Smart Betting Market Size (2025 – 2030)

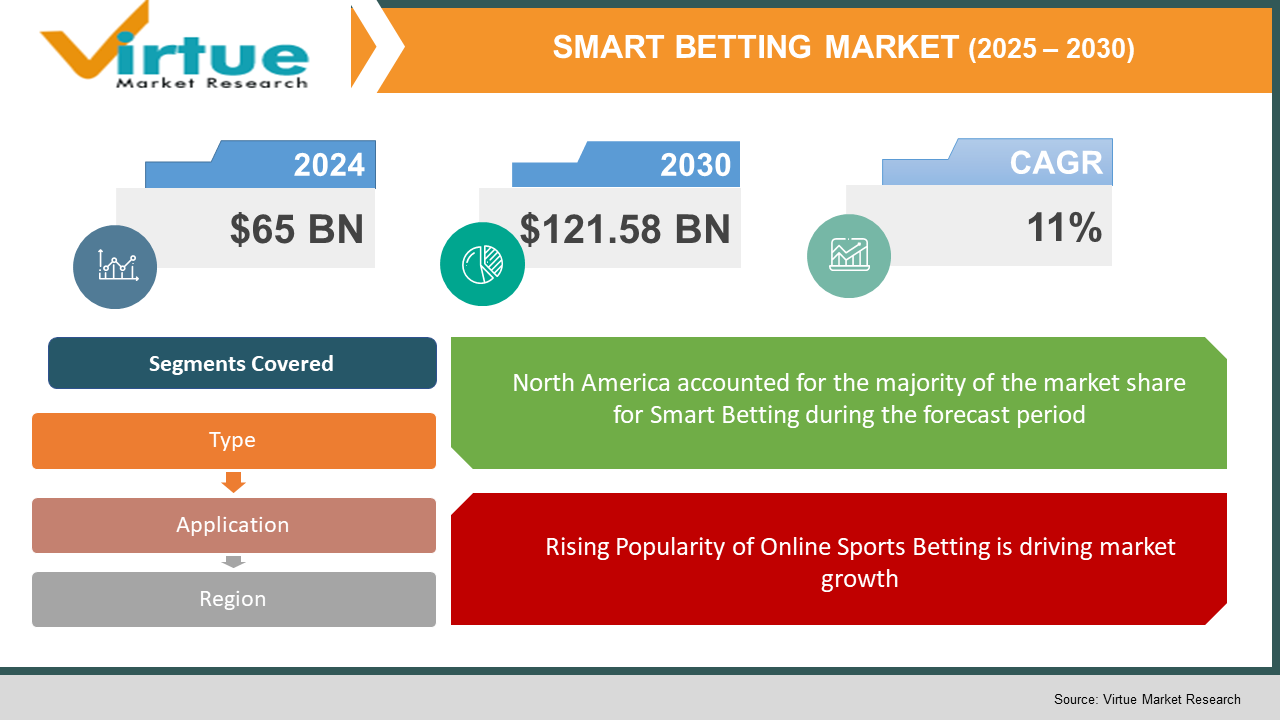

The Global Smart Betting Market was valued at USD 65 billion in 2024 and is projected to grow at a CAGR of 11% from 2025 to 2030. The market is expected to reach USD 121.58 billion by 2030.

The Smart Betting Market refers to the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Big Data Analytics in betting platforms to provide predictive analysis, real-time odds, and personalized betting experiences. The market is expanding rapidly due to growing interest in online sports betting, rising digital adoption, and an increasing number of players engaging in gambling as a form of entertainment. Enhanced user interfaces and secure payment systems further drive the market growth.

Key Market Insights

- The online segment accounts for over 70% of the total revenue, as smart betting platforms leverage AI algorithms to analyze historical data and provide accurate predictions.

- Growth in the use of blockchain technology in betting platforms ensures transparency, secure transactions, and reduced fraud, attracting tech-savvy users.

- In 2024, the Asia-Pacific region witnessed a 15% growth in online sports betting platforms due to increased smartphone penetration and access to high-speed internet.

- Live in-play betting contributed to over 35% of the market share as bettors increasingly prefer real-time engagement with games and events.

- AI and ML-powered algorithms can predict outcomes with up to 85% accuracy, appealing to data-driven bettors.

- The legal landscape is gradually becoming more favorable, with countries like the US and Canada legalizing sports betting, boosting market opportunities.

- E-sports betting emerged as a fast-growing segment, registering a CAGR of 18%, driven by rising interest in competitive gaming and streaming platforms.

