Solid State Battery Market Size (2024-2030)

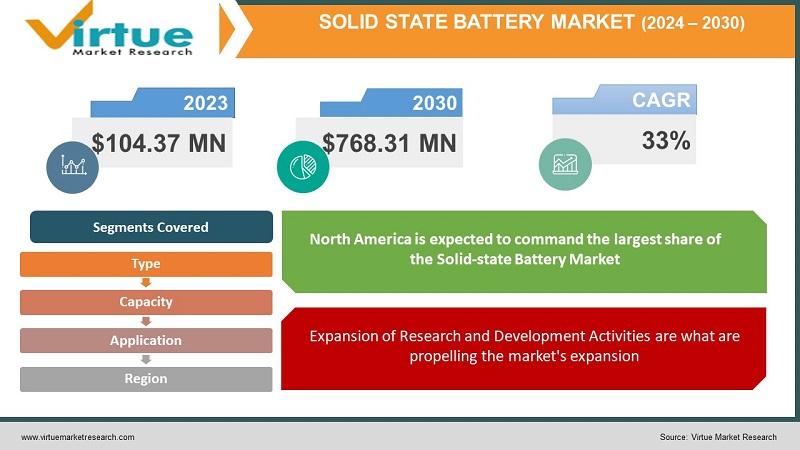

The Global Solid State Battery Market size is valued at USD 104.37 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 33% from 2024 to 2030 and it will reach USD 768.31 Million in 2030.

The escalating demand for robust regional batteries within end-of-life sectors and the surge in research and development endeavors aimed at reducing battery costs are projected to propel market growth in the forecasted period. Key industry drivers encompass the increased adoption of electronic devices, heightened utilization of battery-saving systems, and a rise in electric vehicle exports. These batteries, distinguished by their superior power density, diminished combustion risk, and heightened electrochemical stability compared to traditional counterparts, consequently augment their commercial market value. A lithium-ion battery comprises a cathode, anode, separator, and electrolyte. In applications such as smartphones, power tools, and electric vehicles, lithium-ion batteries utilize a liquid electrolyte solution. Conversely, solid-state batteries utilize a solid electrolyte instead of a liquid. Examining the commercially used Li-ion battery, it features a separator maintaining the separation between the cathode and anode, along with a liquid electrolyte solution. In contrast, a solid-state battery relies on a solid electrolyte, serving the dual purpose of a separator without the use of a liquid electrolyte solution.

Primary concerns for users regarding lithium-ion battery safety relate to potential battery damage, such as inflammation due to temperature fluctuations or leakage from external forces, attributed to the use of a liquid electrolyte solution. Consequently, there is a need for tools or components that enhance security. In contrast, a solid-state battery with a robust electrolyte exhibits improved stability and heightened safety, maintaining its structural integrity even in the event of electrolyte damage.

Key Market Insights:

The escalating research and development activities associated with solid-state batteries, the increasing deployment of IoT to drive the adoption of solid-state batteries, and the high adoption of solid-state batteries in electric vehicles, coupled with the miniaturization of electronic devices, will emerge as major factors driving market growth. Additionally, factors such as the expanding application scope of solid-state batteries in healthcare, electric vehicles, and drone sectors, coupled with the incorporation of flexible and lightweight batteries in wearable devices, along with the extended shelf life of solid-state batteries compared to conventional batteries, will further amplify market value. However, the high cost of solid-state batteries and the complex manufacturing process act as restraints for the market. Moreover, the rise in investments and partnerships among automobile companies and solid-state battery manufacturers, along with the high demand for electric vehicles, are estimated to create new opportunities for market growth within the forecast period. The cost-efficient manufacturing of solid-state batteries remains a challenge for the market.

