Soy Isoflavones Market Size (2024 – 2030)

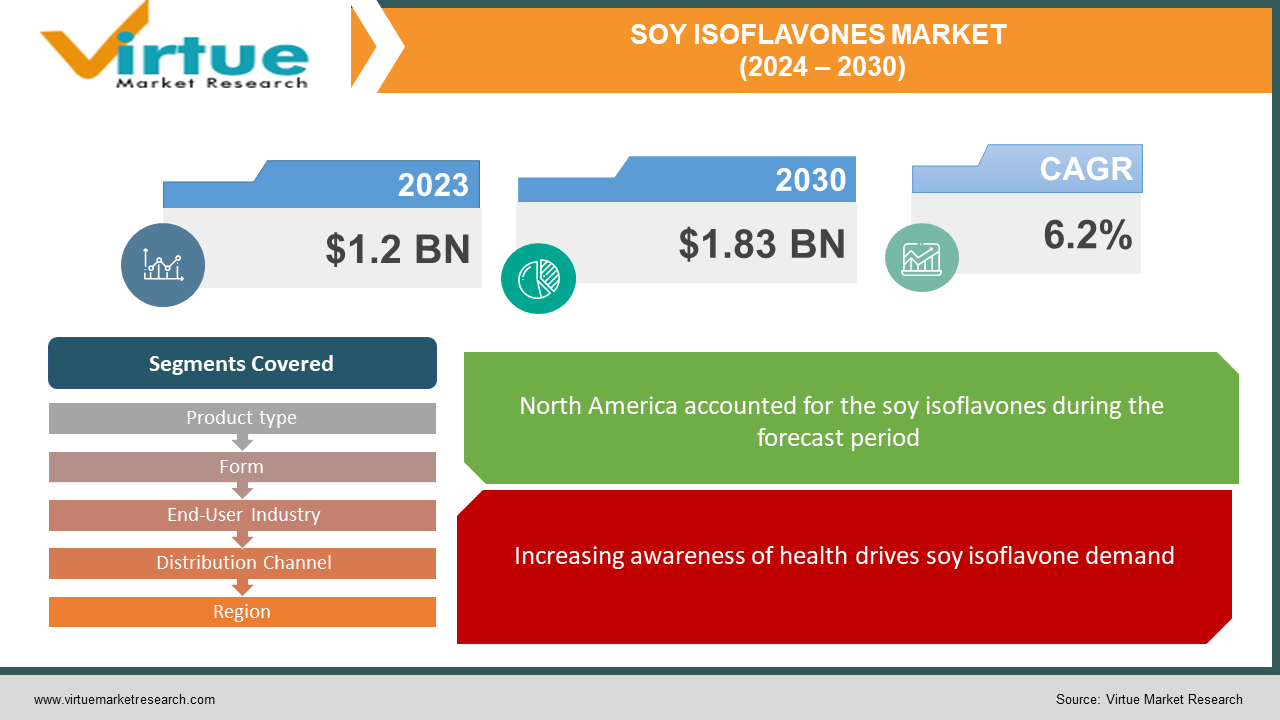

The market for soy isoflavones on a global level is expanding quickly; it was estimated to be worth USD 1.2 billion in 2023 and is expected to increase to USD 1.83 billion by 2030, with a projected compound annual growth rate (CAGR) of 6.2% from 2024 to 2030.

The dynamic global soy isoflavones market has been impacted by a growing awareness of health and wellness, which has increased demand for natural and plant-based supplements. Soy isoflavones, primarily derived from soybeans, have drawn interest because of their possible health benefits, which include promoting cardiovascular health, bone health, and a reduction in menopausal symptoms. The increasing predisposition of consumers towards functional foods and dietary supplements has led to remarkable growth in the business. As consumers seek out alternatives to conventional pharmaceuticals, the pharmaceutical industry has embraced soy isoflavones in the production of supplements and treatments. The personal care and cosmetics industry has added these compounds to skincare products in an attempt to further profit from their antioxidant properties. The market for soy isoflavones is anticipated to increase at a predicted compound annual growth rate (CAGR) of 6-7% over the next several years, offering opportunities for innovation and product development across several industries.

