Global Smart Devices Market Size (2023 - 2030)

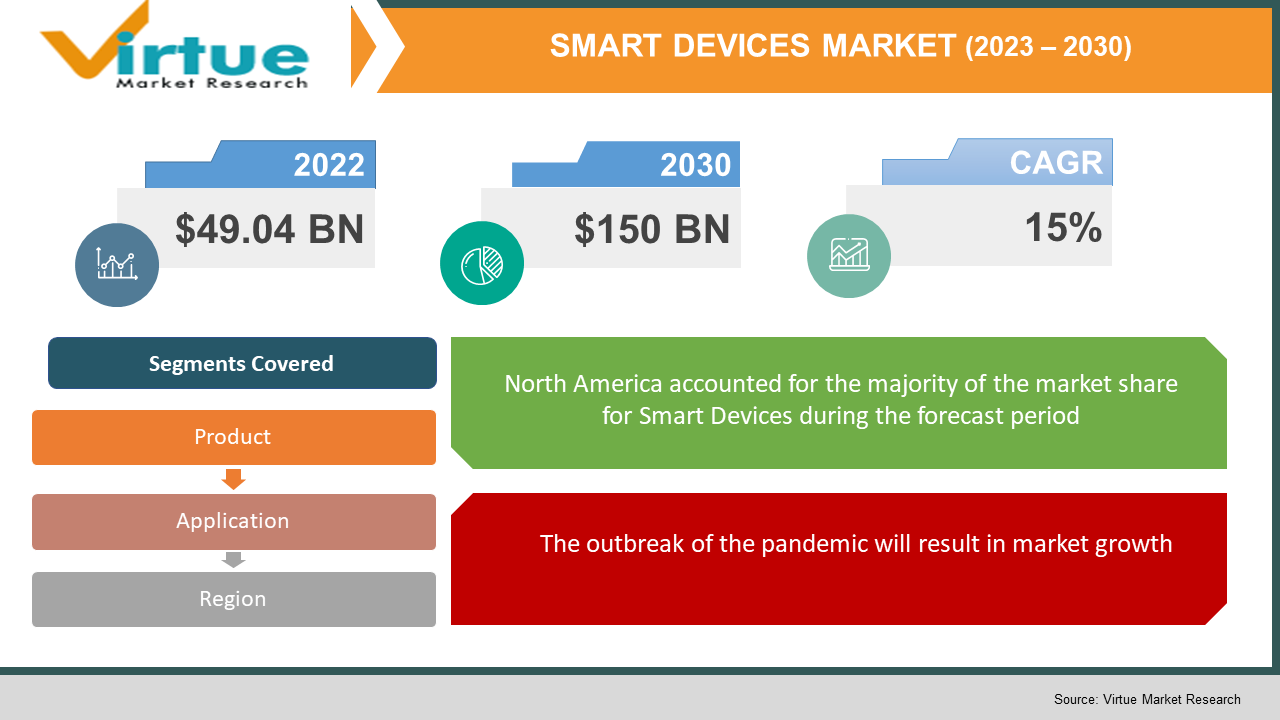

According to our research report, the global smart devices market was valued at $49.04 billion in 2022, and is projected to reach a market size of $150 billion by 2030. The market is projected to grow with a CAGR of 15% per annum during the period of analysis.

Industry Overview

Smart gadgets are devices that perform a variety of intelligent purposes such as health monitoring, people tracking, driving instructions, and so on. Aside from smart TVs, the majority of these wearable gadgets may be worn on the eyes, wrist, ankles, and so on. The research examines the market's present and future development potential. The majority of the goods are in the research and development or pre-commercialization stages, and the study forecasts future market estimates based on some assumptions. Because the majority of the goods are wearable gadgets, firms must seek government clearance before selling them on the market. The research discusses the effects of government regulation on market growth. The report examines such significant prospects so that businesses may design their strategy to capitalize on them.

