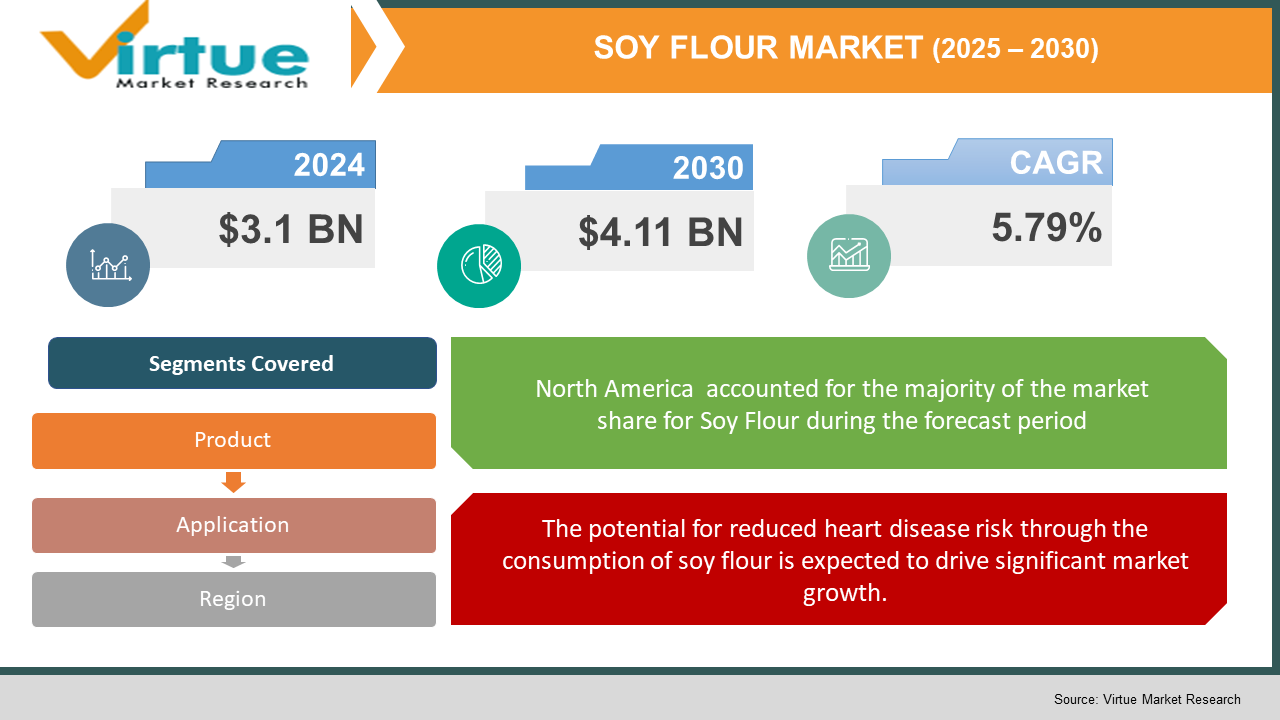

Soy Flour Market Size (2025-2030)

The Soy Flour Market was valued at USD 3.1 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 4.11 billion by 2030, growing at a CAGR of 5.79%.

Soy flour is a powder derived from ground soybeans. It is considered a nutritious food ingredient and can be incorporated into various other food products. The growing awareness about healthy eating habits has contributed to the rising demand for soy flour. This flour is packed with essential vitamins, minerals, and proteins. It is known to support cholesterol reduction and has demonstrated benefits in preventing cancer and minimizing bone mass loss. Soy flour is highly recommended for individuals with diabetes, as well as elderly individuals and pregnant women. Additionally, it is low in both fat and sodium, making it beneficial in lowering the risk of heart-related diseases.

Key Market Insights:

- The rising demand for gluten-free and nutritionally rich flours in the food industry is driving the growth of soy-based flour. Furthermore, the increasing population of vegans is a key factor contributing to the demand for this product, as it serves as an excellent meat alternative. These factors are expected to foster substantial market growth during the forecast period.

- As consumers become more health-conscious, there is a noticeable shift towards healthier, nutrient-dense foods. Soy-based flour is abundant in isoflavones, omega-3 fatty acids, protein, vitamins, calcium, fiber, and iron. Its high nutritional value, coupled with its gluten-free nature, positions it as an ideal option both as a nutritious food and a meat substitute. To meet the growing demand for meat alternatives and functional baked goods, leading manufacturers are employing strategies such as mergers and acquisitions, as well as launching new product offerings.

Soy Flour Market Drivers:

The potential for reduced heart disease risk through the consumption of soy flour is expected to drive significant market growth.

