Soil Conditioners Market Size (2025-2030)

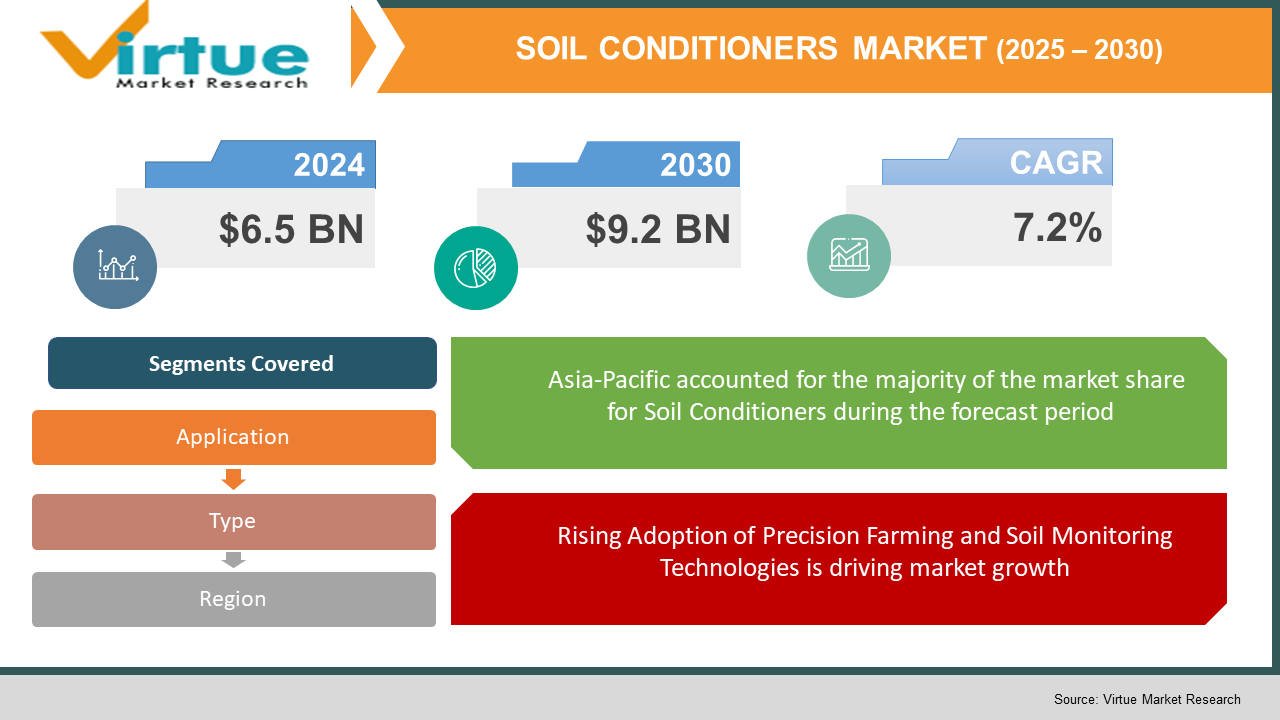

The Global Soil Conditioners Market was valued at USD 6.5 billion in 2024 and will grow at a CAGR of 7.2% from 2025 to 2030. The market is expected to reach USD 9.2 billion by 2030.

The Soil Conditioners Market focuses on substances added to soil to enhance its physical properties, fertility, and overall structure. These conditioners include organic and inorganic materials that improve aeration, water retention, and nutrient availability, promoting better crop yields. The market's growth is driven by increasing agricultural activities, soil degradation concerns, and the rising demand for high-yield crops. With the adoption of sustainable farming practices and advancements in soil health technologies, soil conditioners are expected to witness significant demand globally.

Key Market Insights

- The rising global population and increasing food demand are driving the adoption of soil conditioners to enhance agricultural productivity. The Food and Agriculture Organization (FAO) estimates that food production must increase by 70% by 2050 to feed the growing population.

- Soil degradation affects nearly 33% of the Earth's land surface, making soil conditioners essential for restoring soil health. Governments and agricultural organizations worldwide are promoting the use of soil conditioners to combat erosion, compaction, and nutrient depletion.

- Organic soil conditioners, including compost and biochar, are gaining popularity due to their environmentally friendly nature. The organic segment accounted for 45% of the global market share in 2024, driven by increasing consumer preference for sustainable agriculture.

- The inorganic soil conditioners segment, which includes products like gypsum and synthetic polymers, remains significant, particularly in commercial farming. This segment contributed to 55% of the market in 2024, as it provides immediate soil structure benefits.

- Asia-Pacific is the fastest-growing regional market for soil conditioners, expanding at a CAGR of 8.5% from 2025 to 2030. The region’s rapid agricultural expansion, particularly in India and China, is fueling demand.

