Solar Ingot Wafer Market Size (2024 - 2030)

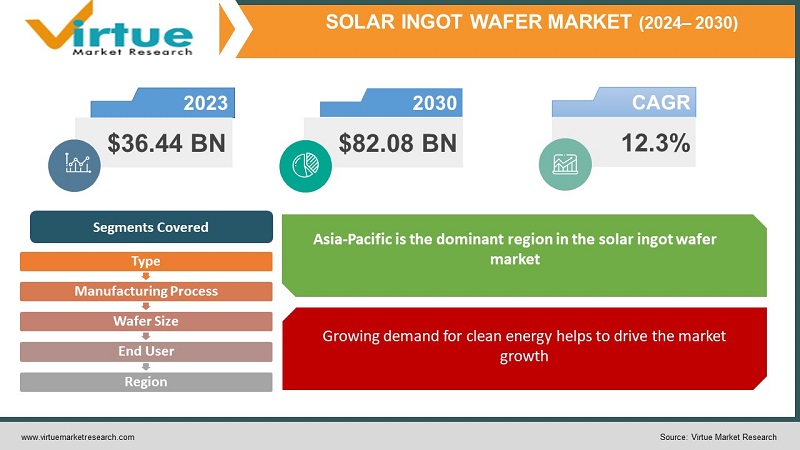

The Global Solar Ingot Wafer Market was valued at USD 36.44 Billion and is projected to reach a market size of USD 82.08 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.3%.

CLICK HERE TO REQUEST SAMPLE BROCHURE OF THIS REPORT

The growth of the solar ingot wafer market is primarily attributed to the increasing demand for renewable energy sources and the growing government initiatives to reduce greenhouse gas emissions. The Asia Pacific region is projected to dominate the solar ingot wafer market owing to the presence of key manufacturers in countries such as China and Taiwan, along with the rising adoption of solar power in the area. North America and Europe are also projected to contribute significantly to the market growth due to the increasing demand for solar energy and supportive government initiatives.

Industry Overview:

The solar ingot wafer market refers to the production and sale of wafers used in the manufacture of solar cells. Solar cells are devices that convert sunlight into electricity, & wafers are an essential component of solar cells. The solar ingot wafer market is projected to grow due to the increasing demand for renewable energy sources & the declining cost of solar energy. The use of solar energy is becoming increasingly popular as governments worldwide focus on reducing greenhouse gas emissions & promoting clean energy.

The market is also driven by promotions in technology that have led to the development of more efficient solar cells. However, the market is also affected by factors such as the high capital investment required for manufacturing facilities and the availability of alternative energy sources. The industry is projected to continue to grow as solar energy becomes more cost-effective and technological advancements improve the efficiency of solar cells.

Market Drivers:

Government initiatives and subsidies for renewable energy help to drive solar ingot wafer market growth

The solar ingot wafer market is driven by various government initiatives & subsidies for renewable energy. Several governments are promoting the use of solar energy by providing tax credits, rebates, & other incentives to encourage the adoption of solar energy. For instance, in the United States, the Investment Tax Credit (ITC) provides a 26% tax credit for solar panel installation. This has resulted in modified demand for solar ingot wafers, as they are an essential component of solar panels.

Growing demand for clean energy helps to drive the market growth

The increasing global demand for clean and sustainable energy sources is a major driver for the solar ingot wafer market. The need to reduce carbon emissions & mitigate the effects of climate change has resulted in a shift towards clean energy sources, with solar energy being one of the most promising options. The solar ingot wafer market is projected to grow as the demand for solar panels increases, especially in developing countries where energy demand is high and there is a need for off-grid solutions.

Market Restraints:

The Solar Ingot Wafer Market's growth is being stifled by high capital investment

Setting up a solar ingot wafer production facility requires a high capital investment. This includes the cost of land, equipment, & labor. The high cost of investment in the installation and setup process can discourage new entrants in the market and limit the growth of the industry in the upcoming years.

The Solar Ingot Wafer Market's growth is being stifled by dependence on government policies

The solar ingot wafer industry heavily depends on government policies & incentives. The reduction or elimination of government subsidies or tax credits can have a negative impact on the industry's growth. Additionally, the trade restrictions and tariffs imposed by governments can also affect the industry's profitability and growth potential. The dependence on government policies can make the industry vulnerable to regulatory changes and political instability.

SOLAR INGOT WAFER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

20223 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.3% |

|

Segments Covered |

By Type, Manufacturing Process, Wafer Size, End-Use Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GCL-Poly Energy Holdings Limited, Longi Green Energy Technology Co. Ltd., Zhonghuan Semiconductor, Wacker Chemie AG, Sumco Corporation, Shin-Etsu Chemical Co., Ltd., Applied Materials, Inc., ReneSola Ltd., Jinko Solar Holding Co., Ltd., Meyer Burger Technology AG |

Segmentation Analysis

This research report on the global Solar Ingot Wafer Market has been segmented based on Type, Manufacturing Process, Wafer-Size, End-user Industry, and Region.

