Smart Water Assistant/Water Usage System Market Size (2024-2030)

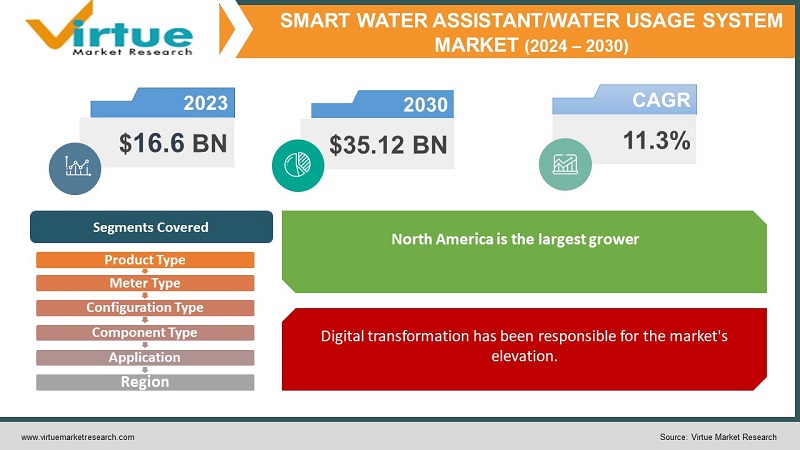

The Smart Water Assistant/Water Usage System Market was valued at USD 16.6 billion in 2023 and is projected to reach a market size of USD 35.12 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.3%.

A smart water meter is a technological advance over traditional water meters. It also automatically measures water consumption and transmits the data to a central system, often using wireless technology. This enables accurate and timely billing and eliminates the need for manual meter reading. One of the benefits of smart water meters is that they allow consumers to monitor their own water consumption through apps or online platforms. This promotes water conservation and helps to detect leaks or defects in a faster way than conventional meters. Utility companies also benefit from effective data collection because it improves resource management and strategic planning. In addition, smart water meters contribute to conservation efforts by reducing the need for physical equipment and labor to collect readings.

Key Market Insights:

The market for water quality assistants and water-use systems continues to grow, due to a combination of factors: increasing concern for water scarcity, increasing losses due to irrigation, water and building systems grow. Companies are looking for solutions for efficient distribution and outage detection, while consumers are looking for water conservation information and automated management. Advanced metering equipment (AMI) with smart meters and real-time data analysis is essential, enabling energy costs, leaks alerts and tailored recommendations to save water. Residential applications dominate, but the commercial and industrial sectors are holding back. A concerted effort towards water conservation and smart city planning is driving growth. Although fragmented, the market has technology giants like Honeywell and emerging players focusing on AI and data-driven solutions. Expect intense competition and new applications as this market shapes the future of water management.

Smart Water Assistant/Water Usage System Market Drivers:

Policy support and government initiatives driving market growth.

Another important driver is the growing support from regulators and government initiatives. Many countries are establishing strict standards on water conservation and encouraging the adoption of technologies that contribute to efficient resource management. Along with this, government grants, subsidies and awareness programs are helping utility companies and consumers to upgrade to smart water meters. These policies simplify the initial installation and provide incentives for long-term use. Legislative efforts often come at a later stage to phase out traditional metering systems, making way for smart water meters. This situation fosters an environment where the adoption of smart water technology is not only an option but a requirement, boosting the market significantly.

Technological Advancements & Integration Capabilities are fueling market expansion.

Technological advancement is another important factor driving the growth of the smart water meter market. Continuous advances in sensor technology, data analysis and wireless communication have made these meters reliable, accurate and user friendly. In addition, smart water meters can be easily integrated into existing utility management systems, allowing a seamless transition from traditional water meters to smart meters. This agreement makes it easier for utility companies to access this technology without having to modify their existing infrastructure. At the same time, modern smart water meters are becoming more affordable, thanks to technological progress, which makes them accessible to many consumers and service providers. All these factors contribute to the rapid adoption of smart water meters in the market.

Conservation & Environment Sustainability augmenting the global market growth.

As awareness of climate change and conservation of natural resources increases, more emphasis is placed on sustainable practices in all areas, including water management. Smart water plays an important role in this by supporting real-time monitoring, which allows consumers and users to identify unnecessary behavior and take corrective action. The collected data makes it possible to quickly find, thus avoiding useless water. Utility companies can use the information obtained to make rational decisions about resource allocation, thus contributing to environmental sustainability. Additionally, integrating smart water meters into broader sustainability initiatives can reduce a city's water footprint, making it an attractive option for those interested in environmental impact.

