Smart Food Processor Market Size (2024 – 2030)

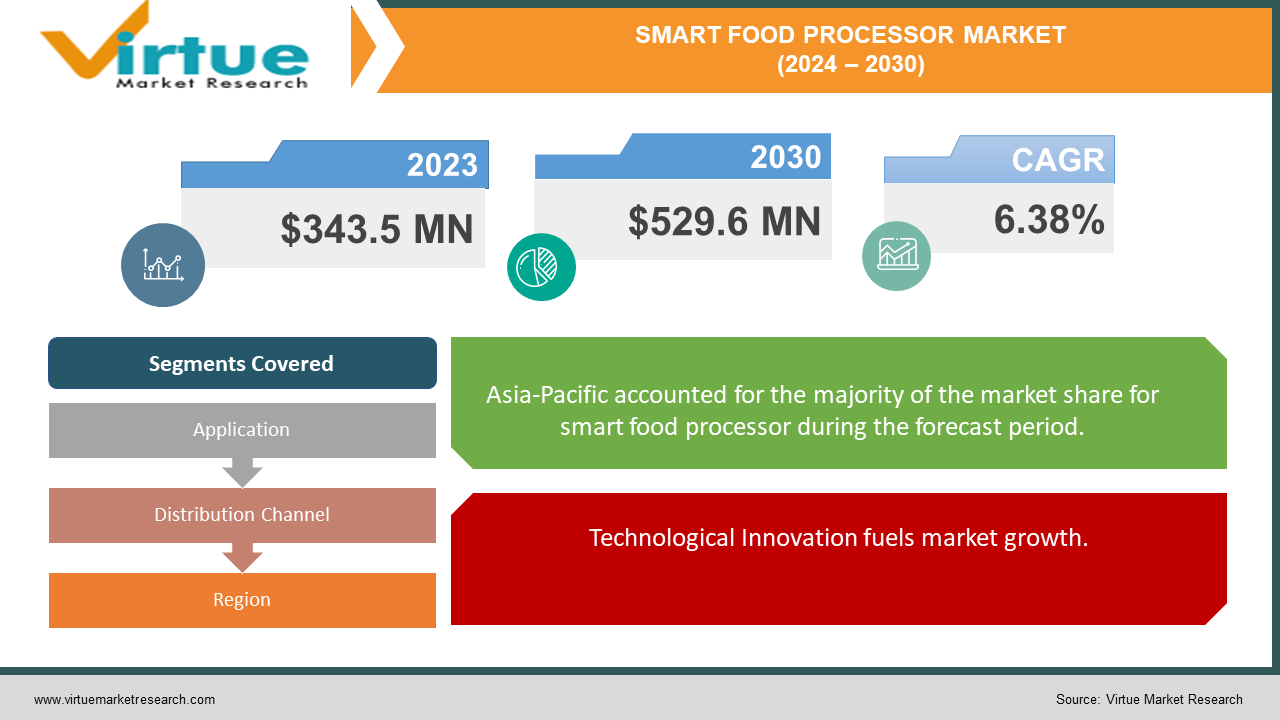

The Global Smart Food Processor Market was valued at USD 343.5 million in 2023 and is projected to reach a market size of USD 529.6 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.38%.

Smart Food Processors are revolutionizing kitchen work with their versatile features and smart designs. This state-of-the-art appliance incorporates the latest technology to make cooking easier and deliver an unparalleled cooking experience. It comes with many attachments and presets that make it easy to chop, slice, dice, puree, and blend ingredients with precision and speed. The intuitive interface and digital graphics provide a great user experience, making it easier for novice chefs to prepare meals. Plus, built-in sensors and smart algorithms optimize performance by adjusting position based on product density and texture, ensuring consistent results every time. Smart food processors also focus on safety with features such as automatic shut-off and overload protection. Its sleek, compact design saves valuable countertop space, while dishwasher-safe components simplify cleanup. Whether preparing everyday meals or elaborate feasts, this innovative appliance elevates kitchen efficiency, making cooking a delight for culinary enthusiasts of all skill levels.

