Ski Market Size (2025 – 2030)

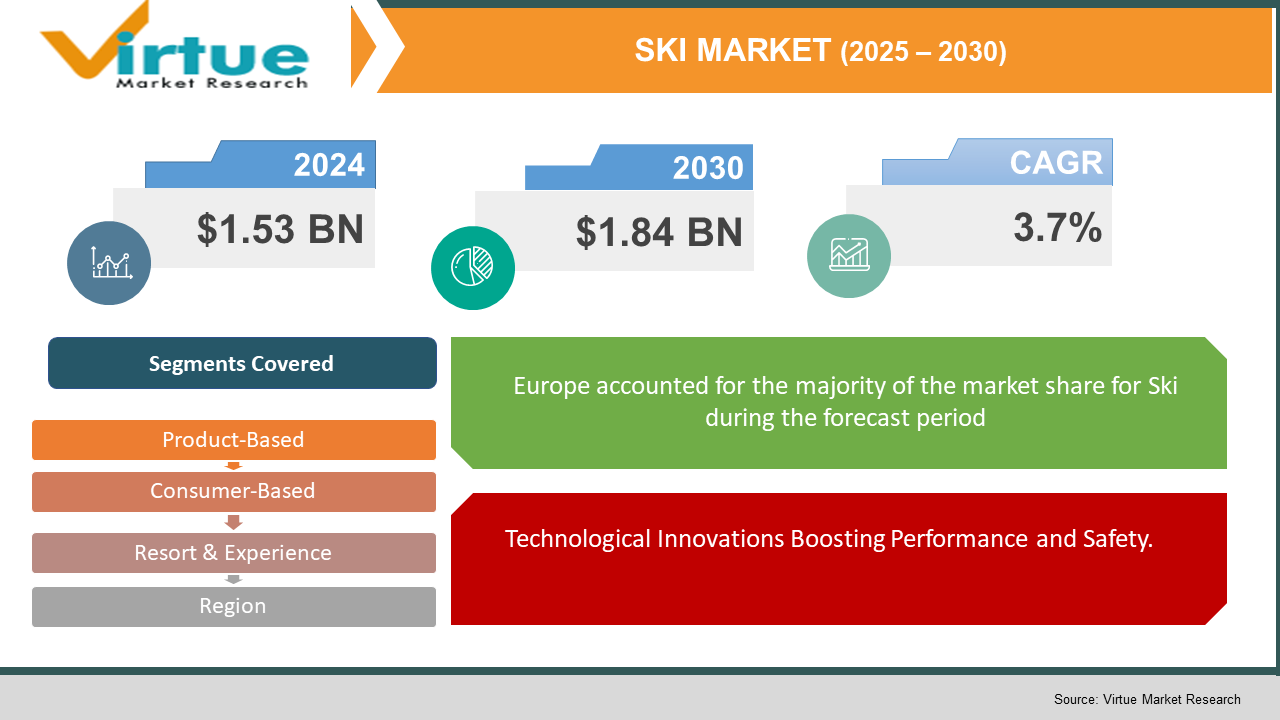

The Ski Market was valued at $1.53 billion and is projected to reach a market size of $1.84 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.7%.

Skiing is the activity or sport of sliding down snow on long, thin runners known as skis, usually connected to ski boots through bindings. Poles are also utilized for balance, control, and direction. The core products within the ski market are skis and poles, ski boots, and protective accessories and equipment such as helmets, goggles, and clothing. These are distributed both online and offline and target men, women, and children. The international ski market is growing steadily as a result of increased participation in winter sports, growing disposable incomes, growing demand for outdoor recreation, and investments in the development of ski resorts. Major trends involve the growing popularity of freeride skiing—off-piste and backcountry skiing—which is creating demand for higher-level, terrain-specific equipment. Technological advances, including lightweight materials, cambered skis, and improved boot design, are increasing performance and safety. Sustainable strategies are also driving the market, with environmentally friendly consumers looking for green products and ski resorts spending money on green infrastructure. While the market is growing, some challenges include the prohibitive cost of ski equipment and maintenance, which can discourage new entrants. Though, companies are answering this challenge through the provision of renting services, price-friendly product offerings, and loaning services. The regulatory norms also define the industry by facilitating safety and protecting the environment. The ski market also enjoys the status of its Olympic status as well as expanding ski tourism across the globe like in North America and Europe, where ski infrastructures are suitably developed. Generally, the market is driven by a combination of innovation, adventure travel, and worldwide emphasis on active lifestyles, so skiing is a long-term, dynamic part of the sporting goods industry.

Key Market Insights:

- Fischer Sports released its new Ranger series skis, featuring environmentally friendly materials like recycled steel edges, vegetable oil-based top sheets, and recyclable bases, focusing on ski manufacturing sustainability.

