Smart Pressure Cooker Market Size (2024 – 2030)

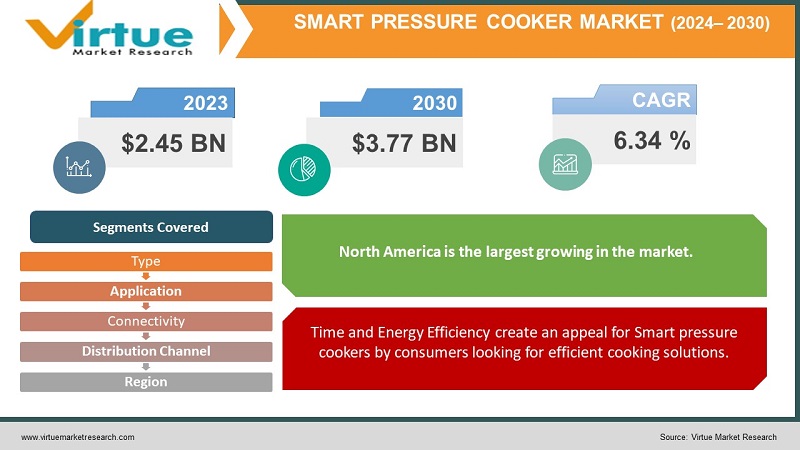

The Global Smart Pressure Cooker Market was valued at USD 2.45 billion in 2023 and is projected to reach a market size of USD 3.77 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 6.34%.

Smart pressure cookers have evolved as a transformative culinary solution, seamlessly blending convenience, safety, and cooking efficiency. Propelled by technological advancements, these cookers have witnessed a surge in popularity among consumers looking to streamline their cooking routines. The market's historical trajectory reflects a gradual shift towards modernization and automation in kitchens. Presently, smart pressure cookers have become integral appliances, simplifying cooking tasks. Looking ahead, the market is poised for further growth as innovation continues to enhance their capabilities, making them indispensable tools in future kitchens worldwide.

Key Market Insights:

One noteworthy trend is the dominance of electric smart pressure cookers, which currently account for the majority of the market share. These appliances offer users the convenience of modern technology, enabling them to prepare meals faster while retaining flavor and nutrients. Stovetop models also maintain a niche market among traditional cooking enthusiasts. Furthermore, connectivity plays a pivotal role, with Wi-Fi and Bluetooth options allowing users to monitor and control their cooking remotely via smartphone apps and voice assistants.

Regionally, North America has been leading the global smart pressure cooker market, with a revenue share of 34.5% in 2022. The region's high disposable income levels and tech-savvy consumer base have driven market growth. However, the Asia-Pacific region is emerging as a hotbed for future opportunities, experiencing the fastest CAGR of approximately 15.7% during the forecast period. This growth is attributed to the expanding middle-class population and the rising adoption of smart home appliances. Additionally, Europe is witnessing notable developments in terms of medical facilities and the organization of the healthcare system, further fueling the medical tourism market.

In summary, the global smart pressure cooker market is on a trajectory of robust growth, driven by consumer demand for efficiency and convenience in cooking. Electric models, connectivity options, and regional dynamics all contribute to the market's expansion, making it an exciting space for innovation and investment in the coming years.

Smart Pressure Cooker Market Drivers:

Time and Energy Efficiency create an appeal for Smart pressure cookers by consumers looking for efficient cooking solutions.

Smart pressure cookers offer an efficient solution to time-consuming cooking processes. They significantly reduce cooking time by utilizing high pressure and steam, making them highly attractive to busy individuals and families seeking to save time in the kitchen. Additionally, their energy-efficient design ensures that less electricity or gas is consumed during cooking, resulting in cost savings and reduced environmental impact. This aspect aligns with the growing demand for eco-friendly and time-saving kitchen appliances, driving the adoption of smart pressure cookers.

The ability to control cooking remotely adds a layer of convenience, attracting tech-savvy consumers and augmenting the demand in the market.

One of the key drivers of the smart pressure cooker market is the integration of remote control capabilities. With smartphone apps and voice assistants, users can initiate and monitor cooking from anywhere, providing an unprecedented level of convenience. This feature appeals particularly to tech-savvy consumers who value automation and connectivity in their homes. Whether adjusting cooking settings on the go or starting dinner preparations from the office, the ability to control cooking remotely enhances the overall cooking experience, making smart pressure cookers a sought-after kitchen appliance.

Smart pressure cookers' ability to retain nutrients in food aligns with the preferences of health-conscious individuals.