Key Market Insights:

Asia-Pacific region has the largest and had almost USD 150 million of total market share in 2023 and is expected to show a CAGR of 8.18%.Manufacturers are focusing on integrating advanced technologies like artificial intelligence, machine learning, and IoT connectivity to enhance the functionality and efficiency of Smart Food Processors.Different regions exhibit unique market dynamics influenced by factors such as consumer preferences, economic conditions, and technological adoption rates.The market is highly competitive, with key players continuously innovating to gain a competitive edge through product differentiation, technological advancements, and strategic partnerships.

Smart Food Processor Market Drivers:

Technological Innovation fuels market growth.

The smart food processor market is mainly fueled by technological developments. Manufacturers continue to add new features such as touch screens, Wi-Fi connectivity, and voice control features to improve the user experience. Advanced sensors and algorithms help determine the exact product and adjust the position for best results. Additionally, integration with smart home systems strengthens convenience and usability by allowing users to control devices remotely.

Changing Consumer Lifestyles accelerate market growth.

Evolving consumer lifestyles, characterized by busy schedules and a growing emphasis on health and wellness, drive the demand for Smart Food Processors. This device offers a time-saving solution to meal preparation, allowing users to prepare nutritious meals quickly and easily. Additionally, features like portion control and recipes may appeal to health-conscious consumers looking for an easy way to eat healthily.

Growing Preference for Smart Kitchen Appliances will drive the Smart Food Processor market forward.

The growth of smart home devices is increasing the demand for smart food processors. Integration with other smart devices and virtual assistants makes it interactive and easy, allowing users to cook flawless meals. In addition, smart food communication with mobile applications provides remote monitoring and control, allowing users to control the cooking process from anywhere. As the smart home ecosystem continues to expand, smart food processors are becoming an important part of the connected kitchen, driving the growth of the sector.

Smart Food Processor Market Restraints and Challenges:

Data Privacy and Security Concerns restrain the market growth.

Smart food processors, like other connected devices, raise concerns about data privacy and security. Integration with Wi-Fi networks and mobile applications allows remote access and data storage, raising the risk of unauthorized access, deletion of information, or misuse of personal information. Manufacturers must prioritize robust data encryption, authentication protocols, and transparent privacy policies to mitigate these concerns and build trust among users. Additionally, educating customers on security best practices and offering data anonymity or opt-out options can alleviate apprehensions and increase trust in smart food.

High Initial Costs prove to be a challenge in the Smart Food Processor Market.

The biggest challenge hindering the widespread use of smart food processors is their higher initial cost compared to other kitchen appliances. The combination of advanced technology, sensors, and smart features increases production costs, resulting in higher sales prices. This price constraint may deter budget-conscious consumers from investing in smart food processors, especially when cheaper options are available. Manufacturers must develop strategies to reduce production costs or provide additional benefits to justify higher content and appeal to a wider range of consumers.

Complexity and Learning Curve hinder the market growth.

The sophisticated technology and multifunctionality of Smart Food Processors contribute to a steep learning curve for some consumers. Operating and optimizing these devices can take time and effort, especially for those who are less skilled or accustomed to traditional cooking techniques. Complex interfaces and intricate settings may intimidate potential buyers, leading to hesitation or reluctance to purchase. Manufacturers need to focus on user-friendly designs, intuitive interfaces, and comprehensive instructional resources to simplify usage and enhance user experience, thereby overcoming this challenge.

Smart Food Processor Market Opportunities:

Integration with AI and Machine Learning provides an opportunity for market players to establish their presence.

Smart food processors have the potential to support advances in artificial intelligence (AI) and Machine Learning technology. Thanks to the integration of artificial intelligence algorithms, these devices can analyze user preferences, cooking habits, and product combinations to offer personalized recipe suggestions and cooking recommendations. Machine learning capabilities can improve recipe design, adjust fulfillment processes, and adapt to customer preferences over time. This opportunity not only improves the user experience but also strengthens trust in the brand by providing solutions that meet the changing needs of customers.

