Software Composition Analysis Market Size (2024 – 2030)

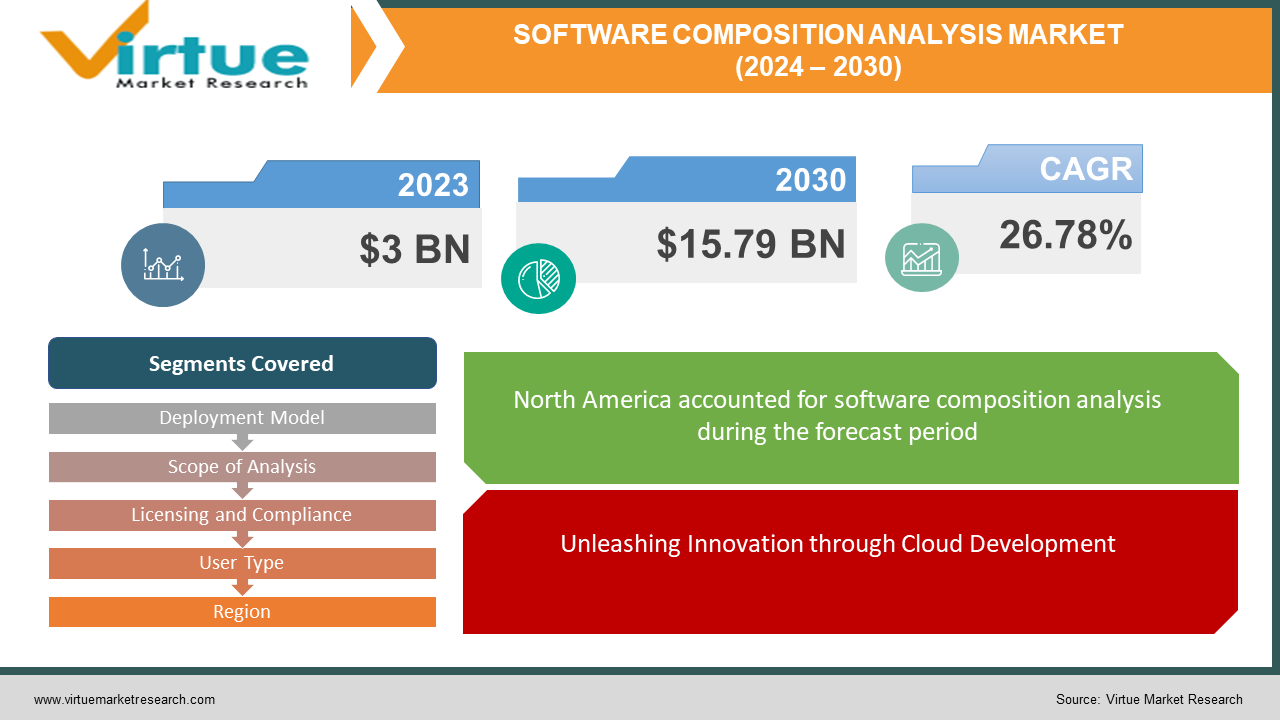

The Software Composition Analysis market is projected to increase from its present size of USD 3 billion in 2023 to USD 15.79 billion by the end of 2030. Between 2024 and 2030, the market is expected to grow at a CAGR of 26.78%.

The global software composition analysis (SCA) market is developing as a result of the growing need to combat cybersecurity risks and the growing reliance on open-source components in software development. Because enterprises are finding it difficult to manage the complexity of today's software supply chains, SCA solutions have emerged as indispensable instruments for identifying and mitigating vulnerabilities and ensuring compliance. The use of cloud-based SCA solutions and integration with DevOps approaches demonstrates the industry's commitment to safe and efficient software development processes. Well-known vendors like Synopsys, WhiteSource, and Snyk have contributed significantly to the development of the SCA environment by offering comprehensive solutions that lower security risks and increase the overall resilience of software systems.

Key Market Insights:

Important market insights into the Software Composition Analysis (SCA) domain point to a paradigm shift in the way firms address software security. The software supply chain is being strengthened by the SCA industry, which plays a crucial role because of the increasing quantity of open-source components and the growing threat of cyberattacks. Cloud-based solutions are growing in popularity because of their ability to scale and adjust to contemporary development practices. Integrations with DevOps pipelines further emphasise how critical it is to identify vulnerabilities early in the development lifecycle. The market's competitive environment, which is populated by well-known businesses like Synopsys, WhiteSource, and Snyk, highlights how committed the sector is to offering robust SCA solutions that address the different challenges related to protecting complex software ecosystems.

