SME Insurance Market Size (2024 – 2030)

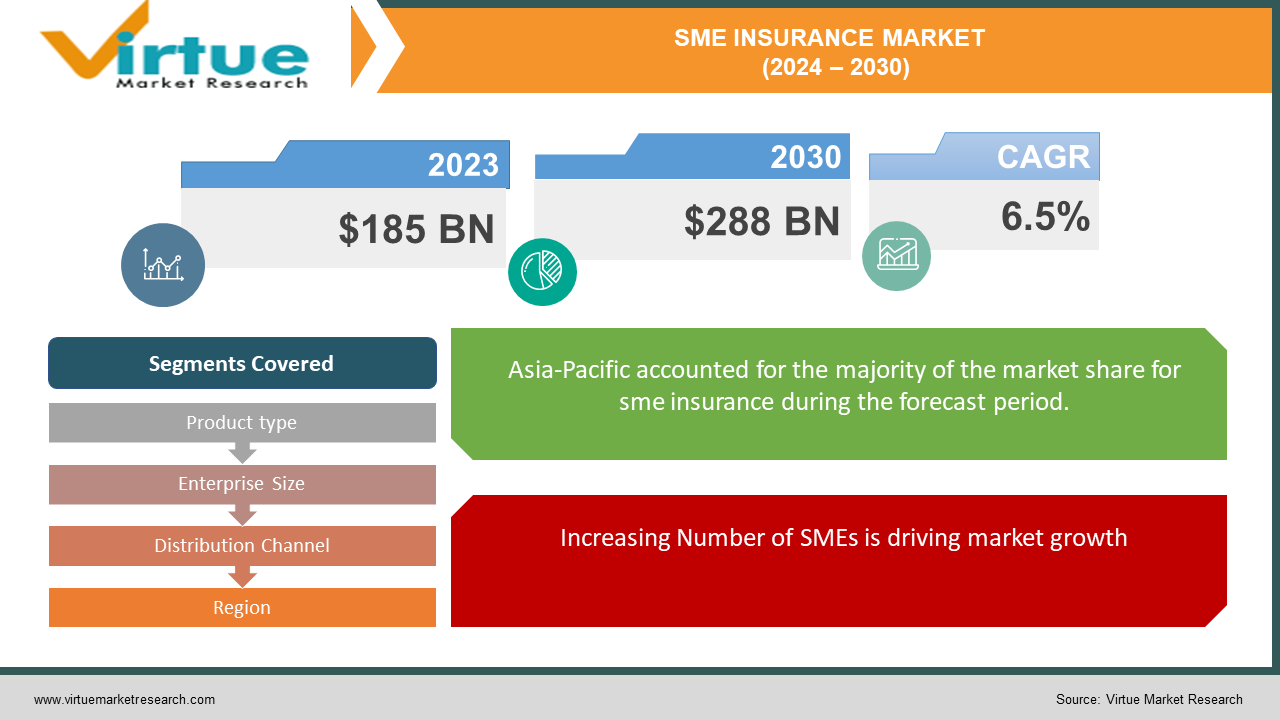

The Global SME Insurance Market was valued at USD 185 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The market is expected to reach USD 288 billion by 2030.

The SME insurance market caters to the specific needs of small and medium-sized businesses. It offers financial protection against various risks these businesses face, from property damage and business interruptions to cyber threats and lawsuits. With growing awareness of these risks, the SME insurance market is expanding as businesses seek to safeguard their operations and financial stability.

Key Market Insights:

Small enterprises dominate the enterprise size segment due to their large number and increasing need for risk management.

Asia-Pacific is the largest market, driven by a well-established insurance sector and high awareness among SMEs.

The increasing number of small and medium-sized enterprises (SMEs), rising awareness about the benefits of insurance, and the growing adoption of digital insurance platforms are driving the market growth.

Offering customized insurance packages and leveraging technology to assess and mitigate risks can also help lower premiums and make insurance more accessible to SMEs.

Global SME Insurance Market Drivers:

Increasing Number of SMEs is driving market growth

The global economy is witnessing a surge in the number of small and medium-sized enterprises (SMEs), which are playing a crucial role in economic development and job creation. According to the World Bank, SMEs represent about 90% of businesses and more than 50% of employment worldwide. This growth in the SME sector is a significant driver for the SME insurance market. As SMEs expand and become more integral to the economy, their need for comprehensive insurance solutions to mitigate various business risks increases. Insurance provides SMEs with financial protection against potential losses arising from unforeseen events such as property damage, legal liabilities, and employee injuries. Moreover, governments and financial institutions are increasingly recognizing the importance of SMEs and are offering various support programs, including access to finance and insurance products. For instance, the Small Business Administration (SBA) in the United States provides resources and support to help SMEs obtain the necessary insurance coverage. The growing number of SMEs, coupled with supportive government initiatives, is expected to drive the demand for SME insurance products in the coming years.

