Sizing and Thickening Agents Market Size (2024 – 2030)

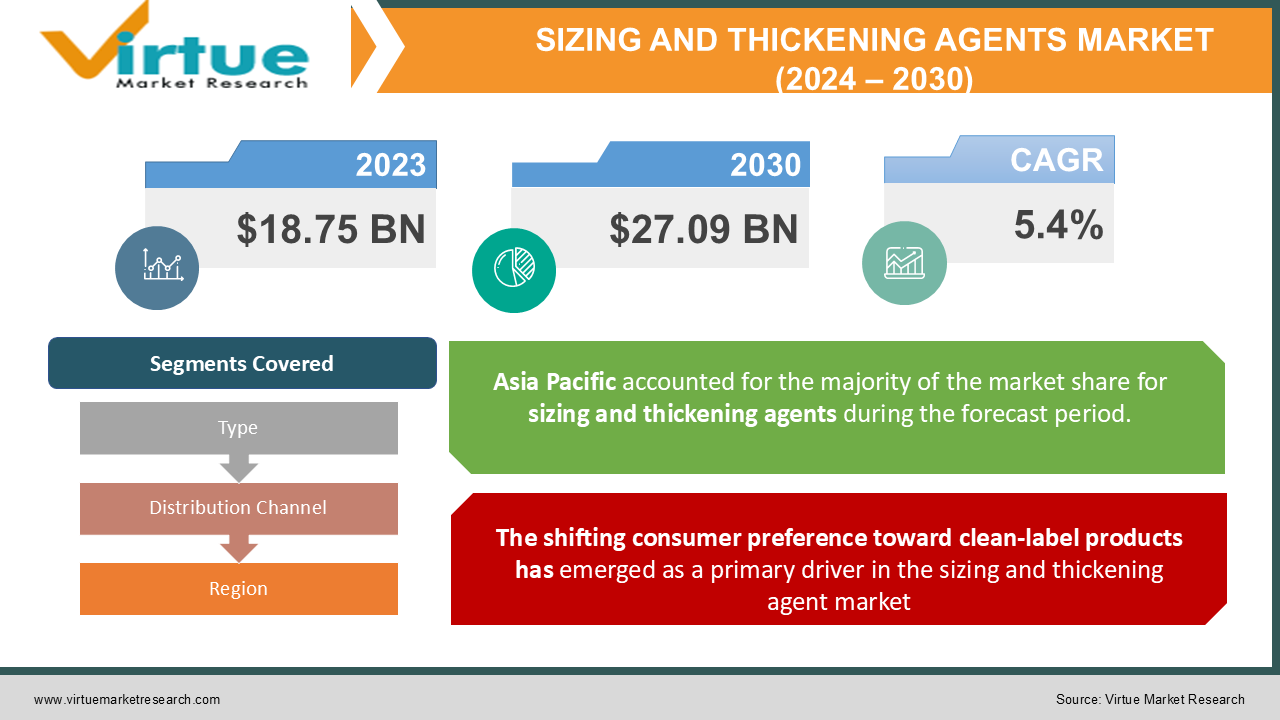

The Sizing and Thickening Agents Market was valued at USD 18.75 Billion in 2023 and is projected to reach a market size of USD 27.09 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.4%.

The Sizing and Thickening Agents Market represents a crucial segment within the specialty chemicals industry, playing a vital role across diverse sectors including food and beverages, pharmaceuticals, personal care, paper manufacturing, and textile industries. These agents are fundamental components that modify the viscosity, texture, and stability of various products, enabling manufacturers to achieve desired product characteristics and performance attributes. In 2023, the market demonstrated robust growth driven by increasing demand from end-use industries and evolving consumer preferences for products with specific textural properties. The food and beverage sector emerged as a particularly strong driver, with manufacturers utilizing these agents to develop innovative products that meet changing consumer expectations for texture and mouthfeel. The personal care and cosmetics industry has also significantly contributed to market growth, with rising demand for sophisticated formulations in skincare, haircare, and color cosmetics.

Key Market Insights:

-

Food and beverage applications accounted for 45% of the overall sizing and thickening agent market share in 2023.

