Skid Market Size (2024-2030)

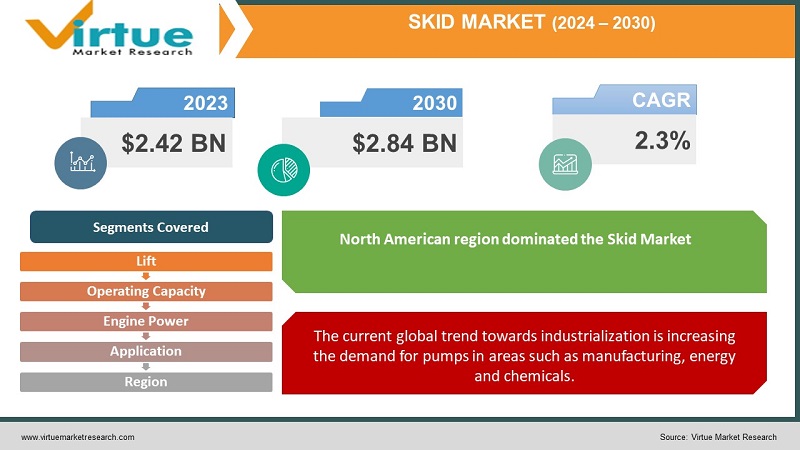

The Skid Market was valued at USD 2.42 billion in 2023 and is projected to reach a market size of USD 2.84 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.3%.

Skid loaders can maneuver in small spaces, which is expected to increase their demand in construction projects where larger vehicles cannot fit. In addition, skid steer loaders have a lot of accessories. Buckets, forks, augers, hydraulic hammers, trenchers, stumps and rakes are popular attachments for these loaders. Depending on the requirements, these attachments are used to perform certain tasks. Therefore, it is expected that the ability of skid steer loaders to accomplish different tasks and the easy change of attachments will have a positive impact on market growth opportunities.

Continued technological advancements in user comfort, telematics integration and automation are expected to expand the company's players. However, the high cost of skids compared to backhoe loaders is expected to limit their adoption to some extent.

Key Market Insights:

Trade Volume Trends: Our report extracts import and export data from the past five years to reveal key trends and growth trends in the global skid steer loaders market. This research makes data that allows readers to gain a deeper understanding of the market situation. Market Players: Get a profile of the top players in the skid steer loader industry. From established giants to emerging competitors, our analysis highlights key contributors to import and export. Geographical location: deepen the geographic distribution of business activities. Find out which regions control exports and which hold rights to imports, building a comprehensive picture of the company's global footprint. Product Breakdown: By segmenting data based on skid steer loader models, we provide a greater view of business interests and changes, allowing companies to align their strategies with changing technologies.

Import and export data is critical to reporting because it provides insight into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing business trends, businesses can make smart decisions, manage risks and adapt strategies to changing demand. This data helps the government in policy making and trade negotiations, while investors use it to evaluate market potential. In addition, import and export data contribute to economic indicators, affect product production and improve understanding of international trade, making it necessary for comprehensive and informed research.

Skid Market Drivers:

The construction industry is growing augmenting the demand for skids in the market.

Significant growth in the construction sector is expected to fuel the demand for skid steer loaders across the globe. Vertical skid lifters are used in many places and industries for different purposes. Mid-range skid steer loaders see a rise in productivity.

It is expected that increased government investment in various infrastructure projects in developing and developed countries will promote the growth of the construction sector, which will increase the market for shippers. The skid steer loader market is showing steady growth, fueled by increasing construction and agricultural activity. Skid loaders are widely used in construction for their versatility in applications such as excavation and material handling. Additionally, their compact design makes them ideal for tight spaces. Agricultural equipment, including material handling and agricultural processing, also contributes to market demand. Technological progress plays an important role, focusing on improving efficiency, user comfort and the integration of telematics. The market is competitive, with companies emphasizing innovation and eco-friendly initiatives. Regional trends depend on economic conditions and infrastructure development. In addition, there is a noticeable change in support, leading to the design of skid loaders that are more efficient in the environment. Keeping up with these trends is crucial for players who want to navigate the dynamic skid steer loader market. The long waiting time is a major concern and is augmenting the tourism business in the medical sector.

The demand for skid steer loaders is expected to increase due to their improved performance and compact size.