Soya flour offers numerous health benefits and can help address various health concerns. It is a rich source of iron, calcium, protein, and vitamin B. In addition to its health advantages, it enhances the texture and flavor of food products.

One of the primary benefits of incorporating soya flour into the diet is its ability to lower the risk of heart diseases. By using soya flour, which contains lower levels of saturated fats and cholesterol, heart health can be significantly improved. Regular consumption of soya flour can help reduce cholesterol levels and regulate blood pressure. This has become a key factor driving the growth of the market.

Soy Flour Market Restraints and Challenges:

The availability of more affordable and superior substitutes is expected to reduce the market share of soy flour.

Despite the numerous health benefits of soy flour, it can be easily replaced by other, more affordable alternatives that are considered better substitutes. Various other gluten-free and nutritious flours are available in the market.

Flours such as chickpea flour, almond flour, quinoa flour, lupin flour, chestnut water starch, and coconut flour are among the healthier alternatives that can serve as substitutes for soy flour. This availability of competitive options acts as a key factor restraining the growth of the soy flour market.

The reduction of menopausal symptoms through the consumption of soy flour is expected to hinder market growth.

In addition to promoting heart health, the consumption of soy flour offers significant benefits in alleviating menopausal symptoms. Women undergoing menopause can greatly benefit from incorporating soy flour into their diets. The impressive health advantages provided by soy flour serve as a key driver of market growth.

Soy flour has been found to help reduce symptoms such as night sweats, irritability, mood swings, hot flashes, and other uncomfortable experiences associated with menopause. Research conducted by the University of Maryland Medical Center suggests that women who consume soy flour experience fewer menopausal symptoms. This benefit highlights soy flour as one of the most effective dietary options for managing menopause.

Soy Flour Market Opportunities:

The rising demand for vegan and gluten-free products is expected to drive significant growth in the soy flour market.

The growing awareness about health and wellness has significantly boosted the global soy flour market. As individuals become more health-conscious, they are increasingly choosing healthier alternatives such as vegan and gluten-free products.

Soy flour plays a crucial role as a gluten-free option. Instead of using traditional white flour, which is high in gluten and carbohydrates, soy flour serves as an effective substitute. Not only does it replace white flour, but it also offers a higher protein content. The shift towards vegan and gluten-free diets, with soy flour being a preferred choice, reflects a notable recent trend in consumer behavior.

SOY FLOUR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.79% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Pure Ceylon Cinnamon, HDDES Group and Bio Foods Pvt Ltd. |

Soy Flour Market Segmentation:

Soy Flour Market Segmentation By Product:

- Full-fat

- Defatted

The defatted soy flour segment leads the global soy flour market due to its widespread use in various food applications, thanks to its high protein content and low-fat properties. This type of soy flour is particularly favored in the production of bakery products, meat substitutes, and health foods, where a high protein-to-fat ratio is essential. Its ability to improve the texture and nutritional profile of food products has made it a preferred choice among manufacturers. Furthermore, defatted soy flour is commonly utilized as a functional ingredient in processed foods, driving its extensive adoption. Increased consumer awareness of health and wellness, coupled with the rising demand for high-protein, low-fat food products, has significantly propelled the growth of the defatted soy flour market.

The full-fat soy flour segment is anticipated to experience steady growth, fueled by the increasing demand for natural and minimally processed food ingredients. Full-fat soy flour retains the natural oils in soybeans, offering a richer flavor and greater nutritional value compared to its defatted counterpart. It is gaining popularity in applications where natural fats are advantageous, such as in the production of certain bakery items, snacks, and meat substitutes.

The growing demand for clean-label products and the rising popularity of plant-based diets are also contributing to the steady expansion of the full-fat soy flour segment. As consumers continue to prioritize wholesome and nutritious food options, the demand for full-fat soy flour is expected to rise, supporting its market growth in the forecast period.

Soy Flour Market Segmentation By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Others

The bakery and confectionery segment is experiencing growth due to the increasing consumer demand for healthier, gluten-free baked goods. Soy flour is commonly used in baking because of its high protein content, which enhances the nutritional value of baked products. It also improves the texture and extends the shelf life of these goods, making it a preferred ingredient among bakers and confectioners. Soy flour's versatility allows it to be incorporated into various products such as bread, cakes, cookies, and pastries, catering to the rising health-conscious consumer base. The trend towards clean-label and plant-based ingredients further drives the adoption of soy flour in this segment, as consumers seek products made from recognizable and wholesome ingredients.

