GLOBAL SOLAR CELL FILMS MARKET (2024 - 2030)

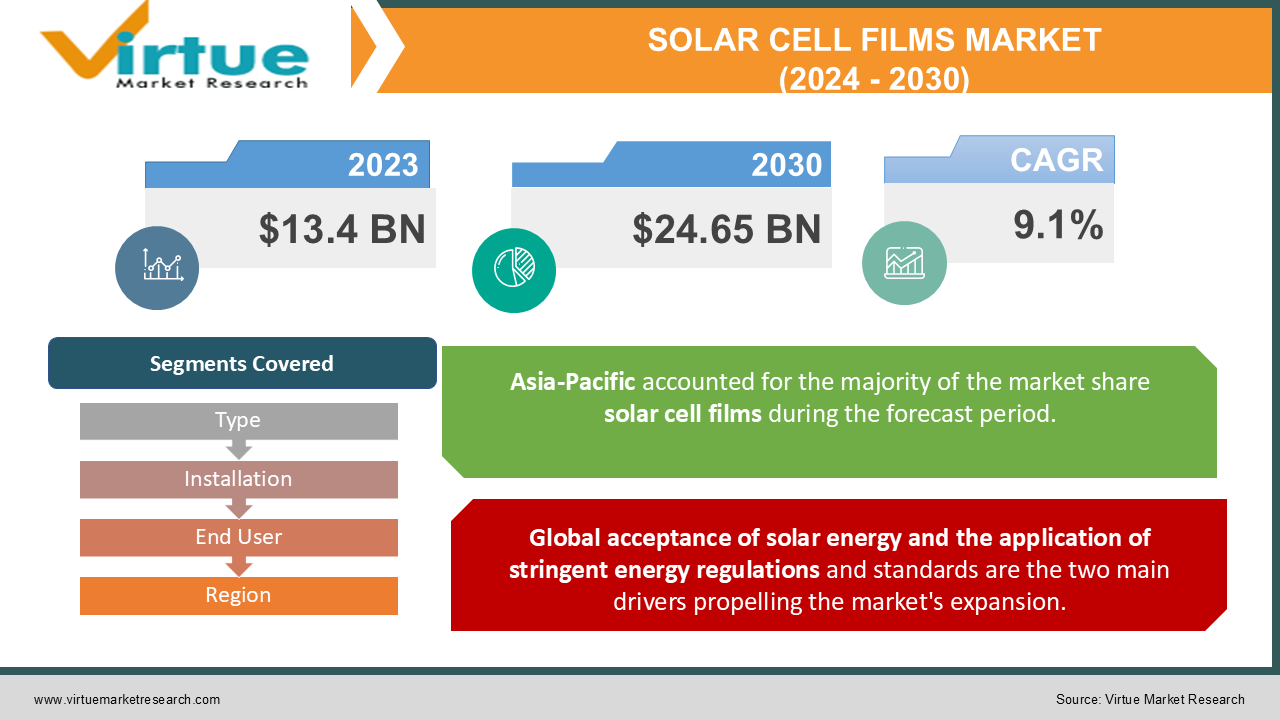

The Solar Cell films Market was valued at USD 13.4 Billion in 2023 and is projected to reach a market size of USD 24.65 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.1%.

Thin-film solar cells are another term for solar cell films. A thin-film solar cell is a type of solar cell that is used in second-generation solar cells. It is made of photovoltaic material thin layers, or thin films (TF), on metal, plastic, or glass. Furthermore, these cells are used commercially in several technologies, including amorphous thin-film silicon (a-Si, TF-Si), copper indium gallium diselenide (CIGS), and cadmium telluride (CdTe). Nonetheless, there is a wide range in film thickness from a few nanometers (nm) to tens of micrometers (m). This makes thin-film cells lighter and more flexible.

Key Market Insights:

Given their increased versatility and ability to be used anywhere for the production of power, solar cell films are in greater demand on the global market. Additionally, benefits like zero carbon emissions and lower electricity generation costs are provided by the quick advancement of photovoltaic technology. When compared to traditional fossil fuel technologies for the production of energy, solar PV systems have reduced operating and maintenance costs, which significantly accelerates market growth. The growing need for renewable energy sources has been greatly accelerated by the Asia-Pacific and Latin American emerging regions' rapid need for electricity. It is also used as a semi-transparent photovoltaic glazing material that is bonded onto windows once more. Rigid thin-film solar panels, which are positioned between two panes of glass, are also being used more often in commercial applications like photovoltaic power plants to feed electricity into the grid.