Global Solid State Battery Market Drivers:

Expansion of Research and Development Activities are what are propelling the market's expansion

In comparison to lithium-ion batteries, solid-state batteries exhibit high energy density, a solid structure, stability, and safety. Despite limitations such as low ionic conductivity, high reactivity, and higher cost, the demand for these batteries is rapidly increasing. To address such limitations, various solid-state electrolytes are developed using different materials. Although solid polymer and inorganic electrolytes excel in all-solid-state batteries, they face limitations such as low ionic conductivity and poor mechanical properties. This challenge has been addressed through the discovery of Composite Solid Electrolytes (CSEs), incorporating active or passive inorganic fillers and polymer matrices. Major players, including Robert Bosch, Quantum Scape, Planar Energy Devices, Toyota Motor, among others, are actively engaged in developing solid-state batteries, propelling their adoption in various verticals.

Solid-State Batteries' Extended Shelf Life Compared to Conventional Batteries is pushing the industry

Current lithium-ion batteries fall short in terms of weight, cost, and charging time. Solid-state batteries offer the potential for a longer lifespan, high energy density, and fast charging, making electric vehicles more cost-effective. Silicon, with ten times the energy density of graphite, is a highly desirable anode material. However, in Li-ion cells using liquid electrolysis, silicon anodes expand and degrade rapidly during charging and discharging. Solid-state batteries promise increased safety, cost-effectiveness, and durability. Sodium-ion chemistries, especially promising due to the abundance and low cost of sodium, offer potential applications in large-scale grid energy storage. Solid-state batteries address several issues associated with current Li-ion batteries, with features like nonflammable or self-ignitable solid-state electrolytes, reducing the risk of thermal runaway and allowing for tighter cell packaging, improving design flexibility and volumetric density.

Global Solid State Battery Market Constraints and Challenges:

Low prices for Li-ion batteries impede market expansion.

The declining prices of lithium-ion batteries pose a challenge to market growth. These batteries, employing lithium as a light metal with excellent electrochemical potential, are widely used globally. The advantages of lithium-ion batteries, including low maintenance, low discharge, lightweight, and high energy storage capacity, support their use in modern applications. The falling prices of lithium-ion batteries are expected to increase their sales, potentially hindering the growth of the global solid-state battery market during the forecast period.

Solid-state batteries' high manufacturing costs are a barrier to the market.

High manufacturing costs represent a significant constraint in the solid-state battery market. Developing solid-state batteries requires substantial investments in research and development, as well as the establishment of advanced manufacturing facilities. Manufacturing these batteries demands sophisticated machinery and cutting-edge technologies. Designing a stable solid electrolyte, an effective ion conductor, and chemically inert solid-state batteries poses a challenge and is considered more expensive to manufacture than lithium-ion batteries. The brittleness of electrolytes adds complexity to the process, posing a risk of cracking.

Currently, solid-state batteries are approximately eight times more expensive than Li-ion batteries, requiring separate production line setups due to differences in technologies. The machinery and technologies for solid-state battery development demand significant investments, presenting a considerable hurdle, especially for newcomers to the market.

Global Solid State Battery Market Opportunities:

One of the most significant growth opportunities in the solid-state battery market lies in their application in electric vehicles. The global demand for electric vehicles is steadily increasing, driven by supportive policies in countries such as the US, UK, Germany, China, and Japan, promoting electric vehicle adoption. The adoption of electric vehicles reduces reliance on imported oil and decreases greenhouse gas emissions in the transport sector. Key countries, including China, the US, the UK, Germany, France, and Japan, witness substantial growth in electric vehicle sales each year. The growing adoption of electric-powered vehicles acts as a driving force in solid-state battery development.