Key Market Insights:

Key market data indicates that growing consumer awareness of the health benefits of soy-based products will propel the worldwide soy isoflavones market to grow at a solid rate. The rising prevalence of lifestyle-related health issues has increased demand for functional foods and dietary supplements; soy isoflavones are gaining popularity as a natural, plant-based solution. By adding soy isoflavones to supplements intended to address a variety of health issues, the pharmaceutical industry has significantly contributed to the market's expansion in recognition of the potential therapeutic benefits of soy isoflavones. Moreover, the beauty and personal care sectors have embraced soy isoflavones' antioxidant properties, which has prompted their inclusion in skincare products. Due to the long-standing dietary traditions that include soy, Asia-Pacific remains a significant player in the region. The market's compound annual growth rate (CAGR) indicates that innovations and strategic alliances will probably cause the sector to change in the future to satisfy the shifting demands of consumers, who are everywhere health-conscious.

Global Soy Isoflavones Market Drivers:

Increasing awareness of health drives soy isoflavone demand.

Globally, consumers' growing emphasis on health and wellbeing is driving up demand for natural and plant-based solutions. Owing to their widely recognized advantages for cardiovascular and bone health, soy isoflavones have become an important component in addressing these problems. People are actively looking for functional foods and supplements, which is driving the industry's rapid expansion and shifting the paradigm in favor of preventative healthcare.

Soy isoflavones' therapeutic potential in the pharmaceutical industry is accelerating the growth rate.

The pharmaceutical industry's discovery of soy isoflavones' inherent therapeutic properties has sped up the incorporation of these compounds into supplement formulations that address a variety of health problems. As more and more studies highlight the health advantages of these substances, pharmaceutical companies are incorporating soy isoflavones into their products. As a result, the market is growing, and new chances for therapeutic breakthroughs are being created.

The beauty and skincare sectors benefit from the antioxidant properties of soy isoflavones, which is driving growth.

Because of the growing emphasis on natural ingredients, soy isoflavones have become crucial components in cosmetic and personal care products. These compounds are becoming more and more common in skincare products because of their well-known antioxidant properties. In keeping with the trend towards natural skincare products and holistic well-being, the beauty industry uses soy isoflavones to improve skin health and combat signs of aging.

Global Soy Isoflavone Market Restraints and Challenges:

Lack of knowledge is a major barrier.

A lack of client knowledge prevents the market from potentially growing. Despite all of the health advantages linked to soy isoflavones, a significant portion of the general public remains ignorant about them. To address this awareness gap, industry players will need to work together and implement targeted marketing campaigns, educational initiatives, and open channels of communication about the advantages of including soy isoflavones in daily meals.

Regulatory hurdles are faced by the market.

One major challenge facing the soy isoflavones sector is the compromise of numerous regulatory regimes. Differential approval processes between regions need companies to take a deliberate and thorough approach. Regulatory barriers must be removed via industry collaboration, adherence to evolving standards, and proactive interaction with regulatory bodies to speed up approval processes and grant market access.

Overcoming the different tastes is another challenge.

The unique flavor and taste of soy isoflavones may act as a barrier to their general acceptance. It takes creative product formulations, flavor masking, and application diversification to overcome customer opposition. Creating goods that appeal to a wide range of tastes and give health advantages is essential to growing the market's customer base and promoting acceptance of a variety of food and beverage options.

Global Soy Isoflavones Market Opportunities:

The use of this compound in menopause solutions has provided many opportunities.

The soy isoflavone market is expected to grow significantly and have a significant impact on women's health, particularly in the menopausal period. Specific solutions that target menopausal symptoms could potentially cater to the growing demand for natural therapies. Manufacturers have the chance to advance in the areas of functional foods and dietary supplements, providing women with effective and specific solutions for managing their health at this critical juncture in life.

The beauty and wellness industry has been helping with the expansion.

