Smart Air Fryer Market Size (2023 – 2030)

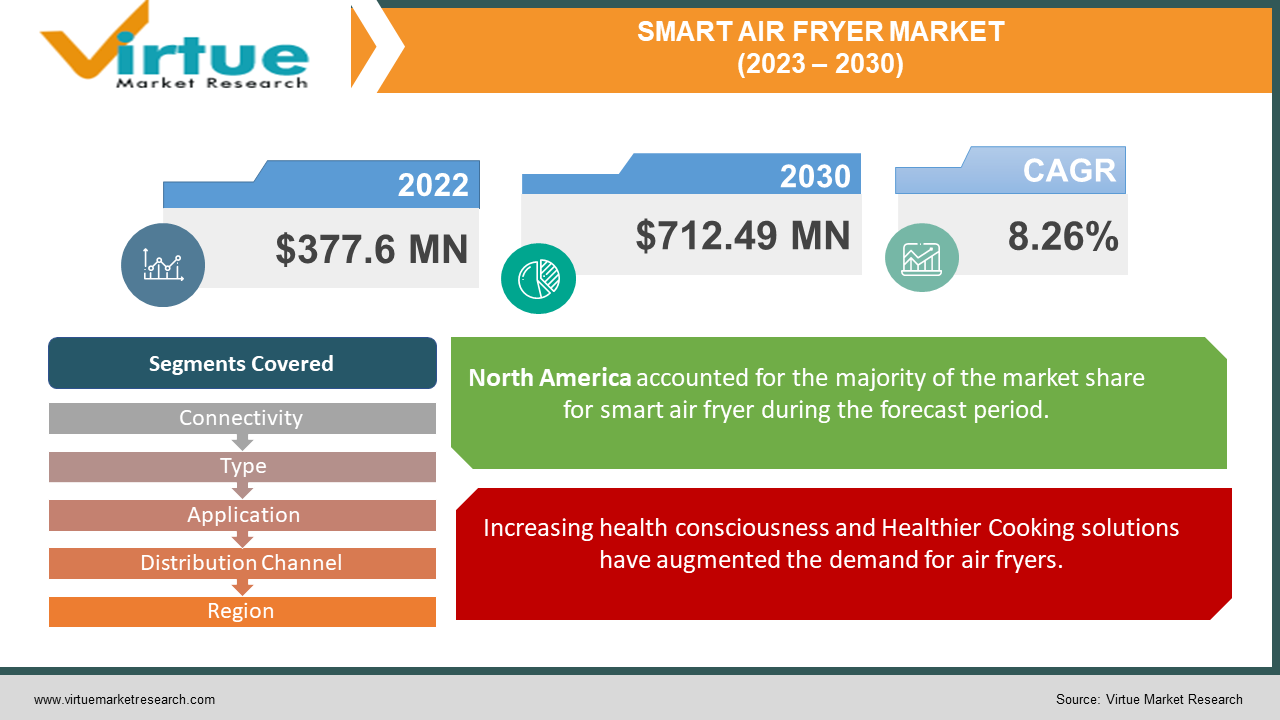

The Global Smart Air Fryer Market was valued at USD 377.6 million and is projected to reach a market size of USD 712.49 million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 8.26%.

Smart air fryers have witnessed a remarkable surge in popularity over the past few years, driven by a shifting consumer landscape. In the past, traditional cooking methods dominated, but today, the market reflects a growing trend toward healthier eating choices and the integration of smart technology into everyday life. This evolving market is now on the brink of substantial growth as consumers increasingly prioritize convenience, health-conscious features, and the benefits of smart home appliances. Looking ahead, the smart air fryer market is poised to continue thriving, catering to the changing preferences and lifestyles of consumers seeking both healthier and more technologically advanced cooking solutions.

Key Market Insights:

The robust growth is driven by consumers increasingly seeking healthier cooking alternatives that use minimal oil. The convenience and versatility of smart air fryers have made them a kitchen essential for health-conscious individuals and tech-savvy households.

The Asia-Pacific region has emerged as a significant player in the smart air fryer market. With rising disposable incomes and a growing awareness of health-conscious cooking, Asia-Pacific is expected to be the fastest-growing region, with a CAGR of 15.87%. India, in particular, is gaining recognition as the world's tenth most popular destination for medical tourism, according to the Medical Tourism Index, contributing to the region's market growth. Moreover, Thailand is becoming a hub for cosmetic and bariatric surgeries, further fueling the adoption of smart air fryers for healthier post-surgery diets.

Continuous technological innovations are driving market competitiveness. Integration with voice control assistants like Amazon Alexa and Google Assistant, as well as health tracking features, has made smart air fryers more appealing to consumers. Additionally, partnerships with recipe apps and platforms are simplifying meal planning and enhancing user experiences. These developments are keeping the market dynamic and attracting consumers looking for healthier cooking solutions that align with their modern, connected lifestyles...