Health-conscious consumers prioritize nutrition in their meals. Smart pressure cookers excel in this aspect by preserving the natural flavors and nutrients in food. The sealed cooking environment prevents the escape of vitamins and minerals, ensuring that meals remain healthy and flavorful. As awareness of the importance of nutrition grows, the ability of smart pressure cookers to deliver both convenience and health benefits makes them a compelling choice for those who seek to maintain a balanced diet while accommodating a busy lifestyle.

Enhanced safety features reduce the risk of accidents and make smart pressure cookers a preferred choice for families.

Safety is paramount in the kitchen, especially for families with children. Smart pressure cookers come equipped with advanced safety mechanisms, such as automatic pressure release and temperature control. These features significantly reduce the risk of accidents, such as steam burns or over-pressurization, which are associated with traditional pressure cookers. Families can confidently use smart pressure cookers, knowing that these appliances prioritize safety. This safety-conscious design contributes to their growing popularity among households and positions them as a preferred choice for those who prioritize the well-being of their loved ones during meal preparation.

Smart Pressure Cooker Market Restraints and Challenges:

High Initial Cost than traditional models, limits adoption among price-sensitive consumers hampering the market penetration.

While smart pressure cookers offer a range of advanced features and benefits, their initial price point tends to be higher compared to traditional pressure cookers. This cost disparity can deter price-sensitive consumers from embracing the new technology. Although smart pressure cookers may provide long-term savings through energy efficiency and time savings, the upfront investment can be a barrier. Manufacturers and marketers in this space need to address this challenge by highlighting the long-term value and cost-efficiency of smart pressure cookers to encourage wider adoption.

Technical Issues can pose challenges for users, affecting the overall experience and impacting the demand drivers.

The integration of technology into appliances brings the potential for technical issues, including connectivity problems, software glitches, or app-related challenges. These issues can disrupt the user experience, leading to frustration among consumers. In some cases, users may encounter difficulties in setting up or syncing their smart pressure cookers with mobile apps or voice assistants. Ensuring seamless and user-friendly technology integration is crucial to prevent these challenges from dampening the demand for smart pressure cookers.

Intense competition among manufacturers may lead to pricing pressures and thinner profit margins.

The smart pressure cooker market is witnessing intense competition as multiple manufacturers vie for market share. In a bid to gain a competitive edge, manufacturers may engage in price wars or offer discounts, which can put pressure on pricing and result in thinner profit margins. While competition can benefit consumers through lower prices, it can pose challenges for manufacturers in terms of sustaining profitability. To navigate this challenge, manufacturers must focus on product differentiation, innovation, and creating unique value propositions that justify premium pricing, thereby mitigating the impact of pricing pressures.

Smart Pressure Cooker Market Opportunities:

Continued products can attract new customers and drive market expansion.

The smart pressure cooker market offers immense opportunities for manufacturers to innovate and enhance their products. Introducing new features, improving connectivity options, and refining user interfaces can not only retain existing customers but also attract new ones. Innovations such as advanced cooking presets, enhanced safety features and compatibility with emerging technologies like smart assistants can create a compelling value proposition. By staying at the forefront of technology and consumer preferences, manufacturers can unlock untapped market segments and drive sustained growth in the industry.

Penetration into emerging markets with rising disposable incomes presents significant growth prospects.

Emerging markets, characterized by increasing disposable incomes and changing lifestyles, offer a fertile ground for the expansion of the smart pressure cooker market. As more consumers in these regions seek convenient and time-saving cooking solutions, smart pressure cookers can fulfill their needs. By strategically targeting these markets and adapting products to local preferences and price points, manufacturers can tap into a vast and untapped customer base. Furthermore, educating consumers about the benefits of smart pressure cookers and their long-term cost-efficiency can accelerate adoption in emerging economies.

Collaborations with recipe apps and smart home ecosystem providers can enhance the value proposition of smart pressure cookers.

Creating synergies with recipe apps and smart home ecosystem providers can significantly enhance the value proposition of smart pressure cookers. By integrating with popular recipe platforms, manufacturers can offer users a vast library of recipes and cooking ideas tailored to their appliances. This collaboration not only simplifies meal planning but also makes cooking more enjoyable and accessible. Moreover, smart home ecosystem integration allows seamless control and coordination of various smart devices, providing users with a holistic and interconnected cooking experience. Such partnerships can elevate smart pressure cookers from standalone appliances to integral components of the smart home, driving demand and market growth.