Insights also show how the market has responded to regulatory issues, with SCA tools playing a critical role in helping organisations comply with stringent regulations. The future of the SCA industry hinges on continuous advancements to keep up with evolving cyberthreats and ensure that these solutions will always be necessary for businesses attempting to strike a careful balance between security and software development pace. SCA is well-positioned to maintain its leadership position as cybersecurity gains traction across industries globally. It offers priceless insights and protection against weaknesses in the quickly evolving digital ecosystem.

Market Drivers:

Unleashing Innovation through Cloud Development.

In the age of digital transformation, cloud-based development has emerged as a disruptive force that is revolutionising the way companies plan, develop, and use the software. This paradigm change leverages the scalability and flexibility of cloud infrastructure to provide smooth scaling, foster collaboration, and accelerate development cycles. Cloud-based development is transforming software engineering by enabling not only instantaneous deployment but also automatic upgrades and real-time collaboration. By embracing the cloud, teams of all sizes—from startups to multinationals—can transcend traditional boundaries, fostering innovation and adaptability in a quickly evolving technological landscape and, in the process, revolutionising the way we create and execute software solutions.

The Inexorable Rise of Open-Source Software in Contemporary Development

The software development ecosystem has undergone a massive upheaval due to the emergence of Open Source Software (OSS). OSS is now the cornerstone of innovation, valued for its affordability, adaptability, and teamwork-oriented mindset. By having access to a vast contributor community and shared resources, open-source components are being used by developers all over the world to expedite projects. This rise is more than just a passing trend—rather, it signifies a fundamental rethinking of how software is built and designed. The increasing prevalence of open source software signifies a common dedication to transparency, collaboration, and the democratisation of technology. This will contribute to the creation of a future where new, revolutionary applications and solutions are developed through the collaborative potential of open source software.

Secure Development Processes Are Accelerated by the Synergistic Integration of Software Composition Analysis.

The seamless combination of DevOps techniques and Software Composition Analysis (SCA) has revolutionised modern software development. SCA tools are vital for bolstering the development pipeline in the fast-moving DevOps environment, where collaboration and efficiency are paramount. Businesses can track the security status of their software in real-time by integrating SCA into Continuous Integration/Continuous Deployment (CI/CD) procedures. This integration allows for early vulnerability discovery, enabling development teams to proactively address security concerns without slowing down DevOps's rapid release cycles. As a result, when combined, SCA and DevOps enhance application security generally and flawlessly mesh with the efficiency and agility that define the DevOps approach.

Market Restraints and Challenges:

Ensuring Accurate Vulnerability Detection in Software Composition Analysis.

An important topic in the subject of Software Composition Analysis (SCA) is the accuracy of vulnerability detection. As organisations rely more and more on SCA technologies to detect and handle security risks associated with open-source components, the accuracy of vulnerability detection becomes crucial. It can be challenging to distinguish between false positives and false negatives, which could lead to either an inadvertent disregard of genuine security problems or an overestimation of vulnerabilities and unnecessary precautions. The dynamic and heterogeneous nature of software ecosystems makes this effort more challenging because it requires continuous evolution of SCA solutions to accurately discover vulnerabilities across open-source, third-party, and proprietary code.

Difficulties Resulting from Open Source Licensing's Lack of Standardisation for Software Composition Analysis.

The lack of standards in open-source licencing is a significant barrier in the field of Software Composition Analysis (SCA). The open-source community depends on diversity, which has given rise to a wide range of licensing models with varying rights, obligations, and restrictions. This lack of consistency makes it more difficult to monitor and ensure compliance with licensing requirements. It can be challenging for companies to stay out of legal hot water when using open-source components in their software because of the complex web of licensing agreements they must manage. As a result, it is more challenging to integrate SCA tools into development processes due to the lack of standard licensing techniques, and each unique set of licensing concerns must be carefully examined and handled.

Market Opportunities:

Container Application Security Is Maintained by Specialised Software Composition Analysis.

