Global Smart Kitchen Appliances Market Size (2024-2030)

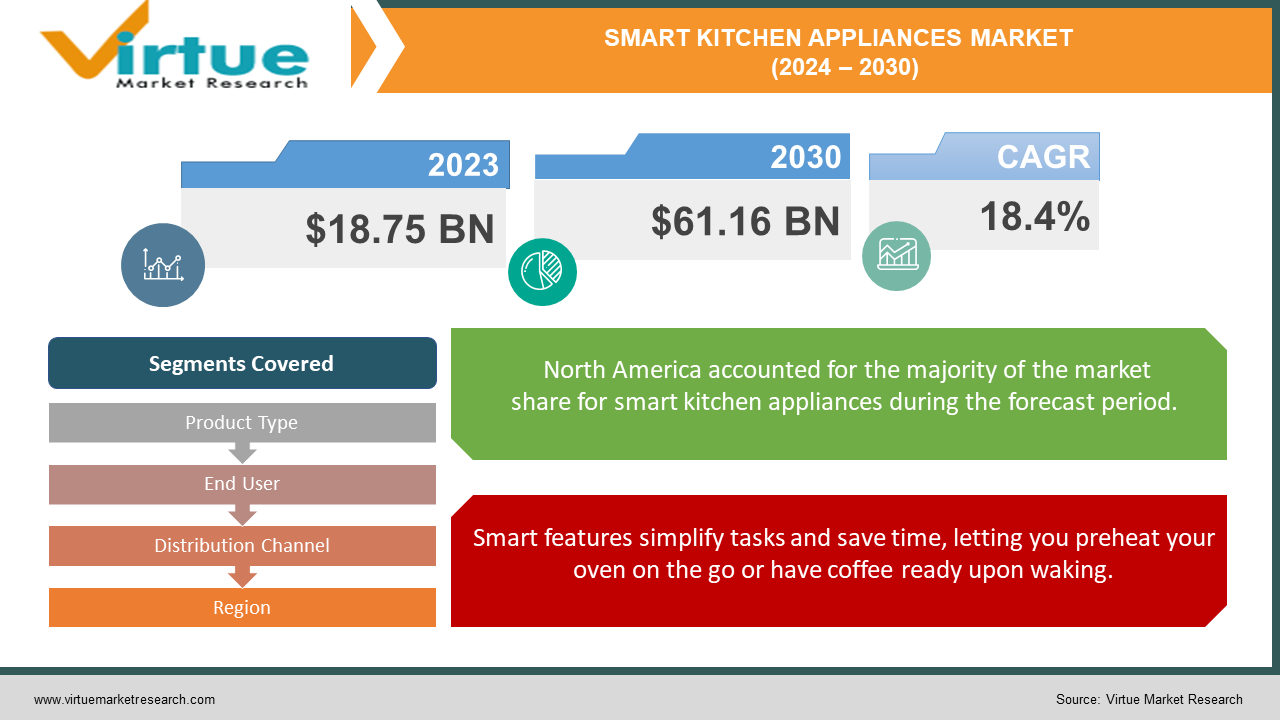

The Global Smart Kitchen Appliances Market was valued at USD 18.75 billion in 2023 and is projected to reach a market size of USD 61.16 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 18.4%.

The smart kitchen appliance market is sizzling. Convenience is king, driven by the rise of single-person households and busy lifestyles. People are spending more on discretionary items, and smart home technology is making integrated appliances all the more appealing. The magic lies in the Internet of Things (IoT), allowing appliances to connect and be controlled remotely. This translates to features like preheating ovens from afar, voice-controlled coffee makers, and even refrigerators that can recommend recipes based on your inventory.

Key Market Insights:

Many smart kitchen appliances are designed with energy-saving features, contributing to sustainability efforts. They have sensors that adjust settings based on usage patterns or external factors like ambient temperature, thereby reducing energy consumption.

North America leads the smart kitchen appliances market, driven by high consumer adoption of smart home technologies and favorable economic conditions.

These appliances integrate advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) to enhance functionality.

