Global Soups and Broths Market Size (2024 – 2030)

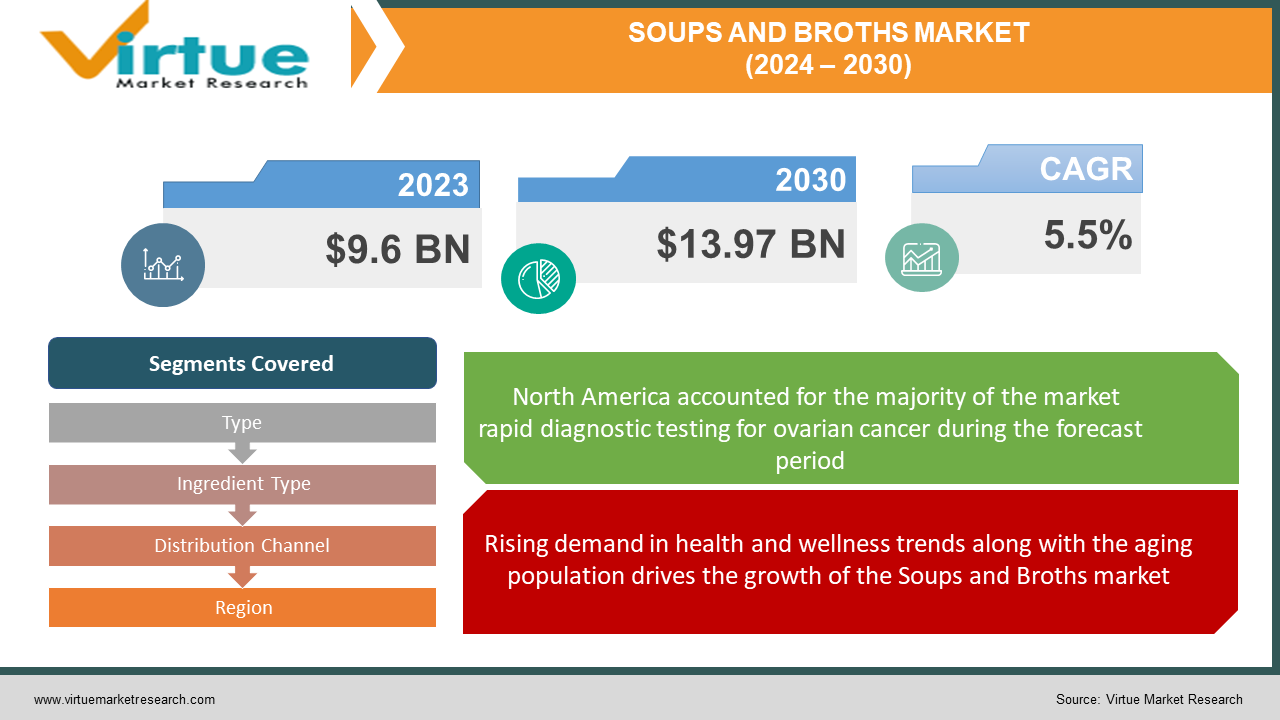

The Global Soups and Broths Market was estimated to be worth USD 9.6 Billion in 2023 and is projected to reach a value of USD 13.97 Billion by 2030, growing at a CAGR of 5.5% during the forecast period 2024-2030.

The soups and Broths market is a significant component of the global food industry and has been experiencing consistent growth. This market has a lot of products, ranging from canned soups to packaged dehydrated mixes. These products cater to a wide consumer base including vegetarian, vegan, and gluten-free as well. As healthier options among consumers are rising, this market is also expanding, as these products offer low fat and sodium content along with other health benefits. The soups and broths market is influenced by various factors like changing consumer preferences, convenience, competition from similar products, and health trends.

Manufacturers are continuously working on providing new flavors catering to different cultural and taste preferences. Some brands are also focusing on providing premium products to differentiate themselves from mainstream products. The soups and broths market is not limited to specific regions. Different cultures and cuisines contribute to a wide and global soup and broth market.

Global Soups and Broths Market Drivers:

Rising demand in health and wellness trends along with the aging population drives the growth of the Soups and Broths market.

Consumers are increasingly looking for healthier food options with natural ingredients and reduced fat content. Soups and broths are an excellent fit for health-conscious consumers, which is expanding this market a lot. Specialized diets like vegetarian, vegan, and gluten-free are also driving the demand for soups and broths. Aging populations may seek similar products that are easy to chew and digest, making soups and broths appealing to them.

Demand for convenience foods and rising e-commerce are expanding the soups and broths market.

The modern population demands meals that are convenient and easy to prepare. Ready-to-eat soups and broths align well with such consumers who have fast-paced lifestyles. The growth of e-commerce and direct-to-consumer sales has expanded access to a wide variety of soups and broth products, increasing the growth of the soups and broth market.

