Sodium Cyanide Market Size (2025 – 2030)

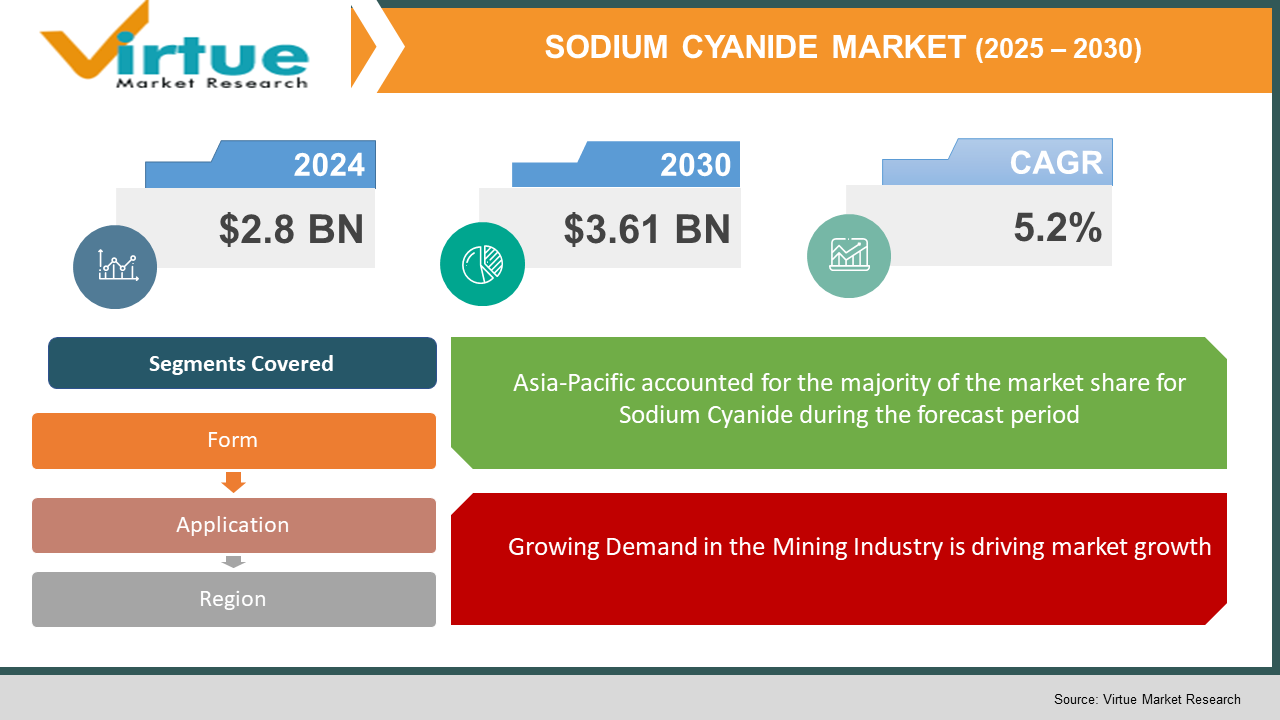

The Global Sodium Cyanide Market was valued at USD 2.8 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2030. The market is anticipated to reach USD 3.61 billion by 2030.

Sodium cyanide is primarily used in the mining industry for the extraction of gold and silver, as well as in various other chemical applications. The increasing demand for precious metals and the growing mining activities in developing regions are driving the market's expansion. Additionally, the compound is used in chemical synthesis, pharmaceuticals, and electroplating, further enhancing its market potential. As the mining industry grows and the need for efficient extraction methods increases, the Sodium Cyanide Market is expected to experience significant growth in the coming years.

Key Market Insights:

- The sodium cyanide market is largely driven by its use in the mining industry, particularly in gold and silver extraction processes. This application alone accounts for over 80% of the market share.

- The Asia-Pacific region dominates the global market, with China being the largest producer and consumer of sodium cyanide due to its vast mining sector.

- The market is witnessing a trend of growing demand for safer and more environmentally friendly sodium cyanide alternatives, driven by regulatory pressures and concerns about the toxicity of cyanide compounds.

- The global increase in precious metal prices, particularly gold and silver, has resulted in higher demand for sodium cyanide, as mining companies seek to capitalize on profitable mining opportunities.

- The pharmaceutical industry’s growing need for cyanide derivatives, used in the synthesis of chemicals, is contributing to the overall expansion of the sodium cyanide market.

- Stringent environmental regulations in regions like North America and Europe are prompting companies to innovate and develop safer cyanide alternatives and improved handling and disposal methods.