Expansion of IoT Ecosystem – an opportunity to be more profitable in the market.

The Internet of Things (IoT) presents a vast opportunity for Smart Food Processors to become central components of interconnected kitchen ecosystems. By integrating seamlessly with other smart devices such as refrigerators, ovens, and grocery management systems, Smart Food Processors can automate meal planning, inventory management, and cooking processes. Collaboration with voice assistants and smart home devices increases customer convenience and usability by enabling voice control and remote monitoring. Developers can use partnerships and collaboration to expand IoT ecosystems and create smart solutions in the kitchen that cater to the connected lifestyle of modern consumers.

Market Penetration in Emerging Economies provides limitless opportunities.

The global smart food processor market has the potential to grow in new markets where rising disposable incomes, urbanization, and changing consumer lifestyles drive demand for convenient kitchen appliances. Offering entry-level smart food processor models that align with consumers' preferences and purchasing power in new markets can drive adoption and drive business growth. Additionally, adapting product features to accommodate regional cuisines, cooking techniques, and ingredients can increase suitability and appeal across different cultures, thus promoting market penetration and brand recognition.

SMART FOOD PROCESSOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.38% |

|

Segments Covered |

By Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Krones AG, Buhler, Meyer Industries, AFE Group Ltd., Tomra Systems, Atlas Pacific Engineering Company Inc., National Refractories, Heat and Control, Inc., ZIEMANN HOLVRIEKA, B.K Engineers |

Smart Food Processor Market Segmentation - by Application

-

Beverages

-

Dairy

-

Meat & Poultry

-

Bakery

-

Convenience Food & Snacks

-

Fruits & Vegetables

-

Confectionery

-

Others

In 2023, based on the Application, Beverages hold the largest market share with over 25% of the market. As people become more conscious about health and wellness, the demand for healthy beverages such as smoothies, juices, and plant-based drinks is also increasing. Smart food processors that include blending and juicing can solve this need by allowing customers to prepare their drinks at home. The rising demand for smoothies and juice bars has surged in recent years, driven by users seeking convenient and nutritious on-the-go beverage options. Smart Food Processors play a significant role in these establishments, enabling efficient blending and juicing of fresh ingredients to create custom beverages. Smart Food Processors with beverage options extend to coffee and tea brewing. With the increase in home brewing culture, users are investing in appliances that offer features like coffee grinding, espresso extraction, and tea steeping, improving the quality and convenience of homemade drinks. Beverages often play a significant role in health and fitness routines, with users incorporating protein shakes, smoothies, and hydrating drinks into their daily lives. Smart Food Processors with features for portion control, nutrient extraction, and recipe recommendations align with health-conscious consumer trends.

Smart Food Processor Market Segmentation - by Distribution Channel

-

Online Retailers

-

Brick-and-Mortar Retailers

-

Direct-to-consumer (DTC) Sales

-

Other Channels

In 2023, based on the Distribution Channel, Online Retailers hold a significant portion of the market share and are expected to grow at an 8.27% CAGR during the forecast period. Online retailers offer users unparalleled convenience and accessibility, allowing them to search, compare, and purchase Smart Food Processor models from the comfort of their homes or on-the-go using mobile devices. The widespread availability of online platforms enables users to access a vast variety of devices from anywhere with an internet connection. Online retailers offer numerous delivery options, including home delivery, express shipping, and in-store pickup, providing users with convenience and flexibility in purchasing their Smart Food Processor. Expedited shipping options ensure timely delivery, while click-and-collect services allow users to retrieve their orders at particular pickup locations. Online retailers often feature customer reviews and ratings for Smart Food Processor devices, enabling consumers to make smart purchasing decisions based on the experiences of other users. Additionally, online platforms may provide customized product recommendations and curated lists to help users discover new and trendy models.