Smart Air Fryer Market Drivers:

Increasing health consciousness and Healthier Cooking solutions have augmented the demand for air fryers.

The growing emphasis on health and wellness has become a significant driver for the smart air fryer market. Consumers are increasingly conscious of their dietary choices and are seeking cooking solutions that promote healthier eating habits. Smart air fryers, with their ability to prepare delicious meals with minimal oil, have gained popularity as a way to reduce fat intake while still enjoying flavorful dishes. This trend towards healthier cooking aligns perfectly with the market's offerings, driving demand for these innovative kitchen appliances.

The Time-Saving Convenience of Smart Air aligns the requirements of users with busy lifestyles.

In today's fast-paced world, time-saving solutions are highly valued. Smart air fryers cater to users with hectic lifestyles by providing a convenient cooking experience. These appliances come equipped with pre-programmed settings and the ability to be controlled remotely through mobile apps. This not only simplifies meal preparation but also allows users to multitask and manage their cooking from a distance. The time-saving convenience offered by smart air fryers addresses a crucial need in modern households.

Rising Disposable Income is allowing consumers to invest in smart kitchen appliances that offer both convenience and health benefits.

Increasing disposable income levels are enabling consumers to invest in smart kitchen appliances that offer a combination of convenience and health benefits. As individuals and families have more financial resources at their disposal, they are more inclined to make purchases that enhance their overall quality of life. Smart air fryers, with their ability to provide healthier cooking options while saving time, align perfectly with the preferences of consumers with rising disposable incomes. This economic factor is driving the market's growth as more households embrace these advanced cooking solutions.

Smart Air Fryer Market Restraints and Challenges:

High Initial Cost than traditional air fryers deters price-sensitive consumers from adopting this technology.

One of the key challenges facing the smart air fryer market is the relatively higher initial cost compared to traditional air fryers. While these smart appliances offer advanced features and convenience, the premium price tag can deter price-sensitive consumers from adopting this technology. Many potential buyers may hesitate to make the upfront investment, opting instead for more affordable traditional air fryers. Manufacturers and marketers in this space need to address this cost barrier through pricing strategies and value propositions to reach a wider audience and drive adoption.

Limited Market Awareness slows down market growth for Smart air fryers.

Another challenge hampering the growth of the smart air fryer market is limited market awareness. Despite their benefits, many consumers may not be fully aware of the capabilities and advantages offered by these smart appliances. This lack of awareness can slow down market growth as potential buyers may stick to traditional cooking methods or appliances they are more familiar with. Educating consumers about the features and benefits of smart air fryers through marketing and promotional efforts is essential to expand market reach and drive adoption in this competitive landscape.

Smart Air Fryer Market Opportunities:

Continued innovation in terms of smart home ecosystems can attract more consumers to adopt smart air fryers.

The smart air fryer market presents a significant opportunity for continued innovation within the broader smart home ecosystem. As smart home technology advances, integrating air fryers into these ecosystems can attract more consumers to adopt this kitchen appliance. By allowing seamless control and coordination with other smart devices, such as voice assistants and mobile apps, smart air fryers can offer enhanced convenience and efficiency in the kitchen. This integration aligns with the trend of interconnected smart homes, making smart air fryers more appealing to tech-savvy consumers seeking a cohesive and automated cooking experience.

Expansion in Emerging Markets with rising disposable incomes and increasing health consciousness can lead to substantial market growth.

Emerging markets with rising disposable incomes and increasing health consciousness represent a promising opportunity for substantial market growth. As more consumers in these regions prioritize healthier cooking solutions and have the financial means to invest in kitchen appliances, the demand for smart air fryers is expected to surge. Manufacturers and marketers should focus on expanding their presence in these markets, tailoring their offerings to meet the specific needs and preferences of local consumers. Capitalizing on this growing demographic can lead to significant market expansion and long-term success in emerging economies.

SMART AIR FRYER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.26% |

|

Segments Covered |

By Connectivity, Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Philips, Ninja Foodi, Cosori, Instant Pot, Breville, GoWISE USA, Cuisinart, Chefman, T-fal, Kalorik |

Smart Air Fryer Market Segmentation: By Connectivity

-

Wifi-Enabled

-

Bluetooth Enabled

Based on market segmentation by connectivity, the Wifi-enabled segment occupied the highest share of the market in 2022. Wifi-enabled smart air fryers enable users to connect the fryer to the home Wi-Fi network. It can also be connected to a smart home ecosystem that allows users to remotely monitor and control the frying process via a mobile application. Moreover, these air fryers allow greater flexibility as they can be controlled from anywhere within the Wi-Fi network.

