Sludge Treatment Chemicals Market Size (2025 – 2030)

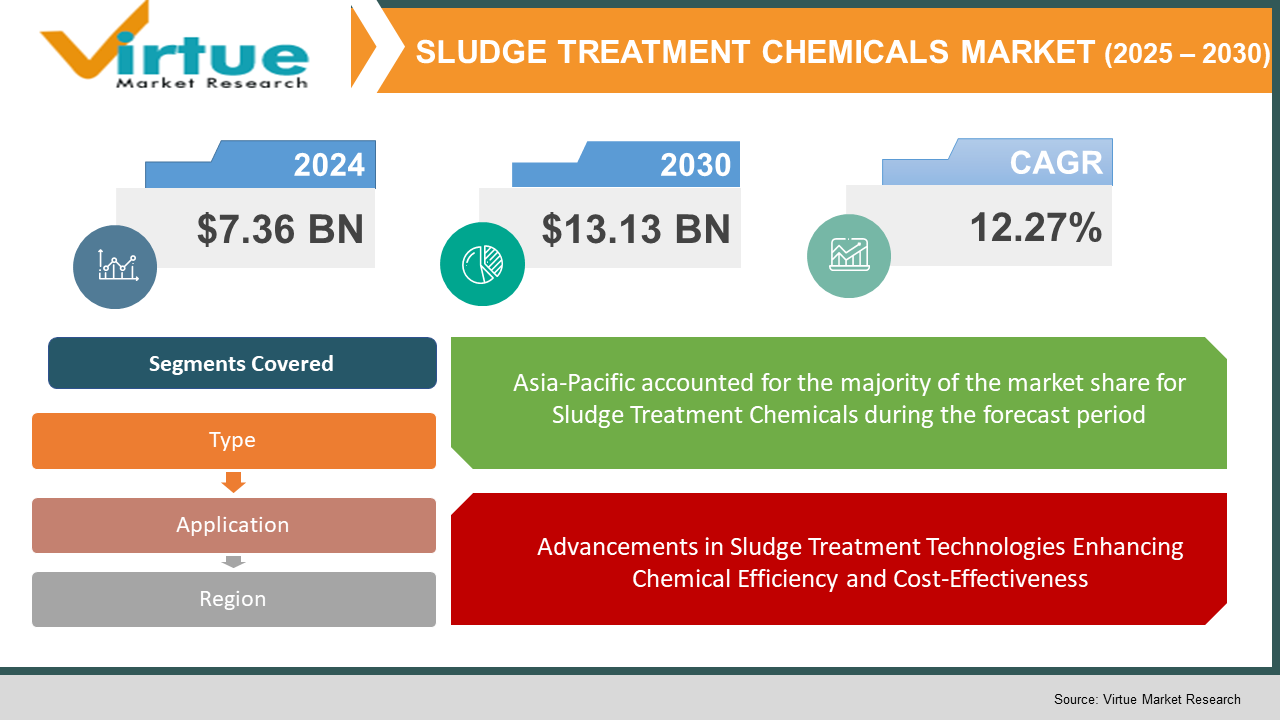

The Global Sludge Treatment Chemicals Market was valued at USD 7.36 billion in 2024 and is projected to reach a market size of USD 13.13 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.27%.

The Sludge Treatment Chemicals Market plays a crucial role in wastewater management by enabling the effective treatment and disposal of sludge generated from industrial and municipal wastewater treatment plants. Sludge treatment is essential to reduce environmental pollution, minimize health hazards, and recover valuable resources such as biogas and reusable water. With stringent environmental regulations and increasing industrialization, the need for effective sludge treatment chemicals is growing rapidly across various sectors, including food & beverage, chemical processing, pharmaceuticals, and power generation. Advancements in sludge treatment technologies, such as anaerobic digestion and thermal hydrolysis, are further driving the need for specialized chemicals that enhance the efficiency of sludge dewatering, thickening, and conditioning. The rising focus on sustainability, coupled with the push for circular economy practices, is encouraging industries to adopt eco-friendly and cost-effective sludge treatment solutions.