Global Soups and Broths Market Challenges:

Consumers’ preference for fresh foods and negative perception of canned foods may pose challenges to the consumption of Soups and Broths

Along with increasing demand for healthier food options, consumers also look for fresh food, including soups and broths, which could be challenging for packaged soups and broths. Individuals could become concerned about the taste, freshness, and nutritional content of these products. To overcome this challenge, manufacturers need to provide products that are both high quality and convenient.

Rising ingredient costs could fluctuate the growth of the soups and broths market.

Product profitability could be affected if the cost of key ingredients faces fluctuations. Managing ingredient costs while maintaining product quality and affordability could be challenging for many manufacturers.

COVID-19 Impact on Global Soups and Broths Market:

In the early stages of the pandemic, consumers stocked up on pantry staples including canned soups and broths, which benefitted the market at that time, as these products have a longer shelf life and are convenient. Lockdowns and restaurant closures made people look for convenient and easy-to-prepare meals surging the demand for soups and broths. The e-commerce platforms saw a rise in demand during the pandemic including increased online sales for soups and broths, as people tried avoiding crowded stores. Health and wellness took priority for customers in the pandemic and consumers were looking for options with nutritional benefits.

Though the soups and broths market experienced profit during the pandemic because of being a packaged and staple food item, it also faced some challenges in labor and production. Operational challenges arose due to labor shortage and affected the production capabilities along with delays and shortage of supply.

Latest Developments in the Global Soups and Broths Market:

- In November 2022, Borough Broth company launched a co-branded range of soups and broths with Plant Organic, to expand their product portfolio catering to specific consumer needs.

- In April 2021, Pacific Foods, a subsidiary of the Campbell Soup Co., introduced two new vegan soups and broths, Creamy Oat Milk Soup and Creamy Plant-Based Broths, among which the creamy oat-milk soups are the first oat milk-based soups introduced in the market.

GLOBAL SOUPS AND BROTHS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Ingredient Type, , Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Campbell Soup Company, The Kraft Heinz Company, Nestlé S.A., Unilever, Conagra Brands, Inc., General Mills, Inc., Nissin Foods Holdings Co., Ltd., Amy's Kitchen, Inc., Hain Celestial Group, Inc., Pacific Foods of Oregon, LLC |

Global Soups and Broths Market Segmentation:

Global Soups and Broths Market Segmentation: By Type

-

Canned Soups

-

Packaged Broths

-

Dehydrated Soup Mixes

-

Ready-to-Eat Soups

-

Chilled and Fresh Soups

-

Dairy-Based Soups

Canned soups are pre-packaged soups sealed in cans and are typically heated before consumption. Packaged broths come in cartons and cans and can be used as a base for soup, sauces, dishes, and stews. These are liquid bases used for cooking and flavoring. Dehydrated soup mixes are dry soup mixes that include dehydrated vegetables, flavoring packets, meat, or noodles. These are a popular choice because of their convenience and longer shelf life. Ready-to-eat soups are fully cooked and packed in containers that can be heated and consumed. Chilled and fresh soups are to be consumed cold or lightly heated and offer a fresh and convenient option to consumers. Dairy-based soups are made from milk, cream, or cheese and give a creamy texture and flavor.

Canned soups comprise the largest segment in the soups and broths market due to their long shelf life, convenience, and wide variety of flavors. Canned soups are pantries stocked a lot by consumers. The fastest growing segment in this market is Ready-to-eat soups due to increasing demand for convenient and healthy options considering the changing lifestyle of the modern population.

Global Soups and Broths Market Segmentation: By Ingredient Type

-

Vegetable-Based Soups

-

Meat-Based Soups

-

Seafood Soups

-

Plant-Based and Vegan Soups

-

Gluten-Free Soups

Vegetable-based soups consist of vegetables like carrots, potatoes, peas, and corn, as main ingredients. Vegetable-based soups are an excellent choice for vegetarians seeking lighter, plant-based meals. Meat-based soups are made using meat, including chicken, beef, and pork as a main ingredient, providing a good source of protein. Seafood soups have seafood like shrimp, fish and, clams as main ingredients. Plant-based and vegan soups are similar to vegetable-based soups, and these don’t contain any animal products. Gluten-free soups are made without ingredients containing gluten making them suitable for consumers having gluten sensitivity. Vegetable-based soups are the largest segment in the soups and broths market. Plant-based and Vegan soups are the fastest growing segment because of the rise in popularity of plant-based diets, which are free from any sort of animal products.

