Smart Contracts Market Size (2025 – 2030)

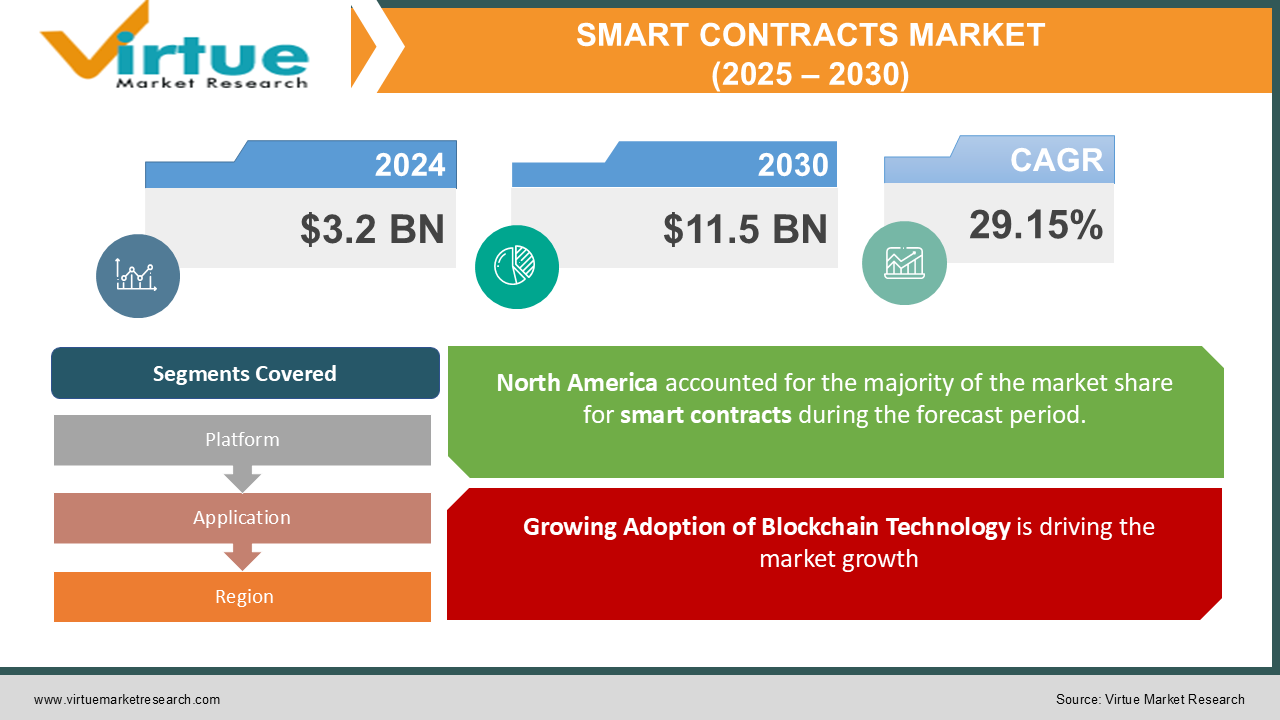

The Global Smart Contracts Market was valued at USD 3.2 billion in 2024 and is projected to reach USD 11.5 billion by 2030, growing at a CAGR of 29.15% during the forecast period.

Smart contracts are self-executing digital agreements stored on a blockchain, facilitating transactions without intermediaries. The increasing adoption of blockchain technology in sectors such as banking, finance, supply chain, real estate, and healthcare is a significant driver of market growth. Additionally, the rising need for automation, transparency, and security in contractual processes is further fueling demand. Ethereum remains the dominant platform for smart contracts, though emerging technologies like Hyperledger and Tezos are gaining traction.

Key Market Insights

-

Ethereum remains the leading platform, holding over 55% of the smart contracts market share in 2024.

-

The banking & finance sector dominates, accounting for 38% of total market revenue due to widespread adoption in DeFi (Decentralized Finance) applications.

-

Supply chain management is the fastest-growing application, projected to grow at a CAGR of 27%, driven by demand for real-time tracking and automated compliance.