They can move to different locations as they are a suitable solution for construction projects when large trucks cannot reach the sites. Skid loaders have many attachments, including buckets, forks, augers, water hammers, landscape rakes, trenchers and stump grinders.

Skid Market Restraints and Challenges:

Despite its growth, the skid steer loader market is facing some obstacles and challenges. One of the main challenges is the economic impact of global uncertainty, such as the economic downturn and geopolitical conflicts, which can hinder construction and infrastructure projects, thereby affecting demand of skid carriers. In addition, the company faces fluctuations in raw material prices, which affect manufacturing costs as well as product costs and profit margins. Strict environmental regulations also pose challenges, prompting manufacturers to invest in research and development to create environmentally friendly products. In addition, the market faces competition from other equipment and machines, and the rapid pace of technological progress requires continuous innovation to remain competitive. In addition, the shortage of skilled labor in some areas poses challenges to the operation and maintenance of skid loaders, highlighting the need for training programs and the improvement of automation strategies. Addressing these challenges is critical to the continued growth and success of the flexible skid steer loader market.

Compared to other options, skid steers are expensive. This is why it is difficult for some producers to rent or buy them in large quantities. Even in the agricultural sector, it is becoming impossible for poor farmers to buy these machines.

The mechanism of skid loaders is complicated compared to that of normal tractors. It is also expected that some strict clearance regulations regarding the use of various construction materials will also apply to the products sought by the industry.

Skid Market Opportunities:

The skid steer loader market provides tremendous opportunity for growth and innovation. Current trends in the construction industry around the world are driving the demand for skid loaders and equipment development. In addition, the growing focus on sustainable practices and environmental awareness paves the way for the development of eco-friendly models and energy, giving manufacturers the opportunity to enter the growing market. . Technological advances, including the integration of smart technology and automatic features, allow to improve the efficiency and capacity of skid carriers, meeting the changing needs of the industry. In addition, the expansion of the agricultural sector and the adoption of active farming systems are creating new applications for skid carriers such as crop management and processing. Partnerships with rental companies and partnerships are necessary to enter emerging markets and provide opportunities for industry players. As demand for versatile and compact equipment continues to rise, the skid steer loader market provides fertile ground for innovation and market expansion.

SKID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.3% |

|

Segments Covered |

By Lift, Operating capacity, engine power, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bobcat, Caterpillar, John Deere, Kubota, New Holland, Case IH, Terex, Wacker Neuson, Gehl, Komatsu |

Skid Market Segmentation:

Skid Market Segmentation: By Lift

- Radial

- Vertical

In 2023, based on the Lift type, the Radial Lift segment accounted for the largest revenue share. The concept of Radial Lift has been a major factor influencing the global skid steer loader market. Radial lift design refers to the boom which is continuously making noise, providing the ability to dig and push. This design has gained popularity due to its versatility, making it suitable for many construction, agricultural and landscaping applications. The growing demand for skid steer loaders with radial lift capabilities can be attributed to their performance in jobs such as digging and lifting, thereby improving overall equipment performance. The impact on the global compact radial loader market is significant as manufacturers are increasingly adopting this strategy to meet user demands for improved productivity and flexibility. The industry is looking for the best equipment in material handling, digging and maneuvering in these confined spaces, making the acceptance of the radial lift system, reshaping the market area and impacting the product development plan to match the behavior and - grow up.

Skid Market Segmentation: By Operating Capacity

- Up to 2,000 lbs

- 2,001 to 3,000 lb

- Above 3,000 lbs

In 2023, the 2,001 to 3,000 lb segment dominated the global market and accounted for the highest market share. The 2,001-3,000 lb segment of the global radial loader market represents an important segment for various applications in the construction, agricultural and industrial sectors. The growing demand for these cargo carriers is due to their optimal size, featuring a balance between compactness and carrying capacity. Factors such as increasing construction activity worldwide, especially in urban areas, are contributing significantly to the growing demand for 2,001-3,000 lb compact radial loaders. Their versatility in navigating confined spaces and handling various applications makes them essential in all areas

Upto 2000lbs is the fastest growing segment. The compact radial loader market, especially those with lift capacities up to 2,000 lbs, is seeing significant growth driven by a variety of factors. The growing demand for compact construction equipment with high lift capacity is a key factor. These carriers, known for their power and versatility, are becoming essential in construction, landscaping and agricultural applications. The growing trend of urbanization and infrastructure development worldwide is driving the demand for skid steers in this weight class. Additionally, the impact of technological advancements, such as the integration of radial lift designs to improve lift efficiency, is shaping the market segment.

