Software-Based Optical Imaging for Ophthalmology Market Size (2024 – 2030)

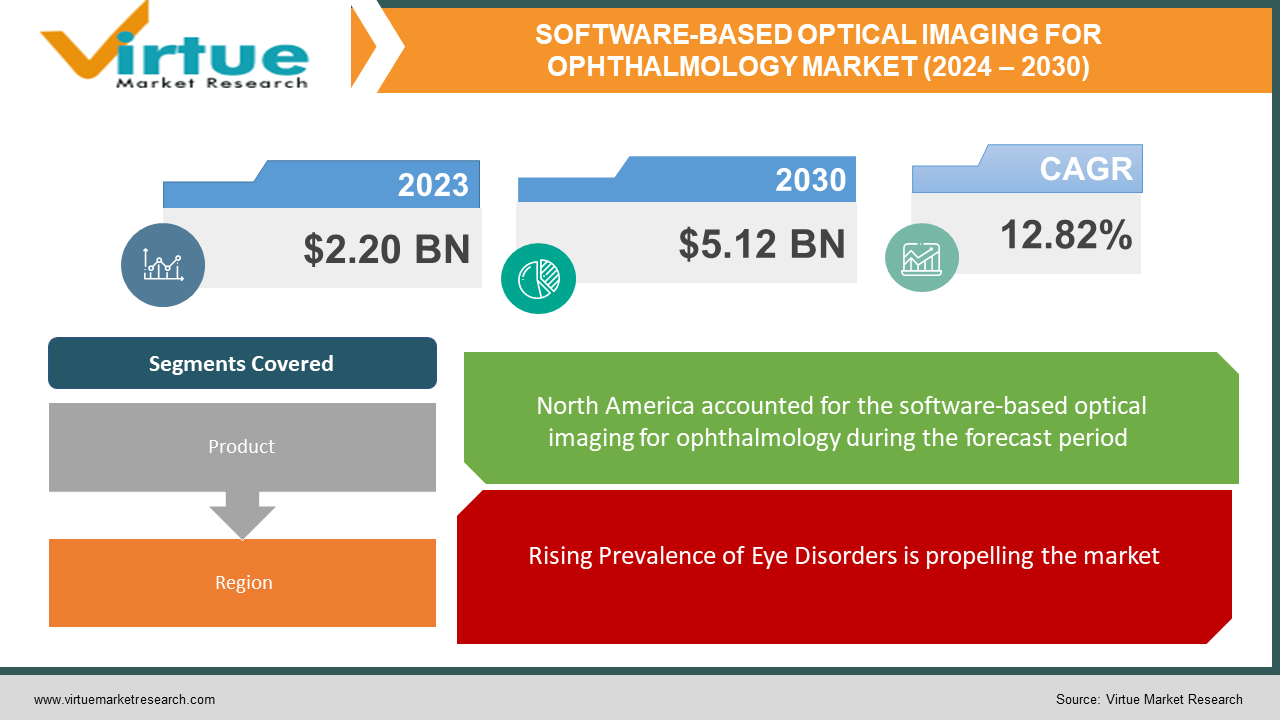

The Software-Based Optical Imaging for Ophthalmology Market was valued at USD 2.20 billion in 2023 and will grow at a CAGR of 12.82% from 2024 to 2030. The market is expected to reach USD 5.12 billion by 2030.

The software acts as the brains behind many optical imaging tools used in ophthalmology, going beyond capturing pictures. It processes and analyzes data from devices like OCT and fundus cameras, revealing detailed structures and potential abnormalities within the eye. This software enables high-resolution visualization, quantitative measurements, and even AI-powered diagnoses, supporting early detection, monitoring, and treatment decisions for various eye diseases. Think of it as the unsung hero, quietly working behind the scenes to translate light into crucial insights for better eye health

Key Market Insights:

The Software-Based Optical Imaging for Ophthalmology market is expected to see massive growth, fueled by various factors. The rising prevalence of eye diseases like macular degeneration, diabetic retinopathy, and glaucoma pushes the demand for better diagnosis and monitoring tools. Technology advances like AI-powered image analysis, cloud-based solutions, and quantitative measurements further contribute by enhancing accuracy and efficiency. Additionally, increased affordability makes this technology accessible to a wider range of healthcare providers. Even research applications are seeing a boost with software playing a key role in drug discovery, clinical trials, and personalized medicine initiatives. However, challenges like high initial costs and integration with existing systems remain. Despite these hurdles, the market offers a promising opportunity for companies offering innovative software solutions that address these challenges and ultimately contribute to improved ophthalmic care.

Software-Based Optical Imaging for Ophthalmology Market Drivers:

Rising Prevalence of Eye Disorders is propelling the market

As populations age, the prevalence of sight-stealing conditions like cataracts, macular degeneration, and glaucoma skyrockets. This burgeoning burden fuels the need for efficient and accurate diagnosis. Thankfully, advanced imaging technologies like Optical Coherence Tomography (OCT) and AI-powered fundus cameras are rising to the challenge. These tools offer unparalleled visualization of ocular structures, enabling ophthalmologists to detect subtle changes even before symptoms arise. Imagine catching the disease in its early stages, potentially preventing irreversible vision loss! This translates to not only improved patient outcomes but also reduced healthcare costs in the long run. It's a win-win for both individual and societal well-being, making advanced imaging a crucial weapon in the fight against age-related eye diseases.

Increased Desire for Early Detection and Personalized Treatment is propelling the market

Gone are the days of reactive treatments; today, patients and professionals alike embrace preventive healthcare and personalized medicine. This shift fuels the crucial goal of early detection and ongoing monitoring of eye diseases. Thankfully, software-based analysis steps in as a powerful ally. By scrutinizing data captured by imaging technologies, these intelligent tools unearth subtle clues of disease even before symptoms whisper. This early detection empowers timely intervention, potentially preventing irreversible vision loss. Furthermore, the beauty of software lies in its ability to tailor treatment plans to individual patients. By considering a patient's unique genetic makeup, lifestyle factors, and disease progression, personalized plans are crafted, maximizing treatment effectiveness while minimizing side effects. This shift towards proactive, data-driven, and individualized eye care paves the way for a future where vision loss becomes less of a threat and more of a preventable reality.

Non-invasive and Patient-friendly Methods are driving the market

Optical imaging techniques have revolutionized eye diagnostics by ditching invasive procedures and harmful radiation associated with traditional methods like X-rays. Imagine saying goodbye to needles and uncomfortable positions while welcoming a comfortable, patient-friendly experience. Optical imaging shines a light on the eye, capturing detailed images without ever breaking the skin. This translates to no pain, no discomfort, and most importantly, no exposure to potentially harmful ionizing radiation. This is a major win for both patients and physicians. Patients appreciate the ease and safety of the process, while physicians gain access to high-resolution images essential for accurate diagnosis and treatment planning. This shift towards non-invasive, radiation-free methods paves the way for a more patient-centered and safer approach to eye healthcare, opening doors to earlier diagnoses and improved outcomes for all.

Software-Based Optical Imaging for Ophthalmology Market challenges and restraints:

High initial investment is required which is hurdling the market growth

The high price tag of software-based optical imaging hangs over the ophthalmology field like a dark cloud. The sophisticated software and hardware needed come with a hefty upfront cost, leaving smaller clinics and healthcare systems struggling to see the light. Imagine a small, local clinic, the cornerstone of their community's eye care, unable to afford this potentially life-changing technology. This creates a two-tiered system, where larger, well-funded institutions have access to advanced diagnostics, while smaller players are left behind. The consequences are stark: delayed diagnoses, limited treatment options, and potentially avoidable vision loss for patients who rely on these local clinics. While the technology offers immense benefits, its financial burden threatens to widen the healthcare gap and leave smaller players in the dark. Addressing this cost barrier through innovative financing models, government subsidies, or even open-source software initiatives is crucial to ensure equitable access to this game-changing technology and illuminate the path toward better eye health for all.