- Dalbello released the Green Menace and Green Gaia ski boot line, using recycled materials to make what is deemed the most sustainable ski boot on the market.

- Premium fashion brands such as Louis Vuitton, Gucci, and Jimmy Choo have moved into the skiwear segment, launching collections that merge technical performance with high-fashion design, responding to the increasing trend for fashionable and functional skiwear.

- Ski equipment stores are embracing digital technologies such as augmented reality (AR) and virtual try-on capabilities to improve online shopping, enabling consumers to see products before they buy.

- Helly Hansen released radar-sensitive pants with a revised rescue system that reflects the position of the skier if buried in snow, highlighting innovation in safety-oriented ski wear.

Ski Market Key Drivers:

Revolutionizing Ski Equipment: Technology, Tourism, and Sustainability Trends

Technological Innovations Boosting Performance and Safety.

Advances in materials and design are transforming ski gear. Companies are integrating lightweight composites and intelligent technologies to enhance performance and safety. For example, the incorporation of GPS tracking and performance analysis software in ski equipment enables real-time monitoring and improved user experience. These technologies benefit not only professional athletes but also provide greater accessibility and enjoyment for recreational users.

Adventure Tourism Growth Spurring Equipment Demand.

The growth in adventure tourism has greatly influenced the ski equipment industry. Ski resorts globally are diversifying their activities to year-round operations, drawing tourists looking for off-the-beaten-path experiences. This has increased the demand for ski equipment, as tourists invest in good quality equipment for their adventures. Tour operators and ski schools are also providing package offers that involve equipment rental, opening up skiing to a wider market.

Focus on Sustainability and Eco-Friendly Products.

Environmental issues are affecting consumer behavior, and consumers are now demanding sustainable ski gear. To keep pace, manufacturers are designing products that incorporate recycled materials and utilize environmentally friendly production processes. For instance, some manufacturers are crafting skis and boots out of recycled plastic, which lessens the ecological footprint of products. This trend towards sustainability is not just appealing to green consumers, but it also addresses larger industry aspirations to encourage sound skiing habits.

Ski Market Restraints and Challenges:

Ski Industry Confronts Growing Challenges in the Face of Climate Change and Increased Costs.

The ski industry is facing serious challenges that challenge its sustainability and affordability. Climate change has resulted in decreased snowfall and shorter ski seasons, prompting resorts to invest heavily in artificial snowmaking. This adjustment is expensive, involves high energy and water requirements, and tends to lead to increased operational costs. Thus, these higher expenses are transferred to consumers in the form of higher lift ticket and equipment costs, rendering skiing less accessible to many. Smaller ski resorts, with insufficient finances to invest in such technology, risk closure, further reducing participation in skiing experiences. Additionally, the demographic of the industry continues to be predominantly wealthy and less diverse, with a high percentage of participants being Caucasian and higher-income individuals. This exclusion is compounded by the increased expense of climate adaptation, which has the potential to disenfranchise underrepresented groups. If these tendencies persist, skiing could become progressively elite, only available to the privileged few, thus counteracting attempts to increase participation and enhance diversity in the sector.

Ski Market Opportunities:

Opportunities in the Ski Market Through Innovation, Sustainability, and Wellness Tourism.

The ski market is at the threshold of tremendous growth driven by technological progress, a turn towards sustainability, and the embrace of wellness tourism. The production of skis and snowboards is being fueled by eco-friendly materials like recycled plastics and vegetable-based resins, reflecting consumers' growing call for environmentally sustainable products. In addition, the use of 3D printing technology enables customized gear with improved performance and less waste of material. The trend towards customization meets the needs of skiers with customized equipment optimized for their use, hence an enhanced user experience and satisfaction. Further, ski resorts are diversifying their services beyond conventional winter sports to wellness facilities such as spas, thermal baths, and health retreats. This diversification draws a wider customer base, including those who are interested in holistic health experiences and makes ski resorts year-round destinations. The incorporation of wellness tourism not only increases off-season income but also caters to the international trend of valuing health and well-being in travel decisions. New markets offer another source of growth. Developing economies are investing in ski facilities, backed by government policies to encourage tourism and sports. These investments create new markets for ski equipment makers and service providers, providing opportunities to access a growing pool of winter sports enthusiasts.

