Solvent-Free Adhesives Market Size (2025-2030)

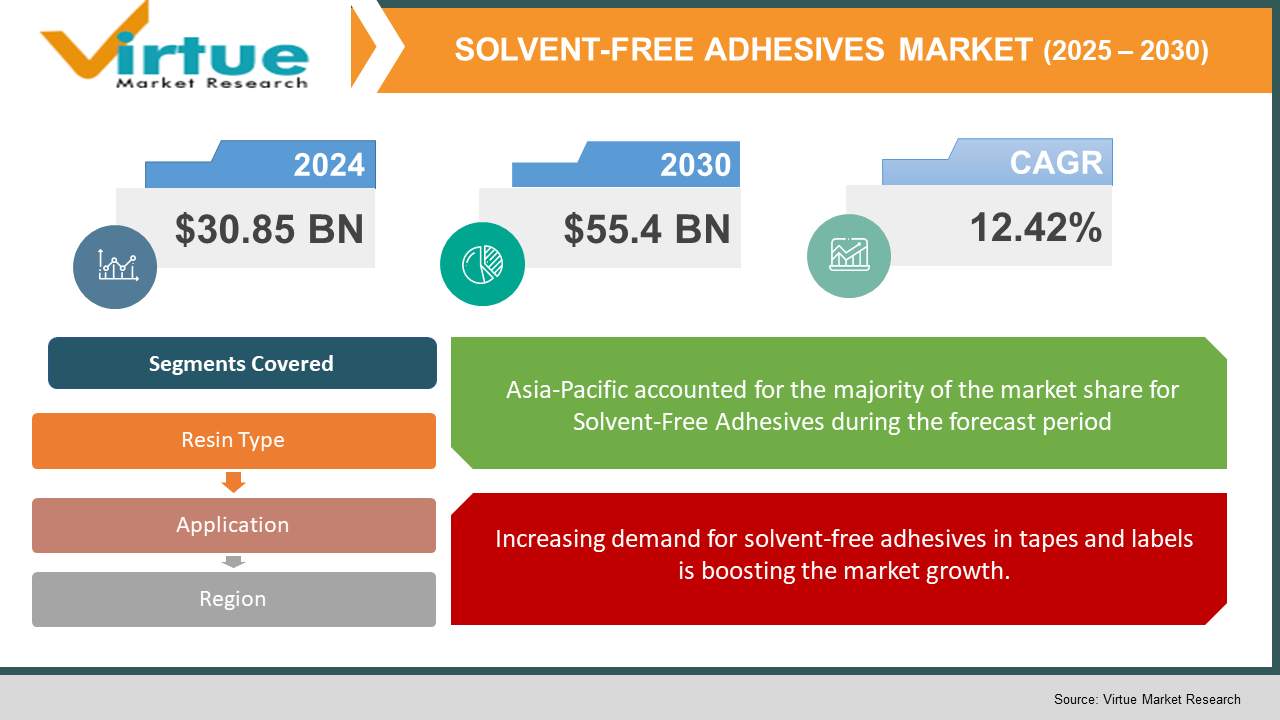

The Global Solvent-Free Adhesives Market was valued at USD 30.85 billion in 2024 and is projected to reach a market size of USD 55.4 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.42%.

A compound that has minimal or no solvent is referred to as solvent-free. When adhesives have less than 5% solvent, it is called solvent-free adhesive. Solvent-free synthesis is an alternative method of solution-based synthesis. Paint, adhesives, hash oil, resins, and epoxy typically have very little solvent. Solvent-free epoxy resin is solid and has no water or solvent as diluents. Solvent-free synthesis has varied benefits over the conventional traditional method of synthesis. It is a green chemistry in which minimal or no solvents are utilized and is eco-friendly. A solvent-free adhesive has various benefits, including fewer health hazards and lower safety needs. It is eco-friendly and applied in most industries to prevent and mitigate corrosion and environmental pollution. There are certain solvent-free anti-corrosion agents formulated on mineral oil, which are applied against corrosion. They are especially suitable for protecting iron or non-iron metals.