The lack of standardized protocols for image acquisition and analysis is hurdling the market growth

The lack of standardized protocols for image acquisition and analysis creates confusion for both manufacturers and healthcare providers. Different ways of capturing and analyzing data make comparing results across institutions difficult, hindering collaboration and research efforts. Additionally, the regulatory landscape surrounding this technology is still evolving, with new requirements popping up like unexpected obstacles. This can be particularly daunting for smaller players who struggle to keep up with the changing rules, further slowing down adoption. The lack of a clear and consistent path hinders both innovation and accessibility, ultimately impacting patient care. To navigate this maze effectively, collaboration between manufacturers, healthcare professionals, and regulatory bodies is crucial. Establishing clear guidelines, streamlining approval processes, and promoting data-sharing practices are essential steps to ensure the safe, effective, and widespread adoption of this potentially life-changing technology.

Protecting sensitive patient data from cyberattacks is the biggest challenge

Safeguarding patient data in the digital age is an ever-present concern, and software-based optical imaging in ophthalmology adds another layer of complexity. Protecting sensitive medical images and personal information from cyberattacks is paramount, but achieving HIPAA compliance adds another burden on healthcare providers. Imagine the stress of having a treasure trove of eye scan data and worrying about it falling into the wrong hands. The potential for data breaches and identity theft necessitates robust cybersecurity measures, including secure storage, access controls, and regular security audits. This translates to additional costs for hardware, software, and skilled IT professionals, creating a strain on already stretched budgets. The challenge lies in striking a balance between affordability and robust security, ensuring patient data remains safe without hindering access to this valuable diagnostic tool. Collaborative efforts between healthcare providers, technology companies, and cybersecurity experts are crucial to developing cost-effective and secure solutions that safeguard patient privacy and foster trust in this evolving technology.

Market Opportunities:

The Software-Based Optical Imaging market in Ophthalmology presents a wealth of opportunity. Aging populations driving up eye disease cases fuel the demand for accurate diagnosis and monitoring tools. Cutting-edge advancements like AI-powered image analysis and cloud solutions offer heightened diagnostic accuracy and efficiency. Additionally, increased affordability makes this technology more accessible, expanding the potential user base. Research applications are also flourishing with software playing a key role in drug discovery, clinical trials, and personalized medicine. However, challenges like high initial costs and integration with existing systems exist. Companies that focus on innovative software solutions addressing these challenges and contributing to improved ophthalmic care, such as AI-powered early detection or cloud-based workflow optimization, are poised to capitalize on this exciting market with its significant growth potential.

SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.82% |

|

Segments Covered |

By Product, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Carl Zeiss Meditec AG, Topcon Corporation, Canon Medical Systems, Leica Microsystems, Heidelberg Engineering GmbH, Optovue Inc., Optos plc |

Software-Based Optical Imaging for Ophthalmology Market segmentation: by product

-

Optical coherence tomography (OCT)

-

Fundus photography

-

Angiography

-

Corneal topography

Optical coherence tomography (OCT) reigns supreme in the software-based ophthalmic imaging realm, offering high-resolution, cross-sectional views of the eye's inner workings. Top players like Carl Zeiss Meditec, Topcon, and Canon Medical Systems lead the charge. Fundus photography follows closely, capturing detailed images of the eye's back with key players like Topcon and Canon Medical in the mix. Angiography, visualizing blood flow within the eye, sees players like Heidelberg Engineering and Carl Zeiss Meditec at the forefront. Finally, corneal topography maps the cornea's surface, with Topcon, Nidek, and Haag-Streit taking the lead. So, while OCT currently holds the crown, each technology plays a crucial role in diagnosing and monitoring various eye conditions.

