Sodium Silicate Market Size (2025 – 2030)

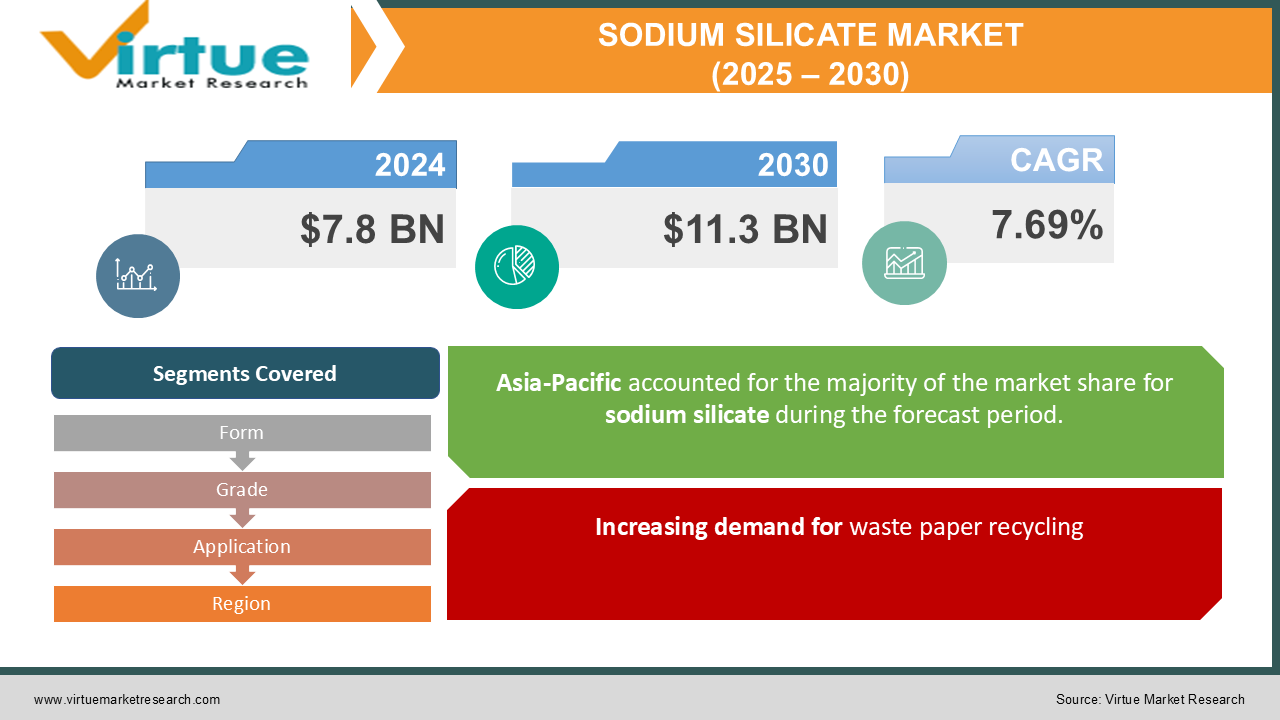

The Global Sodium Silicate Market was valued at USD 7.8 billion in 2024 and is projected to reach a market size of USD 11.3 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.69%.

Sodium silicate is a key source of reactive silica that has high demand in numerous application industries, including detergent, rubber, food and beverages, and pulp and paper. Increasing demand for other derivatives such as silica gels and silica sols in applications, including paints and coatings, plastics, and ink, is expected to have a positive impact on the market growth over the forecast period.

The sodium silicate market is a significant segment within the broader chemicals industry, driven by its diverse applications across multiple sectors. Sodium silicate, commonly known as water glass, is an inorganic compound composed of sodium oxide (Na₂O) and silica (SiO₂). It is available in both liquid and solid forms, with properties that make it valuable in adhesives, detergents, water treatment, construction, and the automotive industry.

Key Market Insights:

-

Studies have shown that the addition of sodium silicate can improve the compressive strength of concrete by approximately 15-20% over standard formulations. The detergent industry continues to be a major consumer, with nearly 25-30% of all sodium silicate production being used in cleaning agents and soaps due to its emulsifying and alkaline properties. In water treatment applications, sodium silicate has been found to reduce corrosion in pipelines by up to 60%, significantly extending infrastructure lifespan.

-

Sodium silicate is a major component in detergents, with its use improving cleaning efficiency by up to 30% compared to conventional formulations. The material’s water treatment applications have influenced, with over 40% of municipal water treatment plants incorporating sodium silicate for corrosion control and heavy metal precipitation. In the construction industry, sodium silicate-based concrete sealers have been analyzed to enhance surface durability by over 50%, reducing maintenance costs.

-

The pulp and paper industry has also witnessed demand for sodium silicate consumption, particularly in de-inking and bleaching processes. Reports suggest that sodium silicate can improve paper fiber recovery rates by around 25%, making the recycling process more efficient. Additionally, the automotive sector has begun utilizing sodium silicate in high-performance adhesives, with demand in this sector growing at a notable pace.