-

Asia-Pacific is the fastest-growing region, fueled by rapid digital transformation and increasing investments in blockchain solutions.

-

Rising concerns over security vulnerabilities in smart contract execution are prompting increased focus on audit tools and formal verification techniques.

Global Smart Contracts Market Drivers

1. Growing Adoption of Blockchain Technology is driving the market growth

The widespread adoption of blockchain-based applications across multiple industries is a major factor driving smart contract demand. Businesses are leveraging blockchain to enhance security, reduce transaction costs, and automate processes without intermediaries. Sectors such as banking, supply chain, and real estate are increasingly integrating smart contracts to streamline transactions, prevent fraud, and ensure contract enforcement without disputes.

Additionally, governments worldwide are investing in blockchain research and development, further encouraging the implementation of smart contracts in digital identity verification, voting systems, and public records management.

2. Rising Popularity of Decentralized Finance (DeFi) is driving the market growth

Smart contracts are the backbone of DeFi applications, allowing users to conduct automated financial transactions without traditional banking intermediaries. The exponential growth in DeFi platforms has led to increased demand for self-executing financial agreements that facilitate lending, borrowing, and trading securely on blockchain networks.

Furthermore, the tokenization of assets, including real estate, stocks, and commodities, is gaining momentum, further driving the adoption of programmable smart contracts for asset transfers and fractional ownership.

3. Increased Demand for Transparency and Security is driving the market growth

One of the key advantages of smart contracts is their ability to enhance security and reduce fraud. Unlike traditional contracts, smart contracts are stored on a tamper-proof blockchain ledger, ensuring immutability and transparency. Companies dealing with sensitive financial transactions, intellectual property, and legal agreements are increasingly turning to smart contracts to prevent document tampering and unauthorized modifications.

The growing need for compliance automation in finance, healthcare, and logistics is also driving market growth, as smart contracts provide an automated and verifiable method for executing agreements.

Global Smart Contracts Market Challenges and Restraints

1. Security Vulnerabilities and Hacking Risks is restricting the market growth

Despite their advantages, smart contracts are vulnerable to exploitation through coding flaws and cyberattacks. The DAO hack of 2016 and other DeFi-related security breaches have raised concerns about the reliability of smart contracts, leading organizations to invest in security audits, formal verification, and bug bounty programs.

The absence of standardized security protocols in smart contract development increases the risk of flawed implementations, which can result in financial losses and reputational damage.

2. Legal and Regulatory Uncertainty is restricting the market growth

The lack of clear regulations surrounding smart contracts poses a challenge to widespread adoption. Many jurisdictions have yet to define the legal status of smart contracts, making enforcement in courtrooms and regulatory frameworks complex.

Additionally, compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations remains a concern, particularly in DeFi and cryptocurrency-related applications. Governments worldwide are working towards establishing regulatory frameworks, but differences in global laws continue to create challenges for cross-border smart contract execution.

Market Opportunities

The Global Smart Contracts Market presents significant growth opportunities, primarily driven by technological advancements, enterprise adoption, and regulatory improvements. The integration of AI with smart contracts is an emerging trend that enhances contract efficiency, risk assessment, and automated dispute resolution. AI-driven self-learning contracts can adapt to changing business conditions, reducing the need for manual intervention. Moreover, enterprise adoption of private and hybrid blockchain solutions is increasing. Businesses are exploring permissioned smart contracts that combine the security of blockchain with controlled access, ensuring compliance with corporate policies and regulatory requirements. Another growth avenue lies in the real-world application of smart contracts in IoT (Internet of Things). IoT-enabled smart contracts can automate machine-to-machine transactions, enabling autonomous supply chain management, predictive maintenance, and connected device payments. As governments introduce clear regulations and security protocols improve, enterprises will have more confidence in adopting blockchain-based smart contracts, leading to accelerated market expansion.