Key Market Insights:

- Solvent-free adhesives can cut VOC emissions by 80% or more, greatly enhancing indoor air quality and worker safety. Improved solvent-free adhesives offer longer curing times, increasing production effectiveness by 30% in high-speed sectors such as the packaging and car industries.

- More than 60% of packaging makers have switched to solvent-free adhesives due to environmental aspects and regulatory drivers. Relative to conventional adhesives, solvent-free systems lower energy consumption by 25-40% through reduced heat demands in processing. New solvent-free polyurethane adhesives provide 50% stronger bond strength compared to conventional adhesives, which suit high-stress applications.

- Automotive use of solvent-free adhesives grows by 15% per annum, as vehicle manufacturers seek light and environmentally friendly bonding solutions. The food and beverage sector contributes to more than 35% of solvent-free adhesive usage, fueled by consumer interest in safe and non-toxic packaging solutions. Investments in solvent-free adhesives based on bio-based raw materials have jumped 40% over the past five years, indicating the industry's move toward sustainable raw materials.

Global Solvent-Free Adhesives Market Drivers:

Huge expenditure in the adhesive industry in emerging economies is fostering market growth.

Due to diversified factors with the increase in rapid urbanization, growing need for green building, and expanding the use of solvent-free adhesives such as acrylic dispersion adhesives in construction processes, healthcare industry, and others to glue decorative floor coverings & ceramic tiles adhesives. Enormous capital investments are directed into the adhesive business to cater to growing consumers' demands and are expected to increase the market size during the forecast period.

Increasing demand for solvent-free adhesives in tapes and labels is boosting the market growth.

End-use industries like packaging, masking, electrical & electronics, healthcare, automotive, paper & printing, building & construction, retail, and others use adhesive tapes and labels. The extensive applications of adhesives make them extremely popular and firms are inclined towards solvent-free adhesives as they are environment-friendly. Therefore, the increasing applications of adhesive tapes and labels are anticipated to propel the solvent-free adhesive market. The trend towards the use of flatter and micro-electronic devices made the use of adhesive tapes more common in the electrical & electronics sector thus creating more demand for solvent-free adhesives.

Increasing demand for e-commerce is bolstering the market size.

Similar to most industries, the solvent-free industry is also experiencing benefits because of technological innovations. The suppliers & manufacturers are taking up various online distribution channels such as mobile applications, social media platforms, etc., to enhance their online presence to a greater audience by offering a variety of products through the online distribution channel. Customer convenience, quick and simple payment, and reduced expense are some of the factors for the increase in online sales and offer tremendous advantages and opportunities for the sector. And as e-commerce increased, the need for quality adhesives with a number of other attributes like flexibility, and an increasingly more environmentally focused method for parcels of all sizes and forms increased. Therefore, it will also generate a profitable growth opportunity for the world market in the next few years.

Global Solvent-Free Adhesives Market Restraints and Challenges:

The time-consuming working process may slow down the Solvent-free adhesives market growth.

One of the significant challenges in the development of the solvent-free adhesives market is the lengthy working process associated with these adhesives. Unlike conventional solvent-based adhesives, which cure rapidly owing to solvent evaporation, solvent-free adhesives tend to have longer curing periods, which can render production procedures slower. This slowdown can be especially bothersome in high-speed production lines like packaging, automotive, and electronics, where speed and rapid turnaround are vital. Furthermore, certain solvent-free adhesives have to undergo specialized curing processes, such as heat or UV radiation, that can involve extra energy and infrastructure investment requirements. These considerations may deter manufacturers from complete substitution with solvent-free variants, even with the environmental advantages that they bring. This will need to be addressed by improvements in formulation technologies that improve curing speed without impairing adhesive performance.

Global Solvent-Free Adhesives Market Opportunities:

The global solvent-free adhesives market has good growth opportunities driven by increasing environmental regulations, sustainability initiatives, and adhesives technology development. With industries shifting towards sustainable and low-VOC alternatives, solvent-free adhesives demand is increasing in packaging, automotive, electronics, and construction applications. Development in fast-curing and high-performance chemistries is also expanding their applications, overcoming the previous issues of long curing times. The shift towards sustainable packaging in the food and beverages industry and increasing concerns for worker safety and green manufacturing processes are also driving market adoption. Emerging markets, particularly in Asia-Pacific and Latin America, are promising opportunities due to industrialization and increasing environmental regulations. As companies invest in R&D to achieve efficiency and longevity, the solvent-free adhesives market is expected to see solid growth in the next few years.

