Solvent-based Medical Adhesives Market Size (2024 – 2030)

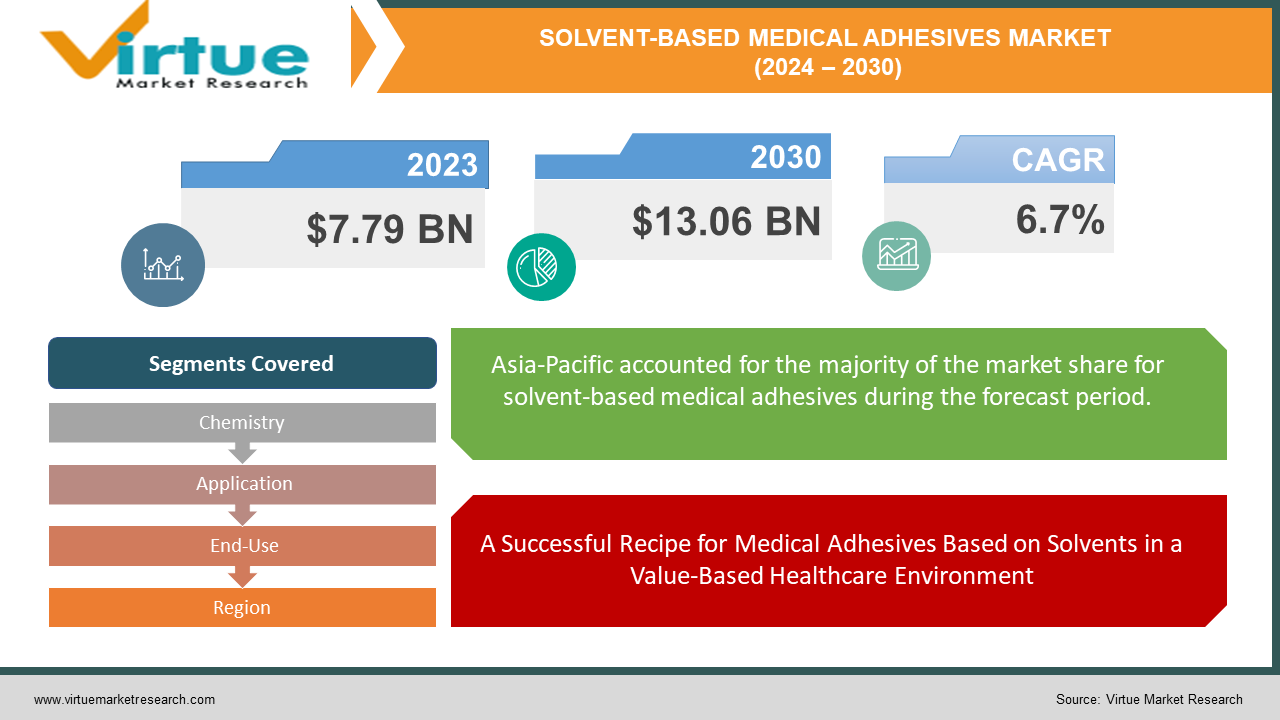

The Global Solvent-based Medical Adhesives Market was valued at USD 7.79 billion in 2023 and is projected to reach a market size of USD 13.06 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.7%.

Medicinal adhesives based on solvents are essential for a variety of medicinal uses. They are perfect for dressing wounds, especially weeping ones or those in regions that are frequently moved about, because they are excellent at forging strong bindings that withstand moisture and motion. Furthermore, they affix IVs, feeding tubes, and catheters to the skin securely. They even have a part in the distribution of medications via patches, such as hormone replacement treatment or nicotine. There are disadvantages even while price and simplicity of usage are advantages. The solvents' vapours might cause respiratory problems and skin irritation. Furthermore, not every skin type can use these adhesives.

Key Market Insights:

The market for medical adhesives based on solvents was estimated to be worth USD 7.79 billion in 2022 and is expected to grow to USD 13.06 billion. This remarkable compound annual growth rate (CAGR) of around 5.9% is fuelled by these adhesives' unparalleled ability to produce strong connections that withstand movement and moisture. Because of this, they are crucial for closing wounds, particularly those that are leaking or on regularly moving surfaces, and for locking down medical equipment like IVs and catheters.

Solvent-based medical adhesives are typically less expensive to create than certain alternative choices, such as water-based or hot-melt adhesives. Lower expenses for healthcare organisations and providers result from this. revealed that using solvent-based adhesives for wound closure was significantly less expensive than utilising sutures.

Growing demand for greener alternatives presents a significant threat to the market for medical adhesives based on solvents. Hot-melt, solvent-free, and water-based adhesives are becoming more popular because of their enhanced sustainability profiles and reduced environmental impact. The market share of solvent-based adhesives is anticipated to decrease somewhat in the upcoming years, whilst environmentally friendly substitutes are anticipated to rise at a substantial compound annual growth rate (CAGR) of around 8%.

