sparkling Tea Market Restraints and Challenges:

The Global Sparkling Tea Market faces significant restraints and challenges primarily due to high production costs and market fragmentation. The production of sparkling tea involves specialized processes and premium ingredients, which contribute to elevated costs. These expenses can impact pricing strategies and limit accessibility to certain consumer segments, particularly in price-sensitive markets. Additionally, the market is fragmented with numerous small and artisanal brands competing alongside established players, leading to intense competition and pricing pressures. This fragmentation can make it difficult for new entrants to gain a foothold and for existing brands to differentiate themselves. The variety of flavors and formulations also complicates supply chain management and consistency in product quality. Furthermore, regulatory requirements and quality control standards add to the complexity and cost of production. These factors combined can hinder market growth and profitability, as companies must navigate a challenging landscape to balance innovation, cost management, and consumer demand. Addressing these challenges requires strategic planning, investment in efficient production technologies, and effective brand differentiation to sustain growth in a competitive and evolving market.

Global Sparkling Tea Market Opportunities:

The Global Sparkling Tea Market presents substantial opportunities driven by expanding consumer preferences and growth in emerging markets. As consumers continue to seek healthier beverage options, sparkling tea's unique combination of effervescence and tea benefits aligns well with current health trends, creating a fertile ground for market expansion. The rising interest in functional beverages and natural ingredients offers opportunities for innovation in flavor profiles and formulations, such as adaptogenic or functional blends that cater to specific health needs. Additionally, emerging markets in Asia-Pacific and Latin America are witnessing increased disposable incomes and changing lifestyles, contributing to a growing demand for premium and novel beverage options. Companies can capitalize on this trend by introducing region-specific flavors and expanding distribution channels to cater to diverse consumer tastes. Furthermore, the rise of e-commerce and direct-to-consumer models presents new avenues for market penetration and customer engagement, allowing brands to reach a broader audience and build brand loyalty. By leveraging these opportunities, companies can drive growth, differentiate themselves in the marketplace, and meet the evolving needs of a global consumer base seeking innovative and health-conscious beverage choices.

SPARKLING TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Product type, Packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kombucha Breweries, PepsiCo, Inc., Nestlé S.A., Keurig Dr Pepper Inc., The Coca-Cola Company, Coca-Cola Company, GT’s Living Foods, Brew Dr. Kombucha, Humm Kombuchas, ITO EN, Ltd. |

Global Sparkling Tea Market Segmentation: By Product Type

-

Fruit-flavored sparkling tea

-

Herbal-flavored sparkling tea

-

Blended sparkling tea

-

Caffeinated sparkling tea

-

Decaffeinated sparkling tea

In 2023, based on market segmentation by Product Type, Fruit-Flavored sparkling tea had the highest share of the Global Sparkling tea Market. Fruit flavors have emerged as a dominant trend in the sparkling tea category due to their broad consumer appeal and refreshing natural taste. These flavors resonate with a wide audience, making them a popular choice among consumers looking for a flavorful and satisfying beverage. The variety and innovation within fruit-flavored sparkling teas are significant drivers of market growth, as brands continually introduce new and unique flavors to capture consumer interest and stand out in a competitive market. This constant innovation not only attracts new customers but also helps maintain the interest of existing ones. Additionally, fruit-flavored sparkling teas are often marketed as healthier alternatives to sugary sodas and juices, aligning with the growing trend of health-conscious consumption. Their appeal is further enhanced by their versatility; they can be enjoyed as standalone beverages or used as mixers in cocktails, adding to their attractiveness. While herbal and blended sparkling teas also cater to specific niche markets, the combination of popularity, versatility, and health-conscious appeal positions fruit-flavored sparkling teas as the dominant product type in 2023. This trend reflects the evolving preferences of consumers who prioritize taste, health benefits, and multifunctionality in their beverage choices.

Global Sparkling Tea Market Segmentation: By Packaging

-

Plastic bottles

-

Aluminum cans

-

Glass bottles

In 2023, based on market segmentation by Packaging, Plastic Bottles sparkling tea had the highest share of the Global Sparkling tea Market. Plastic bottles continue to hold a significant share in the packaging industry due to their practical advantages and affordability. Their lightweight nature and ease of use make them highly convenient for consumers, particularly those who are frequently on the go. Plastic bottles are easy to carry, open, and close, which enhances their appeal for daily use and portability. Additionally, they are generally more cost-effective compared to alternatives such as glass bottles or aluminum cans, contributing to their widespread adoption. The versatility of plastic bottles is another key factor, as they can be produced in various sizes and shapes to meet different product volumes and marketing requirements. While there have been concerns about the environmental impact of plastic, the proliferation of recycling programs has helped mitigate some of these issues by promoting the reuse and recycling of plastic materials. Despite the growing popularity of aluminum cans and glass bottles, which are valued for their sustainability and premium feel, plastic bottles maintain a strong market presence due to their convenience, affordability, and adaptability, making them a practical choice for both consumers and manufacturers.

Global Sparkling Tea Market Segmentation: By Distribution Channel

-

Supermarkets and hypermarkets

-

Convenience stores

-

Online retailers

In 2023, based on market segmentation by Distribution Channel, Supermarkets and hypermarkets sparkling tea had the highest share of the Global Sparkling tea Market.