SOLVENT-FREE ADHESIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.42% |

|

Segments Covered |

By Resin Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Henkel, H.B. Fuller, DIC, Arkema, Sika, Dowdupont, 3M, Mapei, Ashland, Evonik, Huber Group, Ardex, Jowat |

Global Solvent-Free Adhesives Market Segmentation:

Solvent-Free Adhesives Market Segmentation: By Resin Type

- Acrylic Polymer Emulsion (PAE)

- Polyvinyl Acetate (PVA) Emulsion

- Vinyl Acetate Ethylene (VAE) Emulsion

- Styrene Butadiene (SB) Latex

- Polyurethane Dispersion (PUD)

- Other

The global market for solvent-free adhesives can be divided based on resin type, with major classifications being Acrylic Polymer Emulsion (PAE), Polyvinyl Acetate (PVA) Emulsion, Vinyl Acetate Ethylene (VAE) Emulsion, Styrene Butadiene (SB) Latex, and Polyurethane Dispersion (PUD), among others. Acrylic Polymer Emulsion (PAE) is widely used for its good adhesion, stability, and environmental resistance, and is a favourite in the construction and packaging industries. Polyvinyl Acetate (PVA) Emulsion is a favourite in woodworking, paper binding, and textiles because of its good bonding and affordability. Vinyl Acetate Ethylene (VAE) Emulsion offers flexibility and water resistance and is therefore suitable for high-performance industrial applications. Styrene Butadiene (SB) Latex offers high strength and flexibility and is widely used in carpet backing and paper coating. Polyurethane Dispersion (PUD) offers good adhesion and chemical resistance and is best used in automotive and high-performance coatings. Other resin types include hybrid formulations to cater to specific industry needs. The demand for these resin types in the market for solvent-free adhesives is being driven by the increasing demand for environmentally friendly and high-performance adhesives in various industries.

Solvent-Free Adhesives Market Segmentation: By Application

- Tapes & Labels

- Paper & Packaging

- Building & Construction

- Woodworking

- Automotive & Transportation

- Others

Market demand for solvent-free adhesives for use in applications like tapes and labels is comparatively higher as they are employed in medium and heavy-duty sealing of cartons, gift packaging, and ornamentation, general maintenance, bundling and strapping, and stationery use. Labels and tapes are employed in electrical and electronic appliances, medical instruments, delivery devices, construction equipment, automobile and transportation parts, and industrial items. Thus, market demand for solvent-free adhesive tapes in packaging industries is rising, thus augmenting demand for solvent-free adhesives.

Solvent-Free Adhesives Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Asia-Pacific solvent-free adhesives market is divided into China, Japan, India, South Korea, Thailand, Indonesia, Taiwan, and the Rest of the region. China and India are the two fastest-growing consumer markets in APAC, as per a report by the Population Reference Bureau. The total population of APAC countries is nearly 4 billion. This vast population is expected to become an enormously critical driver for sectors like paper & packaging, building & construction, and automotive & transportation in the next two decades. Solvent-free adhesives have critical usage in these sectors, which is estimated to lead to the expansion of the market in APAC.

COVID-19 Impact Analysis on the Global Solvent-Free Adhesives Market:

The outbreak of COVID-19 started in Wuhan (China) in December 2019, and it has since expanded across the world at a very high speed. China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the US are some of the worst-affected nations based on the number of positive cases and deaths reported. The COVID-19 pandemic has heavily impacted economies and industries across different countries owing to lockdowns and closures of businesses. Harsh lockdowns significantly influenced different industrial segments like packaging, thereby indirectly affecting the dynamics of the solvent-free adhesive industry. The growth is a result of the organizations realigning and reshuffling their operations and getting over the effects of COVID-19, which previously caused restriction measures that had forced social distancing, working remotely from home, and the closing down of commercial activities that saw operations being plagued. The raised demand for medicine and ready-to-eat foods during the COVID-19 period saw the resultant higher consumption of shelf-ready pack solutions. The aforementioned factors, coupled with the gradual relaxation of stringent lockdown and other restrictions in various economies, assisted the solvent-free adhesive market in gaining momentum during the forecast period. Key players in the market are concentrating on sustaining and generating revenues to match up customer expectations and demands resulting in a higher number of developments in the solvent-free adhesive market.