Global Sodium Cyanide Market Drivers:

Growing Demand in the Mining Industry is driving market growth:

The mining industry, particularly gold and silver mining, remains the primary driver of the sodium cyanide market. Sodium cyanide is used in cyanide leaching processes for the extraction of these precious metals from ores. As global demand for gold continues to rise due to its status as a safe-haven asset, mining companies are increasing their operations, driving up the need for sodium cyanide. Additionally, the growth in mining activities in emerging markets such as Asia-Pacific and Latin America is expanding the market for sodium cyanide. These regions are rich in mineral resources, which require sodium cyanide for efficient extraction. With increasing exploration in these regions and the surge in gold prices, the market demand for sodium cyanide is set to witness sustained growth.

Industrial and Chemical Applications is driving market growth:

Beyond mining, sodium cyanide is increasingly being utilized in various industrial applications, such as chemical synthesis and electroplating. In the chemical industry, sodium cyanide serves as an essential building block for the synthesis of organic compounds, such as pesticides, plastics, and pharmaceuticals. The rise in global demand for these chemical products, as well as increased industrial activities in developing nations, has contributed to the overall market expansion. Additionally, electroplating processes, which require sodium cyanide to create smooth metal finishes, are witnessing growth due to increased demand in electronics, automotive, and manufacturing sectors. This broad application of sodium cyanide in various industrial sectors is a key driver of the market.

Rising Precious Metal Prices is driving market growth:

Another significant driver of the sodium cyanide market is the increasing value of precious metals such as gold and silver. When the price of these metals rises, mining companies are incentivized to invest in new extraction technologies and expand their operations. This, in turn, leads to an increase in the consumption of sodium cyanide for the extraction of metals from ores. The volatility of precious metal prices, particularly during periods of economic uncertainty, further drives the demand for sodium cyanide, as companies seek to maximize the efficiency and profitability of their mining operations. As the demand for gold and silver remains strong, the sodium cyanide market will continue to benefit from this trend.

Global Sodium Cyanide Market Challenges and Restraints:

Environmental Concerns and Toxicity is restricting market growth:

One of the most significant challenges facing the sodium cyanide market is the environmental impact and toxicity associated with its use. Sodium cyanide is a hazardous substance that can pose risks to human health and the environment if not handled properly. Accidental spills and leaks can result in severe contamination of water sources, soil, and ecosystems, leading to costly remediation efforts and potential damage to a company’s reputation. Governments worldwide are enforcing stricter regulations concerning the safe storage, transportation, and disposal of cyanide. This has prompted mining companies to invest in safety measures, which can increase operational costs. Additionally, public opposition to the use of toxic substances in the mining process has led to growing calls for more sustainable and environmentally friendly alternatives to sodium cyanide.

Regulatory Pressure and Ban on Cyanide Use is restricting market growth:

The use of sodium cyanide in mining operations faces increasing scrutiny and regulation, particularly in regions like North America and Europe. Several countries have introduced or are considering legislation that limits or bans the use of cyanide in mining, which could significantly impact the sodium cyanide market. Although alternatives to sodium cyanide exist, such as thiosulfate and halide leaching processes, they are not as widely adopted due to higher costs and less proven effectiveness in large-scale gold extraction. Regulatory pressure has prompted the industry to invest in research and development to find less harmful alternatives, but until these alternatives become commercially viable, the market for sodium cyanide may face restrictions or slowdowns in certain regions.

Market Opportunities:

The sodium cyanide market presents several opportunities for growth, particularly in emerging economies with expanding mining sectors. As countries like China, India, and Brazil continue to develop their mining industries, the demand for sodium cyanide will rise in tandem. Additionally, the increasing trend of urbanization and industrialization in developing nations is driving demand for chemicals in sectors such as electronics, automotive, and pharmaceuticals, which rely on sodium cyanide. This opens up new avenues for the market beyond traditional mining applications.

Another significant opportunity lies in the development of safer and more environmentally friendly alternatives to sodium cyanide. As environmental concerns continue to gain traction globally, research into new, less toxic compounds and methods of metal extraction is a key area of focus. Companies investing in the development of eco-friendly sodium cyanide substitutes could position themselves as leaders in a market that is increasingly prioritizing sustainability.

The market also stands to benefit from the growth of the global gold market. As long as gold remains a valuable asset, mining operations will require sodium cyanide for efficient extraction. Furthermore, the rise in recycling and secondary mining activities presents another opportunity for sodium cyanide use, as these methods also require cyanide for the extraction of metals.