Rising Awareness About the Benefits of Insurance is driving the market growth

Awareness about the benefits of insurance among SMEs is on the rise, contributing significantly to the growth of the SME insurance market. Many SMEs are beginning to understand that insurance is not just a regulatory requirement but also a strategic tool for business continuity and risk management. Insurance helps SMEs mitigate financial risks associated with unexpected events, such as natural disasters, accidents, and lawsuits, which can otherwise lead to significant financial strain or even business closure. Additionally, insurance coverage can enhance an SME's credibility and trustworthiness among clients, investors, and partners. For instance, having liability insurance can assure clients that the business is prepared to handle any potential legal issues, thereby fostering trust and long-term relationships. Insurance companies and industry associations are also actively conducting awareness campaigns and educational programs to highlight the importance of insurance for SMEs. These efforts are making SMEs more informed about the types of insurance available, their benefits, and how to choose the right coverage for their specific needs. As awareness continues to grow, more SMEs are likely to invest in comprehensive insurance policies, driving market growth.

Growing Adoption of Digital Insurance Platforms is driving the market growth

The digital transformation of the insurance industry is a major driver for the SME insurance market. The adoption of digital insurance platforms is revolutionizing how insurance products are offered, purchased, and managed. Digital platforms provide SMEs with easy access to a wide range of insurance products, enabling them to compare different options, get quotes, and purchase policies online. This convenience and accessibility are particularly appealing to SMEs, who often have limited time and resources to spend on insurance procurement. Additionally, digital platforms leverage advanced technologies such as artificial intelligence (AI) and big data analytics to offer personalized insurance solutions tailored to the specific needs of SMEs. For example, AI-powered chatbots can assist SMEs in understanding their insurance requirements and guide them through the policy selection process. Furthermore, digital platforms offer seamless policy management, allowing SMEs to easily renew, modify, or claim their policies online. The increasing penetration of smartphones and internet connectivity is further fueling the adoption of digital insurance platforms. As more SMEs embrace digital tools for their business operations, the demand for digital insurance solutions is expected to rise, driving the growth of the SME insurance market.

Global SME Insurance Market Challenges and Restraints:

Complex Regulatory Environment is restricting the market growth

The SME insurance market is highly regulated, with different countries having specific regulatory frameworks governing the insurance industry. Compliance with these regulations can be complex and challenging for both insurers and SMEs. For instance, insurance companies must adhere to stringent capital requirements, solvency margins, and reporting standards, which can increase operational costs and affect profitability. SMEs, on the other hand, may find it difficult to navigate the regulatory landscape and understand the various compliance requirements for obtaining insurance coverage. The regulatory environment can also vary significantly across regions, adding to the complexity for multinational SMEs operating in multiple countries. Additionally, frequent changes in regulations and the introduction of new compliance requirements can create uncertainty and disrupt business operations. Non-compliance with regulatory standards can lead to penalties, legal actions, and reputational damage for both insurers and SMEs. To address these challenges, insurance companies need to invest in robust compliance management systems and provide clear guidance to SMEs on regulatory requirements. Simplifying the regulatory process and ensuring transparency in insurance policies can help mitigate the impact of regulatory complexities on the SME insurance market.

High Cost of Premiums is restricting the market growth

The cost of insurance premiums can be a significant barrier for SMEs, particularly for those with limited financial resources. High insurance premiums can deter SMEs from purchasing comprehensive coverage, leaving them vulnerable to potential risks. The cost of premiums is influenced by various factors, including the type of coverage, the size of the business, the industry sector, and the perceived risk level. For example, businesses in high-risk industries such as construction or manufacturing may face higher premiums due to the increased likelihood of accidents or property damage. Additionally, SMEs with a history of claims or poor risk management practices may be subject to higher premiums. The economic impact of the COVID-19 pandemic has also exacerbated the financial challenges faced by SMEs, making it even more difficult for them to afford insurance. To address this issue, insurers are exploring innovative pricing models and flexible payment options to make insurance more affordable for SMEs. For instance, usage-based insurance and pay-as-you-go models can help reduce premium costs by aligning payments with the actual usage or risk exposure of the business.