SOLID STATE BATTERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

33% |

|

Segments Covered |

By Capacity, Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Panasonic Corporation (Japan), SAMSUNG SDI CO., LTD. (South Korea), LG Chem. (South Korea), NEXEON LTD. (United Kingdom), Los Angeles Cleantech Incubator (U.S.), Enevate Corporation (U.S.), Zeptor Corporation (U.S.), CONNEXX SYSTEMS Corp. (Japan), XGSciences (U.S.), Huawei Technologies Co., Ltd. (China) |

Global Solid State Battery Market Segmentation:

Global Solid State Battery Market Segmentation: By Type:

- Portable Battery

- Thin-film Battery

- Others

The thin-film battery segment is poised to achieve the highest Compound Annual Growth Rate (CAGR) of 35.3% from 2023 to 2030, driven by the broad application scope of solid-state batteries. These batteries find primary use in Internet of Things (IoT) and wearable devices, including fitness bands, smart clothing, and smartwatches, owing to their efficient recharging rate and compact design. Unlike conventional batteries, thin-film batteries have minimal environmental impact, further contributing to industry growth over the forecast period.

The adoption of solid-state batteries in portable devices is expected to experience significant growth, attributed to their low maintenance requirements and higher energy densities. The segment is anticipated to flourish due to the high demand for consumer electronics.

Global Solid State Battery Market Segmentation: By Capacity:

- Less than 20 mAH

- 20 mAH – 300 mAH

- 301 mAH – 500 mAH

- Above 500 mAH

The Less than 20 mAH segment is projected to register the fastest CAGR of over 44.3% during the forecast period. Batteries falling under this category, primarily thin-film batteries, cater to a broad application range, including cosmetic and medical patches, wireless sensors, packaging, and more. Limited internal space, compact size, and usage across low drain devices that do not require large battery capacity drive the demand for batteries with Less than 20 mAH capacity.

The Above 500 mAh segment held a market share of 21.5% in 2023, propelled by the increased usage of solid-state batteries in the electric vehicles market. Favorable government policies promoting clean energy transportation contribute to the segment's demand. Additionally, the growing demand for battery energy storage systems across commercial and industrial sectors is expected to further augment segment growth.

Global Solid State Battery Market Segmentation: By Application:

- Electric Vehicles

- Electronics

- Medical Devices

- Wearable Devices

- Smart Cards

- Others

The electric vehicles segment is expected to dominate the market in terms of revenue share by 2028, driven by the increasing deployment of clean energy-powered vehicles across major economies globally. Technological advancements in batteries, coupled with favorable regulatory policies encouraging electric vehicle adoption, are anticipated to boost segment growth.

The Wearable & medical devices segment holds a significant market share and is poised for substantial growth over the forecast period. The rising demand for small energy storage sources and wearable electronics is expected to favor segment growth. Moreover, innovations in medical technology are likely to maximize the penetration rate of wearable batteries.

Global Solid State Battery Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is expected to command the largest share of the Solid-state Battery Market in 2023. However, Europe is projected to witness the fastest growth during the forecast period. The accelerated market growth in Europe is attributed to the European Union's ASTRABAT project, aiming to expedite the development of solid-state battery cells for electric vehicles and other applications. For instance, in September 2018, Ilika inaugurated its new large-format battery facility (Goliath Pre-Pilot Line, or GPPL) in Hampshire, supporting the development and initial production of solid-state batteries. This facility aligns with Ilika's Goliath program, focusing on the development of large-format solid-state batteries for electric vehicles.

COVID-19 Impact Analysis on the Global Solid State Battery Market:

The emergence of a Covid-19 outbreak has impacted the trajectory of the solid-state battery market. The spread of the Covid-19 pandemic has resulted in the shutdown or partial closure of factories, warehouses, businesses, and institutions worldwide. This has been compounded by the implementation of various containment measures, including stringent community reduction practices, restricted mobility, and limited access to public places, restaurants, theme parks, theaters, and supermarkets. On a global scale, numerous industries have experienced disruptions in supply chain operations and essential services. The altered consumer behavior, the adoption of containment measures, and supply chain disruptions collectively contribute to the dynamics of the solid-state battery market. The market has observed a downturn due to the closure of numerous Small and Medium Enterprises (SMEs), interruptions in operations, closures, and other challenges stemming from the Covid-19 pandemic. The crisis has compelled governments across the globe to reallocate their priorities towards healthcare, diverting attention from other sectors. The demand from end-users has experienced a significant decline between 2020 and 2021.