The increasing adoption of containerisation technologies such as Docker and Kubernetes has raised awareness of container security within Software Composition Analysis (SCA). Due to the efficiency and scalability benefits of containerised programmes, more and more businesses are adopting them. As a result, there is a growing need for specialised software code assurance (SCA) solutions that are specifically tailored to address the challenges presented by container settings. Container security includes inspecting the application code itself and the dependencies present in container images. SCA tools that focus on container security are crucial for preserving the integrity of these images, identifying vulnerabilities in containerised components, and giving warnings about potential risks associated with utilising specific containers. Containerised deployments are rapidly increasing.

Precision in Protection: Industry-Tailored Software Composition Analysis Solutions Address Sector-Specific Challenges and Compliance Standards.

Software composition analysis (SCA) is an ever-evolving topic, and an increasing number of people understand that industry-specific solutions are required to address the unique challenges and regulatory requirements of numerous businesses. Businesses in the healthcare, finance, and automotive industries need to comply with industry-specific security requirements and regulatory frameworks, thus they need SCA tools that are more sophisticated than generic solutions. Customised industry-specific solutions provide a more advanced method, ensuring that SCA tools comply with the intricate regulatory landscape in addition to identifying and addressing vulnerabilities. Industry-specific SCA solutions help organisations improve their software supply chains by taking a customised and compliance-focused approach. This applies to both safeguarding patient data in the healthcare industry and ensuring financial software conforms with legal requirements.

SOFTWARE COMPOSITION ANALYSIS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

26.78% |

|

Segments Covered |

By Deployment Model, Scope of Analysis, Licensing and Compliance, User Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

White Source Software Ltd., Synopsys.Inc., Sonatype.Inc., Veracode.Inc. Flexra Software LLC, FOSSA.Inc., JFrog Ltd., Rogue Wave Software,Inc,, Protecode Inc., CAST Highlight |

Software Composition Analysis Market Segmentation: By Deployment Model

-

On-Premises SCA

-

Cloud Based SCA

The greater control and customizability that on-premises Software Composition Analysis (SCA) solutions provide is advantageous for businesses with strict data protection regulations. However, on-premises solutions require more upkeep from the company's IT team and have a higher initial infrastructure cost. Conversely, SCA systems hosted in the cloud offer accessibility, scalability, and flexibility. Due to its ability to reduce infrastructure costs, automate updates, and optimise operations, this method is gaining traction. Cloud-based SCA substantially benefits modern development methodologies, particularly in DevOps situations, since it facilitates real-time collaboration between geographically dispersed teams and makes integration into CI/CD pipelines easier.

Selecting the optimal deployment model depends on an organization's specific demands, resources, and strategic objectives. On-premises SCA solutions may be of interest to organisations with strict infrastructure control, significant security concerns, and regulatory requirements. However, cloud-based SCA solutions are easier to use, more scalable, and more flexible, which makes them perfect for collaborative, scalable, and effective security measures in businesses as well as modern development processes. Ultimately, a variety of factors, such as organisational preferences, security policies, and the need for flexibility and scalability in the software development lifecycle, will determine whether to deploy software on-premises or in the cloud.

Software Composition Analysis Market Segmentation: By Scope of Analysis

-

Code-Level SCA

-

Binary-Level SCA

Code-level software composition analysis, or SCA, helps businesses to manage open-source components, closely inspect dependencies, and identify vulnerabilities by thoroughly analysing the source code used in software development. Development environments (IDEs) and version control systems can easily integrate code-level source code analysis (SCA) tools, which give developers real-time feedback that fits into their workflows. Because proactive code analysis helps developers address security issues early on and promote safe coding habits, it lowers the possibility of vulnerabilities in the final product.

The choice between binary-level and code-level SCA depends on the specific needs and organisational processes. Code-level security vulnerability analysis (SCA) is often viewed as being more successful during the development phase since it gives developers real-time insights and enables them to repair vulnerabilities early in the process. However, binary-level SCA becomes essential when assessing security in third-party components and developed apps. The best results come from combining the two approaches: code-level analysis ensures proactive security measures throughout development, while binary-level analysis offers comprehensive security checks in the assembled final products. The most effective scope of analysis is influenced by the organization's development practices, the kind of software being examined, and the level of security assurance necessary during the software development process.