Global Soups and Broths Market Segmentation: By Distribution Channel

-

Supermarkets

-

Convenience Stores

-

Online Retail

-

Others

Supermarkets are big retail outlets that offer a wide range of products including soups and broths to consumers. Convenience stores are small stores that provide a convenient option to make quick purchases. These are suitable stops for on-the-go soups and other food items. Online retail and e-commerce platforms provide a wide variety of soups and broths along with other products to consumers. These platforms allow customers to shop from the comfort of their homes along with other benefits like discounts. Other channels might include specialty stores and food services. The largest segment among these is the supermarkets which offer a stop destination for a wide variety of products, making them appealing among consumers. Online retail is the fastest-growing segment as people are increasingly looking for convenient methods to buy groceries.

Global Soups and Broths Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America has a diverse soups and broths market, and it often includes chicken noodle soups, tomato soups, and chowder. Convenience, healthy food options, and ready-to-eat solutions are important factors in this region. It is the largest segment in this market. Europe has a wide soups and broths market influenced by different cultural cuisines in the region. Some popular flavors of soups and broths in this region include minestrone, borscht, and gazpacho. Asia-Pacific is the fastest-growing region in this market and is known for its rice culinary heritage with more focus on fresh ingredients. Instant noodle soups are particularly popular here including ramen and miso. South America presents growth potential as it is also known for its cuisines where soups and broths play an important role. Flavors like black beans, tortilla soup, and seafood stews are famous here. In the Middle East and Africa, traditional ingredients and spices are important in soups and broths and show great potential for expansion.

Global Soups and Broths Market Key Players:

-

Campbell Soup Company

-

The Kraft Heinz Company

-

Nestlé S.A.

-

Unilever

-

Conagra Brands, Inc.

-

General Mills, Inc.

-

Nissin Foods Holdings Co., Ltd.

-

Amy's Kitchen, Inc.

-

Hain Celestial Group, Inc.

-

Pacific Foods of Oregon, LLC

Chapter 1. Soups and Broths Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Soups and Broths Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Soups and Broths Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Soups and Broths Market Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Soups and Broths Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Soups and Broths Market – By Type

6.1. Introduction/Key Findings

6.2 Canned Soups

6.3 Packaged Broths

6.4 Dehydrated Soup Mixes

6.5 Ready-to-Eat Soups

6.6 Chilled and Fresh Soups

6.7 Dairy-Based Soups

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Soups and Broths Market – By Ingredient Type

7.1. Introduction/Key Findings

7.2 Vegetable-Based Soups

7.3 Meat-Based Soups

7.4 Seafood Soups

7.5 Plant-Based and Vegan Soups

7.6 Gluten-Free Soups

7.7 Y-O-Y Growth trend Analysis By Ingredient Type

7.8 Absolute $ Opportunity Analysis By Ingredient Type, 2023-2030

Chapter 8. Soups and Broths Market – By Distribution Channel

8.1 Supermarkets

8.2 Convenience Stores

8.3 Online Retail

8.4 Others

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2023-2030

Chapter 9. Soups and Broths Market , By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2 By Type

9.1.3.By Ingredient Type

9.1.4. By Distribution Channel

9.1.6. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1. U.K.

9.2.2. Germany

9.2.3. France

9.2.4. Italy

9.2.5. Spain

9.2.6. Rest of Europe

9.2.2. By Type

9.2.3. By Ingredient Type

9.2.4. By Distribution Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. Rest of Asia-Pacific

9.3.2 By Nature

9.3.3. By Ingredient Type

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Colombia

9.4.4. Chile

9.4.5. Rest of South America

9.4.2. By Type

9.4.3. By Ingredient Type

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1. United Arab Emirates (UAE)

9.5.2. Saudi Arabia

9.5.3. Qatar

9.5.4. Israel

9.5.5. South Africa

9.5.6. Nigeria

9.5.7. Kenya

9.5.8. Egypt

9.5.9. Rest of MEA

9.5.2. By Type

9.5.3. By Ingredient Type

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Soups and Broths Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Hobart Corporation

10.2 BIRO Manufacturing Company

10.3 Marel

10.4 Weiler

10.5 Risco Group

10.6 Butcher Boy Machines International

10.7 Meyn Food Processing Technology B.V.

10.8 Jarvis Products Corporation

10.9 Mainca

10.10 Grote Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Soups and Broths Market was estimated to be worth USD 9.1 Billion in 2022 and is projected to reach a value of USD 13.97 Billion by 2030, growing at a CAGR of 5.5% during the forecast period 2023-2030

The Global Soups and Broths Market Drivers are rising demand in health and wellness trends along with the aging population, demand for convenience foods, and rising e-commerce.

Based on the type, the Global Soups and Broths Market is segmented into Canned Soups, Packaged Broths, Dehydrated Soup Mixes, Ready-to-Eat Soups, Chilled and Fresh Soups, Dairy-Based Soups

North America holds the largest share of the Global Soups and Broths Market.

Campbell Soup Company, Kraft Heinz Company, Nestlé S.A., and Unilever are a few of the leading players in the Global Soups and Broths Market.