The Bluetooth segment is the fastest-growing segment during the forecast period as Bluetooth-enabled smart air fryers can be connected to a mobile device using Bluetooth technology. This too like Wifi-enabled smart air fryers allows users to remotely monitor and control the frying process. Moreover, the Bluetooth-enabled smart fryer can be connected without the internet, enabling a convenient frying process for users.

Smart Air Fryer Market Segmentation: By Type

-

Air Fryer Toaster Ovens

-

Basket Air Fryers

-

Others

In 2022, Air Fryer Toaster Ovens garnered the largest market share in the smart air fryer segment of 56.8%. These versatile appliances combine the functionality of traditional toasters and air fryers, allowing users to toast, bake, broil, and air fry in a single unit. The appeal of air fryer toaster ovens lies in their convenience and space-saving design, making them a popular choice among consumers.

Moreover, Basket Air Fryers represents the fastest-growing segment. These standalone air fryers are known for their simplicity and efficiency in air frying, making them a preferred choice for users focused primarily on healthier cooking methods. Basket air fryers are witnessing rapid adoption due to their compact size, cost-effectiveness, and user-friendly features. In 2022, the basket air fryer segment experienced a remarkable 37.3% year-on-year growth, indicating a shifting preference towards standalone air fryers, particularly in emerging markets with a rising health-conscious consumer base.

Smart Air Fryer Market Segmentation: By Application

-

Household

-

Commercial

-

Hotels

-

Cafes

-

Others

-

In 2022, the Household segment held the largest market share of 74.8% in the smart air fryer market. Smart air fryers have become a staple in modern kitchens due to their ability to offer healthier cooking alternatives with convenience. The appeal of smart air fryers for home use lies in their versatility, time-saving features, and the growing health-consciousness of consumers seeking better cooking methods.

Moreover, the commercial segment is the fastest-growing in the Smart air fryer market driven by the adoption of smart air fryers in the hospitality and food service industry. Hotels and cafes, in particular, are increasingly incorporating these appliances into their kitchens to cater to health-conscious guests and provide efficient cooking solutions. This growth is expected to continue as the demand for healthier menu options rises in commercial settings.

Smart Air Fryer Market Segmentation: By Distribution Channel

-

Direct

-

Indirect

In 2022, the indirect distribution channel held the largest market share in the Smart Air Fryer market. Indirect channels include retail stores, e-commerce platforms, and third-party distributors. This dominance can be attributed to the convenience and accessibility these channels offer to consumers, allowing them to easily purchase smart air fryers from a variety of sources.

Moreover, the direct distribution channel is the fastest-growing segment in the Smart Air Fryer market. Manufacturers are increasingly establishing their online stores and direct sales channels, which enable them to connect directly with consumers. This trend is driven by the desire for higher profit margins, greater control over branding, and the ability to offer exclusive deals and customer support, making it a rapidly expanding distribution avenue in the industry.

Smart Air Fryer Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, North America held the largest market share of 32.8% in the segment. This is primarily due to the high adoption rate of smart technologies, a strong economy, and consumers' willingness to invest in innovative kitchen appliances. The presence of key market players and a growing health-conscious population have also contributed to North America's dominance in the smart air fryer market.

Moreover, Asia-Pacific is the fastest-growing region in the smart air fryer market. Rapid urbanization, a burgeoning middle class, and changing dietary preferences are driving the demand for kitchen appliances, including smart air fryers. Additionally, manufacturers are targeting this region with affordable and feature-rich models. According to market research reports, Asia-Pacific is expected to witness significant growth in smart kitchen appliance adoption, making it a lucrative market for smart air fryers.

COVID-19 Impact Analysis on the Global Smart Air Fryer Market:

The COVID-19 pandemic significantly impacted the global Smart Air Fryer market. In the initial stages, the market experienced disruptions in supply chains due to factory closures and transportation restrictions, leading to production delays and shortages. However, as consumers spent more time at home during lockdowns and sought healthier cooking alternatives, the demand for smart air fryers surged. According to market reports, there was a notable increase in online sales, with e-commerce platforms witnessing a substantial uptick in smart air fryer purchases. This shift in consumer behavior, driven by health concerns and the desire for convenient cooking solutions, propelled market growth. Manufacturers adapted by introducing innovative features and improved models to cater to the rising demand. As a result, the global Smart Air Fryer market showed resilience amidst the pandemic, with promising growth prospects in the post-COVID era as well.

