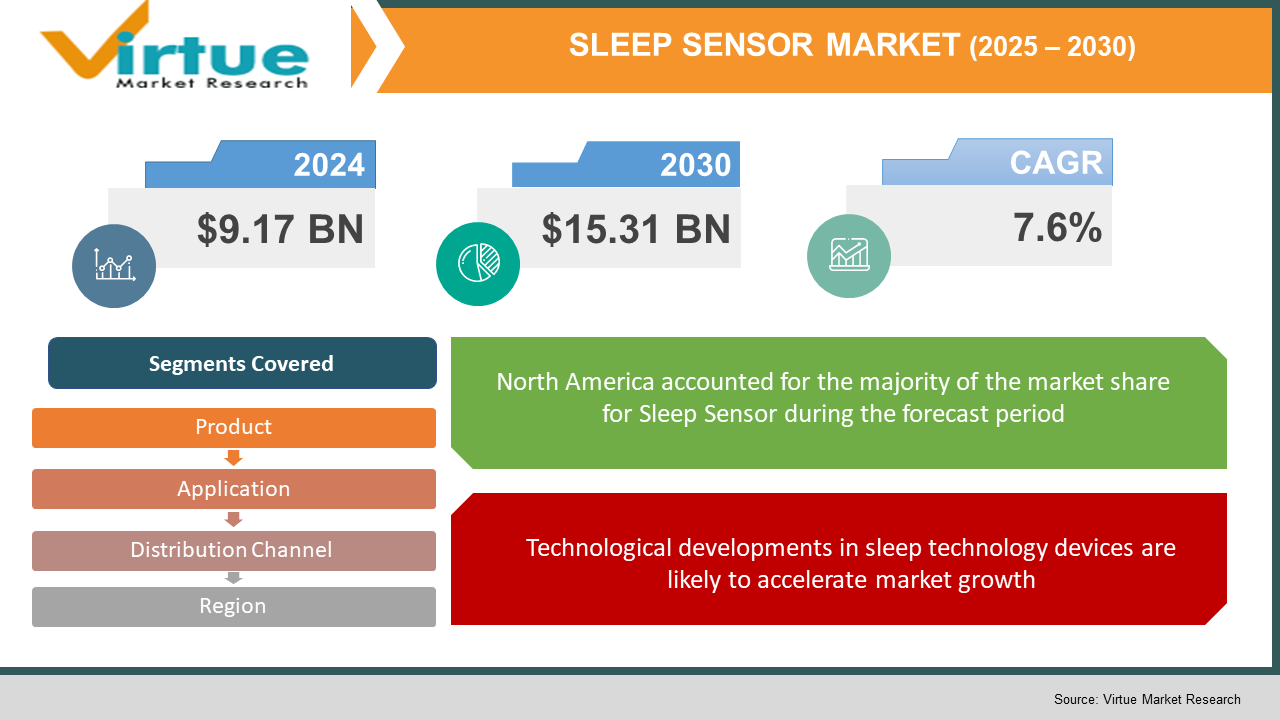

Sleep Sensor Market Size (2024 – 2030)

In 2023, the Global Sleep Sensor Market was valued at $9.17 billion, and is projected to reach a market size of $15.31 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 7.6%.

Industry Overview:

Devices and tools marketed as sleep tech are intended to improve sleep. These gadgets use upgraded sensor technologies that can estimate sleep patterns by monitoring a person's heart rate, blood oxygen levels, and sleep patterns. Rapid eye movement sleep is recorded by sensors built into the sleep monitors. In turn, sleep monitors assist in gathering important data based on analytical skills. Not only that but the wearer's patterns are observed by the sleep trackers, which then recommend treatments for sleep disorders. The global population's increasing prevalence of sleeping problems and rising personal disposable income are the two main drivers of the market for sleep trackers. The use of these devices for treating sleep apnea will increase most quickly. Other market development drivers include the increasing penetration of consumer goods, particularly in developing nations, the increased acceptance of smart and wearable technologies or devices, and the simple accessibility through both online and offline distribution channels. In the long run, evolving consumer lifestyles and increasing e-commerce platform penetration, particularly in developing economies, will also open up profitable and rewarding market expansion potential for sleep trackers. The market is anticipated to advance due to the rising awareness of sleep technology devices' availability in developing and undeveloped nations.

COVID-19 pandemic impact on Sleep Sensor Market

The COVID-19 pandemic had a detrimental impact on the market for sleep technology products in the first two quarters of 2020, but it has since recovered after the lifting of lockdowns. Additionally, the production, development, and shipment of sleep technology devices were hampered by the coronavirus pandemic. Due to these disruptions, production facilities had to temporarily close, while contract manufacturers and other supply chain providers had limited availability. Additionally, people have had numerous sleepless nights as a result of their social and physical isolation and financial stress, which has increased the usage of tools that may identify, track, and assist with the management of sleep disorders during the pandemic.