Smart gadgets have improved characteristics such as optimal display, in-house health monitoring, and so on. Because these sophisticated features are gaining customer attention these gadgets, are a major driver of industry growth. Furthermore, ownership of these smart gadgets is regarded as a status symbol, which motivates people to purchase these items. Another significant driver of market expansion is the development of numerous goods that can fulfill several activities. Google, for example, is creating smart contact lenses for monitoring blood glucose levels and hopes to incorporate additional capabilities such as blood pressure monitoring. However, the cost of the items is now relatively high when compared to traditional devices, which is the primary market limitation.

Impact of Covid-19 on the Industry

The spread of COVID-19 has also increased the usage of indirect sales channels in the smart home sector. People have begun to use online mode more regularly as a result of lockdowns in many places throughout the world. During the epidemic, the need for internet outlets has skyrocketed. Companies provide product setup and installation services, allowing customers to buy things online with confidence. Furthermore, third-party delivery services have begun to take extra safeguards to encourage consumers to buy without fear of becoming infected. As a result, the internet sales channel sector is predicted to expand throughout the projection period.

Market Drivers

The outbreak of the pandemic will result in market growth

The smart appliances market for residential end-users is expected to develop throughout the projected period in the post-COVID-19 situation. The COVID-19 pandemic has had an impact on both the good and bad aspects of the smart appliances industry. The COVID-19 epidemic has raised the demand for smart equipment such as refrigerators and washing machines. Following the virus's spread, the bulk of the population is working from home; hence, spending more time at home necessitates a huge number of appliances that can execute chores more effectively than previous techniques.

Technological Advancement in smart home devices to drive the market growth

As a result of fast technology breakthroughs, consumer tastes are changing. They anticipate more groundbreaking smart technologies as their level of living improves. As a result, manufacturers are motivated to invest in cutting-edge and creative technologies to broaden their product offering and customize it to consumer demands. Millennials, as a consumer demographic, have a significant impact on current market trends. This epoch has also given rise to a different set of expectations and goals among millennials. They are more eager to learn and embrace new things, which is why they are more linked to the digital world.

For example, smart household gadgets like temperature control mugs have specific advantages that contribute to their popularity. Against this backdrop, manufacturers are considering incorporating sophisticated technology into their goods, offering opportunities for further market penetration of smart home devices in the future years.

Market Restraints

High cost is associated with smart devices

The most significant issue, drawback, or disadvantage of a smart home system is the cost. Several firms provide smart home systems, but they are all fairly pricey. This is something only a few people can afford. You should have enough money and income to deploy this system. It will be pricey at first but will save money in the long run.

Concern over data privacy

The majority of smart devices are dependent on the internet. Without a good and strong internet connection, you will not be able to take control of this. If there is no internet connection for some reason, there is no other way through which you can access and control your system. This increases the risk of hacking such devices. Many smart home device owners in the US have reported getting hacked into their home CCTV cameras by an outsider which is a serious threat to their privacy.

SMART DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung Electronics Co. Ltd., Apple Inc., Google Inc., Pebble Technology Corporation, Mayo Clinic, Adafruit, Sony Corporation, Panasonic Corporation, Vuzix, General Electric Co. (GE) |

This research report on the global smart devices market has been segmented and sub-segmented based on, Geography & region.

Global Smart Devices Market- By Product

- Smartwatches

- Smart TV

- Google Glass

- GPS jacket

- Wireless accelerometer

- Smart Socks

- GPS Smart Shoes

- Others

In 2020, the wrist-wear category led the market, accounting for more than 48.9 percent of the market share. A fitness wristwatch or band can be combined with a mobile application to provide the user with important fitness-related information and data. GOQii, Apple, Xiaomi, Fitbit, and Nike are among the main wrist-wear manufacturers for sports and fitness applications. The watches and wristbands industry faced a setback in the first half of 2020 as prominent Chinese manufacturing businesses grappled with workforce constraints and inadequate raw material availability. The market had a minor comeback in the second half of 2020 as manufacturing units began to operate. The growing use of smartwatches and fitness trackers in the healthcare business is projected to drive category development in the coming years.