Software Composition Analysis Market Segmentation: By Licensing and Compliance

-

Security-Centric SCA

-

License-Centric SCA

A software development approach called code-level software composition analysis (SCA) involves carefully going over the source code. It aids in the management of open-source components, careful observation of dependencies, and vulnerability detection for companies. Code-level source code analysis (SCA) technologies provide developers with instantaneous feedback while they work, seamlessly integrating with development environments (IDEs) and version control systems. This proactive analysis aids developers by promoting safe coding habits, addressing security issues early, and reducing the likelihood of vulnerabilities in the final product.

The most effective SCA strategy will depend on the objectives and priorities of the organisation and whether it is security- or license-centric. Since a security-centric SCA strategy addresses vulnerabilities in-depth and reduces the chance of security breaches, it is likely more successful for organisations where security is of the utmost importance. But in industries with stringent licencing requirements, such as those governed by specific regulatory frameworks, license-centric SCA becomes crucial for maintaining compliance and avoiding legal problems. A well-rounded approach that takes licencing and security issues into account may yield the most complete software composition analysis, ensuring a clear comprehension of potential risks and compliance needs. The optimal course of action is determined by the particular needs of the organisation, industry rules, and risk tolerance.

Software Composition Analysis Market Segmentation: By User Type

-

Developer-Centric SCA

-

Security Team-Centric SCA

Developer-centric Software Composition Analysis (SCA) solutions leverage version control systems and integrated development environments (IDEs) to seamlessly integrate them into developers' daily routines and settings. These technologies help developers make informed decisions at every step of the development process by providing real-time analysis and fast feedback on code security. This proactive strategy enhances security awareness, encourages secure coding practices, and enables early vulnerability fixes across the software development lifecycle. On the other hand, comprehensive capabilities for assessing and managing the security of the whole software supply chain are provided by SCA solutions that are tailored to security teams and created with cybersecurity specialists in mind. With its complex features, extensive research, and complete reporting, security team-centric SCA facilitates compliance reporting, promotes strategic decision-making for overall security planning, and increases awareness of security threats. This is a highly favourable approach for businesses whose cybersecurity measures depend on centralised control and thorough security research.

Which user-type approach—developer-centric or security team-centric—is more successful will depend on the organization's priorities, processes, and structure. Because developer-centric SCA integrates well with developer workflow and promotes timely vulnerability mitigation, it can be particularly effective in agile development environments that emphasise DevOps. However, in large firms or sectors with complicated security requirements, a security team-centric approach, which gives centralised control, in-depth research, and comprehensive reporting, might be more successful. Combining the two points of view in a hybrid approach can also be beneficial because it provides developers with immediate feedback while security experts maintain a broad understanding of the organization's software security environment.

Software Composition Analysis Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Software Composition Analysis (SCA) market is segmented into discrete market influence zones based on geographical share. North America is in the lead with a dominant 35% of the market. The region's reputation is ascribed to the presence of prominent firms in the SCA industry, the widespread implementation of cybersecurity measures, and its advanced technological environment. Europe comes in second with a quarter of the market, demonstrating the region's dedication to strong cybersecurity protocols and the application of SCA technology in a range of industries. On the other hand, the Asia-Pacific area holds a significant 20% share of the market, mainly due to the swift expansion of software development and IT infrastructure in nations like China and India.

The Middle East, Africa, and South America account for 10% of the total, indicating the growing significance of SCA in bolstering software security and compliance norms.

This regional segmentation emphasises the global aspect of SCA adoption, with multiple regions contributing to the market's overall growth based on their own technological landscapes, regulatory settings, and industrial agendas. As software development and cybersecurity continue to advance, the SCA industry is anticipated to expand and diversify even more.

COVID-19 Impact Analysis on the Global Software Composition Analysis Market:

The COVID-19 pandemic has had a significant impact on the worldwide Software Composition Analysis (SCA) market. It has also expedited certain trends in software development and cybersecurity and redirected industry priorities. Because of the sudden shift to remote work, there is a greater need for robust software security measures because there is a greater reliance on digital solutions. Organisations have prioritised SCA tools to secure their software supply chains and decrease vulnerabilities in the face of evolving cyber hazards, as a result of the pandemic's increased cybersecurity threats.