Smart Water Assistant/Water Usage System Market Restraints and Challenges:

The water industry is a government controlled and highly regulated technology center. Good things are done little by little. Installing a smart water meter requires a lot of money investment. There is no government subsidy approved for the installation of smart water meters.

The smart water assistant/water usage system market, despite its promise, faces challenges. The high cost of smart meters and system installation remains a barrier, especially for developing regions and low-income consumers. Data privacy concerns are important, as the collection and analysis of water consumption data raises concerns about misuse. Cybersecurity threats are on the rise, requiring robust data protection systems to prevent hacking and leakage. In addition, resistance to change in traditional water companies and the lack of qualified personnel to manage these systems may limit their adoption. These challenges require new solutions, such as flexible currency options, strong data encryption systems and user-friendly interfaces, to ensure that this promising technology reaches its full potential and making progress in global water management.

Smart Water Assistant/Water Usage System Market Opportunities:

The market for water quality assistants and water use systems is very thirsty and full of opportunities. Growing water scarcity, shrinking infrastructure and tech-savvy consumers are creating a perfect storm for growth. The government that is hungry for good management and security is joining the party, providing support and promoting a beautiful city plan. This global food is not just for tech giants: AI-powered start-ups can carve out a niche for themselves through innovative, customized water research and water-saving solutions. Expect AI and data analytics to drive new efficiencies, from automated leak detection to powerful pricing models. Sustainability is key, water helpers become eco-warriors at home and beyond. So, whether you're a technical chef or a novice water developer, pick up your pitchfork - the market for water-friendly helpers and water-use systems offers you a bright future.

SMART WATER ASSISTANT/WATER USAGE SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.3% |

|

Segments Covered |

By Product Type, Meter Type, Configuration Type, Component Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Badger Meter, Kamstrup A/S, Diehl Stiftung & Co. KG, Landis+Gyr, Aclara Technologies LLC (Hubbell Incorporated), Sensus Worldwide Holdings Limited (Xylem Inc.), Itron Inc., Zenner International GmbH & Co. KG, Neptune Technology Group (Roper Technologies) |

Smart Water Assistant/Water Usage System Market Segmentation:

Smart Water Assistant/Water Usage System Market Segmentation: By Product Type

- Electromagnetic Meter

- Ultrasonic Meter

- Electromechanical Meter

- Others

In 2023, Ultrasonic meters rule the leading segment of smart water helps, control water use and pinpoint precision. Unlike their workers, these advanced maestros use the sound of waves to make the water flow and waltz, even with small streams or pipes. Their accuracy saves every fall is precious, making them lovers of water-stressed areas and beautiful city plans. Consumers of technology love personalized water conservation advice at the smallest level, while their durability and reduced maintenance requirements appeal to markets around the world. By raising the price, stimulating AI innovation and expanding the market, ultrasonic meters are charting a future where water use is a well-rounded activity.

Electromechanical meter is the fastest growing segment. The electromechanical section in the company of intelligent meters often enjoy the value of his value and self-confidence. While the digital full meter obtains an important, electromechanically meter continues to be viable, optimistic for traditional changes in intelligence systems. These meters provide a combination of mechanical components for speed measurement and electronic components for accurate data and remote communication. Their ability to work well in different environmental conditions, including potentially volatile areas, makes them different. In addition, they are also valued for their durability and low maintenance, making them a good choice for utility companies. As emerging markets begin to realize the benefits of modern water management, the robustness and effectiveness of electromechanical meters position them as an attractive option, thus raising their demand in the smart water monitoring sector.

Smart Water Assistant/Water Usage System Market Segmentation: By Meter Type

- Smart Hot-Water Meter

- Smart Cold-Water Meter

In 2023, Smart Cold-Water Meter dominated the market. The introduction of smart cold water meters represents a significant advance in the water/water utility market. These meters use cutting-edge technology to provide real-time information on cooling water consumption, improving the efficiency and accuracy of water management. Equipped with IoT connectivity and data analysis features, smart water meters allow users to monitor usage patterns, detect leaks quickly and optimize water consumption. This innovative response is growing for complete water management solutions, especially in residential and commercial areas. By providing users with accurate and timely information, these meters play an important role in promoting water conservation practices and supporting sustainability goals. As the market continues to grow, smart water meters are emerging as a key part of the revolution for efficient and effective water use.