Key Market Insights:

- The Sludge Treatment Chemicals Market is witnessing steady growth, driven by increasing wastewater generation from industrial and municipal sectors. Reports indicate that over 60% of global sludge comes from municipal wastewater treatment plants, requiring effective chemical treatment for safe disposal or reuse. Additionally, industrial wastewater contributes significantly to sludge volume, with the chemical and petrochemical industries accounting for nearly 25% of total sludge production. As water treatment regulations tighten worldwide, the demand for sludge treatment chemicals is rising, particularly in regions with high industrialization and urbanization rates.

- The adoption of coagulants and flocculants, essential for sludge dewatering and thickening, has grown by over 35% in the last decade, as industries seek efficient methods to minimize sludge volume. Advanced polymer-based flocculants, which improve sludge settling rates and reduce chemical consumption, are gaining traction, especially in wastewater treatment plants looking to optimize operating costs. Additionally, pH conditioners and disinfectants are witnessing higher demand, as industries focus on pathogen control and safe sludge disposal in compliance with environmental standards.

- Energy recovery from sludge is becoming a key trend, with over 40% of treated sludge now being utilized for biogas production through anaerobic digestion. Governments and industries are investing in sustainable sludge treatment solutions that not only minimize waste but also generate renewable energy. As a result, demand for biological treatment chemicals, such as enzymatic and bacterial formulations, is growing as industries move toward eco-friendly alternatives to conventional sludge management.

Sludge Treatment Chemicals Market Drivers:

Increasing Stringent Environmental Regulations and Wastewater Treatment Standards Driving the Demand for Sludge Treatment Chemicals

Governments and regulatory bodies worldwide are enforcing stringent environmental regulations to control wastewater discharge and sludge disposal, leading to an increased need for effective sludge treatment chemicals. Industries such as pharmaceuticals, food processing, and chemical manufacturing must comply with strict wastewater treatment guidelines to reduce their environmental footprint. As a result, businesses are increasingly adopting advanced sludge treatment solutions to meet compliance requirements, ensuring safe disposal and reuse of treated sludge while minimizing environmental risks.

Rapid Industrialization and Urbanization Leading to Higher Sludge Generation and Need for Treatment Solutions

The rapid pace of industrialization and urbanization, particularly in emerging economies, has significantly increased wastewater and sludge production, necessitating efficient treatment methods. Industrial wastewater, laden with contaminants and hazardous materials, requires specialized chemical treatments to neutralize pollutants before disposal. Additionally, the expansion of urban infrastructure, coupled with growing populations, has led to a surge in municipal sludge generation, further fueling the demand for sludge treatment chemicals to manage growing waste volumes sustainably.

Advancements in Sludge Treatment Technologies Enhancing Chemical Efficiency and Cost-Effectiveness

Continuous technological advancements in sludge treatment processes, including the development of more efficient coagulants, flocculants, and disinfectants, have improved the overall effectiveness of sludge management. Innovations such as bio-based treatment chemicals and polymer-enhanced flocculants offer superior dewatering, reduced sludge volume, and improved filtration efficiency, resulting in cost savings for industries and municipal wastewater treatment plants. These developments are driving industries to adopt advanced chemical-based sludge treatment solutions to enhance operational efficiency and sustainability.

Growing Focus on Resource Recovery and Circular Economy Driving Chemical-Based Sludge Treatment Adoption

With growing emphasis on sustainability, industries and municipalities are exploring ways to recover valuable resources from sludge, such as biogas, organic fertilizers, and reusable water. The use of sludge treatment chemicals plays a crucial role in optimizing resource recovery by facilitating efficient separation, dewatering, and stabilization processes. This shift towards a circular economy, where waste is converted into valuable by-products, is expected to further propel the demand for specialized sludge treatment chemicals in the coming years.

Sludge Treatment Chemicals Market Restraints and Challenges:

High Operational Costs and Environmental Concerns Limiting the Widespread Adoption of Sludge Treatment Chemicals

One of the key challenges in the sludge treatment chemicals market is the high operational costs associated with chemical treatment processes, including procurement, storage, and disposal of residual sludge. Many industries, particularly in developing regions, struggle with budget constraints, making it difficult to invest in advanced sludge treatment solutions. Additionally, concerns over the environmental impact of certain chemical treatments, such as the potential release of harmful by-products into water bodies, have led to increased scrutiny and regulatory pressure. The shift towards sustainable and eco-friendly alternatives further challenges the growth of conventional sludge treatment chemicals, pushing manufacturers to innovate and develop greener solutions while maintaining cost-effectiveness.