The meat substitute segment is projected to register the fastest compound annual growth rate (CAGR) during the forecast period. This growth is driven by the increasing popularity of plant-based diets and the growing awareness of the environmental and health benefits of reducing meat consumption. Soy flour plays a crucial role in the formulation of meat substitutes, providing both protein content and a texture that closely resembles traditional meat products. Advances in food technology have enabled the development of soy-based products that mimic the taste and texture of meat, appealing to vegetarians and flexitarians alike. The increased investment in research and development by food manufacturers to create more diverse and appealing meat substitute products is expected to further propel the growth of this segment.

Soy Flour Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The North American soy flour market holds a significant revenue share in the global market, driven by the increasing demand for gluten-free and high-protein food products. The growing

popularity of plant-based diets and rising awareness of the health benefits of soy flour further contribute to the market’s expansion. The presence of major food manufacturers and the continuous development of innovative soy-based products also support the market in North America.

The European soy flour market is projected to grow at a compound annual growth rate (CAGR), fueled by the rising demand for plant-based and gluten-free food products across the region. As consumers become more health-conscious and seek high-protein, low-fat alternatives, the adoption of soy flour in various food applications continues to rise. The increasing popularity of vegan and vegetarian diets is also contributing to the market's growth. Key countries such as Germany, France, and the UK are driving this expansion due to their large consumer base and the presence of prominent food manufacturers. Additionally, the growing trend towards clean-label and natural ingredients is expected to further support the steady growth of the soy flour market in Europe over the forecast period.

COVID-19 Pandemic: Impact Analysis

The global COVID-19 pandemic was unprecedented and had a significant impact on markets worldwide, with demand for many products falling below pre-pandemic levels. However, the market's compound annual growth rate (CAGR) has spiked as demand and growth have returned to pre-pandemic levels following the resolution of the crisis.

During the pandemic, health became a major concern as the number of people suffering from infections, particularly from the coronavirus, surged. A weakened immune system was identified as a key factor contributing to increased vulnerability to the virus.

As a result, individuals began to prioritize improving and strengthening their immune systems to protect themselves from the disease. This shift in focus led to a notable rise in the consumption of health foods, including fruits, vegetables, and soy flour. This shift in consumer behavior helped drive the growth of the global soy flour market during the pandemic.

Latest Trends/ Developments:

-

In February 2024, Amfora launched its inaugural commercial products, introducing a groundbreaking line of ultra-high plant protein offerings, including Amfora ultra-high protein soy flour.

- In February 2024, White River Soy Processing, LLC acquired Benson Hill, Inc.'s soy processing plant in Creston, Iowa. This state-of-the-art facility is capable of producing a wide range of soy-based products, including soy meal, oil, food-grade soy white flake, flour, and grits.

Key Players:

These are top 10 players in the Soy Flour Market :-

- Pure Ceylon Cinnamon

- HDDES Group

- Biofoods Pvt Ltd.

- C.F. Sauer Company

- Ceylon Spice Company

- Elite Spice

- First Spice Mixing Company

- McCormick & Company, Inc.

- EHL Ingredients

- SDS SPICES (PVT) LTD.

Chapter 1. SOY FLOUR MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SOY FLOUR MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SOY FLOUR MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SOY FLOUR MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SOY FLOUR MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SOY FLOUR MARKET – By Product

6.1 Introduction/Key Findings

6.2 Full-fat

6.3 Defatted

6.4 Y-O-Y Growth trend Analysis By Product

6.5 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. SOY FLOUR MARKET – By Application

7.1 Introduction/Key Findings

7.2 Non-Residential Construction

7.3 Residential Construction

7.4 Industrial

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. SOY FLOUR MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SOY FLOUR MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Pure Ceylon Cinnamon

9.2 HDDES Group

9.3 Biofoods Pvt Ltd.

9.4 C.F. Sauer Company

9.5 Ceylon Spice Company

9.6 Elite Spice

9.7 First Spice Mixing Company

9.8 McCormick & Company, Inc.

9.9 EHL Ingredients

9.10 SDS SPICES (PVT) LTD

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As consumers become more health-conscious, there is a noticeable shift towards healthier, nutrient-dense foods.

The top players operating in the Soy Flour Market are - Pure Ceylon Cinnamon, HDDES Group and Bio Foods Pvt Ltd.

The global COVID-19 pandemic was unprecedented and had a significant impact on markets worldwide, with demand for many products falling below pre-pandemic levels.

The growing awareness about health and wellness has significantly boosted the global soy flour market. As individuals become more health-conscious, they are increasingly choosing healthier alternatives such as vegan and gluten-free products.

Europe is the fastest-growing region in the Soy Flour Market.