SKI MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.7% |

|

Segments Covered |

By Product- Based, consumer based, resort and experience , and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amer Sports Oyj, Fischer Sports GmbH, Rossignol Group, Black Diamond Equipment Ltd., K2 Sports, Volkl Sports GmbH, Nordica S.p.A., Blizzard Sport GmbH, Elan d.o.o., Head |

Ski Market Segmentation:

Ski Market Segmentation: By Product-Based

- Ski Gear & Equipment (Skis and Poles, Ski Boots, Protective Gear & Accessories)

- Ski Apparel

Among ski equipment products, ski boots have become the most rapidly growing product category. Holding about 30% of the market share in 2023, their growth is driven by innovations to increase comfort and performance. Developments like custom-fit liners, better insulation, and lighter materials have increased the attractiveness of ski boots to both beginners and professionals. The rising popularity of skiing as a sports activity, along with a greater focus on customized equipment, has further driven demand. Companies are also investing efforts into creating boots targeted for distinct skiing styles and terrain types, thus expanding their customer base.

On the other hand, ski apparel is in the leading position in the market, generating much of total revenue. This dominance is due to the intrinsic role of clothing in offering protection from extreme weather conditions and performance improvement. The segment has a broad portfolio of products, ranging from jackets, pants, base layers, and accessories, all made with cutting-edge materials for better insulation, breathability, and moisture-wicking capabilities. The marriage of function and fashion has also been significant, as customers now look for fashionable yet functional skiing clothing. Additionally, the growing number of eco-aware consumers has resulted in an increased demand for sustainable ski wear, encouraging brands to integrate recycled materials and environmentally friendly manufacturing. This mix of innovation, fashion, and sustainability continues to further establish ski wear's dominant market position.

Ski Market Segmentation: By Consumer-Based

- Demographics (Age Groups, Gender)

- Behavior (Comfort-Pursuant, Price-Sensitive, Safety-Oriented)

The ski market is experiencing strong growth among women due to higher participation and product targeting. The sales of women-specific ski equipment have grown, with a growth of 18% in recent years exceeding that of men and juniors. This growth is due to drives encouraging women's participation in winter sports and the creation of equipment designed according to women's tastes and ergonomic needs. Also, safety-conscious consumers are a rapidly growing behavioral segment. There is increasing demand for sophisticated protective equipment, including helmets featuring impact-resistant materials and built-in technologies such as Bluetooth interfaces and GPS monitoring. This is indicative of an increasing focus on safety and performance enhancement among skiers.

Even with increased female participation, male skiers still hold the market in terms of total participation levels, especially in competitive and extreme skiing categories. This group tends to look for high-performance equipment that maximizes speed and agility on the slopes. From a behavioral standpoint, safety-oriented participants make up the largest market segment. These participants are concerned with safety features and tend to spend more on protective gear and training. Their emphasis on safety dictates purchasing behavior, making them an important target for products that stress protection and reliability.

Ski Market Segmentation: By Resort & Experience

- Service Offerings

- Booking Channels

- Tourist Types

The ski tourism market is changing fast, with adventure travelers becoming the most rapidly growing segment. Fueled by younger tourists in search of adrenaline-pumping experiences, activities such as heli-skiing, off-piste skiing, and snowcat tours are becoming increasingly popular. This is driven by social media, a quest for novelty, and a post-pandemic move towards outdoor pursuits. Online channels are seeing strong growth in terms of booking channels. The ease of comparing choices, reading reviews, and booking deals online attracts technology-literate consumers, with online bookings becoming the favored choice for most. Also driving this trend is solo travel, as more and more people seek personalized and adaptable skiing experiences. Resorts are responding by providing customized packages and facilities to meet the needs of this sector.

On the other hand, conventional skiing continues to be the prevailing experience in the ski industry, with a significant share of winter tourism activity. This is backed by well-established infrastructure such as ski schools, equipment rentals, and groomed trails, making it possible for a wide range of consumers. Luxury resorts continue to be at the forefront in terms of service provision, drawing high-income tourists with high-end accommodations, fine dining, and upscale amenities. Families are an important tourist segment, attracted by family-oriented resorts that provide activities for all ages, childcare facilities, and group lessons. These resorts aim to create inclusive settings that meet the needs of families, providing a holistic and enjoyable experience for everyone. Although new segments are appearing, these leading categories continue to define the heart of the ski tourism market.

Ski Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The international ski industry is dominated by Europe with a 38% share of market volume, owing to iconic Alpine resorts and entrenched skiing tradition. North America occupies the next spot with 32%, facilitated by vast ski bases in the U.S. and Canada. The Asia-Pacific region is also rising rapidly with an existing 22% market share because of improved tourism, improved disposable incomes, and improved infrastructure in China, Japan, and South Korea. Latin America and the Middle East & Africa account for a combined 8% (4% each), an indication of growing interest and investment in ski tourism in these regions.

