Slickline Services Market Size (2025 – 2030)

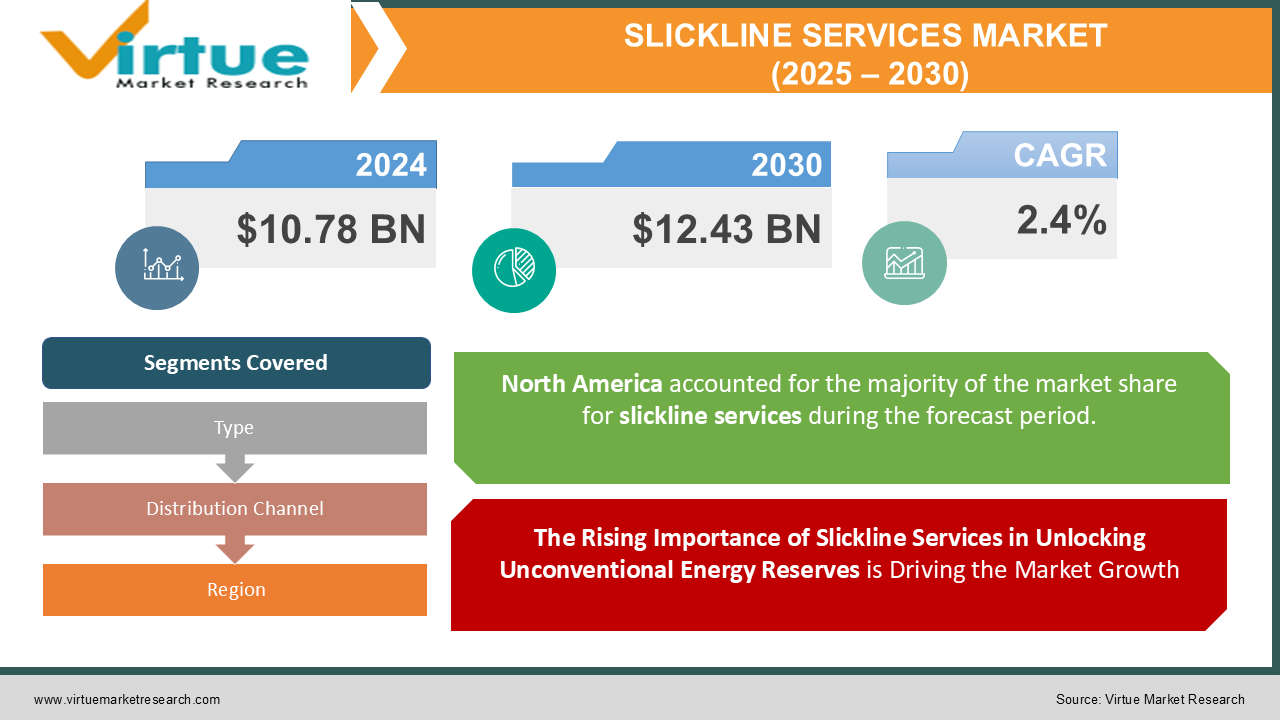

The Slickline Services Market was valued at USD 10.78 Billion in 2024 and is projected to reach a market size of USD 12.43 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 2.4%.

The slickline services market plays a pivotal role in the oil and gas sector, particularly in the realm of well intervention, maintenance, and data acquisition. Slickline services encompass the deployment of a thin, single-strand wire into oil and gas wells for various applications, including retrieving, installing, or manipulating downhole tools, as well as performing depth correlation and well diagnostics. This wireline service has become indispensable due to its precision, cost-effectiveness, and ability to function in high-pressure and high-temperature conditions. As global energy demand continues to surge, the need for efficient well intervention and maintenance has grown exponentially. Slickline services offer a non-invasive approach, enabling operators to optimize well performance without significant downtime. Unlike coiled tubing or more complex wireline methods, slickline services are lightweight, mobile, and require minimal operational infrastructure, making them highly preferred in remote and offshore locations. The market for slickline services has experienced consistent growth due to increased exploration and production (E&P) activities, particularly in unconventional reserves such as shale, tight oil, and deepwater fields. Enhanced oil recovery (EOR) techniques and secondary recovery methods also rely heavily on slickline tools to optimize well output. Moreover, as aging oil and gas infrastructure faces declining productivity, slickline services provide a cost-effective solution for well remediation and maintenance. However, the industry is not without its challenges. Volatility in crude oil prices has led to fluctuating investments in upstream activities, impacting demand for slickline services. Additionally, advancements in technology have introduced competition from other intervention methods, such as e-line and coiled tubing services. Despite these obstacles, the market remains robust due to its adaptability and indispensable role in well operations.