Market Opportunities:

The SME insurance market presents several significant opportunities for growth and expansion. One of the key opportunities lies in the increasing demand for customized and flexible insurance solutions tailored to the specific needs of SMEs. Traditional one-size-fits-all insurance policies may not adequately address the unique risks and requirements of different SMEs. As a result, there is a growing demand for personalized insurance products that offer coverage tailored to the size, industry, and risk profile of individual businesses. Insurers can capitalize on this opportunity by developing modular insurance products that allow SMEs to choose and combine different coverage options based on their specific needs. For example, an SME in the technology sector may require cyber insurance in addition to general liability and property coverage. Additionally, the rise of digital platforms and InsurTech innovations offers opportunities for insurers to enhance their service offerings and improve customer engagement. Leveraging technologies such as artificial intelligence (AI), big data analytics, and blockchain can enable insurers to provide more accurate risk assessments, streamline underwriting processes, and offer seamless claims management. Furthermore, partnerships and collaborations with industry associations, government agencies, and financial institutions can help insurers reach a broader customer base and provide comprehensive risk management solutions to SMEs. The expanding SME sector, coupled with the increasing awareness of the importance of insurance and the advancements in digital technology, creates a favorable environment for the growth of the SME insurance market.

SME INSURANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product type, Enterprise Size, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Allianz SE, AXA Group, Zurich Insurance Group, Aviva plc, American International Group, Inc. (AIG), The Hartford Financial Services Group, Inc., Chubb Limited, Hiscox Ltd, Liberty Mutual Insurance, Berkshire Hathaway Inc. |

SME Insurance Market Segmentation - by Product Type

-

Property and Casualty Insurance

-

Liability Insurance

-

Workers' Compensation Insurance

-

Business Interruption Insurance

-

Others

Property and casualty (P&C) coverage reigns supreme. This broad category protects businesses from physical losses or damage to their property and equipment (property insurance) and financial responsibility for injuries or accidents caused to others (casualty insurance). While liability, workers' compensation, and business interruption insurance are crucial for specific risks, P&C insurance provides a foundational layer of security for most SMEs.

SME Insurance Market Segmentation - by Enterprise Size

-

Small Enterprises

-

Medium Enterprises

The dominant segment leans towards small enterprises. This is because there are simply more small businesses compared to medium-sized ones. Additionally, smaller businesses might be more vulnerable to financial setbacks from unexpected events. They may have fewer resources to manage risks internally, making insurance even more crucial for their survival. However, medium enterprises often handle larger operations and face potentially higher costs associated with incidents. As a result, their insurance needs can be more complex, requiring a wider range of coverage options.

SME Insurance Market Segmentation - by Distribution Channel

-

Direct Sales

-

Brokers and Agents

-

Bancassurance

-

Online Channels

-

Others

Brokers and agents have been the dominant force in SME insurance distribution. They act as trusted advisors, helping businesses navigate the complexities of insurance options and tailoring coverage to their specific needs. However, direct sales channels are gaining traction, particularly for simpler SME insurance products. These channels allow businesses to obtain quotes and purchase coverage online or through phone calls, offering a faster and potentially more cost-effective approach. Bancassurance, where insurance is sold through banks, is another growing channel, leveraging existing customer relationships. Online aggregators and price comparison websites are emerging players, offering convenience and transparency in comparing different insurance options. The future of SME insurance distribution likely involves a blend of these channels, with businesses choosing the approach that best suits their needs and preferences.

SME Insurance Market Segmentation - by Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is currently the frontrunner in the SME insurance market. This dominance is driven by several factors. Firstly, the region boasts a booming population with rising birth rates, leading to a surge in new businesses. Secondly, growing economies in this region translate to more disposable income for business owners, who are increasingly recognizing the value of SME insurance. Finally, there's a heightened awareness of the risks inherent in running a business, prompting companies to seek financial protection. While North America and Europe have well-established SME insurance markets, Asia-Pacific offers the most exciting potential for future growth.