Latest Trends/Developments:

One of the newest developments in the business is the application of artificial intelligence (AI) to enhance the capability of software composition analysis (SCA) tools. Numerous aspects of risk assessment, remediation, and vulnerability detection are being optimised and automated with the application of AI. Machine learning techniques are used to analyse large datasets of open-source components, enabling SCA tools to identify patterns, trends, and potential security threats more quickly. This AI integration improves vulnerability detection accuracy, decreases false positives, and increases automation, which helps SCA stay up with the fast-paced, dynamic nature of modern software development.

The SCA market has seen notable merger and acquisition (M&A) activity as businesses seek to improve their capacities and increase the scope of their product offerings. More established software development and cybersecurity companies are acquiring specialised SCA providers to enhance their end-to-end security services. Establishing comprehensive cybersecurity ecosystems that handle vulnerability management in addition to other facets of software security is the aim of these acquisitions. A further factor promoting the integration of SCA into bigger cybersecurity frameworks is strategic agreements and acquisitions. This pattern indicates that, in response to evolving security concerns in the complex realm of software composition, the SCA industry is developing, with increased collaboration and consolidation taking place.

Key Players:

-

White Source Software Ltd.

-

Synopsys.Inc.

-

Sonatype.Inc.

-

Veracode.Inc.

-

Flexra Software LLC

-

FOSSA.Inc.

-

JFrog Ltd.

-

Rogue Wave Software,Inc,

-

Protecode Inc.

-

CAST Highlight

Chapter 1. Software Composition Analysis Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Software Composition Analysis Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Software Composition Analysis Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Software Composition Analysis Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Software Composition Analysis Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Software Composition Analysis Market – By Deployment Model

6.1 Introduction/Key Findings

6.2 On-Premises SCA

6.3 Cloud Based SCA

6.4 Y-O-Y Growth trend Analysis By Deployment Model

6.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. Software Composition Analysis Market – By Scope of Analysis

7.1 Introduction/Key Findings

7.2 Code-Level SCA

7.3 Binary-Level SCA

7.4 Y-O-Y Growth trend Analysis By Scope of Analysis

7.5 Absolute $ Opportunity Analysis By Scope of Analysis, 2024-2030

Chapter 8. Software Composition Analysis Market – By Licensing and Compliance

8.1 Introduction/Key Findings

8.2 Security-Centric SCA

8.3 License-Centric SCA

8.4 Y-O-Y Growth trend Analysis End-Use Industry

8.5 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Software Composition Analysis Market – By User Type

9.1 Introduction/Key Findings

9.2 Developer-Centric SCA

9.3 Security Team-Centric SCA

9.4 Y-O-Y Growth trend Analysis End-User

9.5 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Software Composition Analysis Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Deployment Model

10.1.2.1 By Scope of Analysis

10.1.3 By Licensing and Compliance

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Deployment Model

10.2.3 By Scope of Analysis

10.2.4 By Licensing and Compliance

10.2.5 By User Type

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Deployment Model

10.3.3 By Scope of Analysis

10.3.4 By Licensing and Compliance

10.3.5 By User Type

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Deployment Model

10.4.3 By Scope of Analysis

10.4.4 By Licensing and Compliance

10.4.5 By User Type

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Deployment Model

10.5.3 By Scope of Analysis

10.5.4 By Licensing and Compliance

10.5.5 By User Type

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Software Composition Analysis Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 White Source Software Ltd.

11.2 Synopsys.Inc.

11.3 Sonatype.Inc.

11.4 Veracode.Inc.

11.5 Flexra Software LLC

11.6 FOSSA.Inc.

11.7 JFrog Ltd.

11.8 Rogue Wave Software,Inc,

11.9 Protecode Inc.

11.10 CAST Highlight

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Software Composition Analysis market is projected to increase from its present size of USD 3 billion in 2023 to USD 15.79 billion by the end of 2030. Between 2024 and 2030, the market is expected to grow at a CAGR of 26.78%.

Among the problems facing the worldwide software composition analysis market are making sure security patch updates arrive on time and fixing vulnerabilities in third-party components.

The global market for software composition analysis is driven by the rising use of open-source components in software development and the growing demand for cybersecurity safeguards.

North America held the largest market share of 35% This dominant position can be attributed to the region's robust industrialization, rapid economic growth, and diverse improvement.

JFrog Ltd., White Source Software Ltd., Veracode Inc., Flexra Software LLC, FOSSA Inc., Rogue Wave Software Inc., Protecode Inc., Synopsys Inc., Sonatype Inc., and CAST Highlight are the Main Players.