Global Sparkling Tea Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, Asia-Pacific sparkling tea had the highest share of the Global Sparkling tea Market. The Asia-Pacific region has emerged as a powerhouse in the sparkling tea market, driven by rapid growth factors such as rising disposable incomes, changing lifestyles, and an increasing preference for healthier beverages. As consumers in this region become more health-conscious, sparkling tea has gained popularity as a refreshing alternative to sugary sodas and traditional tea. The cultural significance of tea in many Asian countries also plays a crucial role, making sparkling tea a natural fit for these markets. Furthermore, the region has been at the forefront of product innovation, with local companies introducing new and unique flavors, packaging formats, and functional ingredients that appeal to a diverse and discerning consumer base. The large and growing population in Asia-Pacific significantly contributes to the overall size and expansion of the sparkling tea market, positioning the region as a key player in the global landscape. While North America and Europe have traditionally been strong markets for sparkling tea, the rapid growth and innovation seen in Asia-Pacific suggest that this region may have surpassed them in market share. The combination of cultural alignment, economic growth, and innovative product offerings has solidified Asia-Pacific's dominance in the sparkling tea market.

COVID-19 Impact Analysis on the Globa Sparkling Teal Market.

The COVID-19 pandemic had a notable impact on the Global Sparkling Tea Market, influencing both consumer behavior and supply chains. As the pandemic prompted a shift towards healthier lifestyles, consumer interest in sparkling tea surged, driven by its perceived health benefits and low-calorie profile compared to traditional sugary drinks. This trend led to increased demand for sparkling tea as consumers sought healthier and refreshing alternatives while spending more time at home. However, the pandemic also caused significant supply chain disruptions, affecting the production and distribution of sparkling tea. Lockdowns and restrictions led to delays in sourcing raw materials, manufacturing processes, and transportation, resulting in product shortages and increased costs. Additionally, the closure of many foodservice outlets and a shift towards online shopping altered traditional sales channels, requiring brands to adapt their strategies to meet changing consumer behaviors. Despite these challenges, the pandemic accelerated the adoption of e-commerce and direct-to-consumer models, providing new opportunities for market growth. Overall, while COVID-19 created short-term disruptions, it also highlighted and accelerated long-term trends favoring healthier beverages and digital engagement, shaping the future landscape of the sparkling tea market.

Latest trends / Developments:

The Global Sparkling Tea Market is currently experiencing several notable trends and developments driven by innovation and health-focused consumer preferences. One prominent trend is the introduction of new and exotic flavors, as brands seek to differentiate themselves and cater to diverse consumer tastes. This includes unique combinations of fruits, herbs, and spices that enhance the sensory appeal of sparkling tea. Another significant development is the rise of functional sparkling teas, which incorporate ingredients like adaptogens, probiotics, and vitamins aimed at boosting health benefits and catering to wellness-oriented consumers. The premiumization trend is also evident, with an increasing number of artisanal and high-quality sparkling tea options emerging, reflecting a growing consumer appetite for upscale and sophisticated beverages. Additionally, there is a notable shift towards sustainable and eco-friendly packaging, as brands respond to rising environmental concerns and consumer demand for greener choices. The expansion of e-commerce platforms and direct-to-consumer sales channels is further reshaping the market, allowing brands to reach a broader audience and adapt to changing shopping behaviors. These trends collectively highlight the dynamic evolution of the sparkling tea market, driven by innovation, health consciousness, and sustainability.

Key Players:

-

Kombucha Breweries

-

PepsiCo, Inc.

-

Nestlé S.A.

-

Keurig Dr Pepper Inc.

-

The Coca-Cola Company

-

Coca-Cola Company

-

GT’s Living Foods

-

Brew Dr. Kombucha

-

Humm Kombuchas

-

ITO EN, Ltd.

Chapter 1. Sparkling Tea Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sparkling Tea Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sparkling Tea Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sparkling Tea Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sparkling Tea Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sparkling Tea Market – By Product Type

6.1 Introduction/Key Findings

6.2 Fruit-flavored sparkling tea

6.3 Herbal-flavored sparkling tea

6.4 Blended sparkling tea

6.5 Caffeinated sparkling tea

6.6 Decaffeinated sparkling tea

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Sparkling Tea Market – By Packaging

7.1 Introduction/Key Findings

7.2 Plastic bottles

7.3 Aluminum cans

7.4 Glass bottles

7.5 Y-O-Y Growth trend Analysis By Packaging

7.6 Absolute $ Opportunity Analysis By Packaging, 2024-2030

Chapter 8. Sparkling Tea Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets and hypermarkets

8.3 Convenience stores

8.4 Online retailers

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Sparkling Tea Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Packaging

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Packaging

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Packaging

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Packaging

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Packaging

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Sparkling Tea Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Kombucha Breweries

10.2 PepsiCo, Inc.

10.3 Nestlé S.A.

10.4 Keurig Dr Pepper Inc.

10.5 The Coca-Cola Company

10.6 Coca-Cola Company

10.7 GT’s Living Foods

10.8 Brew Dr. Kombucha

10.9 Humm Kombuchas

10.10 ITO EN, Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Sparkling Tea market is expected to be valued at US$ 459.66 million.

Through 2030, the Sparkling Tea market is expected to grow at a CAGR of 6.3%.

By 2030, the Global Sparkling Tea Market is expected to grow to a value of US$ 704.96 million.

Asia-Pacific is predicted to lead the Global Sparkling Tea market.

The Global Sparkling Tea Market has segments By product type,packaging, distribution channel and Region.