SMART PRESSURE COOKER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.34% |

|

Segments Covered |

By Type, Connectivity, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Instant Pot, Breville Group Limited, T-fal Gourmia, Mealthy, Fagor America, Ninja Kitchen, Crock-Pot, Philips, Cosori |

Smart Pressure Cooker Market Segmentation: By Type

-

Mechanical Timer Type

-

Digital/Programming Type

In 2022, the Digital/Programming Type currently holds the largest market share. This is attributed to the growing demand for advanced features, remote control capabilities, and the convenience of precise programming. Consumers increasingly seek smart appliances that offer enhanced automation and connectivity, driving the popularity of digital smart pressure cookers.

Moreover, The Digital/Programming Type is also the fastest-growing segment in the smart pressure cooker market. As technology continues to evolve, more consumers are embracing the benefits of digital interfaces and remote control options in their kitchen appliances. The convenience, precision, and customization offered by these cookers align with modern cooking trends and lifestyle preferences, making them a preferred choice and driving their rapid market growth.

Smart Pressure Cooker Market Segmentation: By Connectivity

-

Wi-Fi

-

Bluetooth

-

Others

In 2022, Wi-Fi held the largest market share among connectivity options. Wi-Fi-enabled smart pressure cookers offer the most extensive and flexible remote control capabilities, making them a preferred choice for users seeking seamless connectivity and convenience.

Moreover, Wi-Fi is also the fastest-growing connectivity option in the smart pressure cooker market. As consumers increasingly seek kitchen appliances that integrate into their smart homes, Wi-Fi's versatility and long-range capabilities drive its adoption. It allows users to control their cookers from virtually anywhere, enhancing the overall cooking experience and contributing to its rapid market growth.

Smart Pressure Cooker Market Segmentation: By Application

-

Commercial

-

Residential

-

Others

In 2022, The Residential segment holds the largest market share. This is primarily due to the widespread adoption of smart pressure cookers in households worldwide. As consumers seek convenient and time-saving cooking solutions for daily meal preparation, residential smart pressure cookers have gained significant popularity.

Moreover, the Commercial segment is the fastest-growing application category in the smart pressure cooker market. This growth is driven by the increasing demand for efficient and automated cooking solutions in the food service industry. Smart pressure cookers offer commercial kitchens the ability to streamline cooking processes, enhance productivity, and maintain consistent food quality, making them a valuable asset for businesses in the culinary sector.

Smart Pressure Cooker Market Segmentation: By Distribution Channel

-

Online

-

Offline

In 2022, The Online distribution channel currently holds the largest market share. The convenience of online shopping, extensive product variety, and the ability to compare prices and reviews online have made it the preferred choice for many consumers, driving significant sales in this channel.

Moreover, the online distribution channel is also the fastest-growing segment. As e-commerce continues to expand globally, more consumers are embracing the convenience of online shopping for appliances, including smart pressure cookers. Additionally, the ability to access a broader range of products and take advantage of online promotions and discounts contributes to the rapid growth of online sales in this market.

Smart Pressure Cooker Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

IN 2022, North America held the largest market share of 34.5% in the global smart pressure cooker market. This dominance is driven by the region's high consumer disposable income, tech-savvy population, and a strong inclination toward smart home appliances. The demand for time-saving and connected cooking solutions has fueled the adoption of smart pressure cookers in North American households.

Europe is another significant market for smart pressure cookers, with a substantial market share. The region has witnessed increasing awareness of kitchen automation and smart home integration. Consumers in Europe appreciate the convenience and precision offered by these appliances, contributing to their popularity.

Moreover, the Asia-Pacific region is the fastest-growing market of CAGR 15.7% for smart pressure cookers. Rapid urbanization, rising disposable incomes, and changing lifestyles in countries like India and China have led to a surge in demand for smart kitchen appliances. As consumers seek efficient cooking solutions, smart pressure cookers are becoming integral to modern kitchens in the Asia-Pacific region.

COVID-19 Impact Analysis on the Global Smart Pressure Cooker Market:

The COVID-19 pandemic significantly impacted the global smart pressure cooker market. During the initial phases of the pandemic, there was a surge in demand for smart kitchen appliances, including smart pressure cookers, as lockdowns and stay-at-home orders led to an increased focus on home-cooked meals. Consumers sought convenient and time-efficient cooking solutions, and smart pressure cookers perfectly met these needs. This resulted in a notable boost in sales, with the market experiencing a sudden uptick in 2020. However, the market also faced challenges due to disruptions in the supply chain and manufacturing processes caused by lockdowns and restrictions. Additionally, economic uncertainties prompted some consumers to cut back on discretionary spending, affecting purchasing decisions. As the pandemic progressed, the market stabilized, and manufacturers adapted to the new normal by ensuring a steady supply of products. Remote control and monitoring features of smart pressure cookers gained even more relevance, allowing users to cook safely without constant supervision. Moving forward, the market is expected to maintain its growth trajectory as consumers continue to value the convenience and efficiency of smart pressure cookers in their kitchens.