The soy isoflavones' antioxidant properties present an exciting opportunity for the cosmetics and personal care industries. Integrating these components into skin care products can help companies take the lead in creating effective and natural anti-aging treatments. Soy isoflavones are crucial in the creation of skincare products that promote skin health and vibrancy, and the market is spearheading a skincare revolution in this area.

Consumer awareness is extremely beneficial for the market to grow.

The soy isoflavones business presents a strategic opportunity to fund substantial consumer education initiatives to facilitate its international expansion. By providing clear and concise information about the health advantages of soy isoflavones, the industry can bridge the trust gap and increase consumer awareness globally. Education plays a major role in the transition of soy isoflavones from a specialty product to a generally recognized health advantage.

SOY ISOFLAVONES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Product type, Form, End-User Industry, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ADM, BASF SE, Cargill Incorporated, DSM S.V., Solbar Industries, Alpro, Frutarom, Sanwei, Shuanghe Songnen Soybean, Future Ceuticals, Fujicco |

Soy Isoflavones Market Segmentation: By Product Type

-

Genistein

-

Daidzein

-

Glycitein

Genistein is the largest and fastest-growing product type. Renowned for its potent antioxidant properties, genistein has been demonstrated to have several beneficial health effects, such as cardiovascular system support and potential anticancer effects. Studies suggest that genistein may be necessary to improve overall health and treat certain medical conditions. Owing to its numerous beneficial effects, genistein occupies a key position in the soy isoflavones market and draws clients seeking comprehensive health benefits from natural and plant-based sources.

Soy Isoflavones Market Segmentation: By Distribution Channel

-

Offline Retail

-

Online Retail

Offline retail is the largest growing channel. They are crucial for businesses that need large quantities of goods, yet retail stores are the most effective way to reach end consumers. With these channels, customers can communicate directly and make well-informed decisions based on their preferences. They also provide accessibility and ease of use. Online retail is the fastest-growing category. This is because e-commerce is becoming more and more popular. Additionally, this platform offers a wide range of possibilities, both domestic and foreign. Regular promotions and discounts are given out in a variety of ways. With all of these benefits, this section is a well-liked option.

Soy Isoflavones Market Segmentation: By Form

-

Powder

-

Liquid

Because of their versatility, powdered soy isoflavones are the largest and fastest-growing form. It is simple to include powdered forms in a range of products, including baked goods and dietary supplements. Because they are simple to blend and combine, powdered soy isoflavones are a popular choice among producers and consumers alike. This allows for greater flexibility in product creation and consumption. Powdered soy isoflavones are the most effective solution to meet a variety of market demands because of their versatility in dietary choices and use.

Soy Isoflavones Market Segmentation: By End-User Industry

-

Functional food and beverages

-

Cosmetics

-

Animal feed

-

Pharmaceuticals

Functional food and beverages are the largest growing segment. These firms have added soy isoflavones to their goods, including energy bars, nutritional supplements, and soy milk, because of their known health advantages. They have gained popularity due to consumer awareness The pharmaceutical industry is the fastest-growing end-user sector when it comes to optimizing the medicinal potential of soy isoflavones. These compounds are incorporated by the pharmaceutical industry into medications and supplements to address specific health concerns like hormone balance, bone health, and cardiovascular health. Precise formulations maximize the effects of soy isoflavones on specific health issues while delivering them in a regulated manner for pharmaceutical applications. This industry not only contributes significantly to research that broadens our understanding of soy isoflavones' potential medical applications, but it also makes it easier to accurately administer these compounds.

Soy Isoflavones Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America holds the largest market share of around 33%, indicating a significant presence and demand in the region because of growing consumer awareness of trends related to health. The Asia-Pacific region is the fastest-growing region with a substantial 27% share, highlighting the custom of incorporating soy-based products into local meals, together with the increasing popularity of natural health solutions.