Skid Market Segmentation: By Engine Power

- Up to 65 HP

- 66 to 80 HP

- Above 80 HP

In 2023, the Upto 65 HP segment dominated the market share. The below 65 HP group is playing an important role in shaping the growth trend of the global radial loader market. The importance of this aspect is demonstrated by its translation and application in various areas including construction, agriculture and landscaping. The growing demand for compact and powerful equipment in these sectors is driving the market, as these low-power machines support tasks that require maneuvering in space.

66 to 80 HP is the fastest growing segment. The 66-80 horsepower (HP) segment has been the main driver of the global radial loader market, contributing significantly to its growth. This power range affects the balance between power and performance, meeting different applications in industry, agriculture and industry. The growing demand for machines of this power is caused by their diversity in different tasks, from large construction projects to agriculture.

Market Segmentation: By Application:

- Construction

- Agriculture and Forestry

- Mining

- Industrial

- Ground Maintenance

In 2023, the Construction segment dominated the skid market. Based on application, the construction segment dominates the skid steer loader market. Skid steer loaders are important on the construction site because of their incredible flexibility. Excavation, material handling, grading, demolition and site preparation are all services used. Due to their small size and mobility, they can work in small areas and work in crowded areas, making them essential for many construction projects, from building developments to infrastructure projects. Their ability to handle various materials adds to their value in the construction industry. Skid steer loaders excel in material handling. They safely load and unload goods from trucks, deliver construction materials to the site, and manage inventory in storage. This capability increases productivity, reduces schedule and helps construction companies save money. Skid steers have developed into useful tools in agriculture and forestry. Farmers use them to carry food, haul hay, and clean barns. They help with land clearing, planting and activities. Because of their small size and low soil pressure, they are ideal for light agriculture. In addition, forestry-specific tools, such as mulchers and grapples, enable them to perform intensive forestry activities. Skid loaders are used in mining operations to transport, excavate and clean in the ground and mine. Their small size and flexibility are useful in the chaotic and chaotic conditions of mines.

Skid Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, the North American region dominated the Skid Market with a revenue of 35%. The construction industry in North America is one of the largest in the world and will likely continue to grow in the coming years. Skid loaders, which are used in many construction applications including site preparation, material handling and mining, are seeing an increase in demand due to this increase. North America has one of the highest rates of urban development in the world. This is driving the growth of new cities and infrastructure development, as well as the need for compact carriers. Additionally, the availability of premium manufacturing equipment along with an established community of steer loader manufacturers and dealers in North America has made this equipment more accessible. This, in turn, eases maintenance and repair work, making skid boats more attractive to buyers. Due to increasing urbanization, expansion of infrastructure services, introduction of attractive urban programs and rapid regional production, Asia Pacific accounts for the second largest market in the world. Manufacturers are investing heavily in developing advanced equipment to make construction and development of equipment faster and more cost-effective. Smart city programs in various countries across the Asia-Pacific region have increased demand for quality construction equipment, such as skid steers. These machines are very important in creating a modern and technological society. Regional production is another major factor driving the growth of the skid steer loader market in Asia-Pacific.

COVID-19 Impact Analysis on the Skid Market:

The COVID-19 pandemic has had a mixed impact on the skid steer loader market. Earlier, the company faced disruptions in production and supply chain due to lockdowns, restrictions and shortages. Construction has been delayed or stopped, leading to less demand for skid loaders. In addition, economic uncertainty and financial restrictions on businesses and individuals have affected the market. However, as part of construction and agriculture have adapted to the new standards, the market has shown strength. The focus on automation and technology during the pandemic has accelerated the integration of smart devices into skid loaders, driving contactless and efficient operations. Increased attention to infrastructure development, especially in areas implementing economic recovery policies, has spurred the demand for construction equipment, including skid steers. Although the initial impact has been challenging, the sector's ability to adapt to changing conditions and use technology points to a path to recovery that can be developed in the long term.

