Soft Drinks Market Size (2025 – 2030)

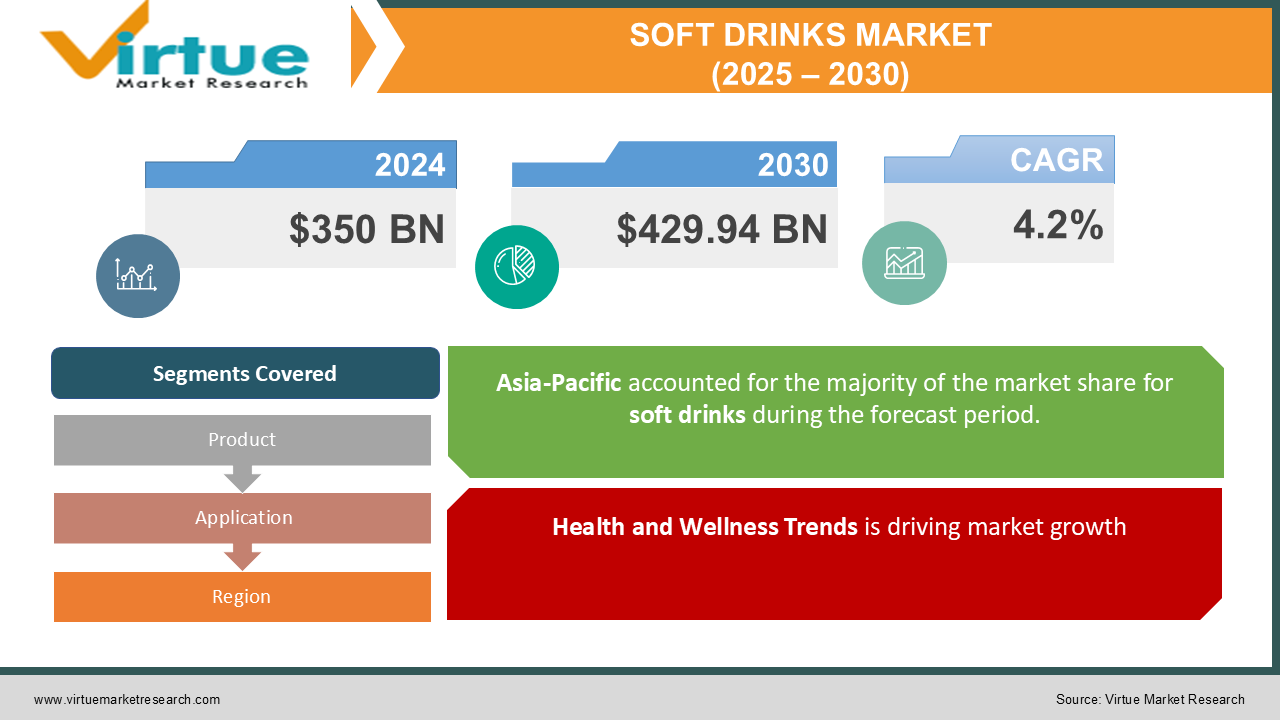

The Global Soft Drinks Market was valued at USD 350 billion in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030 and is estimated to reach 429.94 billion in 2030.

By the end of this period, the market is expected to reach approximately USD 310 billion. Soft drinks include carbonated drinks, fruit beverages, bottled water, and ready-to-drink teas and coffees. The market's growth is fueled by the increasing demand for innovative and healthier drink options among consumers worldwide. Despite facing challenges from health advocacies against sugary drinks, the industry has adapted by diversifying portfolios to include low-calorie, low-sugar, and no-sugar options, which have gained considerable market traction.

Key Market Insights

-

The demand for low-sugar and sugar-free soft drinks is rapidly increasing due to growing health consciousness among consumers.

-

Asia-Pacific is witnessing significant growth due to rising disposable incomes and the young population's preference for soft drinks.

-

Functional soft drinks, enriched with vitamins, minerals, and added proteins, are seeing a surge in popularity.

-

Environmental concerns are pushing companies to innovate with eco-friendly packaging solutions.

-

The market is highly competitive with a strong presence of both global and local brands.

-

Technological advancements in production and logistics have improved the market reach and efficiency.

-

Seasonal and limited-edition flavors are becoming popular strategies for engaging customers.

-

The ongoing pandemic has shifted consumer preferences towards products that offer wellness and immunity benefits.

