Solar panel Coatings Market Size (2024-2030)

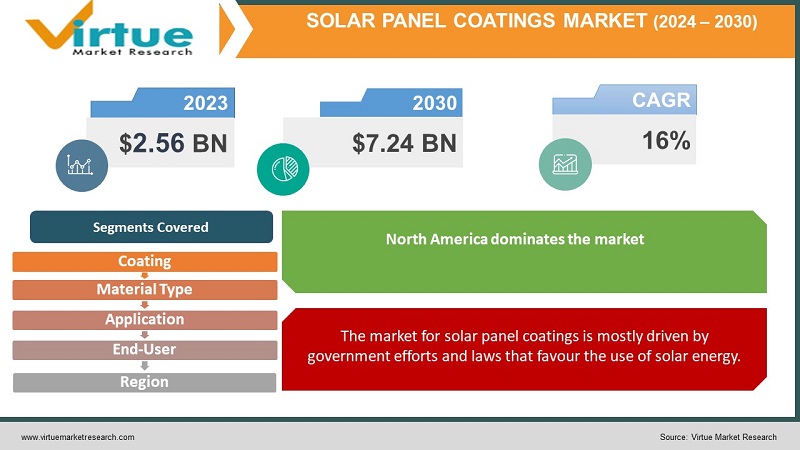

The Solar panel Coatings Market was valued at USD 2.56 Billion in 2023 and is projected to reach a market size of USD 7.24 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16%.

Solar panel coatings are very thin layers that are put on the surface of solar panels to improve their longevity and efficiency. These coatings have a variety of uses, such as reducing sunlight reflection, minimising dirt accumulation, repelling water, protecting against corrosion, UV resistance, enhancing electron flow, and managing heat. The hydrophobic coatings also serve these purposes. Every form of coating tackles a particular issue that solar panels encounter, which eventually leads to higher efficiency, longer lifespans, and an overall rise in the effectiveness of solar energy conversion into electrical power.

Key Market Insights:

The rising use of solar energy solutions and public awareness of sustainable energy practices have led to a notable increase in the global market for solar panel coatings in recent years. The industry has grown as a result of government programmes and incentives encouraging solar power installations as well as the growing need for renewable energy sources. The capacity of hydrophobic and anti-reflective coatings to improve self-cleaning qualities and reduce reflection is driving up demand for these coatings, which increase solar panel efficiency. The market is further driven by the push for environmentally friendly technologies and the focus on achieving energy efficiency in both the residential and commercial sectors. New coating advancements are being made in an effort to improve the overall performance and longevity of solar panels.

But obstacles like high startup costs and the requirement for sophisticated production techniques impede market expansion. Nevertheless, it is anticipated that continued efforts to address these issues through research and development as well as the continual advancement of coating technologies will open up new avenues. Collaborations between major players in the solar industry, developments in coating materials, and the creation of affordable solutions are likely to influence the market's trajectory as the solar industry grows, making solar panel coatings an essential part of the global transition to clean and sustainable energy sources.

Solar panel Coatings Market Drivers:

The market for solar panel coatings is being driven in large part by the worldwide movement towards environmentally friendly and sustainable energy options.

Solar energy is a vital renewable energy source that stands out as governments and businesses throughout the world resolve to lowering carbon footprints and combating climate change. As a result, the market for solar panels has expanded, increasing the demand for cutting-edge coatings that improve the panels' longevity and efficiency. The market for solar panel coatings is anticipated to continue growing in the upcoming years due to the focus on sustainable energy solutions.

The market for solar panel coatings is mostly driven by government efforts and laws that favour the use of solar energy.

In order to promote the installation of solar panels and increase the economic viability of renewable energy for both consumers and enterprises, numerous nations provide financial incentives, tax credits, and subsidies. The favourable climate created by these rules encourages the expansion of the solar sector and raises the need for coatings that extend the life and performance of solar panels. The market for solar panel coatings is growing largely as a result of government incentives matching market growth.

Solar panel coatings are improving and evolving as a result of ongoing research and development efforts in the field of coating materials.

Thanks to technological developments, coatings may now be created with higher qualities like increased durability, improved self-cleaning characteristics, and better anti-reflective capabilities. Nanotechnology advancements, for instance, have produced coatings that can offer multipurpose advantages, resolving a number of issues with solar panels. The market is driven by these developments, which further encourage the adoption of solar energy technologies by providing answers that not only increase efficiency but also address issues like cost-effectiveness and environmental impact.