Smart water heaters are emerging as an important part of the broader market of water quality enablers and water use systems. This unique metering technology focuses on monitoring and managing hot water consumption, for residential and commercial applications. Combining advanced sensors and connectivity features, these meters provide real-time data on hot water consumption patterns, allowing users to improve energy efficiency and reduce operating costs. With an increasing focus on sustainability and energy conservation, hot water heaters are fitting into the larger market of water quality management. Its ability to provide accurate information on hot water consumption improves the overall planning process, helping to improve the environmental and economic conditions for the use of water in the situation separately. As water quality solutions continue to evolve, smart water heaters are emerging as a key innovation in improving resource use.

Smart Water Assistant/Water Usage System Market Segmentation: By Configuration Type

- Automated Meter Reading (AMR)

- Advanced Metering Infrastructure (AMI)

In 2023, Automated Meter Reading (AMR) dominated the market. Automated meter reading (AMR) is one of the most popular technologies in the smart water meter industry, mainly due to its efficiency in data collection. AMR allows utilities to collect usage data remotely, eliminating the need for manual meter reading and reducing costs and the risk of human error. Efficiency results in faster billing processes and more accurate pricing, improving customer satisfaction. In addition, AMR systems are easier and cheaper to install than advanced systems, such as Advanced Metering Infrastructure (AMI), making them a popular choice for utilities taking their first steps in smart metering. The technology also supports the ability to monitor and detect leaks, providing companies with an easy way to manage water and reduce water costs. These advantages make the AMR configuration an attractive choice for many service providers, driving and marketing growth.

Advanced Metering Infrastructure (AMI) leads to data, leading to better compliance and water management. Imagine applying water usage privacy directly to the equipment, revealing its leaks with its intelligent sensors, and even changing the meter control like a digital puppet. Unlike it lack luster predecessor, AMI brings two-way communication to life, enabling cost efficiency, targeted security and resource optimization. This alarming sound reverberates around the world: water districts are paying all the bills, cities are trying to get the best water, and technology buyers are becoming home drivers. , directed by AMI for water. As the praise for AMI rises, one thing is clear: the sound of the data that supports it documents the future where the use of water is a beautiful painting directed by the maestro himself - even.

Smart Water Assistant/Water Usage System Market Segmentation: By Component Type

- Meters & Accessories

- IT Solutions

- Communication System

In 2023, Meters & Accessories dominated the market. Behind the scenes of intelligent water helpers, meters and instruments play a very important role, as the unsung heroes of the water conservation music. These intelligent devices, from meters that turn to hidden sensors, detect the water, analyse every failure and tell their secrets to an intelligent assistant. Think of it like this: those sneaky traps under the sink? The meter detects them, saving you money and water like magic. They reveal your water usage habits and even tell you whether you are a fan of long showers or a champion of quick showers. What if you forget to turn off the faucet? An intelligent assistant, with meter information, will help you to stop water from flowing unnecessarily. This water sport is played in different cities and countries. In thirsty areas, every drop is metered to help ensure that none is wasted. Smart cities use their data to fix leaking pipes, build better systems, and even pay citizens for tears. And in your own home, you will be the guide, using the advice of a smart assistant to control your water consumption, playing a game where every saved stop is a victory.

In the Smart Water and Water Management Systems market, new IT solutions are playing a key role in changing water management practices. These solutions use advanced technologies such as IoT, data analysis and machine learning to provide real-time monitoring and optimization of water consumption. From residential to industrial applications, intelligent water assistants provide intelligent insights into usage patterns, helping consumers make better conservation decisions. In addition, these IT solutions improve efficiency by identifying leaks, reducing waste, and optimizing distribution networks. By focusing on sustainability, the integration of IT and water management not only ensures the protection of resources, but also contributes to a more sustainable society and the environment. As the demand for water conservation solutions increases, IT continues to be the force that creates the future of the water supply/water market.