COVID-19 Impact Analysis on the SME Insurance Market:

The COVID-19 pandemic has had a profound impact on the SME insurance market. The pandemic led to widespread economic disruption, affecting the operations and financial stability of many SMEs. As a result, there was an increased awareness of the importance of insurance coverage to mitigate the risks associated with such unprecedented events. The pandemic highlighted the need for business interruption insurance, which became a critical component for many SMEs facing temporary closures or reduced operations. Additionally, the pandemic accelerated the adoption of digital insurance platforms, as face-to-face interactions were limited due to social distancing measures. Insurers leveraged technology to offer remote consultations, digital policy management, and online claims processing, providing SMEs with continued access to insurance services. However, the economic downturn also led to financial constraints for many SMEs, making it challenging for them to afford insurance premiums. Insurers responded by introducing flexible payment options and premium relief measures to support their SME clients during the crisis. The pandemic underscored the resilience and adaptability of the insurance industry in meeting the evolving needs of SMEs. As the global economy recovers, the SME insurance market is expected to stabilize and continue its growth trajectory, driven by the ongoing need for comprehensive risk management solutions and the lessons learned from the pandemic.

Latest Trends/Developments:

The SME insurance market is witnessing several notable trends and developments. One significant trend is the increasing demand for digital insurance solutions. SMEs are increasingly adopting digital platforms for purchasing and managing their insurance policies, driven by the convenience, accessibility, and cost-effectiveness of online channels. Insurers are investing in digital transformation to enhance their service offerings, streamline processes, and improve customer engagement. Another key trend is the focus on personalized and modular insurance products. SMEs have diverse needs based on their industry, size, and risk profile, and they are seeking insurance solutions that can be tailored to their specific requirements. Insurers are responding by developing flexible and customizable insurance packages that allow SMEs to select and combine different coverage options. Additionally, the integration of advanced technologies such as artificial intelligence (AI) and big data analytics is transforming the SME insurance landscape. These technologies enable insurers to perform more accurate risk assessments, automate underwriting processes, and offer proactive risk management solutions. The rise of InsurTech startups is also driving innovation in the SME insurance market, with new entrants offering innovative products and services that cater to the evolving needs of SMEs. Furthermore, there is a growing emphasis on sustainability and environmental, social, and governance (ESG) factors in the insurance industry. Insurers are increasingly considering ESG criteria in their underwriting processes and developing sustainable insurance products that align with the values of socially responsible SMEs. These trends, driven by technological advancements, changing consumer preferences, and the evolving regulatory environment, are shaping the future of the SME insurance market.

Key Players:

-

Allianz SE

-

AXA Group

-

Zurich Insurance Group

-

Aviva plc

-

American International Group, Inc. (AIG)

-

The Hartford Financial Services Group, Inc.

-

Chubb Limited

-

Hiscox Ltd

-

Liberty Mutual Insurance

-

Berkshire Hathaway Inc.

Chapter 1. SME Insurance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SME Insurance Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SME Insurance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SME Insurance Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SME Insurance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SME Insurance Market – By Product Type

6.1 Introduction/Key Findings

6.2 Property and Casualty Insurance

6.3 Liability Insurance

6.4 Workers' Compensation Insurance

6.5 Business Interruption Insurance

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. SME Insurance Market – By Enterprise Size

7.1 Introduction/Key Findings

7.2 Small Enterprises

7.3 Medium Enterprises

7.4 Y-O-Y Growth trend Analysis By Enterprise Size

7.5 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 8. SME Insurance Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Brokers and Agents

8.4 Bancassurance

8.5 Online Channels

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. SME Insurance Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Enterprise Size

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Enterprise Size

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Enterprise Size

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Enterprise Size

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Enterprise Size

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. SME Insurance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Allianz SE

10.2 AXA Group

10.3 Zurich Insurance Group

10.4 Aviva plc

10.5 American International Group, Inc. (AIG)

10.6 The Hartford Financial Services Group, Inc.

10.7 Chubb Limited

10.8 Hiscox Ltd

10.9 Liberty Mutual Insurance

10.10 Berkshire Hathaway Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global SME Insurance Market was valued at USD 185 billion in 2023 and is expected to reach USD 288 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030.

The market is driven by the increasing number of SMEs, rising awareness about the benefits of insurance, and the growing adoption of digital insurance platforms.

The market is segmented by product type into property and casualty insurance, liability insurance, workers' compensation insurance, and others. It is also segmented by enterprise size into small enterprises and medium enterprises, and by distribution channel into direct sales, brokers and agents, bancassurance, online channels, and others.

Asia-Pacific is the most dominant region due to its well-established insurance sector, high awareness among SMEs, and the presence of leading insurance providers.

Leading players in the market include Allianz SE, AXA Group, Zurich Insurance Group, Aviva plc, American International Group, Inc. (AIG), The Hartford Financial Services Group, Inc., Chubb Limited, Hiscox Ltd, Liberty Mutual Insurance, and Berkshire Hathaway Inc.