-

Over 18,000 new product formulations incorporating thickening agents were launched in the cosmetics sector in 2023.

-

The use of biopolymers as sizing agents in paper manufacturing increased by 16% in 2023 compared to the previous year.

-

Rheology modifiers, a subset of thickening agents, contributed to approximately $2.4 billion in sales in 2023.

-

Xanthan gum sales reached 120,000 tons globally in 2023, with a notable uptick in demand from the gluten-free food segment.

-

Textile sizing agents generated revenues exceeding $1.8 billion in 2023, fueled by growing apparel production.

-

The global consumption of starch-based thickening agents surpassed 15 million tons in 2023, primarily driven by the food sector.

-

Thickeners for personal care products witnessed a 7% increase in demand in 2023, aligning with the surge in premium skincare launches.

Sizing and Thickening Agents Market Drivers:

The shifting consumer preference toward clean-label products has emerged as a primary driver in the sizing and thickening agent market.

This transformation has fundamentally altered how manufacturers approach product formulation and ingredient selection. Modern consumers demonstrate unprecedented awareness of product ingredients, actively seeking natural, sustainable, and transparently sourced alternatives to traditional synthetic agents. This driver has catalyzed significant investment in the research and development of plant-based thickening agents, such as modified starches, seaweed extracts, and fruit-derived pectins. Manufacturers have responded by developing innovative extraction and processing techniques that maintain the functional properties of natural thickeners while ensuring consistent performance and stability. The clean label movement has particularly influenced the food and beverage sector, where consumers increasingly scrutinize ingredient lists. This has led to the development of hybrid solutions that combine natural and modified natural ingredients to achieve optimal functionality while maintaining clean label status. The trend has also spurred innovation in minimal processing techniques that preserve the natural characteristics of thickening agents while ensuring their practical application in industrial processes.

The second significant market driver centers on technological innovations in production processes, which have revolutionized the manufacturing efficiency and product quality of sizing and thickening agents.

Advanced processing technologies have enabled manufacturers to develop more sophisticated products with enhanced functionality and consistency. Modern production facilities now incorporate automation, artificial intelligence, and precision control systems that optimize production parameters in real time. These technological improvements have resulted in higher yields, reduced waste, and more consistent product quality. Additionally, new extraction and modification techniques have expanded the range of raw materials that can be effectively processed into viable thickening agents. The integration of Industry 4.0 principles has enabled manufacturers to implement predictive maintenance systems, reducing downtime and improving overall equipment effectiveness. Smart manufacturing solutions have also facilitated better quality control through continuous monitoring and adjustment of process parameters, ensuring consistent product specifications and reducing batch-to-batch variations.

Sizing and Thickening Agents Market Restraints and Challenges:

The Sizing and Thickening Agents Market faces several significant challenges that impact its growth and development. Raw material price volatility represents a major constraint, as fluctuations in commodity prices directly affect production costs and profit margins. This volatility is particularly pronounced for natural ingredients, where supply chains are often vulnerable to weather conditions, geopolitical factors, and changing agricultural patterns. Regulatory compliance poses another substantial challenge, with different regions implementing varying standards and requirements for chemical substances. Manufacturers must navigate complex approval processes and adapt formulations to meet diverse regulatory frameworks, which increases development costs and time-to-market. The need for extensive safety documentation and clinical studies further compounds these challenges. Environmental concerns present additional hurdles, particularly regarding waste management and sustainable production practices. The industry faces pressure to reduce its environmental footprint while maintaining product performance and economic viability. Water consumption in production processes and the biodegradability of synthetic agents remain critical issues that require innovative solutions. Technical limitations in achieving specific functional properties while meeting clean label requirements continue to challenge manufacturers. Some natural alternatives may not match the performance of synthetic agents in terms of stability, shelf life, or cost-effectiveness. This creates a complex balance between meeting consumer demands for natural products and maintaining technical performance standards.