- The use of mobile apps for betting rose by 25% in 2024, with 60% of users opting for mobile-friendly platforms.

Global Smart Betting Market Drivers

Technological Advancements in Betting Platforms is driving market growth:

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in betting platforms has revolutionized the way users engage with betting systems. These technologies allow for predictive analytics, personalized suggestions, and enhanced user experiences. Big Data Analytics processes vast datasets, enabling platforms to offer accurate odds and detailed performance metrics. Additionally, blockchain technology enhances transparency and security, building trust among users. With real-time insights and automated betting features, technology has made smart betting platforms increasingly appealing. As more betting companies adopt cutting-edge tools, the market is expected to grow further, driven by continuous innovation and user-centric developments.

Rising Popularity of Online Sports Betting is driving market growth:

Online sports betting has gained immense traction, particularly due to the convenience and accessibility it offers. With an estimated 4.5 billion sports fans globally, the potential for engagement is enormous. Smart betting platforms allow users to place bets remotely, often offering features like live streaming, in-play betting, and instant withdrawals. The global pandemic further accelerated the transition to online platforms, as physical betting venues experienced restrictions. Governments in various regions are also legalizing online sports betting, fostering a favorable environment for growth. The increasing penetration of smartphones and internet connectivity continues to fuel the sector’s expansion.

Growth of E-Sports and Fantasy Sports Betting is driving market growth:

The rise of e-sports and fantasy sports has created a new avenue for smart betting platforms. E-sports tournaments such as League of Legends World Championship and Dota 2’s The International attract millions of viewers, making them prime opportunities for betting. Similarly, fantasy sports platforms like DraftKings and FanDuel enable users to create virtual teams and place bets based on real-world player performance. These segments appeal to younger demographics, driving market expansion. Smart betting platforms utilize AI to provide performance insights, boosting user engagement and encouraging repeat betting activity.

Global Smart Betting Market Challenges and Restraints

Regulatory and Legal Constraints is restricting market growth:

Despite the growth of the smart betting market, regulatory barriers remain a significant challenge. Betting laws differ across regions, with some countries imposing strict restrictions or outright bans on gambling activities. For instance, countries like India and China have stringent anti-gambling laws, limiting market expansion in these regions. Moreover, even in regions where betting is legal, compliance with licensing and taxation regulations can be costly and complex. Operators must also navigate challenges related to data protection and responsible gambling initiatives, ensuring user safety while meeting regulatory requirements. These factors create entry barriers for new players and hinder seamless global expansion.

Concerns Over Problem Gambling and Addiction is restricting market growth:

The rise of online betting platforms has also increased concerns over problem gambling and addiction. Easy access to betting platforms and gamified features can lead to impulsive betting behavior, particularly among younger users. This has prompted regulatory authorities and advocacy groups to demand stricter safeguards, such as mandatory loss limits, self-exclusion tools, and awareness campaigns. While these measures aim to protect users, they may also deter casual bettors, potentially impacting revenue growth. Addressing these challenges requires a careful balance between fostering growth and promoting responsible gambling practices.

Market Opportunities

The smart betting market is poised for significant growth, driven by untapped markets and emerging technological trends. One of the most promising opportunities lies in expanding into developing regions such as Latin America, Africa, and Southeast Asia, where smartphone adoption and internet penetration are on the rise. These regions offer a relatively untapped consumer base, eager to explore online betting. The adoption of cryptocurrencies in betting platforms presents another lucrative opportunity, as it enables faster, anonymous transactions while appealing to tech-savvy users. Additionally, advancements in AI and ML algorithms will allow platforms to offer hyper-personalized experiences, such as customized betting tips and real-time game updates, fostering user loyalty. Integration with emerging technologies such as augmented reality (AR) and virtual reality (VR) can create immersive betting experiences, particularly in live sports and e-sports events. Partnerships with sports leagues, gaming companies, and streaming platforms could further drive engagement, making smart betting a central part of the entertainment ecosystem. As regulatory frameworks evolve and public perception of betting becomes more positive, the market is expected to witness accelerated growth in the coming years.

SMART BETTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bet365, William Hill, 888 Holdings, DraftKings, Flutter Entertainment, and Betway Group, |

Smart Betting Market Segmentation

Smart Betting Market Segmentation By Type

- Sports Betting

- Casino Betting

- E-sports Betting

- Lottery Betting

- Others

Sports betting dominates the market, accounting for 55% of total revenue in 2024. The widespread appeal of sports events, coupled with live in-play betting, drives this segment.