Sludge Treatment Chemicals Market Opportunities:

The rising focus on sustainability and stringent environmental regulations presents a significant opportunity for the sludge treatment chemicals market, as industries seek efficient and eco-friendly solutions to manage wastewater. The rising adoption of biological and advanced chemical treatments, such as bio-based coagulants and flocculants, is driving innovation in the market. Additionally, the development of cost-effective sludge-to-energy technologies, which convert treated sludge into biogas or fertilizers, is gaining traction, creating new revenue streams for companies. With rapid industrialization and urbanization, particularly in emerging economies, the demand for effective sludge management solutions is expected to grow, encouraging further advancements in sludge treatment chemicals.

SLUDGE TREATMENT CHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kemira Oyj, BASF SE, Ecolab Inc., and Suez SA |

Sludge Treatment Chemicals Market Segmentation:

Sludge Treatment Chemicals Market Segmentation: By Type:

- Coagulants

- Flocculants

- Disinfectants

- Others

Coagulants hold the dominant position in the sludge treatment chemicals market as they play a key role in destabilizing suspended particles, enabling efficient solid-liquid separation in wastewater treatment plants. Widely used in municipal and industrial wastewater treatment, coagulants such as aluminum sulfate, ferric chloride, and polyaluminum chloride help reduce sludge volume and improve water clarity. Their cost-effectiveness and high efficiency in treating large volumes of sludge make them the preferred choice for industries ranging from food processing to chemical manufacturing. The growing global emphasis on stringent environmental regulations and wastewater treatment compliance further strengthens the demand for coagulants in the market.

Flocculants are the fastest-growing segment in the sludge treatment chemicals market because of their superior efficiency in aggregating fine particles into larger clumps, which enhances sludge dewatering and sedimentation processes. The rising demand for polymer-based flocculants, such as cationic and anionic polyacrylamides, is fueling market expansion, as these chemicals provide better sludge conditioning and reduce the need for excessive coagulant usage. Rapid industrialization, urban wastewater challenges, and increasing investments in water treatment infrastructure are major growth drivers for this segment. Furthermore, advancements in bio-based and biodegradable flocculants are contributing to the market’s expansion, as industries shift toward more sustainable and environmentally friendly sludge treatment solutions.

Sludge Treatment Chemicals Market Segmentation: By Application:

- Pulp & Paper

- Metal Processing

- Oil & Gas

- Food and Beverages

- Chemicals

- Others

The pulp & paper industry holds the dominant share in the sludge treatment chemicals market due to the massive volume of wastewater and sludge generated during paper production processes. This sector relies heavily on coagulants, flocculants, and disinfectants to manage effluent sludge and meet stringent environmental regulations. With growing sustainability concerns and the adoption of advanced wastewater treatment techniques, the demand for sludge treatment chemicals in the pulp & paper industry continues to rise. The industry's push toward water recycling and zero liquid discharge (ZLD) systems further strengthens the need for efficient sludge treatment solutions.

The oil & gas sector is witnessing the fastest growth in the sludge treatment chemicals market, driven by the increasing volume of wastewater and sludge generated from upstream and downstream activities. Drilling operations, refineries, and petrochemical plants require advanced chemical treatments to manage hazardous sludge, including heavy metals and hydrocarbons. Growing regulatory pressure to reduce environmental impact, coupled with technological advancements in sludge dewatering and recovery, is accelerating the adoption of sludge treatment chemicals. Additionally, rising investments in enhanced oil recovery (EOR) and wastewater recycling within the industry are fueling the demand for high-performance treatment solutions.

Sludge Treatment Chemicals Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Since Asia-Pacific holds the highest market share (35%), it is the dominant region in the sludge treatment chemicals market. The region's leadership is fueled by rapid industrialization, expanding urban infrastructure, and increasing government investments in wastewater treatment facilities. Countries like China and India are witnessing a surge in sludge generation due to the rising manufacturing sector, growing population, and stricter environmental regulations. With governments implementing stringent wastewater disposal laws and industries adopting advanced sludge treatment solutions, Asia-Pacific continues to maintain its leading position in the market.