Key Market Insights:

-

The global slickline services market reached a valuation of approximately $8.3 billion in 2023.

-

Over 22% of total slickline service activities were dedicated to well completion operations in 2023.

-

Nearly 15 million feet of slickline were deployed globally in oil and gas operations during 2023.

-

42% of offshore well interventions utilized slickline services in 2023.

-

More than 60% of slickline tools used in 2023 were for retrieval operations, such as fishing and plug removal.

-

Approximately 18% of slickline activities in 2023 supported enhanced oil recovery (EOR) initiatives.

-

Over 1,200 slickline service providers were operational globally in 2023.

-

In 2023, slickline services contributed to 34% of the overall wireline services revenue.

-

The cost of a single slickline operation averaged $8,500 per day in 2023.

-

5% of slickline services in 2023 were used in geothermal well interventions.

-

Digital tools and telemetry-enhanced slickline units represented 10% of total slickline deployments in 2023.

-

Slickline tools for depth correlation accounted for 25% of all tool deployments in 2023.

-

The average lifespan of slickline wires in 2023 was reported to be 12,000 cycles per tool.

Market Drivers:

The Rising Importance of Slickline Services in Unlocking Unconventional Energy Reserves is Driving the Market Growth

Unconventional reserves, such as shale gas, tight oil, and deepwater offshore deposits, are becoming focal points for the energy industry. As conventional reserves dwindle, operators are compelled to explore and extract hydrocarbons from these challenging environments. Slickline services are uniquely positioned to meet the needs of these reserves due to their efficiency, adaptability, and cost-effectiveness. Slickline tools allow operators to perform crucial well intervention tasks, such as retrieving plugs, logging data, and setting downhole equipment, in unconventional reservoirs. These operations are essential for maintaining productivity in horizontal wells and optimizing production in multi-zone completions. As a result, slickline services have become an integral component of upstream operations in unconventional fields, where downtime and costs must be minimized. Moreover, the ability of slickline tools to operate under high-pressure and high-temperature (HPHT) conditions ensures their relevance in deepwater and ultra-deepwater exploration. In 2023, approximately 42% of offshore interventions relied on slickline services, highlighting their critical role in these environments.

Aging Oilfield Infrastructure and the Demand for Well Maintenance Fuelling the Market Growth

Globally, aging oilfields contribute a significant portion of hydrocarbon production. However, as these fields mature, they face challenges such as declining reservoir pressure, increased water production, and equipment wear and tear. Slickline services provide a cost-effective solution to address these issues through interventions that enhance well performance, prolong well life, and reduce operational costs. Slickline operations, such as fishing, plug retrieval, and valve maintenance, are essential for optimizing the productivity of aging wells. For instance, fishing operations using slickline tools accounted for over 60% of tool deployments in 2023, underscoring the importance of these services in maintaining older wells. The rise of digitalization in slickline operations has further strengthened this driver. Telemetry-enabled slickline units and real-time monitoring systems improve the accuracy and efficiency of well interventions. These advancements reduce the risk of equipment failure and enhance decision-making processes, making slickline services indispensable for maintaining aging oilfield infrastructure.

Market Restraints and Challenges:

Despite its numerous advantages, the slickline services market faces several restraints and challenges that could hinder its growth. These include market volatility, technological competition, and environmental concerns. The slickline services market is heavily influenced by fluctuations in crude oil prices. When oil prices decline, exploration and production (E&P) companies often reduce their budgets for well intervention and maintenance, directly impacting the demand for slickline services. This cyclical nature of the oil and gas industry creates uncertainty for service providers, limiting their ability to plan long-term investments and innovations. Advancements in other well intervention technologies, such as coiled tubing and e-line services, present significant challenges to the slickline market. Coiled tubing services, for instance, offer higher pulling and pushing capabilities, making them more suitable for heavy-duty operations. Similarly, e-line services provide advanced telemetry and data acquisition capabilities that compete with slickline tools. To remain competitive, slickline service providers must invest in research and development to integrate digital tools and telemetry systems into their operations. However, these investments require substantial financial resources, which may be difficult to allocate amid market uncertainties.

