Smart Insulin Pen and Pump Market Size (2024-2030)

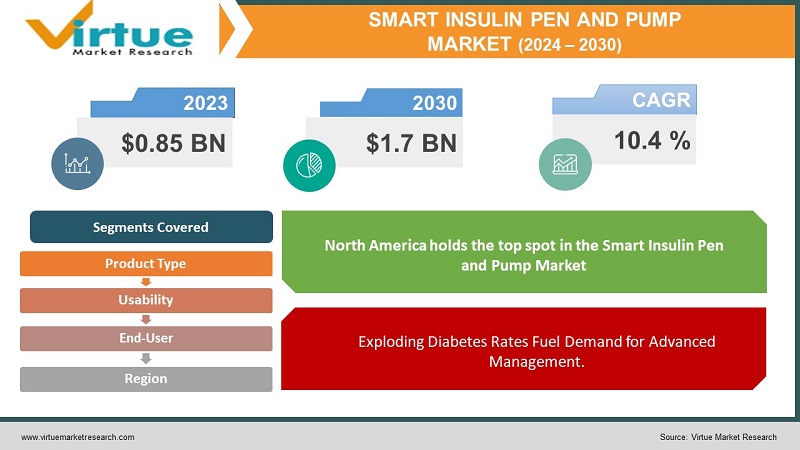

The Smart Insulin Pen and Pump Market was valued at USD 0.85 billion in 2023 and is projected to reach a market size of USD 1.7 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.4%.

The smart insulin pen and pump market is on a growth spurt, driven by the rising number of people diagnosed with diabetes and a growing awareness of the benefits these devices offer. These pens and pumps are revolutionizing diabetes management. Smart insulin pens, for instance, are reusable injectors that connect to smartphone apps, allowing users to track doses, receive reminders, and even get insulin recommendations based on their blood sugar levels.

Key Market Insights:

The smart insulin pen and pump market is experiencing a surge, fueled by a growing need for effective diabetes management. The number of people diagnosed with diabetes is rising globally, with the International Diabetes Federation estimating nearly 463 million cases in 2019 and a projected 700 million by 2045. This alarming trend, linked to factors like obesity and aging populations, is creating a significant demand for advanced tools like smart insulin pens and pumps.

These devices are revolutionizing diabetes management by empowering patients and offering improved health outcomes. Smart insulin pens connect to smartphone apps, allowing users to track doses, receive reminders, and even get personalized insulin recommendations. Smart pumps offer similar functionalities but deliver insulin continuously throughout the day and can be programmed for varying amounts based on the time. Cutting-edge technology like closed-loop systems for automated insulin delivery is further propelling this market forward. Importantly, effective blood sugar control achieved through these devices can significantly reduce the risk of diabetes complications like heart disease, stroke, and kidney disease.

With governments recognizing the economic burden of diabetes, there's a growing focus on supporting management programs. This creates a favorable environment for the smart insulin pen and pump market. Additionally, regions like Asia Pacific with rising diabetic populations and increasing healthcare spending are expected to see significant market expansion, solidifying the future growth potential of this sector.

The Smart Insulin Pen and Pump Market Drivers:

Exploding Diabetes Rates Fuel Demand for Advanced Management.

The global diabetes epidemic is a major driver. With an increasing number of diagnoses due to factors like obesity and aging populations, there's a growing need for effective management solutions. Smart insulin pens and pumps offer the advanced tools necessary to address this growing challenge.

Empowering Patients Through Smart Features.

These devices go beyond simple insulin delivery. Smart features like dose tracking, reminders, and even personalized insulin recommendations through smartphone apps empower patients to take charge of their diabetes management. This increased control and awareness can significantly improve treatment outcomes.

Tech Revolution: Closed-Loop Systems Lead the Way.

Innovation is constantly pushing the boundaries in this market. Closed-loop insulin delivery systems, for example, represent a major leap forward. These automated systems continuously monitor blood sugar levels and adjust insulin delivery automatically, mimicking the function of a healthy pancreas. This level of technological sophistication is a major driver of market growth.

Better Health Outcomes Reduce Complications.

Effective blood sugar control achieved through smart insulin pens and pumps can significantly reduce the risk of diabetes complications like heart disease, stroke, and kidney disease. This translates not only to a healthier population but also to reduced healthcare costs, making smart insulin technology an attractive option for both patients and healthcare systems.

The Smart Insulin Pen and Pump Market Restraints and Challenges:

While the smart insulin pen and pump market is experiencing a surge, there are hurdles to overcome. A significant challenge is the high cost of these devices. This can be a major barrier for patients in low-income countries or even for those with limited insurance coverage in developed nations. Furthermore, even with increasing awareness, there's a need for broader educational initiatives to inform both patients and healthcare professionals about the full potential of smart insulin pens and pumps.

Beyond cost and awareness, technical hurdles exist. Seamless integration with other crucial diabetes management tools like continuous glucose monitors (CGMs) can be a challenge. This lack of communication between devices can create data silos, hindering a holistic approach to diabetes management. Security concerns also come into play as these devices connect to smartphones and transmit data. The risk of data breaches or hacking incidents raises important questions about patient privacy and safety.