Growing healthcare industries in emerging nations such as Latin America and Asia Pacific offer a substantial market opportunity for solvent-based medical adhesives. These adhesives are an appealing choice for these expanding areas where cost reduction is a key issue due to their affordability. believes that because of factors including rising disposable incomes and quickly developing healthcare infrastructure, the Asia Pacific region would have the quickest rate of growth in the market for solvent-based medical adhesives.

Global Solvent-based Medical Adhesives Market Drivers:

Medical Adhesives Based on Solvents Continue to be Essential in Healthcare Due to Their Unmatched Strength and Performance

Medical adhesives based on solvents are the best at forming durable, strong connections that can survive the most demanding circumstances. Their outstanding capabilities render them indispensable for several vital medicinal uses. They are the preferred method for sealing bleeding wounds in wound closure, especially those in regions that move a lot. In certain situations, traditional sutures or bandages might not hold up as well, but solvent-based adhesives offer dependable, secure closure that aids in healing. They are strong enough to secure IVs and catheters, among other medical equipment. These devices are essential for administering medicines and essential fluids, and a secure connection is crucial. These gadgets are kept firmly in place even during routine activities or unintentional pulls thanks to solvent-based adhesives. Solvent-based medical adhesives continue to be used in the healthcare industry due in large part to their unparalleled performance in bond strength and durability across a wide range of applications.

A Successful Recipe for Medical Adhesives Based on Solvents in a Value-Based Healthcare Environment

Solvent-based medical adhesives are a big benefit in an increasingly cost-conscious healthcare environment. economical. They are often less expensive to create than certain alternative solutions. This results in decreased expenses for healthcare organisations and providers, rendering them a financially appealing option. The quality isn't sacrificed for this cost. Adhesives based on solvents provide the required performance for a range of applications. Without going over budget, hospitals and clinics may properly safeguard medical equipment, close wounds effectively, and even use them in medication delivery systems. Solvent-based medical adhesives are an important tool for maintaining access to high-quality healthcare because of their affordability. This is especially true for operations where cost is a major factor in treatment decisions, or for areas with limited resources.

Global Solvent-based Medical Adhesives Market Restraints and Challenges:

Despite being prized for their robust bindings in medication administration, wound closure, and device fixation, solvent-based medical adhesives are seeing an increasing market threat from environmentally friendly substitutes. The less harmful effects on the environment of water-based, hot-melt, and solvent-free alternatives are making them more popular. Solvent-based adhesives are further restricted by severe VOC standards and health concerns about skin irritation and respiratory difficulties. Due to affordability, the market is anticipated to increase modestly; nevertheless, continued success will depend on innovation to address health and environmental concerns as well as managing fluctuating raw material costs.

Global Solvent-based Medical Adhesives Market Opportunities:

Despite competition from environmentally friendly alternatives, solvent-based medical adhesives can take advantage of promising prospects. A strategic advantage can be gained by concentrating on specialised applications where their strong bindings are unrivalled, such as demanding wound closure or high-moisture settings. Regulation and environmental obstacles can be overcome by developing innovative solvents with reduced volatile organic compounds (VOCs) or bio-based substitutes. Improved material compatibility with some medical equipment and sensitive skin can further increase their usefulness. Finally, because solvent-based adhesives are so reasonably priced, the expanding healthcare industries in developing nations offer a promising market for them.

SOLVENT-BASED MEDICAL ADHESIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Chemistry, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company (US), Arkema SA (France), Dow Inc. (US), H.B. Fuller Company (US), Henkel AG & Co. KGaA (Germany), Sika AG (Switzerland) |

Global Solvent-based Medical Adhesives Market Segmentation: By Chemistry

-

Cyanoacrylate Adhesives

-

Acrylic Adhesives

-

Rubber Adhesives

-

Silicone Adhesives

-

Other Chemistries

Due to a lack of data, it is difficult to pinpoint the precise solvent-based medical adhesives segment that is the largest and expanding the quickest. All varieties have their advantages: silicone is perfect for watertight applications like catheters, rubber adhesives manage movement effectively, acrylics combine strength and skin friendliness for devices, and cyanoacrylates are excellent at closing wounds. Cyanoacrylates and acrylic adhesives are probably in the lead based on their respective advantages, but more investigation is required to determine the category leader and growth rates.

Global Solvent-based Medical Adhesives Market Segmentation: By Application

-

Wound Closure

-

Device Fixation

-

Drug Delivery

-

Other Applications

Wound closure and device fixation are perhaps the largest and possibly fastest-growing categories in the solvent-based medical adhesive industry, while data restrictions make it difficult to declare a winner. Solvent-based adhesives are ideal for sealing weeping wounds and anchoring medical equipment like catheters, which makes them essential tools for these applications. Their strengths precisely match typical medical demands.