Market Opportunities:

The slickline services market is poised to benefit from several opportunities, including the integration of digital technologies and the expansion of renewable energy applications. Digitalization is revolutionizing the oil and gas industry, and the slickline market is no exception. The adoption of real-time monitoring systems and telemetry-enhanced slickline units presents a significant growth opportunity for service providers. These advancements enable operators to gather real-time data on well conditions, improve the accuracy of interventions, and reduce operational risks. For example, telemetry-enabled slickline units accounted for 10% of total deployments in 2023, indicating a growing trend toward digital adoption. By embracing these technologies, slickline service providers can enhance their value proposition, attract new customers, and differentiate themselves from competitors. The growing focus on renewable energy sources, such as geothermal energy, presents a new avenue for slickline services. Geothermal wells require interventions similar to those in oil and gas operations, making slickline tools highly relevant in this sector. In 2023, 5% of slickline services were used in geothermal well interventions, and this figure is expected to grow as the renewable energy sector expands.

SLICKLINE SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

2.4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Schlumberger, Halliburton, Baker Hughes, Weatherford International, Archer, Superior Energy Services, Expro Group, Altus Intervention, FMC Technologies, OilSERV, KCA Deutag, AOS Orwell, China Oilfield Services Limited (COSL), Sapura Energy, Wild Well Control |

Slickline Services Market Segmentation: by Type

-

Conventional Slickline

-

Telemetry-Enhanced Slickline

While conventional slickline tools dominate the market due to their established applications, telemetry-enhanced slickline is rapidly gaining traction. The integration of real-time data acquisition capabilities in telemetry-enhanced tools makes them ideal for complex interventions and diagnostics.

Slickline Services Market Segmentation: by Distribution Channel

-

Direct Sales

-

Third-Party Providers

Direct sales remain the dominant channel due to the preference of large operators for in-house tools and services. However, third-party providers are growing quickly, driven by the need for cost-effective and specialized solutions.

Slickline Services Market Segmentation - by Region

-

North America

-

Europe

-

Asia-Pacific

-

Middle East and Africa

-

Latin America

North America accounted for the largest market share in 2023, supported by its extensive oil and gas infrastructure and high levels of E&P activity. Asia-Pacific is the fastest-growing region, driven by increased investments in unconventional reserves and the rising adoption of advanced well intervention technologies.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly disrupted the slickline services market by causing a sharp decline in global energy demand and E&P activities. Many operators deferred well intervention projects due to restrictions on mobility and workforce availability. However, the pandemic also highlighted the importance of digital tools and automation in ensuring business continuity. As a result, the adoption of telemetry-enhanced slickline systems accelerated during this period, laying the foundation for long-term growth.

Latest Trends and Developments:

In 2023, the slickline market witnessed several noteworthy trends, including the increased use of eco-friendly tools, advancements in telemetry systems, and the expansion of service offerings into geothermal and other renewable energy sectors. These developments underscore the industry's commitment to innovation and sustainability.

Key Players in the Slickline Services Market:

-

Schlumberger

-

Halliburton

-

Baker Hughes

-

Weatherford International

-

Archer

-

Superior Energy Services

-

Expro Group

-

Altus Intervention

-

FMC Technologies

-

OilSERV

-

KCA Deutag

-

AOS Orwell

-

China Oilfield Services Limited (COSL)

-

Sapura Energy

-

Wild Well Control

Chapter 1. Slickline Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Slickline Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Slickline Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Slickline Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Slickline Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Slickline Services Market – By Type

6.1 Introduction/Key Findings

6.2 Conventional Slickline

6.3 Telemetry-Enhanced Slickline

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Slickline Services Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Third-Party Providers

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Slickline Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Slickline Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Schlumberger

9.2 Halliburton

9.3 Baker Hughes

9.4 Weatherford International

9.5 Archer

9.6 Superior Energy Services

9.7 Expro Group

9.8 Altus Intervention

9.9 FMC Technologies

9.10 OilSERV

9.11 KCA Deutag

9.12 AOS Orwell

9.13 China Oilfield Services Limited (COSL)

9.14 Sapura Energy

9.15 Wild Well Control

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the slickline services market is driven by increasing exploration and production activities in unconventional reserves, the need for efficient well intervention in aging oilfields, advancements in telemetry-enabled slickline tools, rising demand for real-time monitoring systems, and expanding applications in geothermal and renewable energy sectors.

The main concerns in the slickline services market include crude oil price volatility, which impacts exploration and production budgets; competition from advanced intervention technologies like coiled tubing and e-line services; environmental concerns over carbon emissions; and challenges in adapting to digital advancements, requiring significant investments in telemetry and real-time monitoring systems.

The slickline services market is supported by key players specializing in well intervention technologies. These companies include Schlumberger, Halliburton, Baker Hughes, Weatherford International, Archer, Superior Energy Services, Expro Group, Altus Intervention, FMC Technologies, OilSERV, KCA Deutag, AOS Orwell, China Oilfield Services Limited (COSL), Sapura Energy, and Wild Well Control. Together, these companies drive innovation and provide critical services to the global oil and gas sector.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.