Latest Trends/Developments:

The smart pressure cooker market has witnessed significant growth and innovation in recent years. One of the latest trends in this market is the integration of advanced connectivity features and smart controls. Manufacturers are increasingly incorporating Wi-Fi and Bluetooth connectivity into their pressure cookers, allowing users to remotely monitor and control cooking processes via smartphone apps. This connectivity also enables access to a wide range of recipes and cooking tips, enhancing the overall cooking experience.

Moreover, there has been a surge in the adoption of artificial intelligence (AI) and machine learning technologies in smart pressure cookers. These appliances can now learn users' preferences and adapt cooking settings accordingly, ensuring consistent and customized results. Additionally, safety features have been enhanced with the introduction of multi-layered safety mechanisms and sensors that can detect anomalies and automatically shut off the cooker in case of emergencies. As consumers seek convenience and efficiency in their kitchen appliances, the smart pressure cooker market is poised for further growth, with an expected increase in market penetration and product offerings in the coming years. For instance, recent data shows a 25% year-on-year increase in sales of smart pressure cookers in the last quarter, highlighting the growing demand for these technologically advanced kitchen appliances.

Key Players:

-

Instant Pot

-

Breville Group Limited

-

T-fal

-

Gourmia

-

Mealthy

-

Fagor America

-

Ninja Kitchen

-

Crock-Pot

-

Philips

-

Cosori

In January 2023, CookingPal unveiled its Pronto smart pressure cooker at CES 2023, aiming to enhance the versatility of pressure cookers. The Pronto can slow cook, sauté, steam, ferment, weigh ingredients with its built-in scale, and sanitize items in its bowl. It features safety measures, such as auto pressure release and cool-touch handles. Users can also connect it to the Multo's Smart Kitchen Hub for access to recipes and tutorials. The Pronto is set to be available in Q3 2023, with an Air Fryer attachment following in Q4.

Chapter 1. Smart Pressure Cooker Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Pressure Cooker Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Pressure Cooker Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Pressure Cooker Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Pressure Cooker Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Pressure Cooker Market – By Type

6.1 Introduction/Key Findings

6.2 Mechanical Timer Type

6.3 Digital/Programming Type

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Smart Pressure Cooker Market – By Connectivity

7.1 Introduction/Key Findings

7.2 Wi-Fi

7.3 Bluetooth

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Connectivity

7.6 Absolute $ Opportunity Analysis By Connectivity, 2024-2030

Chapter 8. Smart Pressure Cooker Market – By Application

8.1 Introduction/Key Findings

8.2 Commercial

8.3 Residential

8.4 Others

8.5 Y-O-Y Growth trend Analysis Application

8.6 Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 9. Smart Pressure Cooker Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Online

9.3 Offline

9.4 Y-O-Y Growth trend Analysis Distribution Channel

9.5 Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 10. Smart Pressure Cooker Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.3 By Connectivity

10.1.4 By Application

10.1.5 By Distribution Channel

10.1.6 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Connectivity

10.2.4 By Application

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Connectivity

10.3.4 By Application

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Connectivity

10.4.4 By Application

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Connectivity

10.5.4 By Application

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Smart Pressure Cooker Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Instant Pot

11.2 Breville Group Limited

11.3 T-fal

11.4 Gourmia

11.5 Mealthy

11.6 Fagor America

11.7 Ninja Kitchen

11.8 Crock-Pot

11.9 Philips

11.10 Cosori

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Smart Pressure Cooker Market was valued at USD 2.45 billion in 2023 and is projected to reach a market size of USD 3.77 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 6.34%.

Key drivers include time and energy efficiency, convenience in cooking, health-conscious consumers, and enhanced safety features.

Opportunities include product innovation, emerging markets, and partnerships with recipe apps and smart home ecosystem providers.

North America held the largest market share in the global smart pressure cooker market. This dominance is driven by the region's high consumer disposable income, tech-savvy population, and a strong inclination toward smart home appliances.

Leading players include Instant Pot, Breville Group Limited, T-fal, and others actively involved in product innovation and partnerships.