SMART CONTRACTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

29.15% |

|

Segments Covered |

By Platform, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM Corporation, Ethereum Foundation, Hyperledger (Linux Foundation), Tezos Foundation, Chainlink Labs, Oracle Corporation, Microsoft Corporation, R3 Corda, Avalanche Foundation, Algorand Inc. |

Smart Contracts Market Segmentation - By Platform

-

Ethereum

-

Hyperledger

-

Tezos

-

Others

Ethereum has solidified its position as the dominant platform in the smart contracts market. This dominance can be attributed to a confluence of factors, including its robust ecosystem, developer-friendly architecture, and widespread adoption, particularly within the burgeoning decentralized finance (DeFi) sector. Ethereum's ecosystem is a vibrant and expansive network comprising a vast community of developers, users, and businesses. This active community contributes to the continuous improvement and innovation of the platform, fostering the development of new tools, libraries, and applications. The availability of extensive documentation and learning resources makes Ethereum relatively accessible to developers, lowering the barrier to entry for building decentralized applications (dApps). Its developer-friendly architecture, with its support for the Solidity programming language, simplifies the process of writing and deploying smart contracts. Solidity's syntax and structure are familiar to many programmers, facilitating faster development cycles and making it easier to find skilled developers. Ethereum's widespread adoption in DeFi applications has further cemented its market leadership. DeFi platforms, built on top of Ethereum, offer a range of decentralized financial services, including lending, borrowing, and trading, without the need for traditional intermediaries. The transparency and security offered by Ethereum's blockchain make it an ideal platform for these applications. The introduction of Ethereum 2.0 represents a significant upgrade to the platform, aimed at enhancing scalability and reducing transaction costs. Ethereum 2.0 introduces sharding, a technique that splits the blockchain into smaller, more manageable pieces, allowing for parallel processing of transactions. This significantly increases the network's capacity and reduces transaction times. Furthermore, Ethereum 2.0 transitions to a proof-of-stake consensus mechanism, which is more energy-efficient and environmentally friendly than the previous proof-of-work system. These improvements are making Ethereum an even more attractive platform for businesses and developers, solidifying its position as the preferred choice for building and deploying smart contracts. As the demand for decentralized applications continues to grow, Ethereum's robust ecosystem, developer-friendly architecture, and ongoing improvements position it for continued dominance in the smart contracts market.

Smart Contracts Market Segmentation - By Application

-

Banking & Finance

-

Supply Chain Management

-

Government

-

Healthcare

-

Real Estate

-

Others

The banking and finance sector currently dominates the blockchain technology market. This leading position is largely attributed to the transformative potential of smart contracts within this industry. Smart contracts, self-executing contracts with the terms directly written into code, are revolutionizing core financial processes. They streamline payments by automating the transfer of funds upon fulfillment of pre-defined conditions, reducing processing time and minimizing the risk of errors. Settlements, which traditionally involve complex and time-consuming reconciliation processes, are also being significantly improved by smart contracts. The automated and transparent nature of these contracts enables faster and more efficient settlement, reducing counterparty risk and freeing up capital. Loan processing is another area where smart contracts are making a significant impact. By automating the loan approval process and disbursement of funds, they reduce administrative overhead and accelerate access to credit. Furthermore, the immutability of blockchain records enhances transparency and security in financial transactions, reducing the potential for fraud and manipulation. While the banking and finance sector currently leads the market, supply chain management is emerging as the fastest-growing segment within the blockchain technology landscape. The increasing complexity of global supply chains and the need for greater transparency and traceability are driving the adoption of blockchain solutions in this sector. Blockchain technology enables automated tracking of goods and materials throughout the supply chain, from origin to delivery. This granular visibility provides businesses with real-time insights into inventory levels, shipment status, and potential disruptions. Furthermore, blockchain facilitates compliance by creating an immutable record of all transactions and interactions within the supply chain, simplifying audits and ensuring adherence to regulatory requirements. In procurement, blockchain streamlines the process by automating contract execution, payment processing, and supplier verification. This reduces administrative costs, improves efficiency, and mitigates the risk of fraud. As businesses increasingly recognize the benefits of blockchain technology in enhancing transparency, efficiency, and security within their supply chains, this segment is expected to experience substantial growth in the coming years.

