Smart Irrigation Sensors Market Size (2023-2030)

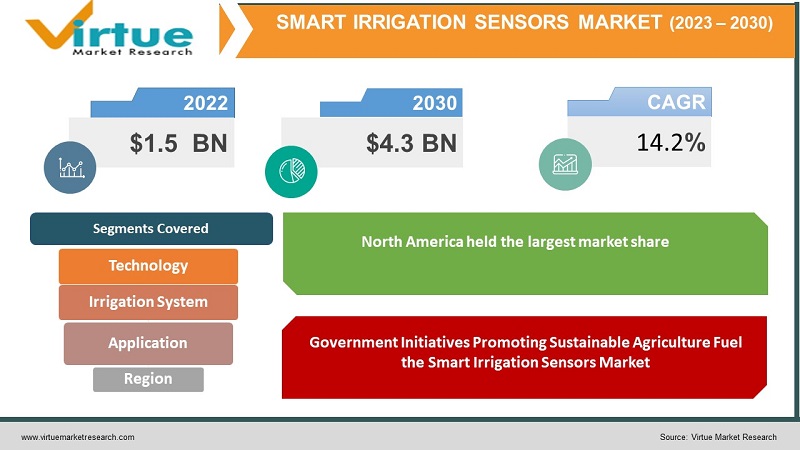

The Global Smart Irrigation Sensors Market was valued at USD 1.5 billion in 2022 and is projected to reach a market size of USD 4.3 billion by the end of 2030. Over the forecast period of 2023-2030, the market is anticipated to grow at a CAGR of 14.2%.

The Smart Irrigation Sensors Market has emerged as a transformative force, reshaping the landscape of agriculture and water management. This industry, at the intersection of technology, agriculture, and environmental conservation, has experienced significant evolution over the years. Its growth can be attributed to a confluence of factors, including the pressing need for water conservation, advancements in sensor technologies, and a growing awareness of sustainable agricultural practices. As technology continues to advance, we can anticipate a continued surge in innovative sensor technologies, integration with data analytics and artificial intelligence, and the development of comprehensive, eco-friendly irrigation systems.

Key Market Insights:

The smart irrigation sensors market is witnessing a significant surge in the adoption of Internet of Things (IoT) technology. Smart irrigation sensors are increasingly being integrated with data analytics and artificial intelligence (AI) technologies. This integration allows for predictive analysis, pattern recognition, and smart decision-making, enabling farmers to anticipate irrigation needs accurately and optimize their farming practices.

Furthermore, the concept of precision agriculture, which involves using technology to optimize field-level management, is boosting the adoption of smart irrigation sensors. These sensors enable precise control over irrigation, ensuring that crops receive the right amount of water, leading to enhanced productivity and reduced wastage. Also, Governments, agricultural organizations, and environmental agencies are encouraging the adoption of smart irrigation solutions to conserve water resources, making it a key market driver.

Smart Irrigation Sensors Market Drivers:

Increasing Demand for Water-Efficient Agricultural Practices Propels Growth in the Global Smart Irrigation Sensors Market

The global smart irrigation sensors market is witnessing robust growth due to the escalating demand for water-efficient agricultural practices. With water scarcity becoming a pressing concern worldwide, farmers and agriculturalists are increasingly turning to smart irrigation solutions equipped with advanced sensors. By optimizing water usage, smart irrigation sensors not only enhance crop yields but also contribute significantly to sustainable farming. This increasing emphasis on water conservation is a pivotal factor driving the expansion of the global smart irrigation sensors market, making it a crucial technology in modern agriculture.

Government Initiatives Promoting Sustainable Agriculture Fuel the Smart Irrigation Sensors Market

Government initiatives and policies promoting sustainable agricultural practices are significant drivers fuelling the smart irrigation sensors market. Recognizing the importance of water conservation in agriculture, many governments worldwide are offering subsidies, incentives, and technical support to encourage the adoption of smart irrigation systems. These initiatives aim to raise awareness among farmers about the benefits of smart irrigation sensors, including water savings, increased yields, and environmental sustainability. As a result, farmers are increasingly adopting these technologies, leading to substantial market growth.