In addition, the use of solar energy in the commercial, industrial, and residential sectors is encouraged by expanding incentives and regulatory rules. The demand for solar cell films among consumers has decreased, though, due to the low efficiency of second-generation PV systems. Furthermore, the variable feed-in-tariff rate is anticipated to create difficulties for market expansion.

Solar Cell Films Market Drivers:

Global acceptance of solar energy and the application of stringent energy regulations and standards are the two main drivers propelling the market's expansion.

This component is driving the global market for thin-film solar cells to see growth in sales. Furthermore, there has been an increase in the usage of solar energy globally as a result of a consistent decline in costs. Thus, opportunities for businesses in the global thin-film solar cell market to turn a profit are increasing. Thin-film photovoltaic technologies are becoming more and more popular in the global market for a variety of applications, including consumer electronics, space exploration, and the military. This is due to the growing demand for energy-efficient technology. The implementation of stringent energy standards and regulations has also increased the demand for these conscientious and environmentally friendly items.

In both established and emerging nations, there is a growing urban population. As a result, businesses in the thin-film solar cell sector are focusing on creating new technology.

Businesses in the solar cell thin film sector are focusing on new technologies as more people live in cities in both developed and developing nations. The global thin-film solar cell business is growing as a result of this component. Apart from this, the global urbanisation trend in both developed and emerging nations is driving the market for thin-film solar cells.

Solar Cell Films Market Restraints:

The thin-film photovoltaic sector has several challenges, including intense rivalry, shifting regulations, and a lack of a technically competent corporate climate that may aid in R&D.

Hard competition and a constantly shifting regulatory landscape are only two of the challenges the market faces. The global industrial trends that could pose a challenge to the success of organisations include the rapid growth of technology. For these companies, these variables may provide serious challenges that limit their market share and keep them within the targeted market segment for the expected period of time. Moreover, businesses' ability to offer customers efficient thin-film solar solutions may be hampered by the lack of readily available funds and financial resources. That would prevent them from capturing a significant portion of the world market.

SOLAR CELL FILMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.1% |

|

Segments Covered |

By Type, Installation, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Heliatek, Dunmore, 3M, Advanced Energy, Lucent Clean Energy, Stion Corporation, Solar Frontier K.K., Kaneka Corporation, Prism Solar Technologies, and Hanergy Holding Group are some of the major market players in this industry. |

Solar Cell Films Market Segmentation

Market Segmentation: By Type

- Amorphous Silicon

- Cadmium Telluride

- Copper Indium Gallium Selenide

- Microcrystalline Tandem Cells

- Thin-film Polycrystalline silicon

The sector that grew at the quickest rate during the forecast period was the cadmium telluride segment, which, depending on type, dominated the worldwide thin-film solar cell market in 2023. Its harmless properties are responsible for this. It absorbs a large portion of the light spectrum, and works well in low light, but quickly loses effectiveness. It also requires little upkeep and production costs. This is because it is non-toxic, absorbs a wide range of wavelengths, and functions reasonably well in low lighting conditions, albeit efficiency is lost quickly. Its production and operating costs are likewise low. Thin-film cadmium-telluride (CdTe) solar cells could be made inexpensively since cadmium can be created as a byproduct of lead, zinc, and copper mining, smelting, and refining processes. This photoelectric method enables the production of relatively inexpensive solar panels by using cadmium telluride. The only renewable energy method that consumes the least amount of resources is this one. The only renewable energy source that requires the least amount of water in production is this one.

Thick coating PV solar panels made of CdTe have higher cell efficiency, starting at 16.7%, as compared to those other thin film solar cells. The US leads the world in the manufacture of CdTe PV. It has been the National Renewable Energies Laboratory (NREL) that has led the development and research in this subject. Compared to traditional fossil fuel sources of energy, the cost of producing electricity from CdTe in 2018 was either much cheaper or comparable. Additional development is possible.

Market Segmentation: By Installations

- On-Grid

- Off-Grid

The on-grid market share by installation was approximately 71% in 2023, and it is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2030. Installation projects that the on-grid category will continue to grow at the quickest rate over the projection period, having dominated the global thin-film solar cell market in 2020. This is explained by the expanding electrical transmission and distribution network, which is related to the integration of electricity generated from renewable sources into the grid and will drive demand during the projected period.

Market Segmentation: By End-User

- Residential

- Commercial

- Industrial

Utility companies have a market share of about 62% of the end-user market in 2023. In contrast, a compound annual growth rate (CAGR) of 8.8% is projected for the commercial category between 2024 and 2030. The utility category, which is expected to continue growing at the quickest rate during the forecast period according to end users. The increase in demand in the market can be ascribed to the rising installation of large-scale projects and the rising expenditure on research and development aimed at lowering maintenance and installation costs.

Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- South-America

- Middle East and Africa

In 2023, Asia-Pacific accounted for 46% of the revenue share. Furthermore, during the course of the projection period, LAMEA is expected to increase at a CAGR of 8.9%. This is due to a multitude of factors, such as urbanisation, a substantial consumer base, and industrialization. Almost half of the world's solar energy consumption in 2018 came from China, making it one of the biggest solar photovoltaic marketplaces in the world. Due to the increasing use of solar photovoltaic panels in commercial, utility-scale, and residential applications, APAC has accounted for a sizeable share of the thin-layer solar PV market. Thin-film technology is mostly used in China's utility-scale solar photovoltaic installations. China's National Commission for Development and Reform released a draught policy in 2018 that increased the country's aim for renewable energy from 20% to 35% by 2032. It is also the planners' intention to purchase renewable energy from utility companies and install solar panels wherever possible. Several solar highways made of polymer crystalline silicon are planned by the board to provide some of the energy needed for the 2020 Games. Thus, it is expected that shortly, there will be a greater need for thin-coating solar photovoltaic systems. For factors including upcoming utility-scale projects, enabling legislation, and incentives, thin-film photovoltaic is expected to increase significantly over the projected period.

Solar Cell Films Market COVID-19 Impact Analysis:

The COVID-19 pandemic caused a temporary suspension of thin-film solar cell manufacture, which had a substantial negative effect on the product's sales. The demand for solar panels directly relates to the sales of thin-film solar cells. A significant decrease in thin-film solar cell sales has been seen, and solar projects have suffered as a result of the COVID-19 lockout. Nearly every industry was affected by COVID-19 since it interfered with several industrial processes and caused supply chain disruptions. The majority of businesses stopped operating because of a shortage of workers. However, as a result of COVID-19, the global market for thin-film solar cells is declining slowly. Additionally, import and export operations suffered greatly, which hurt the businesses that used thin-film solar cells and, ultimately, the thin-film solar cell industry globally. The growth of the solar business depends heavily on construction. The global integrated construction sector was badly damaged by the COVID-19 epidemic. The lack of materials and workforce migration are two factors that cause interruption. The market for thin-film solar cells was, however, severely damaged by the decline in building activity.

Latest Trends/ Developments:

- The founders of the industry sold 99.22 shareholdings of C&S Electrical Ltd to Siemens, a major player in the global market, in March 2021 for around Rs 2,100 crore.

- Digital technology has been integrated by companies in the thin-film semiconductor market, such as Evolar, to improve the efficacy of their products.

Key Players:

Heliatek, Dunmore, 3M, Advanced Energy, Lucent Clean Energy, Stion Corporation, Solar Frontier K.K., Kaneka Corporation, Prism Solar Technologies, and Hanergy Holding Group are some of the major market players in this industry.

Chapter 1. GLOBAL SOLAR CELL FILMS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL SOLAR CELL FILMS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL SOLAR CELL FILMS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL SOLAR CELL FILMS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL SOLAR CELL FILMS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL SOLAR CELL FILMS MARKET – By Type

6.1. Amorphous Silicon

6.2. Cadmium Telluride

6.3. Copper Indium Gallium Selenide

6.4. Microcrystalline Tandem Cells

6.5. Thin-film Polycrystalline silicon

Chapter 7. GLOBAL SOLAR CELL FILMS MARKET – By Installation

7.1. On-Grid

7.2. Off-Grid

Chapter 8. GLOBAL SOLAR CELL FILMS MARKET – By End User

8.1. Residential

8.2. Commercial

8.3. Industrial

Chapter 9. GLOBAL SOLAR CELL FILMS MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By Installation

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type

9.2.3. By Installation

9.2.4. By End User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By Installation

9.3.4. By End User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By Type

9.4.3. By Installation

9.4.4. By End User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Type

9.5.3. By Installation

9.5.4. By End User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL SOLAR CELL FILMS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Heliatek

10.2. Dunmore

10.3. 3M

10.4. Advanced Energy

10.5. Lucent Clean Energy

10.6. Stion Corporation

10.7. Solar Frontier K.K.

10.8. Kaneka Corporation

10.9. Prism Solar Technologies

10.10. Hanergy Holding Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Solar Cell films Market was valued at USD 13.4 Billion in 2023

Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.1 %.

Global acceptance of solar energy and the application of stringent energy regulations and standards are the two main drivers propelling the market's expansion.

The thin-film photovoltaic sector has several challenges, including intense rivalry, shifting regulations, and a lack of a technically competent corporate climate that may aid in R&D.

Off-Grid and On-Grid are the 2 segmentations by installations.