Solar panel Coatings Market Restraints:

The high initial cost of solar energy system installation is a major barrier to the market for solar panel coatings.

Some customers and businesses may be put off by the initial cost of solar electricity, even though the long-term advantages—such as lower energy costs and environmental sustainability—are clear. The cost of adding sophisticated coatings to improve the performance of solar panels raises the total cost of the system. Economic obstacles may impede the adoption of solar technology and hence affect the market for solar panel coatings, particularly in areas with limited financial incentives and subsidies for renewable energy. Gaining traction in the market will require overcoming these financial obstacles and achieving cost-effectiveness.

The application of specialised coatings and maintaining consistent quality throughout large-scale production are two of the manufacturing process problems that the solar panel coatings business must overcome.

It takes accuracy and strict adherence to guidelines to achieve consistent and long-lasting coatings on solar panels. Furthermore, increasing output level without sacrificing cost-effectiveness might be a difficult technical task. Coating technology innovations might have trouble being integrated into current production processes or would need to build new, costly infrastructure. In order to ensure that modern solar panel coatings are widely adopted and that a wider market may profit from these coatings, it is imperative that these manufacturing process problems are overcome.

SOLAR PANEL COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

16% |

|

Segments Covered |

By Coating, Material Type, Application, End user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PPG Industries, AkzoNobel, Sherwin-Williams, Axalta Coating Systems, 3M, Kansai Paint, Arkema, Nano-Care Deutschland AG, Heliatek, DUNMORE Corporation |

Solar panel Coatings Market Segmentation:

Solar panel Coatings Market Segmentation: By Coating

- Anti-Reflective

- Anti-Soiling

- Hydrophobic

- Anti-Corrosion

The capacity of anti-reflective coatings to improve light absorption and raise overall solar panel efficiency has made this category the fastest-growing one. The worldwide drive for more efficient solar energy use is driving up demand for anti-reflective coatings. Conversely, the anti-soiling coatings sector now holds the highest proportion of the solar coatings market. Given its critical role in preserving the optimal functioning of solar panels in a variety of conditions, the market for anti-soiling coatings is expected to stay healthy as the emphasis on solar energy continues to expand.

Solar panel Coatings Market Segmentation: By Material Type

- Nano

- Polymer

- Metal oxide

Because of its adaptability, simplicity of use, and resilience to environmental influences, the polymer coatings category commands the highest market share. However, the market's fastest-growing section is the nano coatings category. By utilising nanotechnology, nano coatings can provide enhanced functionality like enhanced optical qualities, better conductivity, and greater durability. The solar industry's nano coatings market is expanding quickly due to the increased interest in cutting-edge technology and the need for coatings with multifunctional benefits. Nano coatings are expected to have a significant influence on how solar panels operate in the future as nanotechnology research and development continue.

Solar panel Coatings Market segmentation: By Application

- Residential

- Commercial

- Utility-Scale

The residential segment now holds the largest proportion of the market, with homeowners adopting solar energy solutions at a rising rate due to government incentives and environmental concerns. Utility-scale installations and large-scale solar farms are becoming more and more popular, which is why this category is expanding at the quickest rate. The market for coatings that meet the particular needs of these projects is growing significantly as utility-scale solar installations spread throughout the world.

Solar panel Coatings Market Segmentation: By End-User

- Photovoltaic panels

- Concentrated Solar Panels

Due to the widespread use of conventional solar technology in residential, commercial, and utility-scale applications, photovoltaic panels hold the highest share in the market. Concentrated solar panels, on the other hand, are the fastest-growing market. These panels employ mirrors or lenses to concentrate sunlight into a small area, creating heat that is then used to generate power. The market for coatings designed to specifically address the needs of CSP installations is expanding quickly as new ideas and technological developments continue to increase the efficiency of concentrated solar panels.

Solar panel Coatings Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- South-America

- Middle East and Africa

- Europe

Regional differences can be seen in the solar panel coatings business, which is impacted by things like energy demand, government regulations, and environmental awareness. Adoption of renewable energy is strongly encouraged in industrialised regions such as North America and Europe, with financial incentives and supportive policies from the government. The solar business in the United States, for example, has experienced significant expansion due to state-level incentives and tax credits, which has raised the demand for coatings for solar panels. Europe's solar energy adoption has been led by countries like Germany and the Netherlands, which have created a strong market for coatings that improve the efficiency of solar panels. Further driving the need for solar panel coatings is the increased interest in solar power in emerging economies across Asia, including China and India, as a result of their fast industrialization and rising energy needs. The market for coatings that increase the durability and efficiency of solar panels is anticipated to rise significantly as these countries put a greater emphasis on sustainable development.