Sodium Silicate Market Drivers:

Rising demand for sodium silicate from the construction sector is driving the market growth

The construction industry is one of the primary consumers of sodium silicate, using it for concrete durability, surface treatment, and waterproofing applications. Its ability to enhance compressive strength by up to 20% makes it a preferred choice in infrastructure projects. Sodium silicate-based formulations are widely used in soil stabilization, reducing permeability and improving foundation stability. Additionally, its eco-friendly nature aligns with the growing emphasis on sustainable construction materials.

Increasing demand for waste paper recycling

Sodium silicate plays a crucial role in the waste paper recycling industry, where it is used as a de-inking agent to remove ink and other contaminants from used paper. As environmental concerns drive stricter recycling policies, industries are adopting sodium silicate-based solutions to enhance fiber recovery efficiency. It helps in reducing chemical waste while improving the brightness and quality of recycled paper.

Predominant usage of sodium silicate in soap and detergent

Nearly 30% of global sodium silicate production is utilized in this sector, ensuring better cleaning efficiency in both household and industrial applications. With the growing preference for high-performance, phosphate-free detergents, sodium silicate’s role in eco-friendly formulations is becoming even more significant. The rising demand for hygiene and cleaning products, especially post-pandemic, has further fueled its market expansion.

Sodium Silicate Restraints and Challenges:

Strict regulations and safety concerns limit medical use of sodium silicate

The use of sodium silicate in medical applications faces significant challenges due to safety concerns, strict regulatory approvals, and potential toxicity at high concentrations. Although it has antimicrobial and binding properties beneficial in certain formulations, its alkaline nature can cause irritation or adverse reactions in biological systems. Regulatory bodies impose stringent guidelines on its usage in pharmaceuticals and medical-grade products, limiting its widespread adoption. Additionally, the development of biocompatible and non-toxic alternatives is reducing its relevance in the medical field. Research is ongoing to explore safer modifications, but compliance with evolving health standards remains a major restraint.

Sodium Silicate Market Opportunities:

The increasing use of sodium silicate in paints and adhesives presents a significant market opportunity, driven by its excellent binding, corrosion resistance, and fireproofing properties. Additionally, the rising adoption of green tires is boosting demand for sodium silicate, as it plays a crucial role in silica-based tire formulations that improve fuel efficiency and reduce carbon emissions. With growing environmental concerns and stricter regulations on emissions, manufacturers are increasingly incorporating sodium silicate in eco-friendly tire production. These trends are expected to drive significant growth in the coming years.

SODIUM SILICATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.69% |

|

Segments Covered |

By Form, Grade, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Coogee Chemicals Pty Ltd., Evonik Industries AG, Welcome Chemicals, CIECH S.A., C THAI Group, Occidental Petroleum Corporation, Hindcon Chemicals Ltd., Malpro Silica Private Limited, Silmaco NV, Oriental Silicas Corporation |

Sodium Silicate Market Segmentation: By Form

-

Liquid Sodium Silicate

-

Solid Sodium Silicate

Liquid sodium silicate is the dominant in the market due to its widespread use in detergents, water treatment, and adhesives. Its versatility, ease of application, and solubility make it a preferred choice across various industries. Liquid sodium silicate is heavily used in construction for concrete treatment and industrial cleaning formulations, further driving its demand.

On the other hand, solid sodium silicate is the fastest-growing, driven by its increasing use in refractories, ceramics, and foundry applications. The rising demand for eco-friendly binding agents in industries such as pulp & paper and rubber manufacturing is further accelerating its growth.

Sodium Silicate Market Segmentation: By Grade

-

Alkaline

-

Neutral

Alkaline sodium silicate is mostly used due to its extensive usage in detergents, adhesives, and water treatment applications. Its strong alkalinity makes it highly effective in emulsifying oils and grease, making it a key ingredient in industrial and household cleaning products.

On the other hand, neutral sodium silicate is also showing fast growth, driven by its increasing demand in high-purity applications such as pharmaceuticals, coatings, and precision casting.

Sodium Silicate Market Segmentation: By Application

-

Construction

-

Detergents

-

Food Preservation

-

Metal Casting

-

Paints & adhesive

-

Precipitated Silica

-

Pulp & Paper

-

Water Treatment

Construction is the dominant application segment, as sodium silicate is widely used for concrete treatment, soil stabilization, and waterproofing. Its ability to enhance durability, improve bonding strength, and protect against moisture makes it a crucial component in infrastructure projects.

Precipitated silica is the fastest-growing application segment, fueled by its rising use in green tires, personal care products, and industrial rubber applications. Sodium silicate serves as a key raw material in producing precipitated silica, which improves tire durability, fuel efficiency, and performance.

Sodium Silicate Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region, contributing 42% of the global sodium silicate market. The construction, detergent, and water treatment industries are the primary drivers, with strong government investments in infrastructure further supporting growth. The region's large manufacturing base and cost-effective production also contribute to its market leadership.

Middle East & Africa is the fastest-growing region, with demand surging due to expanding infrastructure projects, increasing water treatment needs, and industrial growth. Governments in the region are heavily investing in wastewater treatment plants and sustainable construction, driving the adoption of sodium silicate.