Global Soft Drinks Market Drivers

Health and Wellness Trends is driving market growth:

The growing consumer focus on health and wellness is reshaping soft drink consumption patterns. As people become more health-conscious, they are increasingly seeking beverages that offer more than just refreshment. This shift is prompting manufacturers to reformulate their products by reducing sugar levels and incorporating organic and natural ingredients. Consumers are now more discerning about what they drink, favoring options that align with their wellness goals, such as those that support hydration, energy, or immune health. The rise of functional beverages is one of the most significant indicators of this change. These drinks go beyond basic hydration by offering added health benefits, such as improved digestion, cognitive support, or enhanced energy. This growing interest in functional beverages is influencing product innovation, with brands introducing new formulations that cater to specific health needs.

Emerging Markets is driving market growth:

Emerging markets offer significant growth opportunities for the soft drink industry. Factors such as rapid urbanization, expanding middle classes with increasing disposable incomes, and a younger demographic are driving demand in these regions. Countries like China, India, and Brazil are seeing a surge in soft drink consumption, fueled by these demographic and economic shifts. The growing middle class in these markets is eager to embrace Western consumer products, including soft drinks. To successfully tap into these expanding markets, soft drink companies must focus on localization. Adapting flavors and products to suit local tastes is essential, as preferences can vary greatly across cultures. In addition, tailored marketing strategies that resonate with local values, lifestyles, and traditions will help brands better connect with consumers.

Sustainability Initiatives is driving market growth:

Sustainability has become a key driver in the soft drinks market, as consumers increasingly favor brands with strong environmental credentials. Companies are responding by adopting initiatives like using recycled materials for packaging, minimizing water usage in production, and reducing carbon footprints. These efforts not only enhance brand images but also contribute to global sustainability goals. As environmental concerns grow, consumers are more likely to support brands that demonstrate a commitment to reducing their environmental impact. By prioritizing sustainability, soft drink companies are fostering greater consumer loyalty and attracting new customers who value eco-friendly practices. These initiatives resonate particularly with younger, more environmentally conscious consumers, who are willing to choose brands that align with their values. As sustainability continues to shape consumer preferences, companies that incorporate these practices into their operations are better positioned to thrive in an increasingly competitive market.

Global Soft Drinks Market Challenges and Restraints

Regulatory Pressures is restricting market growth: The soft drinks industry is facing increasing regulatory scrutiny, particularly regarding sugar content and its impact on public health. Governments worldwide are implementing taxes on sugary beverages and requiring clearer labeling to address rising obesity rates. These regulations aim to encourage healthier consumer choices but present challenges for the industry. Companies may face additional costs related to these taxes and the need for product reformulations to reduce sugar levels. As a result, businesses must adapt by exploring healthier alternatives, revising ingredients, and ensuring compliance with new standards, all of which can affect profitability and operational strategies.

Consumer Health Concerns is restricting market growth: As health awareness increases, consumers are becoming more averse to high-calorie drinks with artificial flavorings and sweeteners. The connection between sugary soft drinks and health problems like diabetes and obesity has driven a shift toward healthier alternatives. This change is putting pressure on the traditional soft drink segment, forcing companies to innovate by offering healthier options in order to retain market share. To stay competitive, brands must adapt by reducing sugar content, incorporating natural ingredients, and creating functional beverages that appeal to health-conscious consumers.

Market Opportunities

The soft drinks industry is well-positioned to take advantage of the growing consumer demand for both convenience and functional benefits. As consumers increasingly seek products that not only refresh but also promote well-being, there is a notable opportunity for the industry to expand into the health-focused beverage market. By offering drinks that target specific health concerns—such as digestive health, energy levels, and hydration—brands can tap into a market that prioritizes wellness alongside taste and convenience. Moreover, leveraging emerging technologies like blockchain could play a significant role in enhancing supply chain transparency, which is becoming more important to today’s consumers. Blockchain can provide consumers with verified, real-time information about the sourcing and quality of ingredients, increasing trust in a brand’s products. As transparency becomes a key factor in consumer decision-making, using such technologies could help companies build stronger relationships with their audience and differentiate themselves in an increasingly competitive market. By embracing both health-conscious product formulations and innovative technologies, the soft drinks industry can open new avenues for growth, meeting the demand for functional, convenient, and transparent products. This shift not only aligns with current consumer preferences but also positions the industry to stay ahead of future trends.

SOFT DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Coca-Cola Company, PepsiCo, Nestlé, Dr Pepper Snapple Group, Red Bull GmbH, Monster Beverage Corporation, Danone, Keurig Dr Pepper, Suntory Beverage & Food Limited, Parle Agro |

Soft Drinks Market Segmentation - By Product

-

Carbonated Soft Drinks

-

Bottled Water

-

Juices

-

Ready-to-Drink Tea and Coffee

-

Energy Drinks

Bottled water continues to dominate the soft drink market as consumers increasingly prefer healthier, non-sugary drink options. This trend is driven by the global shift towards health and wellness, particularly in mature markets where consumers are actively reducing their sugar intake.