Finally, smart insulin pens and pumps face competition from traditional methods. Traditional syringes and pumps still offer a more affordable option, even though they lack the advanced features of smart devices. This competition will likely continue until the cost of smart technology becomes more accessible. By addressing these restraints and challenges, the smart insulin pen and pump market can solidify its position as a leading force in revolutionizing diabetes management.

The Smart Insulin Pen and Pump Market Opportunities:

The future of the smart insulin pen and pump market is brimming with exciting opportunities. Expanding market access is crucial, and this can be achieved by developing more affordable versions of these devices. This could involve collaborations with local manufacturers in developing countries or exploring innovative pricing models and government subsidies. Telehealth integration presents another promising avenue. Imagine remote patient monitoring and consultations with specialists – this can significantly improve access to care, especially in remote areas. Furthermore, the vast amount of data generated by these devices can be harnessed through big data and AI. This data goldmine has the potential to unlock personalized treatment plans, better insulin dosing recommendations, and even the ability to predict potential complications. Finally, focusing on user experience is paramount. User-friendly interfaces, intuitive apps, and sleek, discreet device designs will all contribute to improved patient adoption and adherence to therapy. Strategic partnerships between device manufacturers, pharmaceutical companies, and healthcare providers can further accelerate innovation, improve data sharing, and ultimately lead to the development of even more effective diabetes management solutions. By capitalizing on these opportunities, the smart insulin pen and pump market has the potential to revolutionize diabetes care and empower millions to live healthier lives.

SMART INSULIN PEN AND PUMP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.4% |

|

Segments Covered |

By Product Type, Consumption, Distribution Channel Usability, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medtronic, Novo Nordisk, Emperra GmbH, Eli Lilly and Company, Berlin-Chemie, Bigfoot Biomedical, Digital Medics Pty Ltd., Jiangsu Deflu Medical Device Co. Ltd., Pendiq, Sanofi |

The Smart Insulin Pen and Pump Market Segmentation:

The Smart Insulin Pen and Pump Market Segmentation: By Product Type:

- Smart Insulin Pens

- Smart Insulin Pumps

Smart insulin pumps are the dominant segment in the product type sector of the smart insulin pen and pump market. This is because pumps offer continuous insulin delivery, mimicking a healthy pancreas, whereas pens require multiple injections. The Asia Pacific region is the fastest-growing segment due to a rising diabetic population and increasing healthcare expenditure in developing economies.

The Smart Insulin Pen and Pump Market Segmentation: By Usability:

- Pre-filled Pens

- Reusable Pens

Within the usability sector of the smart insulin pen and pump market, reusable pens hold the dominant position. They offer a cost-effective option in the long run as users can refill cartridges instead of constantly buying pre-filled devices. However, the fastest-growing segment belongs to pre-filled pens. Their convenience, with pre-loaded insulin eliminating the need to handle vials and cartridges, is particularly attractive to new users or those who value ease of use over long-term cost savings.

The Smart Insulin Pen and Pump Market Segmentation: By End User:

- Hospitals & Clinics

- Ambulatory Surgical Centres

- Home Care Settings

Segmenting the market by end-user reveals two key trends. The home care setting currently holds the dominant share. Patients managing their diabetes at home benefit most from the flexibility and convenience of smart insulin pens and pumps. However, the Asia Pacific region is experiencing the fastest growth within this market. As healthcare infrastructure and diabetes awareness improve in developing economies, this segment is poised for significant expansion in the coming years.

The Smart Insulin Pen and Pump Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

North America: Currently reigns supreme, holding the largest market share. This dominance can be attributed to factors like high healthcare spending, a well-developed healthcare infrastructure, and a strong presence of leading device manufacturers. Early adoption of new technologies further fuels market growth in this region.

Europe: A mature market with a strong presence of established healthcare systems. Growing awareness of the benefits of smart insulin technology is driving market expansion. Additionally, government initiatives and support programs for diabetes management play a significant role in Europe's smart insulin pen and pump market.

Asia Pacific: This region boasts the fastest growth rate due to a combination of factors. A rapidly rising diabetic population, particularly in countries like China and India, creates a significant demand for advanced diabetes management solutions. Furthermore, increasing healthcare expenditure in developing economies within this region paves the way for market expansion.

South America: This region presents a promising market with potential for future growth. While currently smaller compared to others, South America is experiencing rising diabetes diagnoses and a growing focus on improving healthcare infrastructure. As these trends continue, the market for smart insulin pens and pumps is expected to see a significant upswing.

Middle East and Africa: These regions represent emerging markets with immense potential. However, challenges like limited healthcare infrastructure and lower awareness of smart insulin technology currently impede growth. As these regions invest in healthcare development and raise diabetes awareness, the LAMEA market is expected to witness future expansion.

COVID-19 Impact Analysis on the Smart Insulin Pen and Pump Market:

The COVID-19 pandemic's impact on the smart insulin pen and pump market was a double-edged sword. Disrupted supply chains and a decrease in patient visits due to lockdown restrictions led to temporary shortages and potentially a decline in new prescriptions. Additionally, the economic downturn might have made patients more cost-conscious, delaying purchases of these expensive devices.