Products like smart refrigerators and smart ovens are becoming popular due to their ability to connect to the internet and be controlled remotely via smartphones or voice commands.

Smart Kitchen Appliances Market Drivers:

Smart features simplify tasks and save time, letting you preheat your oven on the go or have coffee ready upon waking.

Our fast-paced lives, coupled with the rising number of single-person households, have created a strong demand for appliances that can simplify tasks and free up precious time. Smart features like remote control, automation, and seamless integration with other smart home devices cater perfectly to this need. Imagine preheating your oven on your phone while you're on the way home from work, ensuring a hot and ready oven for your meal. Similarly, a smart coffee maker can be programmed to brew a fresh pot based on your morning routine, eliminating the need for groggy mornings spent waiting for coffee.

The rise of smart homes fosters a generation comfortable with technology, opening doors for voice-controlled appliances and recipe suggestions tailored to dietary needs.

The smart home revolution has fostered a generation of consumers who are comfortable with technology and eager to leverage it in all aspects of their lives, including the kitchen. This opens doors for innovative smart appliances with features like voice control, revolutionizing the way we interact with our kitchen gadgets. Imagine simply asking your oven to bake a cake at a specific temperature or using voice commands to adjust settings on your smart refrigerator.

Features like portion control and recipe suggestions based on dietary needs empower informed choices, while integration with fitness trackers promotes a holistic approach to wellness.

Smart appliances can be a secret weapon for promoting healthy eating habits. These innovative tools can empower us to make informed choices about what we consume. Features like pre-programmed portion control can help with weight management, while recipe suggestions that consider dietary needs cater to those with allergies or specific diets. Integration with fitness trackers can further enhance this focus on wellness by providing a holistic view of your health and dietary goals.

The Internet of Things (IoT) allows appliances to collect data, personalizing cooking experiences with recipe suggestions based on ingredients and optimizing settings for perfect results.

The Internet of Things (IoT) empowers smart appliances to collect valuable data on our cooking habits and preferences. This data can be used to personalize our cooking experiences in a multitude of ways. Imagine you’re smart oven learning your preferred settings for specific dishes, ensuring perfectly cooked meals every time. Recipe suggestions based on available ingredients can help with meal planning and reduce food waste, while data on cooking processes can be used to optimize settings for better results and energy efficiency.

Smart Kitchen Appliances Market Restraints and Challenges:

Despite the exciting possibilities of smart kitchen appliances, there are hurdles that could slow down their widespread adoption. The biggest challenge is the cost factor. Compared to traditional models, smart appliances carry a significant price premium, which can be a dealbreaker for many, especially in developing economies. Even in developed countries, budget-conscious consumers might hesitate to invest in this new technology. Another hurdle is compatibility. The lack of universal standards in the smart home industry creates a situation where appliances from different brands might not work together seamlessly.

Security is another major concern. As appliances become more connected, the potential for data breaches and privacy issues grows. Consumers are understandably wary of integrating devices into their homes, especially those connected to something as personal as food preparation. The risk of hackers accessing their grocery lists or even taking control of their appliances is a significant deterrent.

Finally, the full potential of smart appliances can be limited by internet access. In areas with unreliable or limited internet connectivity, these appliances lose a significant portion of their functionality and appeal. Without a strong and stable internet connection, features like remote control, recipe recommendations, and automated workflows become unavailable, hindering the overall user experience. Addressing these challenges will be crucial for the smart kitchen appliance market to reach its full potential.

Smart Kitchen Appliances Market Opportunities:

Beyond the challenges, the smart kitchen appliance market brims with exciting opportunities. Imagine a kitchen that personalizes the cooking experience. Smart appliances can learn your habits, recommend recipes based on your diet and ingredients, and even fine-tune settings for perfect results. This personalization can revolutionize cooking, making it more enjoyable and efficient. Food waste reduction is another area ripe for innovation. Smart refrigerators can track inventory and suggest recipes to use up what you have, while smart freezers can optimize temperatures for extended shelf life. Integration with meal-planning apps can further reduce impulse purchases. Safety and efficiency are also on the menu. Leak detection in refrigerators, automatic shut-off functions in ovens, and real-time cooking monitoring can all contribute to a safer kitchen. Additionally, smart appliances can automate tasks based on your habits, freeing up your time. Voice control is poised to transform the kitchen. Imagine controlling appliances with your voice! Smart speakers and voice interfaces can revolutionize how we interact with our kitchens. Hands-free control is a boon for busy cooks or those with mobility limitations. Just ask your oven to preheat while you chop vegetables or use voice commands to adjust settings on your smart cooker. Finally, the market for high-end, luxury smart appliances is expected to take off. These appliances cater to a specific segment willing to pay a premium for a truly connected kitchen experience, offering sleek designs, advanced features, and seamless integration with smart home ecosystems. Niche markets focused on specific dietary needs or allergy management can offer significant growth potential as well.

SMART KITCHEN APPLIANCES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.4% |

|

Segments Covered |

By Product Type, End User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Electrolux AB, Haier Group, Panasonic Corporation, BSH Hausgeräte GmbH, Koninklijke Philips N.V., Miele & Cie. KG, WINIA Electronics Co., Ltd., Sharp Corporation |

Smart Kitchen Appliances Market Segmentation: By Product Type:

-

Smart Ovens & Cooktops

-

Smart Refrigerators

-

Smart Dishwashers

-

Smart Microwaves

-

Smart Coffee Makers

-

Other Smart Appliances

The smart kitchen appliance market is segmented by product type, with smart refrigerators currently reigning supreme. These boast features like inventory management and recipe recommendations, catering to the desire for convenience and reduced food waste. However, the fastest-growing segment is likely "Other Smart Appliances," encompassing innovative products like smart cookware and ventilation systems. This segment capitalizes on the growing trend of automation and niche functionalities in the kitchen.

Smart Kitchen Appliances Market Segmentation: By End User:

-

Residential

-

Commercial

The dominant segment by End User is Residential, catering to individual households and families. This segment benefits from features like remote control and preheating, making busy lives easier. The fastest growing segment is expected to be Asia-Pacific due to a large and growing middle class with increasing disposable income and a growing tech-savvy population. This region is expected to see significant investment in smart home technology, including smart kitchen appliances.

Smart Kitchen Appliances Market Segmentation: By Distribution Channel

-

Multi-Branded Stores

-

Exclusive Stores

-

Online Retailers

-

Other Channels

The dominant distribution channel for smart kitchen appliances is likely Multi-Branded Stores, due to their wide variety of brands and accessibility. They offer a one-stop shop for consumers to compare and choose from different options. However, the fastest-growing segment is likely Online Retailers. The convenience of online shopping, wider selection, and potentially competitive pricing are driving online sales. This trend is expected to continue as more consumers turn to online platforms for their appliance purchases.

Smart Kitchen Appliances Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America takes the cake as the mature market leader, with high adoption rates and a constant hunger for the newest technology. Consumers here are adventurous chefs, readily investing in high-end smart appliances. This has fueled a thriving market overflowing with a wide variety of features and functionalities, constantly pushing the boundaries of what's possible in the smart kitchen.

Asia-Pacific is a rising star, a hotbed of potential with a large and rapidly growing middle class. The affordability of smart appliances is becoming more accessible, and the population's growing tech-savviness is whetting their appetites for these innovative gadgets. Countries like China, South Korea, and Japan are leading the way, and the future of smart kitchens in Asia-Pacific looks bright. Imagine a future where smart appliances are not just a luxury for the few, but a common tool for everyday cooks across Asia.

COVID-19 Impact Analysis on the Smart Kitchen Appliances Market:

The COVID-19 pandemic wasn't a simple recipe for the smart kitchen appliance market. Lockdowns and social distancing measures created a double-edged sword situation. On the one hand, there was a short-term boost. With people cooking at home more, features like remote control, automated cooking, and recipe suggestions on smart appliances have become more appealing. Additionally, the e-commerce boom during this time benefitted the market as consumers turned to online platforms for appliance purchases.