MARKET DRIVERS:

Technological developments in sleep technology devices are likely to accelerate market growth

An increasing number of individuals suffering from severe sleep problems are anticipated to find treatment due to growing advances and advancements in sleep technology. Artificial intelligence has recently become a useful tool for offering advice on how to manage sleep disorders like insomnia. The development of an AI-powered smart bed that can adapt to the user's body posture during the night and help them sleep better is being developed by several manufacturers. Additionally, numerous tools that can change brain waves are being created to encourage specific wave patterns that promote restful sleep. For improved sleep, alpha waves are used in the FitSleep 1 device from a Chinese company called FitSleep.

The demand for wearables will be fueled by rising rates of sleep disorders, and the industry will expand as more people become aware of the advantages of getting quality sleep.

The America Sleep Apnea Association estimates that almost 22 million Americans have sleep apnea, with 80% of cases of moderate and severe obstructive sleep apnea going undiagnosed. If OSA is left untreated, it can result in high blood pressure, chronic heart failure, atrial fibrillation, stroke, and other cardiovascular problems. Additionally, the development of the sleep technology devices market would be aided by the availability of sleep apnea equipment such as revolutionary nerve stimulators and body positioners. Chronic stress or discomfort are all common causes of insomnia. As a result, there is a high need for sleep monitoring and treatment equipment. The demand for smart sleep technology will also rise as people become more aware of the advantages of getting quality sleep for their health and general well-being.

Increased government initiatives are accelerating market expansion.

By implementing numerous educational initiatives, governments and sleep foundations from all over the world are concentrating on lowering the cost of healthcare services. These activities have raised consumer awareness of the different sleep problem therapies and cutting-edge technological tools available, which are fueling the growth of the wearable sleep sensors market.

MARKET RESTRAINTS:

The market growth for sleep sensors may be constrained by high device costs and strict regulatory requirements.

The long-term growth of the sleep tracker market can be significantly hampered by the high prices associated with smart wearable technologies and gadgets. The market growth rate could also be slowed down by volatile raw material prices and increased cost competition among already existing businesses. Additionally, the market growth rate for sleep sensors can be hampered by growing privacy and security worries along with a strict regulatory framework.

The market's expansion is being constrained by a lack of awareness regarding sleep disorders and sleep sensor devices.

The major market players are working together to conduct various research and development projects to introduce cutting-edge solutions for a range of sleep disorders. One of the main challenges likely to slow the growth of the wearable sleep trackers market is the lack of knowledge about sleeping conditions and wearable medical devices available for tracking these conditions.

SLEEP SENSOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By Product, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Beddit (Apple Inc.), Cadwell Industries Inc., Casper Sleep Inc., Eight Sleep, Dodow (LIVLAB), Emfit Ltd., Koninklijke Philips N.V., Fitbit Inc. (Google LLC), ResMed Inc., Sleep Shepherd LLC, Oura Health Ltd., Huawei Technologies Co Ltd, Garmin Ltd, Nike Inc, Sony Corporation, Apple Inc, Sleepace, Xiaomi, Withings, |

This research report on the Sleep Sensor Market has been segmented based on product, application, distribution channel, and region.

Sleep Sensor Market – By Product

- Wearables

- Smartwatches and bands

- Others

- Non-wearables

- Sleep monitors

- Beds

- Others

Based on Product, the Sleep Sensor Market is bifurcated into Wearables and Non-Wearables. The wearables segment had around 76% of the market share in 2021, driven by the increased prevalence of sleep disorders such as sleep apnea and insomnia worldwide, the availability of numerous wearable sleep trackers, and the necessity of getting enough rest. Launches of wearable smart sleep trackers will also have a favorable impact on the market expansion.

Sleep Sensor Market – By Application

- Insomnia

- Obstructive sleep apnea

- Narcolepsy

- Others

Based on Applications, the Sleep Sensor Market is bifurcated into Insomnia, Narcolepsy, Obstructive Sleep Apnea, and Others. The segment for sleep apnea had the greatest market share in 2021 and is predicted to increase at the fastest rate, with a CAGR of 8.2% from 2023 - 2030. The demand for wearable medical devices for the treatment of sleep apnea is on the rise, and this growth is due to factors including the expansion of medical insurance coverage for sleep apnea devices. Rapid eye movement sleep had significant cardiometabolic repercussions from sleep apnea, which is what is propelling the market for wearable sleep trackers. Due to the increasing penetration of new technical devices for the treatment of insomnia and the rise in the use of smart wearable devices for the treatment of insomnia conditions by the young population, the insomnia segment held the second-largest share in 2020.