Smart Irrigation Sensors Market Restraints and Challenges:

High Initial Implementation Costs Pose a Challenge in the Smart Irrigation Sensors Market

One of the significant challenges faced by the smart irrigation sensors market is the high initial implementation costs. The installation of smart irrigation systems, including sensors, controllers, and associated infrastructure, often involves a considerable upfront investment. For small-scale farmers and agricultural businesses with limited budgets, these costs can be prohibitive, leading to slower adoption rates. For instance, In India, less than two hectares of land are owned by 85% of agricultural households. Due to the high expenses and low return on investment, smart irrigation market technologies are not feasible in these farms.

Lack of Technical Expertise and Awareness Hampers Smart Irrigation Sensors Adoption

A critical restraint in the smart irrigation sensors market is the lack of technical expertise and awareness among farmers and agricultural communities. Many farmers, especially in remote or less technologically advanced regions, lack the necessary knowledge to install, calibrate, and maintain smart irrigation systems effectively. Additionally, there is a general lack of awareness about the benefits and functionalities of smart irrigation sensors.

Smart Irrigation Sensors Market Opportunities:

Integration of Artificial Intelligence Unveils Lucrative Opportunities in the Smart Irrigation Sensors Market

The integration of Artificial Intelligence (AI) presents a wealth of opportunities in the smart irrigation sensors market. AI algorithms can process vast amounts of data from sensors, analyzing intricate patterns and correlations. By leveraging AI, smart irrigation systems can make real-time, autonomous decisions regarding irrigation schedules, adapting to changing weather conditions and plant requirements dynamically.

Expansion of Smart Agriculture Initiatives Creates Opportunities in the Smart Irrigation Sensors Market

The expansion of smart agriculture initiatives worldwide is creating significant opportunities in the smart irrigation sensors market. Governments, agricultural organizations, and private enterprises are investing in research and development, promoting the adoption of advanced technologies in farming practices. As the emphasis on precision farming, data-driven decision-making, and sustainable agriculture grows, there is a rising demand for smart irrigation systems.

Increasing Focus on Research and Development Opens New Avenues for Smart Irrigation Sensors

The increasing focus on research and development activities in the field of agriculture and environmental sciences is opening new avenues for smart irrigation sensors. Research institutions, universities, and agricultural organizations are conducting studies to enhance the understanding of plant physiology, soil health, and water dynamics. These research efforts generate valuable insights that can be incorporated into smart irrigation sensor technologies.

SMART IRRIGATION SENSORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

14.2% |

|

Segments Covered |

By Technolgy, Irrigation System, Power source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Toro Company, Rain Bird Corporation, Hunter Industries, Netafim, Weathermatic, Valmont Industries, Irrometer Company, Acclima Inc., Baseline Inc., Aquaspy |

Smart Irrigation Sensors Market Segmentation:

Smart Irrigation Sensors Market Segmentation: By Technology

- Soil Moisture Sensors

- Weather-based Sensors

- Flow Sensors

- Rain Sensors

- Temperature Sensors

In 2022, the Soil Moisture Sensors segment accounted for the largest revenue share in the global Smart Irrigation Sensors market. This dominance is attributed to the critical role soil moisture plays in determining precise irrigation needs. Farmers and agriculturalists increasingly recognize the importance of soil-specific data for optimizing irrigation practices and conserving water resources effectively. Soil moisture sensors provide real-time, accurate measurements, allowing farmers to tailor irrigation schedules according to the unique requirements of their crops and soil types.

The Weather-based sensors segment has emerged as the frontrunner in the global Smart Irrigation Sensors market, marking a remarkable surge in growth with the fastest Compound Annual Growth Rate (CAGR). The predictive capabilities of these sensors empower agriculturalists to anticipate changes in humidity, temperature, and precipitation, allowing for precise and adaptive irrigation strategies. With climate change posing unpredictable weather patterns, the demand for these sensors has escalated significantly. Farmers are increasingly relying on weather-based sensors to mitigate the risks associated with extreme weather events, optimize water usage, and enhance overall crop health.

Smart Irrigation Sensors Market Segmentation: By Irrigation System

- Drip Irrigation

- Sprinkler Irrigation

- Surface Irrigation

In 2022, The Drip irrigation segment commands the largest market share in the Smart Irrigation Sensors market. This dominance is primarily attributed to the efficiency and precision offered by drip irrigation systems. Smart Irrigation Sensors integrated into drip systems further enhance this precision by monitoring soil moisture levels in real time. Farmers appreciate the cost-effectiveness and sustainable water management benefits of drip irrigation, leading to widespread adoption across agricultural landscapes.