Smart Water Assistant/Water Usage System Market Segmentation: By Application

- Water Utilities

- Commercial & Industrial

- Residential

In 2023, Residential Sector dominated the market. The residential sector is at the forefront of technological innovation, and the smart water supply/water use market is no exception to this trend. As water conservation becomes an increasingly important concern, homeowners are turning to smart solutions to monitor and improve their water usage. The Smart Water Assistants market is witnessing significant growth in the residential sector, driven by growing awareness for sustainable living and the need to reduce water consumption. These systems provide homeowners with real-time information about the quality of the water they use, helping to make informed decisions and manage resources effectively. Incorporating advanced sensors and connectivity features, these smart solutions not only contribute to the environment and safety, but also provide homeowners with a direct way to reduce their water bills while promoting a more environmentally friendly environment.

The Commercial and Industrial sectors are pivotal drivers of growth in the Smart Water Assistant/Water Usage System Market, leveraging innovative solutions to address water management challenges. In commercial settings, businesses are increasingly adopting smart water systems to enhance operational efficiency, meet sustainability targets, and reduce costs associated with water consumption. These solutions provide real-time monitoring, leak detection, and data analytics to optimize water usage. In the industrial landscape, where water-intensive processes are prevalent, smart water assistants play a crucial role in ensuring responsible resource utilization, regulatory compliance, and risk mitigation. As industries worldwide prioritize environmental stewardship, the adoption of smart water technologies in the commercial and industrial sectors is poised to escalate, marking a transformative shift towards sustainable and intelligent water management practices.

Smart Water Assistant/Water Usage System Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The North American smart water meter market is expected to grow at a CAGR of 10.3% more during the forecast period. The North American region has become the dominant force in smart technology.

Water metering market, mainly due to many factors that contribute to its control. North America has a well-developed water infrastructure with an emphasis on advanced technology. Aging water infrastructure has forced utilities to invest in its smart metering solutions to improve efficiency, reduce water loss and improve global water management. This meticulous approach has made North America one of the first nations takes an intelligent water analysis method.

Asia-Pacific is the fastest growing segment. Asia Pacific is the fastest growing market for intelligent water resources and water management systems, driven by water scarcity, aging infrastructure, technology buyers and government initiatives. The region also influences the global market by attracting key players, providing cost-effective solutions and driving technological advancements.

COVID-19 Impact Analysis on the Smart Water Assistant/Water Usage System Market:

The COVID-19 pandemic affected the growth rate of the smart water meter market in 2020. Also, the market is estimated to witness slow growth till the end of 2021, due to the lack of regulations or government initiatives in many parts of the world. . The market has been mainly affected by the many obstacles created between the COVID-19 epidemic in the construction sector including the availability of equipment, professional services and safety procedures, materials to be delivered, contract work and delays and it is cancelled. Therefore, this has led to a decrease in the demand for smart water meters. However, the rise of digital infrastructure solutions in the economy is expected to boost the growth of the smart water meter market after a pandemic.

Latest Trends/ Developments:

The water auxiliaries/water management business has seen many significant trends and developments. One of the main things to do is to integrate advanced intelligence and machine learning algorithms into these systems, making more accurate predictions of water consumption patterns and quick detection of leaks. The rise of Internet of Things (IoT) technology has also played a major role, enabling seamless connectivity and real-time data monitoring through mobile applications and cloud platforms. In addition, emphasis is placed on the user-friendly interface and the integration of beautiful buildings, making these processes easier for consumers. In addition, increased awareness of water scarcity and sustainability is driving the market, with residential and commercial sectors looking for new ways to manage water needs.

Key Players:

- Badger Meter

- Kamstrup A/S

- Diehl Stiftung & Co. KG

- Landis+Gyr

- Aclara Technologies LLC (Hubbell Incorporated)

- Sensus Worldwide Holdings Limited (Xylem Inc.)

- Itron Inc.

- Zenner International GmbH & Co. KG

- Neptune Technology Group (Roper Technologies)

- In May 2023, Badger Meter expanded its range of smart water solutions and expanded beyond meters by adding ATI and Syrinix to its product line.

- In April 2023, Landis+Gyr signed an agreement with EPCOR Water to provide AMI technology and integrated services for the City of Edmonton's water meters.