However, the pandemic also presented unforeseen opportunities. The rise of telehealth consultations offered a way to manage diabetes remotely, potentially increasing awareness and adoption of smart insulin pens and pumps that integrate with these platforms. Furthermore, the pandemic's emphasis on remote monitoring highlighted the value of data collection and monitoring features offered by these devices. Finally, the focus on hygiene during this time might have made some patients more receptive to the benefits of using smart insulin pens, which are generally more hygienic than traditional reusable syringes.

Overall, while the initial stages of the pandemic likely caused a temporary setback, the long-term impact is still being assessed. The potential advantages of remote monitoring, telehealth integration, and a growing focus on hygiene could lead to a resurgence in market growth in the post-pandemic era.

Latest Trends/ Developments:

The smart insulin pen and pump market is abuzz with exciting developments. Artificial intelligence is making its mark, with machine learning algorithms analyzing user data to recommend personalized insulin dosing and potentially revolutionize diabetes management. Closed-loop systems with continuous glucose monitoring are taking things a step further, mimicking a healthy pancreas by automatically delivering insulin based on real-time blood sugar levels. The future holds even more promise with self-learning algorithms that can adapt to individual needs over time. Additionally, seamless data sharing between devices is becoming a reality, allowing for a more comprehensive picture of a patient's health. But it's not just about technology; user experience is paramount. Manufacturers are focusing on user-friendly interfaces, sleek designs, and even voice control to improve patient adoption and adherence to therapy. Affordability remains a key concern, and the market is responding with the exploration of cost-effective solutions, innovative pricing models, and wider insurance coverage. Finally, telehealth integration is playing a growing role, allowing for remote monitoring, specialist consultations, and ongoing support, particularly for geographically dispersed patients. These trends paint a clear picture: the smart insulin pen and pump market is on a mission to deliver a future of personalized, automated, and effective diabetes management for millions.

Key Players:

- Medtronic

- Novo Nordisk

- Emperra GmbH

- Eli Lilly and Company

- Berlin-Chemie

- Bigfoot Biomedical

- Digital Medics Pty Ltd.

- Jiangsu Deflu Medical Device Co. Ltd.

- Pendiq

- Sanofi

Chapter 1. GLOBAL SMART INSULIN PEN AND PUMP MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL SMART INSULIN PEN AND PUMP MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL SMART INSULIN PEN AND PUMP MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL SMART INSULIN PEN AND PUMP MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL SMART INSULIN PEN AND PUMP MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL SMART INSULIN PEN AND PUMP MARKET– BY PRODUCT TYPE

6.1. Introduction/Key Findings

6.2. Smart Insulin Pens

6.3. Smart Insulin Pumps

6.4. Y-O-Y Growth trend Analysis By Product Type

6.5. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL SMART INSULIN PEN AND PUMP MARKET– BY USABILITY

7.1. Introduction/Key Findings

7.2. Pre-filled Pens

7.3. Reusable Pens

7.4. Y-O-Y Growth trend Analysis By USABILITY

7.5. Absolute $ Opportunity Analysis By USABILITY , 2024-2030

Chapter 8. GLOBAL SMART INSULIN PEN AND PUMP MARKET– BY End-Use

8.1. Introduction/Key Findings

8.2. Hospitals & Clinics

8.3. Ambulatory Surgical Centres

8.4. Home Care Settings

8.5. Y-O-Y Growth trend Analysis End-Use

8.6. Absolute $ Opportunity Analysis End-Use , 2024-2030

Chapter 9. GLOBAL SMART INSULIN PEN AND PUMP MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By USABILITY

9.1.3. By Product Type

9.1.4. By End-Use

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By USABILITY

9.2.3. By Product Type

9.2.4. By End-Use

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By USABILITY

9.3.3. By Product Type

9.3.4. By End-Use

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By USABILITY

9.4.3. By Product Type

9.4.4. By End-Use

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By USABILITY

9.5.3. By Product Type

9.5.4. By End-Use

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL SMART INSULIN PEN AND PUMP MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Medtronic

10.2. Novo Nordisk

10.3. Emperra GmbH

10.4. Eli Lilly and Company

10.5. Berlin-Chemie

10.6. Bigfoot Biomedical

10.7. Digital Medics Pty Ltd.

10.8. Jiangsu Deflu Medical Device Co. Ltd.

10.9. Pendiq

10.10. Sanofi

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Smart Insulin Pen and Pump Market was valued at USD 0.85 billion in 2023 and is projected to reach a market size of USD 1.7 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.4%.

Rising Diabetes Prevalence, Patient Empowerment, Technological Advancements, Improved Health Outcomes

Hospitals & Clinics, Ambulatory Surgical Centers, Home Care Settings.

North America holds the top spot in the Smart Insulin Pen and Pump Market due to high healthcare spending and early technology adoption

Medtronic, Novo Nordisk, Emperra GmbH, Eli Lilly and Company, Berlin-Chemie, Bigfoot Biomedical, Digital Medics Pty Ltd., Jiangsu Deflu Medical Device Co. Ltd., Pendiq, Sanofi.