Global Soil Conditioners Market Drivers

Growing Need for Sustainable Agriculture and Soil Health Improvement is driving market growth:

Soil degradation has emerged as a critical challenge, affecting agricultural productivity worldwide. Unsustainable farming practices, deforestation, and climate change contribute to soil erosion, compaction, and nutrient depletion, reducing crop yields. Soil conditioners play a vital role in mitigating these effects by improving soil structure, enhancing nutrient retention, and promoting microbial activity. With global food demand increasing, the need for sustainable agriculture is more pressing than ever. Soil conditioners, particularly organic variants like compost and biochar, are being widely adopted to restore soil fertility while reducing reliance on chemical fertilizers. Governments and agricultural organizations are actively promoting soil health initiatives, with policies and subsidies encouraging the use of soil conditioners. As soil degradation continues to threaten food security, the demand for soil conditioners will remain strong, driving market growth.

Rising Adoption of Precision Farming and Soil Monitoring Technologies is driving market growth:

The integration of precision farming techniques with soil conditioning solutions is revolutionizing modern agriculture. Farmers are leveraging advanced soil monitoring technologies such as remote sensing, AI-driven analytics, and soil sensors to assess soil health in real-time. These technologies enable precise application of soil conditioners, ensuring optimal soil structure and nutrient availability. As farming practices become more data-driven, the demand for targeted soil conditioning solutions is increasing. Precision farming not only enhances crop productivity but also reduces resource wastage and environmental impact. The increasing affordability and accessibility of smart farming tools are further accelerating the adoption of soil conditioners, making them an essential component of modern agricultural practices.

Government Policies and Incentives Supporting Soil Management Practices is driving market growth:

Governments worldwide are recognizing the importance of soil health in ensuring food security and environmental sustainability. Numerous policy initiatives and financial incentives are being introduced to promote soil conservation and sustainable farming practices. In the European Union, the Common Agricultural Policy (CAP) provides subsidies for farmers adopting soil-improving practices, including the use of organic soil conditioners. Similarly, the U.S. Department of Agriculture (USDA) supports soil health programs, offering financial aid to farmers implementing soil restoration techniques. These government-backed initiatives are not only raising awareness about soil degradation but also encouraging large-scale adoption of soil conditioners. As more countries implement soil conservation policies, the global market for soil conditioners is expected to expand significantly.

Global Soil Conditioners Market Challenges and Restraints

High Costs Associated with Soil Conditioners and Application Techniques is restricting market growth:

One of the major challenges facing the soil conditioners market is the high cost of these products and their application techniques. While soil conditioners improve soil health and productivity, the initial investment required can be substantial. Organic soil conditioners such as biochar and compost require significant processing and handling costs, making them expensive for small and medium-scale farmers. Inorganic conditioners like gypsum and synthetic polymers may offer quick results but often come with additional costs related to transportation and labor. Moreover, advanced soil monitoring technologies used to optimize soil conditioner application add to the overall expenses. Many farmers, particularly in developing regions, struggle to afford these solutions, limiting widespread adoption. The market's growth is highly dependent on cost-effective solutions that balance affordability with long-term soil health benefits.

Lack of Awareness and Limited Availability in Emerging Markets is restricting market growth:

Despite the increasing recognition of soil degradation, awareness regarding soil conditioners and their benefits remains low in several emerging markets. Many farmers lack access to reliable information about soil health management, leading to continued reliance on traditional farming methods that contribute to soil depletion. Additionally, limited distribution channels for high-quality soil conditioners hinder market penetration in remote agricultural regions. Inadequate infrastructure and logistical challenges further restrict product availability, preventing farmers from adopting soil conditioners effectively. Government and private sector initiatives aimed at educating farmers and expanding supply chains will be crucial in overcoming this challenge. Bridging the knowledge gap and improving accessibility will be key factors in unlocking the full potential of the soil conditioners market in developing economies.

Market Opportunities

The growing emphasis on regenerative agriculture presents a significant opportunity for the soil conditioners market. Regenerative farming practices focus on improving soil health, increasing biodiversity, and enhancing carbon sequestration, aligning perfectly with the benefits offered by soil conditioners. As consumers and food companies demand more sustainable agricultural practices, farmers are increasingly adopting soil restoration techniques that rely on organic and bio-based soil conditioners. The rise of carbon credit markets is also incentivizing farmers to invest in soil health solutions, as healthy soils play a crucial role in carbon capture. Additionally, research and development in innovative soil conditioning products, including microbial-based conditioners and nanotechnology-enhanced formulations, are expanding the market's potential. With regulatory frameworks supporting sustainable farming, the soil conditioners market is poised for significant growth.

SOIL CONDITIONERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF, Syngenta, UPL Limited, Evonik Industries, and The Andersons Inc. |

SOIL CONDITIONERS Market Segmentation

SOIL CONDITIONERS Market Segmentation By Type:

• Organic Soil Conditioners

• Inorganic Soil Conditioners

The organic soil conditioners segment is the most dominant, accounting for approximately 55% of the market share in 2024. Increasing consumer preference for natural and sustainable farming inputs has driven demand for compost, biochar, and manure-based conditioners. These products not only enhance soil structure but also contribute to long-term soil fertility, making them highly preferred in organic and regenerative agriculture.