Chapter 1. Global Smart Water Assistant/Water Usage System Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Smart Water Assistant/Water Usage System Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Smart Water Assistant/Water Usage System Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Smart Water Assistant/Water Usage System Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Smart Water Assistant/Water Usage System Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Smart Water Assistant/Water Usage System Market– By Product Type

6.1. Introduction/Key Findings

6.2. Meter Type

6.3. Ultrasonic Meter

6.4. Electromechanical Meter

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Global Smart Water Assistant/Water Usage System Market– By Source Temperature

7.1. Introduction/Key Findings

7.2. Smart Hot-Water Meter

7.3. Smart Cold-Water Meter

7.4. Y-O-Y Growth trend Analysis By Source Temperature

7.5. Absolute $ Opportunity Analysis By Source Temperature , 2024-2030

Chapter 8. Global Smart Water Assistant/Water Usage System Market– By Application

8.1. Introduction/Key Findings

8.2. Water Utilities

8.3. Commercial & Industrial

8.4. Residential

8.5. Y-O-Y Growth trend Analysis Application

8.6. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. Global Smart Water Assistant/Water Usage System Market– By Configuration Type

9.1. Introduction/Key Findings

9.2. Automated Meter Reading (AMR)

9.3. Advanced Metering Infrastructure (AMI)

9.4. Y-O-Y Growth trend Analysis Configuration Type

9.5. Absolute $ Opportunity Analysis Configuration Type , 2023-2030

Chapter 10. Global Smart Water Assistant/Water Usage System Market– By Component Type

10.1. Introduction/Key Findings

10.2. Meters & Accessories

10.3. IT Solutions

10.4. Communication System

10.5. Y-O-Y Growth trend Analysis Component Type

10.6 . Absolute $ Opportunity Analysis Component Type , 2023-2030

Chapter 11. Global Smart Water Assistant/Water Usage System Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Product Type

11.1.3. By Source Temperature

11.1.4. By Configuration Type

11.1.5. Application

11.1.6. Component Type

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Product Type

11.2.3. By Source Temperature

11.2.4. By Configuration Type

11.2.5. Application

11.2.6. Component Type

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.2. By Country

11.3.2.2. China

11.3.2.2. Japan

11.3.2.3. South Korea

11.3.2.4. India

11.3.2.5. Australia & New Zealand

11.3.2.6. Rest of Asia-Pacific

11.3.2. By Product Type

11.3.3. By Source Temperature

11.3.4. By Configuration Type

11.3.5. Application

11.3.6. Component Type

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.3. By Country

11.4.3.3. Brazil

11.4.3.2. Argentina

11.4.3.3. Colombia

11.4.3.4. Chile

11.4.3.5. Rest of South America

11.4.2. By Product Type

11.4.3. By Source Temperature

11.4.4. By Configuration Type

11.4.5. Application

11.4.6. Component Type

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.4. By Country

11.5.4.4. United Arab Emirates (UAE)

11.5.4.2. Saudi Arabia

11.5.4.3. Qatar

11.5.4.4. Israel

11.5.4.5. South Africa

11.5.4.6. Nigeria

11.5.4.7. Kenya

11.5.4.11. Egypt

11.5.4.11. Rest of MEA

11.5.2. By Product Type

11.5.3. By Source Temperature

11.5.4. By Configuration Type

11.6.5. Application

11.5.6. Component Type

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Global Smart Water Assistant/Water Usage System Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Badger Meter

12.2. Kamstrup A/S

12.3. Diehl Stiftung & Co. KG

12.4. Landis+Gyr

12.5. Aclara Technologies LLC (Hubbell Incorporated)

12.6. Sensus Worldwide Holdings Limited (Xylem Inc.)

12.7. Itron Inc.

12.8. Zenner International GmbH & Co. KG

12.9. Neptune Technology Group (Roper Technologies)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Smart Water Assistant/Water Usage System Market was valued at USD 16.6 billion in 2023 and is projected to reach a market size of USD 35.12 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.3%.

Owing to rise in need for accuracy in water billing solution and rise in utilities focus toward reducing nonrevenue water drives the growth of the Smart Water Metering market.

Based on Application Type, the Smart Water Assistant/Water Usage System Market is segmented into Water Utilities, Commercial & Industrial and Residential

North America is the most dominant region for the Smart Water Assistant/Water Usage System Market.

Badger Meter, Kamstrup A/S, Diehl Stiftung & Co. KG, Landis+Gyr, Aclara, Technologies LLC (Hubbell Incorporated), Sensus Worldwide Holdings Limited (Xylem Inc.), Itron Inc., Zenner International GmbH & Co. KG, Neptune Technology Group (Roper Technologies) are the key players operating in the Smart Water Assistant/Water Usage System Market.