On the other hand, North America (30%) is the fastest-growing region, driven by stringent environmental policies and increasing wastewater treatment initiatives. The presence of strict EPA guidelines and advanced wastewater treatment plants across the U.S. and Canada accelerates the demand for high-efficiency sludge treatment chemicals. Moreover, the growth of key industries such as oil & gas, food processing, and pharmaceuticals further drives the need for effective sludge management solutions. As industrial expansion continues and sustainability efforts intensify, North America is expected to see the highest growth rate in the coming years.

COVID-19 Impact Analysis on the Global Sludge Treatment Chemicals Market:

The COVID-19 pandemic had a mixed impact on the global sludge treatment chemicals market. On one hand, industrial slowdowns and temporary shutdowns of manufacturing plants led to a decline in wastewater generation, reducing the immediate need for sludge treatment chemicals. Sectors such as oil & gas, metal processing, and paper manufacturing experienced disruptions, affecting overall market growth. However, on the other hand, the increased focus on sanitation, hygiene, and wastewater management in hospitals, pharmaceutical industries, and municipal wastewater treatment plants created a surge in demand for disinfectants and sludge treatment solutions.

Latest Trends/ Developments:

The sludge treatment chemicals market is experiencing a shift towards eco-friendly and sustainable solutions as industries and governments prioritize environmental compliance and wastewater management efficiency. Advanced bio-based and biodegradable coagulants and flocculants are gaining traction as companies seek to minimize chemical residues and improve sludge dewatering efficiency. Additionally, innovations in polymer-based flocculants have enhanced sludge conditioning, reducing sludge volume and disposal costs. Stringent government regulations on wastewater treatment and sludge disposal are pushing industries to adopt advanced sludge treatment solutions, boosting demand for high-performance chemicals that enhance water reuse and lower environmental impact.

Another significant development is the integration of automation and smart monitoring systems in sludge treatment plants. Technologies like AI-powered sensors and real-time data analytics are improving efficiency by optimizing chemical dosing, reducing operational costs, and minimizing human intervention. The growing adoption of zero-liquid discharge (ZLD) systems in industries such as oil & gas, food & beverage, and chemicals is further driving demand for specialized treatment chemicals. Moreover, key market players are investing in R&D to develop next-generation sludge treatment chemicals that enhance sludge digestion and biogas recovery, aligning with the global trend toward circular economy practices in wastewater management.

Key Players:

- Kemira Oyj

- BASF SE

- Ecolab Inc.

- Suez SA

- Veolia Environnement S.A.

- Kurita Water Industries Ltd.

- SNF Floerger

- Buckman Laboratories International Inc.

- Solenis LLC

- Akzo Nobel N.V.

Chapter 1. SLUDGE TREATMENT CHEMICALS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SLUDGE TREATMENT CHEMICALS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SLUDGE TREATMENT CHEMICALS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SLUDGE TREATMENT CHEMICALS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SLUDGE TREATMENT CHEMICALS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SLUDGE TREATMENT CHEMICALS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Coagulants

6.3 Flocculants

6.4 Disinfectants

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. SLUDGE TREATMENT CHEMICALS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Pulp & Paper

7.3 Metal Processing

7.4 Oil & Gas

7.5 Food and Beverages

7.6 Chemicals

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. SLUDGE TREATMENT CHEMICALS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SLUDGE TREATMENT CHEMICALS MARKET – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

9.1 Kemira Oyj

9.2 BASF SE

9.3 Ecolab Inc.

9.4 Suez SA

9.5 Veolia Environnement S.A.

9.6 Kurita Water Industries Ltd.

9.7 SNF Floerger

9.8 Buckman Laboratories International Inc.

9.9 Solenis LLC

9.10 Akzo Nobel N.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Rising industrial wastewater generation and stringent environmental regulations drive market growth

Based on Application, the Global Sludge Treatment Chemicals Market is segmented into Pulp & Paper, Metal Processing, Oil & Gas, Food and Beverages, and others.

Asia-Pacific is the most dominant region for the Global Sludge Treatment Chemicals Market.

Kemira Oyj, BASF SE, Ecolab Inc., and Suez SA are the leading players in the Global Sludge Treatment Chemicals Market.