SODIUM CYANIDE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By form, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Orica, Evonik Industries, Chemours, and Lonza Group. |

Sodium Cyanide Market Segmentation:

Sodium Cyanide Market Segmentation By Form:

- Solid Sodium Cyanide

- Liquid Sodium Cyanide

The most dominant segment by form is solid sodium cyanide, primarily due to its cost-effectiveness and ease of transportation, especially for large-scale mining operations. Solid sodium cyanide also offers stability in storage and handling, making it the preferred choice for gold and silver mining companies. As the demand for gold extraction continues to rise, the solid sodium cyanide segment will maintain its dominant market position.

Sodium Cyanide Market Segmentation By Application:

- Gold Mining

- Silver Mining

- Chemical Synthesis

- Electroplating

- Others

The gold mining application is the most dominant segment in terms of demand, accounting for over 75% of the overall sodium cyanide consumption. Gold mining operations require large amounts of sodium cyanide to extract gold from ore via the cyanide leaching process. As global gold production increases, this segment will continue to be the major driver of the sodium cyanide market. The growing profitability of gold mining in emerging economies further reinforces the importance of this segment in the market.

Sodium Cyanide Market Regional Segmentation:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

The Asia-Pacific region is the dominant market for sodium cyanide, driven by the extensive mining activities in countries like China, India, and Australia. This region is a major consumer and producer of sodium cyanide, particularly for gold and silver mining. The increasing number of mining projects, along with the region's strong infrastructure and investment in the mining sector, contributes to its market dominance. Additionally, the rapid industrialization and urbanization in countries like India and China are pushing demand for sodium cyanide beyond mining, in industries such as chemicals and electronics, further solidifying Asia-Pacific’s position as the largest market.

COVID-19 Impact Analysis on the Sodium Cyanide Market:

The COVID-19 pandemic significantly impacted the sodium cyanide market in 2020. With restrictions on global trade and disruptions to supply chains, the production and distribution of sodium cyanide were hindered, leading to shortages in certain regions. Mining operations were temporarily halted, especially in countries like South Africa and parts of South America, reducing the immediate demand for sodium cyanide. However, the market has shown signs of recovery in the subsequent years, with mining activities resuming as economies reopened. The pandemic highlighted the importance of global supply chain resilience and the need for more sustainable and local production of critical chemicals like sodium cyanide. As the market stabilizes, the demand for sodium cyanide is expected to grow again, particularly in emerging markets where mining activities are expanding rapidly.

Latest Trends/Developments:

The sodium cyanide market is seeing a growing trend towards environmental sustainability and safer extraction methods. Increasing regulatory pressure and consumer demand for eco-friendly solutions have led to the development of more sustainable cyanide alternatives. Companies are investing in research to create less toxic leaching agents that offer similar extraction efficiency without the negative environmental impact. Additionally, the rise of the circular economy is influencing the market, with more focus being placed on recycling and reusing materials from mining operations. The ongoing development of technologies that reduce the overall environmental footprint of mining activities will likely shape the future of the sodium cyanide market.

Key Players:

- Orica

- Evonik Industries

- Chemours

- Lonza Group

- Ascot Industrial Ltd

- Cyanco

- Anglo Pacific Group

- Sasol Limited

- Nouryon

- The Dow Chemical Company

Chapter 1. SODIUM CYANIDE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SODIUM CYANIDE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SODIUM CYANIDE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SODIUM CYANIDE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SODIUM CYANIDE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SODIUM CYANIDE MARKET – By Form

6.1 Introduction/Key Findings

6.2 Solid Sodium Cyanide

6.3 Liquid Sodium Cyanide

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form , 2025-2030

Chapter 7. SODIUM CYANIDE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Gold Mining

7.3 Silver Mining

7.4 Chemical Synthesis

7.5 Electroplating

7.6 Others Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. SODIUM CYANIDE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Form

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Form

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Form

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Form

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Form

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SODIUM CYANIDE MARKET – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

9.1 Orica

9.2 Evonik Industries

9.3 Chemours

9.4 Lonza Group

9.5 Ascot Industrial Ltd

9.6 Cyanco

9.7 Anglo Pacific Group

9.8 Sasol Limited

9.9 Nouryon

9.10 The Dow Chemical Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sodium Cyanide Market was valued at USD 2.8 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2030. The market is anticipated to reach USD 3.61 billion by 2030.

The primary drivers include growing demand in the mining industry, industrial applications, and rising precious metal prices.

The market is segmented by form (solid and liquid) and by application (gold mining, silver mining, chemical synthesis, electroplating).

The Asia-Pacific region dominates the market due to its strong mining sector and growing industrial demand.

Key players include Orica, Evonik Industries, Chemours, and Lonza Group.