Sizing and Thickening Agents Market Opportunities:

The Sizing and Thickening Agents Market presents numerous promising opportunities for growth and innovation. The expanding application scope in emerging industries, particularly in biotechnology and advanced materials, offers significant potential for market expansion. These new applications require specialized thickening agents with precise functional properties, creating opportunities for premium products with higher margins. The growing demand for sustainable and biodegradable products opens avenues for developing eco-friendly alternatives. This presents opportunities for innovation in green chemistry and bio-based materials, potentially leading to new product categories and market segments. The increasing focus on circular economy principles creates possibilities for developing recycling-friendly thickening agents and waste-to-product solutions. Digital transformation in manufacturing and supply chain management offers opportunities for operational optimization and cost reduction. Implementation of advanced analytics and artificial intelligence can improve production efficiency and product development processes. E-commerce platforms provide new distribution channels and direct-to-consumer opportunities, particularly for specialty products. The development of customized solutions for specific applications represents another significant opportunity. As industries require more specialized products, manufacturers can develop tailored solutions that command premium prices and create stronger customer relationships through technical collaboration and support services.

SIZING AND THICKENING AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Inc., DuPont de Nemours, BASF SE, Archer Daniels Midland Company, Ingredion Incorporated, Ashland Global Holdings, CP Kelco, Dow Chemical Company, Tate & Lyle PLC, Kerry Group, Akzo Nobel N.V., Sigma-Aldrich Corporation, Brenntag AG, Lonza Group, Evonik Industries AG |

Sizing and Thickening Agents Market Segmentation: By Type

-

Natural Thickeners

-

Modified Natural Thickeners

-

Synthetic Thickeners

-

Mineral-based Thickeners

-

Protein-based Thickeners

-

Cellulose Derivatives

Fastest Growing Type: Modified Natural Thickeners These agents have experienced rapid growth due to their ability to combine natural origins with enhanced functionality. They offer improved stability and performance while meeting clean label requirements, making them increasingly popular across various applications.

Most Dominant Type: Synthetic Thickeners Synthetic thickeners maintain market dominance due to their consistent performance, cost-effectiveness, and wide application range. They offer superior stability and predictable behavior in various processing conditions.

Sizing and Thickening Agents Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Online Retail

-

Specialty Suppliers

-

Industrial Suppliers

Fastest Growing Channel: Online Retail E-commerce platforms have shown remarkable growth in the distribution of sizing and thickening agents, particularly for specialty and small-volume products.

Most Dominant Channel: Direct Sales Direct sales continue to dominate the market, particularly for large-volume industrial customers who require technical support and customized solutions.

Sizing and Thickening Agents Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

The Asia Pacific region dominates the market with its 35% share, driven by robust industrial growth, expanding manufacturing sector, and increasing consumer goods production. The region's dominance is supported by large-scale production facilities, competitive pricing, and strong domestic demand from various end-use industries. The region demonstrates particular strength in textile and paper manufacturing applications, where sizing agents play crucial roles in product quality and performance. Local manufacturers have developed strong capabilities in producing both conventional and specialized thickening agents, supported by well-established supply chains and technical expertise.

Europe emerges as the fastest-growing region, driven by increasing demand for sustainable and bio-based alternatives. The region's strong focus on environmental regulations and consumer preference for natural products has spurred innovation in eco-friendly thickening agents. Investment in research and development, particularly in bio-based technologies, has positioned European manufacturers at the forefront of sustainable product development.

COVID-19 Impact Analysis on the Sizing and Thickening Agents Market:

The COVID-19 pandemic significantly impacted the Sizing and Thickening Agents Market, creating both challenges and opportunities. Initial supply chain disruptions led to raw material shortages and price volatility, forcing manufacturers to reevaluate their procurement strategies and inventory management practices. The pandemic accelerated certain market trends, particularly the shift toward hygiene-focused products and applications. Increased demand for personal care products and pharmaceuticals created new opportunities for thickening agents in sanitizer formulations and medical applications. The food industry saw changing consumption patterns, with greater demand for packaged and processed foods requiring specific textural properties. Manufacturing facilities faced operational challenges due to social distancing requirements and workforce restrictions. This led to increased automation and digital transformation initiatives, as companies sought to maintain production while minimizing human interaction. Remote monitoring and control systems became more prevalent, accelerating the adoption of Industry 4.0 technologies. The pandemic also influenced product development strategies, with greater emphasis on supply chain resilience and local sourcing. Manufacturers invested in developing alternative formulations using locally available raw materials to reduce dependency on international supply chains. This trend toward localization has continued beyond the immediate crisis period. Recovery patterns varied by region and end-use sector, with some segments showing rapid rebounds while others experienced prolonged impacts. The experience has led to an increased focus on risk management and business continuity planning within the industry.