COVID-19 Impact Analysis on the Ski Market:

The COVID-19 pandemic extensively affected the international ski market, with extreme disruptions within the industry. During the 2020/21 period, international travel skier visits fell by 37%, from 319.5 million to 201.2 million, attributed to mass resort closure and travel bans. Europe, historically a bastion of skiing, was severely hit, with nations such as Austria, France, and Italy suffering partial or total closures of their ski resorts. In China, the ski tourism industry in Chongli recorded a 55% decline in ski tourists and a 50% fall in revenue in 2020 against estimates. The U.S. ski industry lost at least $2 billion in the 2019/20 season, with skier visits declining by 14%. Despite these difficulties, the industry showed resilience by embracing digital innovations like online ticketing and dynamic pricing, and by concentrating on domestic tourism to offset losses. These adjustments not only facilitated the passage through the crisis at hand but also laid the groundwork for a more adaptable and technologically intertwined future for the ski industry.

Trends/Developments:

In January 2025, Armada, a worldwide winter sports equipment manufacturer, introduced its first-ever ski boot collection — the AR-ONE. Conceived by a team with more than a century of combined boot development experience, the AR-ONE combines the comfort of a cabrio boot with the performance of a classic 4-buckle overlap design. The boot is designed for utility, tested hard, and constructed for today's skiers who demand both fit and function.

In November 2024, black crows, the legendary French ski company, unveiled the fifth generation of its cult Corvus ski. Originally launched for the 2007-08 season, the 2024-25 version maintains its solid flex while embracing design technologies that enhance versatility and sustainability while continuing the tradition of a ski that is renowned for high performance and distinctive style.

In May 2022, Amer Sports completed the sale of its outdoor brand Suunto to Liesheng. The action follows Amer Sports' approach to building its direct-to-consumer businesses and expanding its presence in mature markets such as China and the U.S., with a focus on developing its global sporting goods brands across lifestyle, apparel, and footwear.

- Amer Sports Oyj

- Fischer Sports GmbH

- Rossignol Group

- Black Diamond Equipment Ltd.

- K2 Sports

- Volkl Sports GmbH

- Nordica S.p.A.

- Blizzard Sport GmbH

- Elan d.o.o.

- Head

Chapter 1. Ski Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Ski Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Ski Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging Product-Based Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Ski Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Ski Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Ski Market – By Product-Based

6.1 Introduction/Key Findings

6.2 Ski Gear & Equipment (Skis and Poles, Ski Boots, Protective Gear & Accessories)

6.3 Ski Apparel

6.4 Y-O-Y Growth trend Analysis By Product-Based

6.5 Absolute $ Opportunity Analysis By Product-Based , 2025-2030

Chapter 7. Ski Market – By Consumer-Based

7.1 Introduction/Key Findings

7.2 Demographics (Age Groups, Gender)

7.3 Behavior (Comfort-Pursuant, Price-Sensitive, Safety-Oriented)

7.4 Y-O-Y Growth trend Analysis By Consumer-Based

7.5 Absolute $ Opportunity Analysis By Consumer-Based , 2025-2030

Chapter 8. Ski Market – By Resort & Experience

8.1 Introduction/Key Findings

8.2 Service Offerings

8.3 Booking Channels

8.4 Tourist Types

8.5 Y-O-Y Growth trend Analysis Resort & Experience

8.6 Absolute $ Opportunity Analysis Resort & Experience , 2025-2030

Chapter 9. Ski Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Consumer-Based

9.1.3. By Resort & Experience

9.1.4. By Product-Based

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Consumer-Based

9.2.3. By Resort & Experience

9.2.4. By Product-Based

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Consumer-Based

9.3.3. By Resort & Experience

9.3.4. By Product-Based

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Resort & Experience

9.4.3. By Consumer-Based

9.4.4. By Product-Based

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Resort & Experience

9.5.3. By Consumer-Based

9.5.4. By Product-Based

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ski Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Amer Sports Oyj

10.2 Fischer Sports GmbH

10.3 Rossignol Group

10.4 Black Diamond Equipment Ltd.

10.5 K2 Sports

10.6 Volkl Sports GmbH

10.7 Nordica S.p.A.

10.8 Blizzard Sport GmbH

10.9 Elan d.o.o.

10.10 Head

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The ski market is expanding due to increasing participation in winter sports, rising disposable incomes, technological advancements in ski equipment, and growing awareness of the health benefits associated with skiing.

The European region is witnessing rapid growth in ski participation, driven by urbanization, increasing disposable incomes, and government initiatives promoting winter sports.

The ski industry faces challenges such as high equipment costs, environmental concerns related to snowmaking and resort operations, and the seasonal nature of the sport, which can lead to fluctuating demand.

Technological advancements are enhancing ski performance and safety, with innovations like GPS tracking in ski wearables, lightweight materials in ski construction, and improved snowmaking technologies contributing to a better skiing experience

Growth opportunities include expanding into emerging markets, developing sustainable and eco-friendly ski equipment, and capitalizing on the rise of indoor ski resorts that offer year-round skiing experiences