Smart Food Processor Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023 based on Region, Asia-Pacific has the largest market share, with over 42% market share. The Asia-Pacific region includes many markets such as China, Japan, South Korea, India, and Southeast Asian countries, where rapid growth, increasing income waste, and changing eating habits are fueling the growth of smart food. Countries such as Japan and South Korea are known for their technologies and innovations in the field of electronics. Smart kitchen appliances, including smart foods, are popular with consumers in these markets who use technology that is convenient and efficient in cooking. The Asia-Pacific region is home to a variety of cuisines and cooking styles, from stir-fries and curries to sushi and dim sum. Smart food processors with multifunctional functions can meet the different cooking needs and preferences of customers in different countries and cultures in the region.

COVID-19 Impact Analysis on the Global Smart Food Processor Market:

The COVID-19 pandemic has had a significant impact on the Global Smart Food Processors Market, creating both challenges and opportunities. Initially, quarantines and restrictions disrupted the supply chain, resulting in production slowdowns and material shortages. As the economy is uncertain, consumers are spending less on discretionary items, affecting demand for Smart Food Processors. But as people spend more time at home, there is also an increase in home cooking and meal preparation, increasing the need for Smart Food Processors as well as other smart kitchen appliances. Manufacturers responded by emphasizing features like remote operation, meal planning, and sanitation to meet evolving consumer needs. As consumers turn to online shopping, e-commerce platforms are becoming increasingly important for sales. Despite initial setbacks, the market is expected to recover and grow as consumers continue to value convenience, health, and technology in the kitchen.

Latest Trends/ Developments:

The Global Smart Food Processor Market is seeing many trends and developments shaping its course. One of the most important of these is the integration of technologies such as artificial intelligence (AI), machine learning, and Internet of Things (IoT) connectivity into smart food processors. These technologies help improve automation, recipe optimization, and self-service cooking. Another point to note is the focus on sustainability and safety, as companies offer energy-saving models and use environmentally friendly materials in production. There is also an increasing demand for smart food processors with functions ranging from cutting, mixing, cooking, and preparation. Personalization and customization features are also becoming increasingly popular, allowing users to customize settings and recipes to their preferences. Overall, these trends reflect changing consumer preferences for comfort, performance, and durability in kitchen appliances.

Key Players:

-

Krones AG

-

Buhler

-

Meyer Industries

-

AFE Group Ltd.

-

Tomra Systems

-

Atlas Pacific Engineering Company Inc.

-

National Refractories

-

Heat and Control, Inc.

-

ZIEMANN HOLVRIEKA

-

B.K Engineers

Chapter 1. Smart Food Processor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Food Processor Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Food Processor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Food Processor Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Food Processor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Food Processor Market – By Application

6.1 Introduction/Key Findings

6.2 Beverages

6.3 Dairy

6.4 Meat & Poultry

6.5 Bakery

6.6 Convenience Food & Snacks

6.7 Fruits & Vegetables

6.8 Confectionery

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Application

6.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Smart Food Processor Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online Retailers

7.3 Brick-and-Mortar Retailers

7.4 Direct-to-consumer (DTC) Sales

7.5 Other Channels

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Smart Food Processor Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Smart Food Processor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Krones AG

9.2 Buhler

9.3 Meyer Industries

9.4 AFE Group Ltd.

9.5 Tomra Systems

9.6 Atlas Pacific Engineering Company Inc.

9.7 National Refractories

9.8 Heat and Control, Inc.

9.9 ZIEMANN HOLVRIEKA

9.10 B.K Engineers

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Smart Food Processor Market was valued at USD 343.5 million in 2023 and is projected to reach a market size of USD 529.6 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.38%.

The segments under the Global Smart Food Processor Market by Application are Beverages, Dairy, Meat & Poultry, Bakery, Convenience Food & Snacks, Fruits & Vegetables, Confectionery, and Others.

Asia-Pacific is the dominant region in the Global Smart Food Processor Market.

Krones AG, Buhler, Meyer Industries, AFE Group Ltd., Tomra Systems, etc.

The COVID-19 pandemic has had a significant impact on the Global Smart Food Processors Market, creating both challenges and opportunities. Initially, quarantines and restrictions disrupted the supply chain, resulting in production slowdowns and material shortages. As the economy is uncertain, consumers are spending less on discretionary items, affecting demand for Smart Food Processors.