Smart Contracts Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the smart contracts market, holding 40% of global revenue, thanks to early blockchain adoption, strong regulatory frameworks, and widespread use in banking and finance. The U.S. leads in smart contract development, with major financial institutions and enterprises integrating blockchain solutions. Meanwhile, Asia-Pacific is the fastest-growing region, projected to expand at a CAGR of 28% due to rapid digital transformation, increasing investment in blockchain startups, and government-led initiatives in China, India, and Singapore. The region’s focus on financial inclusion and supply chain digitization is fueling smart contract adoption across industries.

COVID-19 Impact Analysis

The COVID-19 pandemic accelerated the adoption of digital and automated solutions, driving interest in blockchain-based smart contracts. Businesses faced contract disputes and inefficiencies, prompting a shift toward self-executing agreements that ensure transparency and reliability. Industries like healthcare, supply chain, and financial services saw increased demand for blockchain solutions to enhance operational efficiency, reduce fraud, and improve remote transaction execution. The post-pandemic landscape continues to favor automation and digitalization, ensuring sustained market growth.

Latest Trends/Developments

The smart contracts market is witnessing a wave of technological advancements and increased enterprise adoption. The integration of AI in smart contracts is enhancing contract automation, fraud detection, and compliance monitoring. AI-driven self-adapting contracts are capable of modifying terms based on real-time data, improving efficiency and accuracy. Additionally, layer-2 scaling solutions like rollups and sidechains are addressing Ethereum’s congestion issues, reducing gas fees and transaction delays. Enterprises are exploring private and hybrid blockchain solutions, ensuring better control and regulatory compliance while maintaining blockchain’s security benefits. Furthermore, NFT-based smart contracts are revolutionizing digital asset ownership, intellectual property rights, and content monetization. As the market evolves, regulatory advancements and security improvements will drive widespread adoption across multiple industries.

Key Players

-

IBM Corporation

-

Ethereum Foundation

-

Hyperledger (Linux Foundation)

-

Tezos Foundation

-

Chainlink Labs

-

Oracle Corporation

-

Microsoft Corporation

-

R3 Corda

-

Avalanche Foundation

-

Algorand Inc.

Chapter 1. Smart Contracts Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Contracts Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Contracts Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Contracts Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Contracts Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Contracts Market – By Platform

6.1 Introduction/Key Findings

6.2 Ethereum

6.3 Hyperledger

6.4 Tezos

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Platform

6.7 Absolute $ Opportunity Analysis By Platform, 2025-2030

Chapter 7. Smart Contracts Market – By Application

7.1 Introduction/Key Findings

7.2 Banking & Finance

7.3 Supply Chain Management

7.4 Government

7.5 Healthcare

7.6 Real Estate

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Smart Contracts Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Platform

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Platform

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Platform

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Platform

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Platform

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Smart Contracts Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 IBM Corporation

9.2 Ethereum Foundation

9.3 Hyperledger (Linux Foundation)

9.4 Tezos Foundation

9.5 Chainlink Labs

9.6 Oracle Corporation

9.7 Microsoft Corporation

9.8 R3 Corda

9.9 Avalanche Foundation

9.10 Algorand Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 3.2 billion in 2024 and is projected to reach USD 11.5 billion by 2030, growing at a CAGR of 29.15%.

Key drivers include the growing adoption of blockchain, DeFi expansion, and increasing demand for automation and transparency.

The market is segmented by Platform (Ethereum, Hyperledger, Tezos, Others) and Application (Banking & Finance, Supply Chain Management, Government, Healthcare, Real Estate, Others).

North America leads the market with a 40% share, driven by early blockchain adoption, strong regulatory frameworks, and extensive use in banking and finance.

Key players include IBM Corporation, Ethereum Foundation, Hyperledger, Tezos Foundation, Chainlink Labs, Oracle Corporation, Microsoft Corporation, R3 Corda, Avalanche Foundation, and Algorand Inc..