Solar Ingot Wafer Market - By Type:

-

Monocrystalline

-

Polycrystalline

In 2022, the monocrystalline wafer segment held the highest market share due to the high adoption rate of these wafers owing to their superior operational efficiency over polycrystalline wafers. However, polycrystalline wafers are also witnessing a gradual increase in their sales and hold a sizeable portion of the global market share.

Solar Ingot Wafer Market - By Manufacturing Process:

-

Czochralski process

-

Float Zone process

-

Bridgman-Stockbarger process

-

Others

The solar ingot wafer market can be segmented based on the manufacturing process into Czochralski process, Float Zone process, Bridgman-Stockbarger process, & others. In recent years, the Czochralski process has dominated the market for solar ingot wafer manufacturing. This process involves melting high-purity silicon in a quartz crucible at high temperatures, and then slowly pulling a single crystal ingot from the molten silicon while rotating the crystal and the crucible in opposite directions. The ingot is then sliced into thin wafers for use in solar cell manufacturing.

However, the Float Zone process has gained popularity in recent years due to its ability to produce high-purity silicon wafers with fewer impurities than those produced by the Czochralski process. This process involves melting silicon in a ceramic crucible and then slowly moving the melt zone through the ingot while simultaneously pulling the ingot from the melt.

The Bridgman-Stockbarger process, which involves solidifying a melt of silicon in a controlled manner, has been used in the past for solar ingot wafer manufacturing, but is less commonly used today due to lower yields and higher costs. Other processes used for solar ingot wafer manufacturing include the Heat Exchanger Method and the Edge-defined Film-fed Growth Method.

Solar Ingot Wafer Market – By Wafer Size:

-

125mm

-

156mm

-

210mm

-

Others

The solar ingot wafer market can be segmented based on wafer size, with the most common sizes being 125mm, 156mm, & 210mm. In recent years, there has been a trend towards larger wafer sizes, as this allows for greater efficiency in solar cell production. In 2020, 156mm wafers were the most commonly used size in the market, accounting for over 80% of the total market share.

However, 210mm wafers are projected to grow quickly in popularity in the coming years, due to their higher efficiency & lower production costs. In fact, some of the major players in the market have already started production of 210mm wafers.

Another interesting development in this segment is the shift towards square-shaped wafers, which are more efficient and can reduce waste in the production process. In 2020, square-shaped wafers accounted for a small but growing portion of the market share, and this trend is projected to continue in the coming years. Overall, the trend towards larger wafer sizes and more efficient shapes is projected to drive growth in the solar ingot wafer market in the coming years.

Solar Ingot Wafer Market – By End-Use Industry:

-

Residential

-

Commercial

-

Industrial

The Solar Ingot Wafer Market is segmented by End-Use Industry into Residential, Commercial, and Industrial sectors. In the residential sector, the demand for solar ingot wafers has been increasing due to the rise in the adoption of solar photovoltaic systems for residential uses such as rooftop solar panels. The increasing consciousness about the benefits of renewable energy sources and government initiatives to promote solar power adoption are driving the demand for solar ingot wafers in the residential sector.

In the commercial sector, the demand for solar ingot wafers is operated by the need for sustainable energy solutions to trim the carbon footprint of commercial buildings. Solar panels installed on commercial buildings help in reducing electricity bills and carbon emissions, thereby making it a cost-effective solution. The increasing demand for renewable energy in the commercial sector is projected to drive the demand for solar ingot wafers in the coming years.

In the industrial sector, solar ingot wafers are used in the manufacturing of solar cells & panels used for large-scale solar power generation. The growth of the industrial sector, coupled with the increasing focus on renewable energy, is projected to drive the demand for solar ingot wafers in this segment. The industrial sector is also projected to witness the development of new solar technologies, which would require advanced solar ingot wafers for their manufacturing.

Solar Ingot Wafer Market – By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

Asia-Pacific is the dominant region in the solar ingot wafer market and is projected to continue to dominate during the forecast period. This is due to the increasing acceptance of renewable energy sources and the growing demand for solar energy in countries such as China, India, Japan, and South Korea. Furthermore, favorable government policies, tax incentives, and subsidies are promoting the growth of the solar energy sector in this region.

Europe is also a momentous market for solar ingot wafers, owing to the increasing focus on reducing carbon emissions and promoting sustainable development. Moreover, the increasing investments in renewable energy sources and the establishment of new solar power plants in this region are driving the growth of the solar ingot wafer market in Europe.

North America and South America are projected to witness moderate growth during the forecast period due to the increasing awareness and adoption of solar energy.

The Middle East & Africa region is projected to grow at a steady pace, driven by favorable government initiatives and increasing investments in renewable energy sources.