Smart Betting Market Segmentation By Application

- Mobile Applications

- Web-based Platforms

Mobile applications are the dominant segment, representing over 60% of the market share. Their convenience, user-friendly interfaces, and enhanced accessibility contribute to their popularity.

Smart Betting Market Regional Segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the leading region in the smart betting market, accounting for 40% of total market revenue in 2024. The legalization of sports betting in the United States, following the repeal of PASPA in 2018, has been a major growth driver. States like New Jersey, Nevada, and Pennsylvania have established themselves as key betting hubs. The region also benefits from advanced technology adoption and a mature digital infrastructure. High disposable incomes and a strong sports culture further fuel market growth. Additionally, partnerships between betting platforms and major sports leagues, such as the NFL and NBA, enhance market visibility and engagement.

COVID-19 Impact Analysis on the Smart Betting Market

The COVID-19 pandemic had a profound impact on the global smart betting market. With major sports events suspended during the initial lockdowns, traditional sports betting saw a temporary decline. However, this disruption led to a surge in alternative betting segments, such as e-sports and virtual sports. Online platforms saw a 30% increase in user registrations in 2020, as bettors turned to digital channels in the absence of physical betting venues. The pandemic also accelerated the adoption of mobile betting apps. Operators enhanced their digital offerings to meet the growing demand for remote betting solutions. As live sports gradually resumed, the market began to recover, with an increasing number of bettors opting for in-play betting options. This shift further underscored the flexibility and adaptability of the industry in responding to changing circumstances. Ultimately, the pandemic highlighted the resilience of the smart betting sector. It showcased the industry's ability to adapt to evolving consumer behaviors and leverage technology to sustain growth, even in challenging times. The experience has set the stage for continued innovation and expansion, with mobile platforms, e-sports, and digital betting expected to remain integral to the market’s future.

Latest Trends/Developments

The smart betting market is evolving rapidly, shaped by several key trends. One of the most significant developments is the rise of AI-driven predictive models, which are becoming more sophisticated and offering users highly accurate betting insights, ultimately improving win rates. Another major trend is the growing adoption of cryptocurrencies and blockchain technology, providing secure, transparent, and fast transactions that enhance the betting experience. E-sports betting continues to gain momentum, with platforms expanding their offerings to include popular games like Call of Duty and Fortnite, attracting a new generation of bettors. Additionally, virtual reality (VR) betting is emerging as a cutting-edge trend, offering immersive experiences that transport users into the heart of the action. Partnerships between betting platforms and sports leagues are also on the rise, allowing for innovative advertising strategies and deeper fan engagement. To boost user retention, operators are leveraging gamification techniques like leaderboards and rewards systems, making the betting experience more interactive and enjoyable. Finally, responsible gambling initiatives are gaining importance, with platforms introducing features like self-exclusion tools and AI-based monitoring systems to detect and address problematic behavior, ensuring a safer betting environment for all users. These trends are shaping the future of smart betting, creating a more dynamic, secure, and engaging market for consumers worldwide.

Key Players

- Bet365

- William Hill

- 888 Holdings

- DraftKings

- Flutter Entertainment

- Betway Group

- Kindred Group

- Betsson AB

- Pinnacle

- Entain Plc

Chapter 1. SMART BETTING MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SMART BETTING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SMART BETTING MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SMART BETTING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SMART BETTING MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SMART BETTING MARKET – By Type

6.1 Introduction/Key Findings

6.2 Sports Betting

6.3 Casino Betting

6.4 E-sports Betting

6.5 Lottery Betting

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. SMART BETTING MARKET – By Application

7.1 Introduction/Key Findings

7.2 Mobile Applications

7.3 Web-based Platforms

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. SMART BETTING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SMART BETTING MARKET – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

9.1 Bet365

9.2 William Hill

9.3 888 Holdings

9.4 DraftKings

9.5 Flutter Entertainment

9.6 Betway Group

9.7 Kindred Group

9.8 Betsson AB

9.9 Pinnacle

9.10 Entain Plc

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Smart Betting Market was valued at USD 65 billion in 2024 and is projected to grow at a CAGR of 11% from 2025 to 2030. The market is expected to reach USD 121.58 billion by 2030.

Key drivers include technological advancements in betting platforms, rising popularity of online sports betting, and the growth of e-sports and fantasy sports betting.

The market is segmented by product (sports betting, casino betting, e-sports betting, lottery betting, and others) and by application (mobile applications and web-based platforms).

North America is the dominant region, accounting for 40% of the market share, driven by favorable regulatory changes and advanced digital infrastructure.

Leading players include Bet365, William Hill, 888 Holdings, DraftKings, Flutter Entertainment, and Betway Group, among others.