Latest Trends/ Developments:

The market for solvent-free adhesives is experiencing several important trends and innovations fueled by sustainability, technology, and market requirements. A prominent trend is the growing use of bio-based and biodegradable adhesives, as companies emphasize lowering carbon footprints and meeting strict environmental regulations. Moreover, accelerated-curing formulations are being created to respond to processing speed concerns, with advancements in UV-curable and hot-melt solvent-free adhesives picking up pace. Another important trend is the growing demand for flexible packaging, especially in food and beverages, where solventless adhesives provide safer and more environmentally friendly bonding options. Businesses are also investing in smart adhesives with enhanced durability, heat stability, and multi-substrate compatibility, increasing their use in the automotive and electronics sectors. In addition, nanotechnology advances are providing the means to produce high-performance adhesives with excellent mechanical and thermal characteristics. With industries focusing more and more on green and high-performance bonding options, the market for solvent-free adhesives is poised to see consistent innovation and growth.

Key Players:

- Henkel

- H.B. Fuller

- Arkema

- Sika

- Dowdupont

- DIC

- 3M

- Illinois Tool Works

- Ashland

- Mapei

- Huber Group

- Evonik

- Jowat

Chapter 1. SOLVENT-FREE ADHESIVES MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SOLVENT-FREE ADHESIVES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SOLVENT-FREE ADHESIVES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SOLVENT-FREE ADHESIVES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SOLVENT-FREE ADHESIVES MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SOLVENT-FREE ADHESIVES MARKET – By Resin Type

6.1 Introduction/Key Findings

6.2 Acrylic Polymer Emulsion (PAE)

6.3 Polyvinyl Acetate (PVA) Emulsion

6.4 Vinyl Acetate Ethylene (VAE) Emulsion

6.5 Styrene Butadiene (SB) Latex

6.6 Polyurethane Dispersion (PUD)

6.7 Other

6.8 Y-O-Y Growth trend Analysis By Resin Type

6.9 Absolute $ Opportunity Analysis By Resin Type , 2025-2030

Chapter 7. SOLVENT-FREE ADHESIVES MARKET – By Application

7.1 Introduction/Key Findings

7.2 Tapes & Labels

7.3 Paper & Packaging

7.4 Building & Construction

7.5 Woodworking

7.6 Automotive & Transportation

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. SOLVENT-FREE ADHESIVES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Resin Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Resin Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Resin Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Resin Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Resin Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SOLVENT-FREE ADHESIVES MARKET – Company Profiles – (Overview, Packaging Resin Type Portfolio, Financials, Strategies & Developments)

9.1 Henkel

9.2 H.B. Fuller

9.3 Arkema

9.4 Sika

9.5 Dowdupont

9.6 DIC

9.7 3M

9.8 Illinois Tool Works

9.9 Ashland

9.10 Mapei

9.11 Huber Group

9.12 Evonik

9.13 Jowat

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Solvent-Free Adhesives Market was valued at USD 30.85 billion in 2024 and is projected to reach a market size of USD 55.4 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.42%.

The global solvent-free adhesives market is driven by increasing environmental regulations and the demand for eco-friendly, low-VOC adhesives across industries like packaging, automotive, and construction. Additionally, advancements in bio-based formulations, improved curing technologies, and the rising adoption of flexible packaging further accelerate market growth.

Based on Service Provider, the Global Solvent-Free Adhesives Market is segmented into material manufacturers, Raw Material Suppliers, Distributors & Wholesalers, and End-to-End Solution Providers.

Asia-Pacific is the most dominant region for the Global Solvent-Free Adhesives Market.

Henkel, H.B. Fuller, DIC, Arkema, Sika, Dowdupont, 3M, Mapei, Ashland, Evonik, Huber Group, Ardex, Jowat are the key players in the Global Solvent-Free Adhesives Market.