COVID-19 Impact Analysis on the Global Soy Isoflavones Market:

The COVID-19 pandemic has had a major effect on the global soy isoflavones industry, as it has on many other enterprises. Disruptions to the supply chain, temporary closures of industrial facilities, and changes in consumer behavior have all affected the dynamics of the market. Since soy isoflavones are regarded as offering potential health benefits, a greater emphasis on health and well-being as a result of the pandemic may increase consumer interest in products containing them. But there have also been challenges, including shifting consumer behavior and unstable economic conditions that affect both manufacturing and consumption. The soy isoflavone market has demonstrated resilience in the face of pandemic-driven health consciousness by adapting to the shifting landscape. The growing market for natural and functional food items has created opportunities.

Latest Trends/ Developments:

The latest developments and trends in the business demonstrate how dynamically the soy isoflavones market responds to shifting consumer preferences and worldwide health trends. One noteworthy trend is the rise in demand for plant-based products; soy isoflavones are becoming more well-known as a sustainable and healthful substitute. This is in line with people's desire for plant-based, healthier diets and their growing consciousness of the environmental impact of their food choices. As a result, soy isoflavones have been the subject of a boom in product innovation, with a variety of applications ranging from drinks to snacks, catering to a larger spectrum of customers seeking functional and clean-label food options.

In addition, there is an increasing emphasis on research and development to discover novel applications and health benefits of soy isoflavones. Scientific studies into the chemicals' potential to cure certain medical conditions, such as hormonal balance, bone health, and cardiovascular health, are driving the market's growth. This evidence-based approach increases consumer confidence and allows the business to promote soy isoflavones as targeted treatments for various health conditions rather than merely as dietary supplements.

Key Players:

-

ADM

-

BASF SE

-

Cargill Incorporated

-

DSM S.V.

-

Solbar Industries

-

Alpro

-

Frutarom

-

Sanwei

-

Shuanghe Songnen Soybean

-

Future Ceuticals

-

Fujicco

Chapter 1. Soy Isoflavones Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Soy Isoflavones Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Soy Isoflavones Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Soy Isoflavones Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Soy Isoflavones Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Soy Isoflavones Market – By Product Type

6.1 Introduction/Key Findings

6.2 Genistein

6.3 Daidzein

6.4 Glycitein

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Soy Isoflavones Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Offline Retail

7.3 Online Retail

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Soy Isoflavones Market – By Form

8.1 Introduction/Key Findings

8.2 Powder

8.3 Liquid

8.4 Y-O-Y Growth trend Analysis End-Use Industry

8.5 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Soy Isoflavones Market – By End-User Industry

9.1 Introduction/Key Findings

9.2 Functional food and beverages

9.3 Cosmetics

9.4 Animal feed

9.5 Pharmaceuticals

9.6 Y-O-Y Growth trend Analysis By End-User Industry

9.7 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 10. Soy Isoflavones Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Distribution Channel

10.1.3 By Form

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Distribution Channel

10.2.4 By Form

10.2.5 By End-User Industry

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Distribution Channel

10.3.4 By Form

10.3.5 By End-User Industry

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Distribution Channel

10.4.4 By Form

10.4.5 By End-User Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Distribution Channel

10.5.4 By Form

10.5.5 By End-User Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Soy Isoflavones Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 ADM

11.2 BASF SE

11.3 Cargill Incorporated

11.4 DSM S.V.

11.5 Solbar Industries

11.6 Alpro

11.7 Frutarom

11.8 Sanwei

11.9 Shuanghe Songnen Soybean

11.10 Future Ceuticals

11.11 Fujicco

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global demand for soy isoflavones is predicted to develop at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030, with a market value assessed at USD 1.2 billion in 2023 and anticipated to reach USD 1.83 billion by 2030.

The primary drivers of the global soy isoflavone market are the rise in the prevalence of lifestyle-related health issues, the expansion of consumer knowledge of the health benefits of soy isoflavones, and the rising demand for plant-based products.

A few of the major issues confronting the global soy isoflavone market are low consumer knowledge, worries about allergies, and competition from other plant-based sources.

In 2023, North America held the largest share of the global soy isoflavone market.

The major companies include Fujicco, ADM, BASF SE, Cargill Incorporated, DSM S.V., Solbar Industries, Alpro, Fruitarom, Sanwei, Huanghe Songnen Soybean, and Future Ceuticals.