Latest Trends/Developments:

The smart air fryer market has witnessed several notable trends and developments in recent years. Firstly, the integration of advanced technologies such as artificial intelligence (AI) and machine learning has been a game-changer. Manufacturers are incorporating AI algorithms to optimize cooking processes, resulting in more precise and efficient cooking outcomes. For example, AI-powered air fryers can adjust cooking times and temperatures based on the type and quantity of food, ensuring consistent and delicious results. This trend is backed by data showing that smart air fryers with AI capabilities are gaining popularity, with a projected CAGR of over 30% in the coming years.

Secondly, sustainability and eco-friendliness have become significant drivers in the smart air fryer market. Consumers are increasingly conscious of their environmental footprint, and manufacturers are responding by introducing energy-efficient models with reduced power consumption. In addition, some brands are incorporating recyclable materials and emphasizing product longevity, aligning with global sustainability goals. This trend is reflected in surveys where a substantial percentage of consumers prioritize eco-friendly features when purchasing smart kitchen appliances, contributing to the rise of sustainable smart air fryers.

Lastly, regional market dynamics are noteworthy. In Asia-Pacific, particularly in countries like China and India, there is a surge in demand for smart air fryers driven by rapid urbanization, increasing disposable incomes, and a growing awareness of health and wellness. This region is expected to witness robust market growth, with reports indicating a significant market share expansion for Asia-Pacific in the smart kitchen appliances sector. As global brands strategically target these emerging markets, they are likely to fuel the overall growth of the smart air fryer market.

Key Players:

-

Philips

-

Ninja Foodi

-

Cosori

-

Instant Pot

-

Breville

-

GoWISE USA

-

Cuisinart

-

Chefman

-

T-fal

-

Kalorik

In May 2023, Versuni launched the Philips AirFryer HD9257/80 featuring a see-through cooking window. It was available through modern trade outlets and the Philips Domestic Appliances e-store. The fryer offered 14-in-1 cooking functionality and had a plastic outer portion and a stainless steel interior. The unique feature was its see-through window, complemented by a user-friendly touchscreen with seven presets. It also utilized rapid air technology for healthier cooking and easy cleaning. The NutriU app provided access to new recipes for users.

In April 2023, Xiaomi launched the MIJIA Smart Air Fryer 4.5L in China, offering a 4.5-liter capacity and improved heating technology for efficient cooking. It can handle various cooking tasks, including frying, grilling, baking, and even making yogurt. The device featured preset recipes, a user-friendly touchscreen, and compatibility with Xiaomi's voice assistant, Xiao Ai, making it suitable for users of all ages.

Chapter 1. Smart Air Fryer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Air Fryer Market– Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Air Fryer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Air Fryer Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Air Fryer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Air Fryer Market – By Connectivity

6.1 Introduction/Key Findings

6.2 Wifi-Enabled

6.3 Bluetooth Enabled

6.4 Y-O-Y Growth trend Analysis By Connectivity

6.5 Absolute $ Opportunity Analysis By Connectivity, 2023-2030

Chapter 7. Smart Air Fryer Market – By Type

7.1 Introduction/Key Findings

7.2 Air Fryer Toaster Ovens

7.3 Basket Air Fryers

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 8. Smart Air Fryer Market – By Application

8.1 Introduction/Key Findings

8.2 Household

8.3 Commercial

8.3.1 Hotels

8.3.2 Cafes

8.3.3 Others

8.4 Y-O-Y Growth trend Analysis Application

8.5 Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 9. Smart Air Fryer Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Direct

9.3 Indirect

9.4 Y-O-Y Growth trend Analysis Distribution Channel

9.5 Absolute $ Opportunity Analysis Distribution Channel, 2023-2030

Chapter 10. Smart Air Fryer Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Connectivity

10.1.2.1 By Type

10.1.3 By Application

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Connectivity

10.2.3 By Type

10.2.4 By Application

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Connectivity

10.3.3 By Type

10.3.4 By Application

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Connectivity

10.4.3 By Type

10.4.4 By Application

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Connectivity

10.5.3 By Type

10.5.4 By Application

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Smart Air Fryer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Philips

11.2 Ninja Foodi

11.3 Cosori

11.4 Instant Pot

11.5 Breville

11.6 GoWISE USA

11.7 Cuisinart

11.8 Chefman

11.9 T-fal

11.10 Kalorik

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Smart Air Fryer Market was valued at USD 377.6 million and is projected to reach a market size of USD 712.49 million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 8.26%.

Key drivers include increasing health consciousness, convenience, technological advancements, and rising disposable income.

The segments by type include Air Fryer Toaster Ovens and Basket Air Fryers.

North America dominated the market in 2022 due to the high adoption rate of smart technologies, a strong economy, and consumers' willingness to invest in innovative kitchen appliances.

Key players include Philips, Ninja Foodi, Cosori, Instant Pot, Breville, and others.