Global Solvent-based Medical Adhesives Market Segmentation: By End-Use

-

Hospitals and Clinics

-

Ambulatory Surgical Centres

-

Home Care Settings

-

Other End-Use Settings

Since hospitals and clinics utilise solvent-based medical adhesives extensively for wound closure, medication distribution, and device attachment in a variety of procedures, they probably account for the greatest portion of the market. Although data is insufficient to conclusively determine which category is growing the quickest, hospitals and clinics are probably leading the way due to the sheer number of procedures they do. Ambulatory surgery centres and home care settings are also expanding.

Global Solvent-based Medical Adhesives Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Due to its sizable and increasing healthcare industry, rising disposable incomes, and developing medical infrastructure, the Asia-Pacific region now leads the global market for solvent-based medical adhesives. The quickest growth is also anticipated in this region because of the ageing population's increased need for medical operations, the growing awareness of wound care, and the increasing acceptance of cutting-edge medical technology.

COVID-19 Impact Analysis on the Global Solvent-based Medical Adhesives Market:

The market for solvent-based medical adhesives was not particularly affected by COVID-19. Travel bans and lockdowns threw off supply networks, perhaps leading to short-term shortages. Nonetheless, COVID-19 therapies most certainly contributed to a rise in the general demand for medical goods, including these adhesives. To ascertain the overall impact of these competing pressures on the market, a more thorough investigation is required.

Recent Trends and Developments in the Global Solvent-based Medical Adhesives Market:

The market for medical adhesives based on solvents is under competition from more environmentally friendly options such as hot-melt and water-based adhesives, which might take away market share. Innovation is increasing as a result. Producers are concentrating on specialised markets where solvent-based adhesives perform very well, such as high-moisture settings. Their reach is also being increased by the creation of bio-derived or reduced volatile organic compounds, as well as better materials that are compatible with devices or skin types. Finally, solvent-based adhesives are well-positioned for expansion in emerging nations with thriving healthcare sectors because of their cost.

Key Players:

-

3M Company (US)

-

Arkema SA (France)

-

Dow Inc. (US)

-

H.B. Fuller Company (US)

-

Henkel AG & Co. KGaA (Germany)

-

Sika AG (Switzerland)

Chapter 1. Solvent-based Medical Adhesives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Solvent-based Medical Adhesives Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Solvent-based Medical Adhesives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Solvent-based Medical Adhesives Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Solvent-based Medical Adhesives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Solvent-based Medical Adhesives Market – By Chemistry

6.1 Introduction/Key Findings

6.2 Cyanoacrylate Adhesives

6.3 Acrylic Adhesives

6.4 Rubber Adhesives

6.5 Silicone Adhesives

6.6 Other Chemistries

6.7 Y-O-Y Growth trend Analysis By Chemistry

6.8 Absolute $ Opportunity Analysis By Chemistry, 2024-2030

Chapter 7. Solvent-based Medical Adhesives Market – By Application

7.1 Introduction/Key Findings

7.2 Wound Closure

7.3 Device Fixation

7.4 Drug Delivery

7.5 Other Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Solvent-based Medical Adhesives Market – By End-Users

8.1 Introduction/Key Findings

8.2 Hospitals and Clinics

8.3 Ambulatory Surgical Centres

8.4 Home Care Settings

8.5 Other End-Use Settings

8.6 Y-O-Y Growth trend Analysis By End-Users

8.7 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 9. Solvent-based Medical Adhesives Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Chemistry

9.1.3 By Application

9.1.4 By By End-Users

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Chemistry

9.2.3 By Application

9.2.4 By End-Users

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Chemistry

9.3.3 By Application

9.3.4 By End-Users

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Chemistry

9.4.3 By Application

9.4.4 By End-Users

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Chemistry

9.5.3 By Application

9.5.4 By End-Users

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Solvent-based Medical Adhesives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3M Company (US)

10.2 Arkema SA (France)

10.3 Dow Inc. (US)

10.4 H.B. Fuller Company (US)

10.5 Henkel AG & Co. KGaA (Germany)

10.6 Sika AG (Switzerland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Solvent-based Medical Adhesives Market size is valued at USD 7.79 billion in 2023.

The worldwide Global Solvent-based Medical Adhesives Market growth is estimated to be 6.7 % from 2024 to 2030.

The Global Solvent-based Medical Adhesives Market is segmented By Chemistry (Cyanoacrylate Adhesives, Acrylic Adhesives, Rubber Adhesives, Silicone Adhesives, Other Chemistries); By Application (Wound Closure, Device Fixation, Drug Delivery, Other Applications); By End-Use (Hospitals and Clinics, Ambulatory Surgical Centres, Home Care Settings, Other End-Use Settings) and by region.

Future expansion of the worldwide solvent-based medical adhesives market is anticipated in specialised applications where the strength of the bond is essential. Their reach can be increased by developing more environmentally friendly solvents and better material compatibility. Their pricing also puts them in a good position to expand into emerging healthcare markets.

The market for medical adhesives based on solvents was not significantly affected by the COVID-19 epidemic. Temporary shortages were brought on by disruptions, but the demand for medical products in general including adhesives likely grew. The net effect must be determined by more investigation.