Latest Trends and Developments:

The Sizing and Thickening Agents Market continues to evolve with several notable trends shaping its future direction. Biotechnology advances have enabled the development of novel bio-based thickeners with enhanced functionality and sustainability profiles. These innovations include engineered enzymes for modified starches and new extraction techniques for plant-based agents. Digital innovation has transformed product development and manufacturing processes. Artificial intelligence and machine learning applications are being used to optimize formulations and predict performance characteristics. Virtual reality tools are enabling remote technical support and training, while blockchain technology is improving supply chain transparency and traceability. Sustainability initiatives have gained prominence, with manufacturers focusing on reducing water consumption and energy usage in production processes. Circular economy principles are being integrated into product design, with increased attention to biodegradability and recyclability. Companies are also investing in renewable energy sources and waste reduction technologies. Customization and personalization trends have led to the development of application-specific thickening agents. Manufacturers are working closely with customers to create tailored solutions that meet specific performance requirements while optimizing cost-effectiveness. Smart packaging solutions incorporating thickening agents are emerging, with innovations in controlled-release systems and intelligent packaging that responds to environmental conditions. This trend is particularly relevant in food preservation and pharmaceutical applications.

Key Players:

-

Cargill, Inc.

-

DuPont de Nemours

-

BASF SE

-

Archer Daniels Midland Company

-

Ingredion Incorporated

-

Ashland Global Holdings

-

CP Kelco

-

Dow Chemical Company

-

Tate & Lyle PLC

-

Kerry Group

-

Akzo Nobel N.V.

-

Sigma-Aldrich Corporation

-

Brenntag AG

-

Lonza Group

-

Evonik Industries AG

Chapter 1. Sizing and Thickening Agents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sizing and Thickening Agents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sizing and Thickening Agents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sizing and Thickening Agents Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sizing and Thickening Agents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sizing and Thickening Agents Market – By Type

6.1 Introduction/Key Findings

6.2 Natural Thickeners

6.3 Modified Natural Thickeners

6.4 Synthetic Thickeners

6.5 Mineral-based Thickeners

6.6 Protein-based Thickeners

6.7 Cellulose Derivatives

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Sizing and Thickening Agents Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Retail

7.5 Specialty Suppliers

7.6 Industrial Suppliers

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Sizing and Thickening Agents Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Sizing and Thickening Agents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Inc.

9.2 DuPont de Nemours

9.3 BASF SE

9.4 Archer Daniels Midland Company

9.5 Ingredion Incorporated

9.6 Ashland Global Holdings

9.7 CP Kelco

9.8 Dow Chemical Company

9.9 Tate & Lyle PLC

9.10 Kerry Group

9.11 Akzo Nobel N.V.

9.12 Sigma-Aldrich Corporation

9.13 Brenntag AG

9.14 Lonza Group

9.15 Evonik Industries AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing demand for ready-to-eat and processed foods is driving the need for thickening agents to improve product texture and consistency.

Variability in the prices of key raw materials like natural gums, cellulose derivatives, or synthetic agents can impact manufacturing costs and profit margins, posing challenges for producers.

The market is dominated by key players including Cargill, Inc., DuPont de Nemours, BASF SE, Archer Daniels Midland Company, Ingredion Incorporated, Ashland Global Holdings, CP Kelco, Dow Chemical Company, Tate & Lyle PLC, Kerry Group, Akzo Nobel N.V., Sigma-Aldrich Corporation, Brenntag AG, Lonza Group, and Evonik Industries AG.

Asia Pacific currently holds the largest market share, estimated at around 35%.

Europe has shown significant room for growth in specific segments.