Software-Based Optical Imaging for Ophthalmology Market Segmentation: Regional Analysis

-

North America

-

Asia Pacific

-

Europe

-

South America

-

Middle East and Africa

The North American market reigns supreme in software-based optical imaging for ophthalmology, driven by both high eye disease rates and strong healthcare infrastructure. Europe follows closely, while Asia Pacific emerges as the star pupil, experiencing the fastest growth thanks to rising incomes and growing awareness of eye health. Latin America shows promising potential with significant projected growth, while the Middle East and Africa, though currently the smallest region, are expected to see moderate expansion in the coming years. In a nutshell, Asia Pacific is sprinting ahead, while the Middle East and Africa are taking a steady jog.

COVID-19 Impact Analysis on the Software-Based Optical Imaging for Ophthalmology Market

The COVID-19 pandemic had a mixed impact on the Software-Based Optical Imaging market for Ophthalmology. While initial disruptions like clinic closures and elective procedure delays temporarily hindered market growth, they also triggered long-term trends that could prove beneficial. Telehealth consultations using remote imaging software boomed, highlighting the potential for wider adoption and improved accessibility. Additionally, research efforts focusing on the ocular complications of COVID-19 spurred the development of specialized software for diagnosis and monitoring. However, ongoing supply chain disruptions and economic strain might limit healthcare facilities' investments in new technologies. Looking ahead, the market is expected to rebound and potentially accelerate as pent-up demand for eye care services is released, coupled with the growing acceptance of telemedicine and the continued demand for advanced diagnostic tools. Adapting software solutions to address pandemic-related challenges and cater to the evolving healthcare landscape will be crucial for companies seeking to thrive in this market.

Latest trends/Developments

The software-based optical imaging market for ophthalmology is buzzing with exciting developments! AI is taking center stage, with algorithms automating analysis and improving disease detection accuracy. Cloud-based solutions are making data storage and access easier, particularly in remote areas. Deep learning algorithms are even personalizing treatment plans based on individual patient characteristics. Telemedicine integration allows remote consultations and diagnoses, expanding access to specialists. Additionally, manufacturers are focusing on affordability, with portable and cost-effective devices emerging. Regulatory bodies are collaborating to create clear guidelines and streamline approval processes. These trends point towards a future where software-based optical imaging becomes standard, empowering early diagnoses, personalized care, and improved eye health outcomes for all.

Key Players:

-

Carl Zeiss Meditec AG

-

Topcon Corporation

-

Canon Medical Systems

-

Leica Microsystems

-

Heidelberg Engineering GmbH

-

Optovue Inc.

-

Optos plc

Chapter 1. SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET – By product

6.1 Introduction/Key Findings

6.2 Optical coherence tomography (OCT)

6.3 Fundus photography

6.4 Angiography

6.5 Corneal topography

6.6 Y-O-Y Growth trend Analysis By product

6.7 Absolute $ Opportunity Analysis By product, 2023-2030

Chapter 7. SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By product

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By product

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By product

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By product

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By product

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. SOFTWARE-BASED OPTICAL IMAGING FOR OPHTHALMOLOGY MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Carl Zeiss Meditec AG

8.2 Topcon Corporation

8.3 Canon Medical Systems

8.4 Leica Microsystems

8.5 Heidelberg Engineering GmbH

8.6 Optovue Inc.

8.7 Optos plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Software-Based Optical Imaging for Ophthalmology Market was valued at USD 2.20 billion in 2023 and will grow at a CAGR of 12.82% from 2024 to 2030. The market is expected to reach USD 5.12 billion by 2030.

Rising Prevalence of Eye Disorders, Increased Desire for Early Detection and Personalized Treatment, and Non-invasive and Patient-friendly Methods are the reasons that are driving the market.

Based on a product it is divided into four segments – Optical coherence tomography (OCT), Fundus photography, Angiography, Corneal topography

North America is the most dominant region for Software-Based Optical Imaging in the Ophthalmology Market.

Carl Zeiss Meditec AG, Topcon Corporation, Canon Medical Systems, Leica Microsystems, etc.