Latest Trends/ Developments:

In March 2023, Panasonic Corporation made an announcement regarding the successful creation of a high-capacity solid-state battery, signifying a notable stride in battery technology. This newly developed solid-state battery surpasses traditional graphite anode batteries in energy storage capacity, paving the way for extended battery life and improved performance.

In June 2023, LG Chem. introduced its latest advancement in battery technology through the development of a high-performance solid-state battery. This innovative battery incorporates a silicon-based anode material, resulting in a substantial increase in energy density and overall capacity when compared to conventional lithium-ion batteries. With this breakthrough, LG Chem. aims to cater to the escalating demand for batteries with prolonged lifespan and heightened power across various industries, including electric vehicles and portable electronic devices.

Key Players:

- Panasonic Corporation (Japan)

- SAMSUNG SDI CO., LTD. (South Korea)

- LG Chem. (South Korea)

- NEXEON LTD. (United Kingdom)

- Los Angeles Cleantech Incubator (U.S.)

- Enevate Corporation (U.S.)

- Zeptor Corporation (U.S.)

- CONNEXX SYSTEMS Corp. (Japan)

- XGSciences (U.S.)

- Huawei Technologies Co., Ltd. (China)

Chapter 1. Global Solid State Battery Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Solid State Battery Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Solid State Battery Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Solid State Battery Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Solid State Battery Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Solid State Battery Market– By Type

6.1. Introduction/Key Findings

6.2. Portable Battery

6.3. Thin-film Battery

6.4. Others

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Global Solid State Battery Market– By Capacity

7.1. Introduction/Key Findings

7.2. Less than 20 mAH

7.3. 20 mAH – 300 mAH

7.4. 301 mAH – 500 mAH

7.5. Above 500 mAH

7.6. Y-O-Y Growth trend Analysis By Capacity

7.7. Absolute $ Opportunity Analysis By Capacity , 2024-2030

Chapter 8. Global Solid State Battery Market– By Application

8.1. Introduction/Key Findings

8.2. Electric Vehicles

8.3. Electronics

8.4. Medical Devices

8.5. Wearable Devices

8.6. Smart Cards

8.7. Others

8.8. Y-O-Y Growth trend Analysis Application

8.9. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. Global Solid State Battery Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By Capacity

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type

9.2.3. By Capacity

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By Capacity

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Type

9.4.3. By Capacity

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Type

9.5.3. By Capacity

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Solid State Battery Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Panasonic Corporation (Japan)

10.2. SAMSUNG SDI CO., LTD. (South Korea)

10.3. LG Chem. (South Korea)

10.4. NEXEON LTD. (United Kingdom)

10.5. Los Angeles Cleantech Incubator (U.S.)

10.6. Enevate Corporation (U.S.)

10.7. Zeptor Corporation (U.S.)

10.8. CONNEXX SYSTEMS Corp. (Japan)

10.9. XGSciences (U.S.)

10.10. Huawei Technologies Co., Ltd. (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Solid State Battery Market is valued at USD 104.37 million in 2023

The worldwide Global Solid State Battery Market growth is estimated to be 33% from 2024 to 2030.

The Global Solid State Battery Market is segmented by Type (Portable Battery, Thin-film Battery and others), by Capacity (Less than 20 mAH, 20 mAH – 300 mAH, 301 mAH – 500 mAH and Above 500 mAH ), by Application (Electric Vehicles, Electronics, Medical Devices, Wearable Devices, Smart Cards and others

Future developments in materials, improved energy density, more research and development, and growing applications in electronics and electric vehicles are all expected to drive trends and present possibilities for the global solid state battery market.

The COVID-19 pandemic had an impact on the worldwide solid state battery business, causing supply chain disruptions, brief production halts, and changes in consumer priorities that affected market dynamics and growth trajectories