Soft Drinks Market Segmentation - By Application

-

Daily Refreshment

-

Sports & Fitness

-

Energy & Wellness

Daily refreshment leads the application segment in the soft drinks market. The ubiquitous nature of soft drinks as a staple in daily life supports steady demand across various demographics and geographies. This segment's resilience is due to the broad consumer base and the essential role these beverages play in social and daily settings.

Soft Drinks Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific stands out as the dominant region in the global soft drinks market. This dominance is attributed to the significant population size, increasing urbanization, and rising middle-class affluence in the region. Countries like China and India are pivotal markets, driving regional growth through rapid consumer lifestyle changes and increasing expenditure on fast-moving consumer goods.

COVID-19 Impact Analysis on the Soft Drinks Market

The COVID-19 pandemic initially disrupted the soft drinks market, primarily due to shifts in consumer behavior and supply chain interruptions. With lockdowns and social distancing measures in place, many consumers changed their purchasing habits, leading to reduced demand in certain retail channels and disruptions in the production and distribution of products. However, the industry bounced back relatively quickly, driven by an increase in home consumption and a rising demand for beverages with perceived health benefits. As consumers became more health-conscious during the pandemic, there was a greater interest in functional drinks and beverages with immunity-boosting properties. Brands that swiftly adapted to these changes were able to not only recover but also expand their market share. Many companies focused on strengthening their online presence and improving direct-to-consumer channels, ensuring they could reach customers who were shopping from home. By embracing e-commerce, enhancing digital marketing strategies, and offering convenience through home delivery, these brands successfully connected with consumers and capitalized on the growing trend of at-home consumption. The quick shift to digital engagement and health-focused products allowed brands to meet the evolving demands of the market and position themselves for continued growth. As a result, the pandemic, while initially challenging, served as a catalyst for innovation and adaptation within the soft drinks industry.

Latest Trends/Developments

Recent developments in the soft drinks market are centered around health, technology, and sustainability. A major trend is the innovation of product formulations that reduce sugar and calories while still maintaining great taste. As consumers become more health-conscious, beverage companies are responding by creating lower-calorie options that don’t sacrifice flavor, allowing them to cater to a growing demand for healthier alternatives. Technology is also playing a key role in reshaping the market. Advances in digital tools are helping brands improve product distribution and enhance consumer engagement. Through digital channels, companies can better connect with customers, offering personalized experiences, promotions, and information about their products. This technological integration is making it easier for consumers to interact with their favorite brands and discover new products. Sustainability continues to be a focal point in the industry. Companies are increasingly investing in renewable energy sources and adopting sustainable packaging solutions to meet the demands of eco-conscious consumers. With a rising awareness of environmental issues, brands are exploring ways to reduce their carbon footprint, from using recyclable materials to exploring alternatives to plastic packaging. These sustainability efforts are not only appealing to environmentally aware consumers but are also becoming a necessary step for companies to stay competitive in the market. In summary, the soft drinks market is evolving to meet the demands for healthier, more sustainable, and tech-driven products. Brands that successfully incorporate these trends are positioning themselves to thrive in an increasingly health-conscious and eco-aware consumer landscape.

Key Players

-

Coca-Cola Company

-

PepsiCo

-

Nestlé

-

Dr Pepper Snapple Group

-

Red Bull GmbH

-

Monster Beverage Corporation

-

Danone

-

Keurig Dr Pepper

-

Suntory Beverage & Food Limited

-

Parle Agro

Chapter 1. Soft Drinks Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Soft Drinks Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Soft Drinks Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Soft Drinks Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Soft Drinks Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Soft Drinks Market – By Product

6.1 Introduction/Key Findings

6.2 Carbonated Soft Drinks

6.3 Bottled Water

6.4 Juices

6.5 Ready-to-Drink Tea and Coffee

6.6 Energy Drinks

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Soft Drinks Market – By Application

7.1 Introduction/Key Findings

7.2 Daily Refreshment

7.3 Sports & Fitness

7.4 Energy & Wellness

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Soft Drinks Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Soft Drinks Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Coca-Cola Company

9.2 PepsiCo

9.3 Nestlé

9.4 Dr Pepper Snapple Group

9.5 Red Bull GmbH

9.6 Monster Beverage Corporation

9.7 Danone

9.8 Keurig Dr Pepper

9.9 Suntory Beverage & Food Limited

9.10 Parle Agro

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Soft Drinks Market was valued at USD 350 billion in 2024.

Key drivers include health and wellness trends, emerging market growth, and sustainability initiatives.

The market is segmented by product (Carbonated Soft Drinks, Bottled Water, etc.) and by application (Daily Refreshment, Sports & Fitness, etc.).

Asia-Pacific is the most dominant region due to its large population and increasing consumer spending.

Leading players include Coca-Cola Company, PepsiCo, and Nestlé.