Sleep Sensor Market – By Distribution Channel

- Specialty clinics

- Direct-to-consumer

- Hospital

- Online Channel

- Others

Based on Distribution channels, the Sleep Sensor Market is bifurcated into Specialty Clinics, Hospitals, Online channels, Direct-to-consumer, and Others. The online channels segment had the biggest market share in 2021 and is predicted to increase at the fastest rate, with a CAGR of 8.5% from 2023 - 2030. This expansion is the result of factors including rising customer desire for a digitalized shopping experience and increased need for door-to-door delivery. The market for wearable sleep trackers is expanding as a result of young people's rising internet desire for fitness tracker gadgets. Due to a variety of smart wearable devices available with a variety of brands and price points, the presence of distinct product shelves combined with alluring promotions in supermarkets, and an increase in investment by the major players, the Supermarkets/Hypermarkets segment held the second-largest share in 2021.

Global PCR Food Testing Systems Market - By Regional Outlook:

- North America

- Europe

- Asia-Pacific

- Rest of the World

North America dominated the sleep sensor market with a 42% market share in 2021 due to the presence of significant companies, the presence of advanced healthcare facilities, and the rising prevalence of sleep disorders in this area. The need for wearable medical devices, fitness tracker gadgets and an increase in the number of innovative product launches for the treatment of various sleep disorders are all contributing factors to the growth of this market. Additionally, a sizeable grant was given to the American Academy of Sleep Medicine in 2021 to spread knowledge about obstructive sleep apnea. The main objective of this campaign is to increase public knowledge of chronic conditions like sleep apnea by enabling partners and stakeholders to educate, engage, and support public awareness campaigns.

The Asia-Pacific Sleep Sensor market is predicted to grow at the highest CAGR over the forecast period due to improvements in wearable technologies. The rise in government initiatives and the rising demand for smart wearable devices for the treatment of sleep apnea are two factors contributing to the growth of this market. Some of the key factors driving market expansion in this region include rising personal disposable income, fast globalization, westernization, modernization, and rising wearable technology awareness.

Major Key Players in the Market

- Beddit (Apple Inc.)

- Cadwell Industries Inc.

- Casper Sleep Inc.

- Eight Sleep

- Dodow (LIVLAB)

- Emfit Ltd.

- Koninklijke Philips N.V.

- Fitbit Inc. (Google LLC)

- ResMed Inc.

- Sleep Shepherd LLC

- Oura Health Ltd.

- Huawei Technologies Co Ltd

- Garmin Ltd

- Nike Inc

- Sony Corporation

- Apple Inc

- Sleepace

- Xiaomi

- Withings

Notable happenings in the Sleep Sensor in the recent past:

- Product Launch- In May 2022, Somnee, a brand-new sleep aid from StimScience, was introduced. It is an electronic headband that employs non-invasive, customized brain stimulation to help individuals fall asleep.

- Product Launch- In January 2020, the Amazfit T-Rex, a sophisticated activity and sleep tracking sensor were introduced by Huami Corporation. This product has a 1.3-inch AMOLED display and promises to have a battery life of up to 20 days.

- Product Launch- In August 2020, Fitbit introduced Inspire 2 with features including a heart-rate monitor, a sleep monitor, guided breathing sessions for sedentary reminders, and more than 20 activity modes. The most cutting-edge sensor technologies and algorithms are combined with these goods to reveal additional details about bodies and health.

- Product Launch- In September 2020, Samsung released the Galaxy Fit 2 fitness tracker, which records heart rate, steps taken, and sleep duration.

- Product Launch- In February 2019, Apple Inc. unveiled a sleep tracking capability for a future iteration of its wristwatch. The company's capacity to increase its product offerings in the market for sleep technology devices was improved by this strategy.

Chapter 1. SLEEP SENSOR MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SLEEP SENSOR MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. SLEEP SENSOR MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. SLEEP SENSOR MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. SLEEP SENSOR MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SLEEP SENSOR MARKET – By Product

6.1. Wearables

6.1.1. Smartwatches and bands

6.1.2. Others

6.2. Non-wearables

6.2.1. Sleep monitors

6.2.2. Beds

6.2.3. Others

Chapter 7. SLEEP SENSOR MARKET – By Application

7.1. Insomnia

7.2. Obstructive sleep apnea

7.3. Narcolepsy

7.4. Others

Chapter 9. SLEEP SENSOR MARKET – By Distribution Channel

8.1. Specialty clinics

8.2. Direct-to-consumer

8.3. Hospital

8.4. Online Channel

8.5.Others

Chapter 9. SLEEP SENSOR MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. Middle-East and Africa

Chapter 10. SLEEP SENSOR MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Company 1

10.2. Company 2

10.3. Company 3

10.4. Company 4

10.5. Company 5

10.6. Company 6

10.7. Company 7

10.8. Company 8

10.9. Company 9

10.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900