From 2021 to 2028, the eyewear and headwear product sector is expected to grow at a 14.2 percent CAGR. Goggles such as Microsoft HoloLens, VISR Goggles, and Google Glass are examples of eye-wear products. Over the projected period, head-mounted display devices are expected to increase significantly. In addition, improvements in augmented reality (AR) and virtual reality (VR) are gaining popularity in the healthcare sector. In medical practice, virtual reality technologies and headsets are utilized to aid surgical training and operations. This helps them reduce the possibility of mistakes during surgery.

Global Smart Devices Market- By Application

- Home Security

- Consumer Electronics

- Healthcare

- Enterprise & Industrial Application

- Others

The market is divided into applications such as healthcare, corporate and industrial applications, consumer electronics, and others. In 2020, the consumer electronics application category will account for more than 48.4 percent of worldwide sales. Fitness and sports, clothing and fashion, multifunction, infotainment and multimedia, and other uses are all possible with consumer electronics. Given the increased consumer demand for wearable consumer electronics, industry participants are concentrating on creating gadgets that can keep end-users tracking their work hours. Furthermore, the rise in connected devices and expanding machine-to-machine communication are likely to drive the expansion of wearable consumer electronics, consequently promoting the market growth.

Global Smart Devices Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In 2020, North America led, accounting for more than 34.7 percent of worldwide sales. The region is home to a huge number of internet users as well as various organizations linked with technical advancements, including Alphabet, Garmin Ltd., and Apple Inc. Furthermore, numerous industry participants are taking steps to broaden their regional footprint and improve their company processes. For example, Xiaomi Corporation announced its entry into the North American market in May 2017. During the projected period, this is likely to strengthen the market for wearable technology.

Furthermore, the Asia Pacific wearable technology market is expected to develop rapidly due to rising buying power, a growing number of tech-savvy individuals, and the presence of numerous significant industry competitors in the area. Several industry participants are also expected to relocate their manufacturing services to the Asia Pacific due to lower operating and labor expenses. Furthermore, the region’s growing urban population is likely to contribute to the use of wearable devices, fueling market expansion.

Global Smart Devices Market- By Companies

- Samsung Electronics Co. Ltd.

- Apple Inc.

- Google Inc.

- Pebble Technology Corporation

- Mayo Clinic

- Adafruit

- Sony Corporation

- Panasonic Corporation

- Vuzix

- General Electric Co. (GE)

NOTABLE HAPPENINGS IN THE GLOBAL SMART DEVICES MARKET IN THE RECENT PAST:

- Product Launch: - In 2021, Apple. Inc launched the 7th edition of its smartwatch called iWatch series 7. This smartwatch has many features such as phone calls, GPS trackers, health trackers, etc.

- Product Launch: - In 2022, Samsung launched its galaxy watch 5 which is a smartwatch with various features.

- Product Launch: - In 2021, Xiaomi launched its first smart glasses which have the capability of clicking pictures and displaying messages on the glasses.

Chapter 1. GLOBAL SMART DEVICES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL SMART DEVICES MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL SMART DEVICES MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL SMART DEVICES MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL SMART DEVICES MARKET Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL SMART DEVICES MARKET – By Product

6.1. Smartwatches

6.2. Smart TV

6.3. Google Glass

6.4. GPS jacket

6.5. Wireless accelerometer

6.6. Smart Socks

6.7. GPS Smart Shoes

6.8. Others

Chapter 7. GLOBAL SMART DEVICES MARKET – By Application

7.1. Home Security

7.2. Consumer Electronics

7.3. Healthcare

7.4. Enterprise & Industrial Application

7.5. Others

Chapter 8. GLOBAL SMART DEVICES MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East and Africa

Chapter 9. GLOBAL SMART DEVICES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Samsung Electronics Co. Ltd.

9.2. Apple Inc.

9.3. Google Inc.

9.4. Pebble Technology Corporation

9.5. Mayo Clinic

9.6. Adafruit

9.7. Sony Corporation

9.8. Panasonic Corporation

9.9. Vuzix

9.10. General Electric Co. (GE)

9.11. Fortinet

Download Sample

Choose License Type

2500

4250

5250

6900