COVID-19 Impact Analysis on the Global Sodium Silicate Market:

The COVID-19 pandemic had a mixed impact on the global sodium silicate market, with initial disruptions followed by a strong recovery. Lockdowns and supply chain interruptions in early 2020 led to temporary declines in production and demand, particularly in industries like construction, automotive, and metal casting. However, the increased focus on hygiene and sanitation significantly boosted the demand for detergents and cleaning products, where sodium silicate is a key ingredient. The water treatment sector also saw steady growth as governments prioritized clean water supply. Moving forward, the market is expected to continue expanding, driven by growing applications in sustainable and high-performance industrial solutions.

The COVID-19 pandemic caused significant disruptions in the sodium silicate market, particularly in sectors like construction, paper & pulp, and automotive, where demand declined due to halted operations and supply chain constraints. The temporary shutdown of manufacturing units and transportation restrictions led to raw material shortages, affecting production capacity. Additionally, price volatility of raw materials and labor shortages further impacted market stability.

On the other hand, the crisis created new opportunities, especially in the detergent and water treatment industries, where the demand for sodium silicate surged due to heightened hygiene awareness and the need for clean water. The chemical's antimicrobial properties made it essential in various cleaning products, supporting market recovery. As industries adapted to post-pandemic challenges, digital transformation, automation, and sustainability initiatives gained traction, influencing future sodium silicate applications and driving long-term market growth.

Latest Trends/ Developments:

The sodium silicate market is witnessing significant advancements, driven by increasing demand for sustainable and high-performance industrial applications. One of the latest trends is its growing use in eco-friendly construction materials, where sodium silicate-based formulations are being integrated into green concrete and sustainable adhesives. Additionally, the rise of bio-based and phosphate-free detergents has spurred demand for sodium silicate, as manufacturers seek effective yet environmentally friendly alternatives for cleaning products.

Another key development is the expanding role of sodium silicate in advanced materials, particularly in precipitated silica production for industries like automotive and personal care. The increasing demand for green tires, which enhance fuel efficiency and reduce rolling resistance, has led to a surge in sodium silicate-based silica applications. Additionally, 3D printing and specialty coatings are emerging as new frontiers for sodium silicate usage, as researchers explore its binding and fire-resistant properties for innovative industrial applications.

Key Players:

-

Coogee Chemicals Pty Ltd.

-

Evonik Industries AG

-

Welcome Chemicals

-

CIECH S.A.

-

C THAI Group

-

Occidental Petroleum Corporation

-

Hindcon Chemicals Ltd.

-

Malpro Silica Private Limited

-

Silmaco NV

-

Oriental Silicas Corporation

Chapter 1. Sodium Silicate Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sodium Silicate Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sodium Silicate Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sodium Silicate Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sodium Silicate Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sodium Silicate Market – BY FORM

6.1 Introduction/Key Findings

6.2 Liquid Sodium Silicate

6.3 Solid Sodium Silicate

6.4 Y-O-Y Growth trend Analysis BY FORM

6.5 Absolute $ Opportunity Analysis BY FORM, 2025-2030

Chapter 7. Sodium Silicate Market – BY GRADE

7.1 Introduction/Key Findings

7.2 Alkaline

7.3 Neutral

7.4 Y-O-Y Growth trend Analysis BY GRADE

7.5 Absolute $ Opportunity Analysis BY GRADE, 2025-2030

Chapter 8. Sodium Silicate Market – By Application

8.1 Introduction/Key Findings

8.2 Construction

8.3 Detergents

8.4 Food Preservation

8.5 Metal Casting

8.6 Paints & adhesive

8.7 Precipitated Silica

8.8 Pulp & Paper

8.9 Water Treatment

8.10 Y-O-Y Growth trend Analysis By Application

8.11 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Sodium Silicate Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 BY FORM

9.1.3 BY GRADE

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 BY FORM

9.2.3 BY GRADE

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 BY FORM

9.3.3 BY GRADE

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 BY FORM

9.4.3 BY GRADE

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 BY FORM

9.5.3 BY GRADE

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Sodium Silicate Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Coogee Chemicals Pty Ltd.

10.2 Evonik Industries AG

10.3 Welcome Chemicals

10.4 CIECH S.A.

10.5 C THAI Group

10.6 Occidental Petroleum Corporation

10.7 Hindcon Chemicals Ltd.

10.8 Malpro Silica Private Limited

10.9 Silmaco NV

10.10 Oriental Silicas Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sodium Silicate Market was valued at USD 7.8 billion in 2024 and is projected to reach a market size of USD 11.3 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.69%.

The global sodium silicate market is driven by rising demand in construction, detergents, water treatment, and eco-friendly industrial applications.

Based on form, the Global Sodium Silicate Market is segmented into liquid and solid sodium silicate.

Asia-Pacific is the most dominant region for the Global Sodium Silicate Market.

Coogee Chemicals Pty Ltd., Evonik Industries AG, Welcome Chemicals, CIECH S.A. are the leading players in the Global Sodium Silicate Market.