Latest Trends/ Developments:

Electric and hybrid skid steer loaders are becoming increasingly popular as teams and operators look for environmentally friendly and fuel efficient solutions. These devices emit fewer emissions, which reduces their environmental impact. Telematics, GPS and automation technologies are becoming increasingly common in skid steer loaders. These solutions make workers more efficient, secure and monitor equipment, increase productivity and reduce downtime. The construction equipment rental market, especially skid steer loaders, is growing as companies choose to lease equipment instead of capitalizing on it. The demand for cost-effective and flexible solutions drives this trend. Due to the development of buildings and infrastructure, the demand for skid loaders is increasing in emerging countries. Manufacturers are looking to expand their markets in these areas. The use of remote control and automation technology is increasing. These features allow operators to operate skid loaders from a distance, improving safety and efficiency, especially in hazardous areas. Skid loaders are also used in other fields such as agriculture, landscaping and mining. This is due to the flexibility and adaptability of skid loaders, making them perfect for many different jobs. Skid loaders are also used in agriculture and forestry for tasks such as loading and unloading, small excavation, and landscaping.

Key Players:

- Bobcat

- Caterpillar

- John Deere

- Kubota

- New Holland

- Case IH

- Terex

- Wacker Neuson

- Gehl

- Komatsu

- In August 2023: Doosan Bobcat has expanded its range of industrial air compressors by introducing its new 150 hp, fixed speed, oil-filled rotary screw compressor, the D150.

- In October 2023: Takeuchi continues to expand the 300 Series excavator lineup with the addition of the new TB320. The TB320 is part of the two-ton production class and features a rotating tail design for height and stability.

Chapter 1. Global Skid Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Skid Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Skid Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Skid Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Skid Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Skid Market– By Lift

6.1. Introduction/Key Findings

6.2. Radial

6.3. Vertical

6.4. Y-O-Y Growth trend Analysis By Lift

6.5. Absolute $ Opportunity Analysis By Lift , 2024-2030

Chapter 7. Global Skid Market– By Operating Capacity

7.1. Introduction/Key Findings

7.2. Up to 2,000 lbs

7.3. 2,001 to 3,000 lb

7.4. Above 3,000 lbs

7.5. Y-O-Y Growth trend Analysis By Operating Capacity

7.6. Absolute $ Opportunity Analysis By Operating Capacity , 2024-2030

Chapter 8. Global Skid Market– By Engine Power

8.1. Introduction/Key Findings

8.2. Up to 65 HP

8.3. 66 to 80 HP

8.4. Above 80 HP

8.5. Y-O-Y Growth trend Analysis Engine Power

8.6. Absolute $ Opportunity Analysis Type, 2024-2030

Chapter 9. Global Skid Market– By Application

9.1. Introduction/Key Findings

9.2. Construction

9.3. Agriculture and Forestry

9.4. Mining

9.5. Industrial

9.6. Ground Maintenance

9.7. Y-O-Y Growth trend Analysis Application

9.8. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 10. Global Skid Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Lift

10.1.3. By Operating Capacity

10.1.4. By Application

10.1.5. Engine Power

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Lift

10.2.3. By Operating Capacity

10.2.4. By Application

10.2.5. Engine Power

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Lift

10.3.3. By Operating Capacity

10.3.4. By Application

10.3.5. Engine Power

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Lift

10.4.3. By Operating Capacity

10.4.4. By Application

10.4.5. Engine Power

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Lift

10.5.3. By Operating Capacity

10.5.4. By Application

10.5.5. Engine Power

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Skid Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Bobcat

11.2. Caterpillar

11.3. John Deere

11.4. Kubota

11.5. New Holland

11.6. Case IH

11.7. Terex

11.8. Wacker Neuson

11.9. Gehl

11.10. Komatsu

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Skid Market was valued at USD 2.42 billion in 2023 and is projected to reach a market size of USD 2.84 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.3%.

Increasing demand in the construction industry is driving skid steer loader market.

Based on Lift, the Skid Market is segmented into Radial, Vertical.

North America is the most dominant region for the Skid Market

Lonking, Caterpillar, JCB, Hitachi, Terex, LiuGong Machinery, Doosan Infracore, Bobcat, Komatsu, Case Construction, Hyundai, Liebherr in the Skid Market.