Moreover, the sprinkler irrigation segment is the fastest-growing segment in the Smart Irrigation Sensors market. Smart Irrigation Sensors integrated with sprinkler systems offer intelligent water distribution, ensuring uniform coverage and optimal moisture levels for diverse crops and landscapes. The ability to remotely monitor and control sprinkler operations based on real-time data has significantly streamlined irrigation management, saving both water and operational costs. For instance, In March 2018, Rachio (US) introduced its voice-activated Rachio 3 smart sprinkler controller and Rachio 3 wireless flow meter.

Smart Irrigation Sensors Market Segmentation: By Power Source

- Battery-Powered Sensors

- Solar-Powered Sensors

- Electrically-Powered Sensors

In 2022, the Battery-Powered Sensors segment held the largest market share in the global Smart Irrigation Sensors market. These sensors offer a balance between efficiency and ease of use, making them a preferred choice among farmers and agricultural enterprises. Battery-powered sensors provide a reliable solution for remote and off-grid locations, eliminating the need for complex wiring or continuous power supply. Their portability and flexibility in installation enable farmers to deploy them in various agricultural settings, including large-scale farms and small-scale plantations.

Moreover, the Solar-powered sensors production segment is the fastest-growing segment in the global Smart Irrigation Sensors market. These sensors harness solar energy to power their operations, offering an eco-friendly and energy-efficient solution. The growing emphasis on environmental sustainability, coupled with advancements in solar technology, has propelled the adoption of solar-powered smart irrigation sensors. These sensors not only provide a continuous, self-sufficient power supply but also contribute to reducing the overall carbon footprint of agricultural practices.

Smart Irrigation Sensors Market Segmentation: By Application

- Agriculture Farms

- Sports Grounds & Golf Courses

- Residential Lawns & Gardens

- Parks and Public Gardens

- Landscaping in Commercial Spaces

- Others

In 2022, the Agriculture farm segment dominated the global Smart Irrigation Sensors market, holding the largest market share. is dominance is a testament to the pivotal role that smart irrigation sensors play in modern agriculture. Agricultural farms, both large-scale enterprises and smaller family-owned operations, are leveraging these sensors to optimize irrigation practices. This targeted approach not only maximizes crop yields but also conserves water resources significantly.

Moreover, The Sports Grounds & Golf Courses segment has the fastest-growing CAGR in the global Smart Irrigation Sensors market. This rapid expansion is attributed to the segment's increasing recognition of the need for precision in irrigation management. Smart Irrigation Sensors have become indispensable in sports grounds and golf courses, ensuring lush greenery while optimizing water usage. These sensors provide real-time data on soil moisture levels, allowing groundskeepers to adjust irrigation schedules based on specific requirements.

Smart Irrigation Sensors Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2022, North America held the largest market share of 36.1% in the global smart irrigation sensors market. The robust market share underscores North America's leadership in implementing cutting-edge agricultural technologies, positioning it as a key contributor to the growth and innovation within the global smart irrigation sensors market.

Moreover, Asia-Pacific held the second largest market share of 25.7% in the global smart irrigation sensors market. Countries in Asia-Pacific, including China and India, are witnessing a rapid transformation in their agricultural practices, with a growing focus on optimizing irrigation methods for enhanced productivity. The need to sustain agricultural output in the face of growing populations has driven the adoption of smart irrigation sensors.

COVID-19 Impact Analysis on the Global Smart Irrigation Sensors Market:

The global Smart Irrigation Sensors market experienced a significant impact from the COVID-19 pandemic. The temporary shutdown of manufacturing facilities in various areas has seriously impacted business and revenue. The COVID-19 outbreak severely disrupted the production and manufacturing processes, which resulted in a decrease in the growth of the market outlook in 2020. According to the smart irrigation market trends, Since production facilities have slowed as a result of the COVID-19 pandemic, there has been a significant increase in demand across industries, which has hurt the manufacturing and industrial sectors globally.

Latest Trends/Developments:

In December 2021, Toro Manufacturing LLC. announced the introduction of the Tempus Automation system for agricultural irrigation. The system exceeds the competition in terms of usefulness, range, and installation simplicity thanks to 4G/wi-fi/LoRa/Bluetooth technologies.