Still, there are issues in some areas. The extensive adoption of solar technology, especially coated panels, may be hampered in developing regions of Africa and Southeast Asia by financial limitations and inadequate infrastructure. Governments, international organisations, and industry players must work specifically to overcome these obstacles in order to foster the development of the solar panel coatings market and guarantee a more equitable distribution of solar energy solutions around the world.

Solar panel Coatings Market COVID-19 Impact Analysis:

The COVID-19 epidemic caused difficulties and disruptions for the worldwide solar panel coatings sector, as it did for many other industries. Lockdowns and limitations were imposed globally, which initially caused supply chain disruptions, production delays, and project slowdowns. The need for solar panel coatings had a brief setback as building projects and installations were postponed. But while governments and companies looked for methods to improve rebuilding, the epidemic also highlighted the significance of robust and sustainable energy solutions, which sparked a fresh interest in solar energy. With a growing emphasis on innovation and sustainable practices driving growth in the post-pandemic age, the solar panel coatings market is anticipated to revive as economies recover and the focus on clean energy intensifies.

Latest Trends/ Developments:

- Self-cleaning coatings have become more and more in demand. These coatings provide steady energy output, minimise the need for manual cleaning, and prevent dirt and dust buildup on solar panels, all of which contribute to lower maintenance costs.

- Biface solar panels are becoming more and more popular. By capturing sunlight from both the front and back, these panels have the potential to produce more energy. The market has seen an increase in interest in coatings made to maximise the performance of bifacial panels.

Key Players:

- PPG Industries

- AkzoNobel

- Sherwin-Williams

- Axalta Coating Systems

- 3M

- Kansai Paint

- Arkema

- Nano-Care Deutschland AG

- Heliatek

- DUNMORE Corporation

Chapter 1. Global Solar panel Coatings Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Solar panel Coatings Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Solar panel Coatings Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Solar panel Coatings Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Solar panel Coatings Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Solar panel Coatings Market– By Coating

6.1. Introduction/Key Findings

6.2. Anti-Reflective

6.3. Anti-Soiling

6.4. Hydrophobic

6.5. Anti-Corrosion

6.6. Y-O-Y Growth trend Analysis By Coating

6.7. Absolute $ Opportunity Analysis By Coating , 2024-2030

Chapter 7. Global Solar panel Coatings Market– By Application

7.1. Introduction/Key Findings

7.2. Residential

7.3. Commercial

7.4. Utility-Scale

7.5. Y-O-Y Growth trend Analysis By Application

7.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Global Solar panel Coatings Market– By Material Type

8.1. Introduction/Key Findings

8.2. Nano

8.3. Polymer

8.4. Metal oxide

8.5. Y-O-Y Growth trend Analysis Material Type

8.6. Absolute $ Opportunity Analysis Material Type , 2024-2030

Chapter 9. Global Solar panel Coatings Market– By End-User

9.1. Introduction/Key Findings

9.2. Photovoltaic panels

9.3. Concentrated Solar Panels

9.4. Y-O-Y Growth trend Analysis End-User

9.5. Absolute $ Opportunity Analysis End-User , 2024-2030

Chapter 10. Global Solar panel Coatings Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Coating

10.1.3. By Application

10.1.4. By End-User

10.1.5. Material Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Coating

10.2.3. By Application

10.2.4. By End-User

10.2.5. Material Type

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Coating

10.3.3. By Application

10.3.4. By End-User

10.3.5. Material Type

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Coating

10.4.3. By Application

10.4.4. By End-User

10.4.5. Material Type

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Coating

10.5.3. By Application

10.5.4. By End-User

10.5.5. Material Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Solar panel Coatings Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 PPG Industries

11.2. AkzoNobel

11.3. Sherwin-Williams

11.4. Axalta Coating Systems

11.5. 3M

11.6. Kansai Paint

11.7. Arkema

11.8. Nano-Care Deutschland AG

11.9. Heliatek

11.10. DUNMORE Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16%.

The market for solar panel coatings is being driven in large part by the worldwide movement towards environmentally friendly and sustainable energy options.

The high initial cost of solar energy system installation is a major barrier to the market for solar panel coatings.

Nano, Polymer and metal-Oxide are the segments by material type.