SOIL CONDITIONERS Market Segmentation By Application:

• Agriculture

• Industrial

• Landscaping

The agriculture segment dominates the market, comprising around 70% of total demand. Farmers globally are integrating soil conditioners into their soil management practices to improve crop yields and soil health. With rising food security concerns, soil conditioners are becoming essential in both commercial and subsistence farming.

SOIL CONDITIONERS Market Regional Segmentation

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

Asia-Pacific is the dominant region, accounting for the largest market share in 2024. The region’s rapid agricultural expansion, increasing government support for soil conservation programs, and high adoption of sustainable farming practices are driving market growth. Countries like China and India are leading in soil conditioner usage due to their large agricultural sectors and the need to improve soil fertility amid rising food demand.

COVID-19 Impact Analysis on the Soil Conditioners Market

The COVID-19 pandemic had a dual impact on the soil conditioners market. In the short term, disruptions in global supply chains caused significant challenges, including raw material shortages and rising production costs. These factors temporarily hindered market growth, as manufacturers faced difficulties in sourcing essential materials and adjusting to the increased costs of production. The instability created by the pandemic strained industries globally, and the soil conditioners sector was no exception. However, the pandemic also brought attention to critical issues such as food security and the need for sustainable agriculture. As global disruptions affected food supply chains, there was a renewed focus on ensuring the resilience of food production systems. This emphasis on food security led many farmers to reconsider their practices, with a growing number turning to soil conditioners as a way to maintain and improve crop yield stability during these uncertain times. The adoption of soil conditioners helped mitigate the effects of environmental stressors, improving soil health and enhancing productivity in an era of unpredictable agricultural challenges. In response to these challenges, governments and agricultural organizations around the world increased their efforts to promote soil health. Several new initiatives and programs were launched, offering support to farmers for the adoption of sustainable farming practices, including the use of soil conditioners. These efforts helped stimulate market demand, driving growth in the long term. As a result, the soil conditioners market not only navigated the difficulties of the pandemic but also found new opportunities for expansion, as the focus on sustainability and food security continues to shape the future of global agriculture.

Latest Trends/Developments

Recent trends in the soil conditioners market reveal significant innovations and shifts toward more sustainable practices. One notable trend is the growing use of microbial-based soil enhancers. These products harness beneficial microorganisms to improve soil health by enhancing nutrient cycling, promoting plant growth, and reducing the need for chemical fertilizers. As the agricultural sector increasingly seeks eco-friendly solutions, microbial-based conditioners are becoming more popular for their natural approach to soil enrichment. Another key trend is advancements in precision soil analysis. Farmers now have access to more advanced tools and technologies that enable them to assess soil conditions with greater accuracy. These innovations, such as soil sensors and digital mapping, allow for targeted application of soil conditioners, ensuring that resources are used efficiently and effectively. This shift towards precision agriculture helps optimize yield while minimizing environmental impact. The rise of biochar as a sustainable solution for soil improvement is also gaining momentum. Biochar, a form of charcoal produced from organic waste, is recognized for its ability to enhance soil structure, retain water, and sequester carbon. This environmentally friendly material offers long-term benefits for soil health and contributes to the reduction of greenhouse gas emissions, making it an increasingly popular choice for sustainable farming. Researchers are also exploring the potential of nano-based soil conditioners. These products are designed to enhance nutrient absorption and improve water retention at the molecular level, offering more efficient and effective solutions for soil enhancement. Additionally, digital platforms providing real-time soil health insights are becoming an essential tool for farmers. These platforms allow for better decision-making by offering data-driven recommendations on soil conditioner applications, helping farmers optimize their use and improve crop productivity.

Key Players

- BASF

- Syngenta

- UPL Limited

- Evonik Industries

- The Andersons Inc.

- Omnia Holdings

- Clariant AG

- Eastman Chemical Company

Chapter 1. SOIL CONDITIONERS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SOIL CONDITIONERS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SOIL CONDITIONERS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SOIL CONDITIONERS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SOIL CONDITIONERS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SOIL CONDITIONERS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Organic Soil Conditioners

6.3 Inorganic Soil Conditioners

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. SOIL CONDITIONERS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Agriculture

7.3 Industrial

7.4 Landscaping

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. SOIL CONDITIONERS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SOIL CONDITIONERS MARKET– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

9.1 BASF

9.2 Syngenta

9.3 UPLLimited

9.4 Evonik Industries

9.5 The Andersons Inc.

9.6 Omnia Holdings

9.7 Clariant AG

9.8 Eastman Chemical Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Soil Conditioners Market was valued at USD 6.5 billion in 2024 and is expected to reach USD 9.2 billion by 2030, growing at a CAGR of 7.2%.

Key drivers include the growing need for sustainable agriculture, adoption of precision farming, and government support for soil health improvement.

The market is segmented by product (organic and inorganic) and application (agriculture, industrial, and landscaping).

Asia-Pacific is the dominant region due to high agricultural activity and government initiatives promoting soil conservation

Key players include BASF, Syngenta, UPL Limited, Evonik Industries, and The Andersons Inc.