In February 2020, The ESP-LXIVM series of two new, simple-to-use controllers for two-wire irrigation systems was introduced by Rain Bird Corporation. These controllers include enhanced water management tools, diagnostics, and several new features for large and difficult locations.

Key Players:

- The Toro Company

- Rain Bird Corporation

- Hunter Industries

- Netafim

- Weathermatic

- Valmont Industries

- Irrometer Company

- Acclima Inc.

- Baseline Inc.

- Aquaspy

In May 2021, Left Hand Robotics, Inc. was acquired by The Toro Company (US). The acquisition complements The Toro Company's objective of being a pioneer in next-generation technology, including alternative power, smart linked, and autonomous products.

In March 2020, Netbeat, FluroSat (Australia), and Netafim (Israel) collaborated to include remote sensing technologies into its digital irrigation management platform

Chapter 1. Global Smart Irrigation Sensors Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Smart Irrigation Sensors Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Smart Irrigation Sensors Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Smart Irrigation Sensors Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Smart Irrigation Sensors Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Smart Irrigation Sensors Market– By Technology

6.1. Introduction/Key Findings

6.2. Soil Moisture Sensors

6.3. Weather-based Sensors

6.4. Flow Sensors

6.5. Rain Sensors

6.6. Temperature Sensors

6.7. Y-O-Y Growth trend Analysis By Technology

6.8. Absolute $ Opportunity Analysis By Technology , 2023-2030

Chapter 7. Global Smart Irrigation Sensors Market– By Irrigation System

7.1. Introduction/Key Findings

7.2. Drip Irrigation

7.3. Sprinkler Irrigation

7.4. Surface Irrigation

7.5. Y-O-Y Growth trend Analysis By Irrigation System

7.6. Absolute $ Opportunity Analysis By Irrigation System , 2023-2030

Chapter 8. Global Smart Irrigation Sensors Market– By Power Source

8.1. Introduction/Key Findings

8.2. Battery-Powered Sensors

8.3. Solar-Powered Sensors

8.4.Electrically-Powered Sensors

8.5. Y-O-Y Growth trend Analysis Power Source

8.6. Absolute $ Opportunity Analysis Power Source , 2023-2030

Chapter 9. Global Smart Irrigation Sensors Market– By Application

9.1. Introduction/Key Findings

9.2. Agriculture Farms

9.3. Sports Grounds & Golf Courses

9.4. Residential Lawns & Gardens

9.5. Parks and Public Gardens

9.6. Landscaping in Commercial Spaces

9.7. Others

9.8. Y-O-Y Growth trend Analysis Application

9.9. Absolute $ Opportunity Analysis Application , 2023-2030

Chapter 10. Global Smart Irrigation Sensors Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Technology

10.1.3. By Irrigation System

10.1.4. By Application

10.1.5. Power Source

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Technology

10.2.3. By Irrigation System

10.2.4. By Application

10.2.5. Power Source

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Technology

10.3.3. By Irrigation System

10.3.4. By Application

10.3.5. Power Source

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Technology

10.4.3. By Irrigation System

10.4.4. By Application

10.4.5. Power Source

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Technology

10.5.3. By Irrigation System

10.5.4. By Application

10.5.5. Power Source

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Smart Irrigation Sensors Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 The Toro Company

11.2. Rain Bird Corporation

11.3. Hunter Industries

11.4. Netafim

11.5. Weathermatic

11.6. Valmont Industries

11.7. Irrometer Company

11.8. Acclima Inc.

11.9. Baseline Inc.

11.10. Aquaspy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Smart Irrigation Sensors Market was valued at USD 1.5 billion in 2022 and is projected to reach a market size of USD 4.3 billion by the end of 2030. Over the forecast period of 2023-2030, the market is anticipated to grow at a CAGR of 14.2%.

The primary drivers include the increasing demand for water-efficient agricultural practices and government initiatives for sustainable agriculture

In 2022, the Soil Moisture Sensors segment held the largest market share in the Smart Irrigation Sensors market

North America dominated the global wine market with the largest market share of 6.19% in the global Smart Irrigation Sensors market

The Toro Company, Rain Bird Corporation, Hunter Industries, Netafim, Weathermatic, and Valmont Industries are some of the key players in the Smart Irrigation Sensors market