However, there were also long-term considerations. The pandemic caused disruptions in global supply chains, leading to shortages of materials and delays in production of smart appliances. This limited product availability and could have impacted sales in some segments. Furthermore, the economic impact of the pandemic might have caused some consumers to tighten their belts, putting non-essential purchases like smart appliances on hold.

On a positive note, the heightened awareness of hygiene and health post-pandemic could be a positive factor for the market moving forward. Features like voice control, which reduces the need to touch surfaces, and appliances that promote healthy eating habits through recipe suggestions or portion control could see increased demand. The overall impact of COVID-19 on the smart kitchen appliance market is still unfolding, but it's clear that both challenges and opportunities have emerged.

Latest Trends/ Developments:

The smart kitchen is on a path to becoming even more intelligent. Artificial intelligence (AI) is emerging as a game-changer, personalizing the cooking experience. Imagine an AI-powered oven that learns your preferences and recommends settings for perfect results, every time. AI can even analyze your dietary needs and curate recipes based on your health goals.

Another hot trend is smart food management. With food waste a growing concern, smart appliances are stepping up as allies. Smart refrigerators with built-in cameras can track inventory and suggest recipes to use up what you have on hand, preventing unnecessary food spoilage. These appliances can even learn your shopping habits and create grocery lists to eliminate impulse purchases.

Sustainability is also becoming a focus in the smart kitchen. New appliances are being designed with features like intelligent power management and automatic shut-off functions to reduce energy consumption. Additionally, smart appliances can be programmed to run during off-peak hours when electricity costs are lower. By embracing these trends, the smart kitchen of tomorrow promises to be not only intelligent and efficient but also environmentally conscious.

Key Players:

-

Samsung Electronics Co., Ltd.

-

LG Electronics Inc.

-

Whirlpool Corporation

-

Electrolux AB

-

Haier Group

-

Panasonic Corporation

-

BSH Hausgeräte GmbH

-

Koninklijke Philips N.V.

-

Miele & Cie. KG

-

WINIA Electronics Co., Ltd.

-

Sharp Corporation

Chapter 1. Smart Kitchen Appliances Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Kitchen Appliances Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Kitchen Appliances Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Kitchen Appliances Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Kitchen Appliances Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Kitchen Appliances Market – By Product Type

6.1 Introduction/Key Findings

6.2 Smart Ovens & Cooktops

6.3 Smart Refrigerators

6.4 Smart Dishwashers

6.5 Smart Microwaves

6.6 Smart Coffee Makers

6.7 Other Smart Appliances

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Smart Kitchen Appliances Market – By End User

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Y-O-Y Growth trend Analysis By End User

7.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Smart Kitchen Appliances Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Multi-Branded Stores

8.3 Exclusive Stores

8.4 Online Retailers

8.5 Other Channels

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Smart Kitchen Appliances Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End User

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End User

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End User

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End User

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End User

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Smart Kitchen Appliances Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Samsung Electronics Co., Ltd.

10.2 LG Electronics Inc.

10.3 Whirlpool Corporation

10.4 Electrolux AB

10.5 Haier Group

10.6 Panasonic Corporation

10.7 BSH Hausgeräte GmbH

10.8 Koninklijke Philips N.V.

10.9 Miele & Cie. KG

10.10 WINIA Electronics Co., Ltd.

10.11 Sharp Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Smart Kitchen Appliances Market was valued at USD 18.75 billion in 2023 and is projected to reach a market size of USD 61.16 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 18.4%.

Convenience Craving, Tech-Savvy Kitchens, Focus on Wellness, Data-Driven Decisions.

Smart Ovens & Cooktops, Smart Refrigerators, Smart Dishwashers, Smart Microwaves, Smart Coffee Makers, and Other Smart Appliances.

North America is considered the most dominant region for the Smart Kitchen Appliances Market, boasting high adoption rates and a strong focus on innovation.

Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Electrolux AB, Haier Group, Panasonic Corporation, BSH Hausgeräte GmbH, Koninklijke Philips N.V., Miele & Cie. KG, WINIA Electronics Co., Ltd., Sharp Corporation.