Major Key Players in the Market:

-

GCL-Poly Energy Holdings Limited

-

Longi Green Energy Technology Co. Ltd.

-

Zhonghuan Semiconductor

-

Wacker Chemie AG

-

Sumco Corporation

-

Shin-Etsu Chemical Co., Ltd.

-

Applied Materials, Inc.

-

ReneSola Ltd.

-

Jinko Solar Holding Co., Ltd.

-

Meyer Burger Technology AG

Market Insights and Developments:

-

In August 2020, LONGi Green Energy Technology announced that it had developed a new M6 monocrystalline silicon wafer that achieved a new world record for efficiency. The company affirmed that the new wafer had an efficiency of 22.38%, which would help to increase the output of solar cells and reduce the cost per watt of solar power.

- In June 2021, DuPont announced that it had launched a new range of DuPont Solamet photovoltaic metallization pastes for use in the production of solar cells. The new pastes are designed to improve the efficiency & durability of solar cells, which will help to increase the adoption of solar power in the coming years.

- In September 2021, China-based solar cell manufacturer Trina Solar announced that it had developed a new type of high-efficiency n-type TOPCon (tunnel oxide passivated contact) solar cell that achieved an efficiency of 25.8%.

Impact of COVID-19 on the Global Solar Ingot Wafer Market:

The COVID-19 pandemic has had a mixed impact on the Solar Ingot Wafer market. On one hand, the pandemic interrupted global supply chains, leading to a slowdown in manufacturing activities and a shortage of raw materials. This affected the production of solar ingot wafers and led to delays in project timelines. On the other hand, the pandemic also led to an increased focus on renewable energy sources as governments around the world look to build back better and prioritize sustainable development. The solar industry witnessed a steady surge in demand, driven by factors such as declining solar panel prices, government incentives, and the need for energy security. This led to an increase in demand for solar ingot wafers, which are a key component of solar panels. However, the pandemic also led to a decrease in overall investment in the solar industry, as companies prioritize cash preservation and limit their capital expenditures. As the world recovers from the pandemic, the Solar Ingot Wafer market is projected to rebound and witness continued growth in the coming years.

Chapter 1. SOLAR INGOT WAFER MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SOLAR INGOT WAFER MARKET– Executive Summary

2.1 Market Size & Forecast (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2024 - 2030

2.3.2 Impact on Supply – Demand

Chapter 3. SOLAR INGOT WAFER MARKET – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. SOLAR INGOT WAFER MARKET - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. SOLAR INGOT WAFER MARKET- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SOLAR INGOT WAFER MARKET—By Type

6.1 Monocrystalline

6.2 Polycrystalline

Chapter 7. SOLAR INGOT WAFER MARKET—By Manufacturing Process

7.1 Czochralski process

7.2 Float Zone process

7.3 Bridgman-Stockbarger process

7.4 Others

Chapter 8. SOLAR INGOT WAFER MARKET – Wafer Size

8.1 125mm

8.2 156mm

8.3 210mm

8.4 Others

Chapter 9. SOLAR INGOT WAFER MARKET – By End-Use Industry

9.1 Residential

9.2 Commercial

9.3 Industrial

Chapter 10. SOLAR INGOT WAFER MARKET – By Region

10.1 North America

10.2 Europe

10.3 Asia-P2acific

10.4 Latin America

10.5 The Middle East

10.6 Africa

Chapter 11. SOLAR INGOT WAFER MARKET – By Companies

11.1 GCL-Poly Energy Holdings Limited

11.2 Longi Green Energy Technology Co. Ltd.

11.3 Zhonghuan Semiconductor

11.4 Wacker Chemie AG

11.5 Sumco Corporation

11.6 Shin-Etsu Chemical Co., Ltd.

11.7 Applied Materials, Inc.

11.8 ReneSola Ltd.

11.9 Jinko Solar Holding Co., Ltd.

11.10 Meyer Burger Technology AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Solar ingot wafers are thin, circular slices of silicon material that are used in the production of solar cells. They are created by slicing a silicon ingot into thin, uniform wafers that can be used as the base material for solar cells.

The growth of the solar ingot wafer market is being driven by the increasing demand for solar energy, as well as advancements in solar technology that have made it more efficient and cost-effective.

One of the major challenges facing the solar ingot wafer market is the high cost of production, which can make it difficult for manufacturers to compete with other sources of energy. Additionally, there is a limited supply of high-quality silicon material, which can also limit the growth of the market.

Solar ingot wafers are primarily used in the production of solar cells, which are then used to create solar panels that can be used to generate electricity from the sun. They are also used in other applications, such as in the production of semiconductors and other electronic devices.

The Global Solar Ingot Wafer Market was valued at USD 36.44 Billion and is projected to reach a market size of USD 82.08 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.3%.