Global Single-Aisle Aircraft Market Size (2024 - 2030)

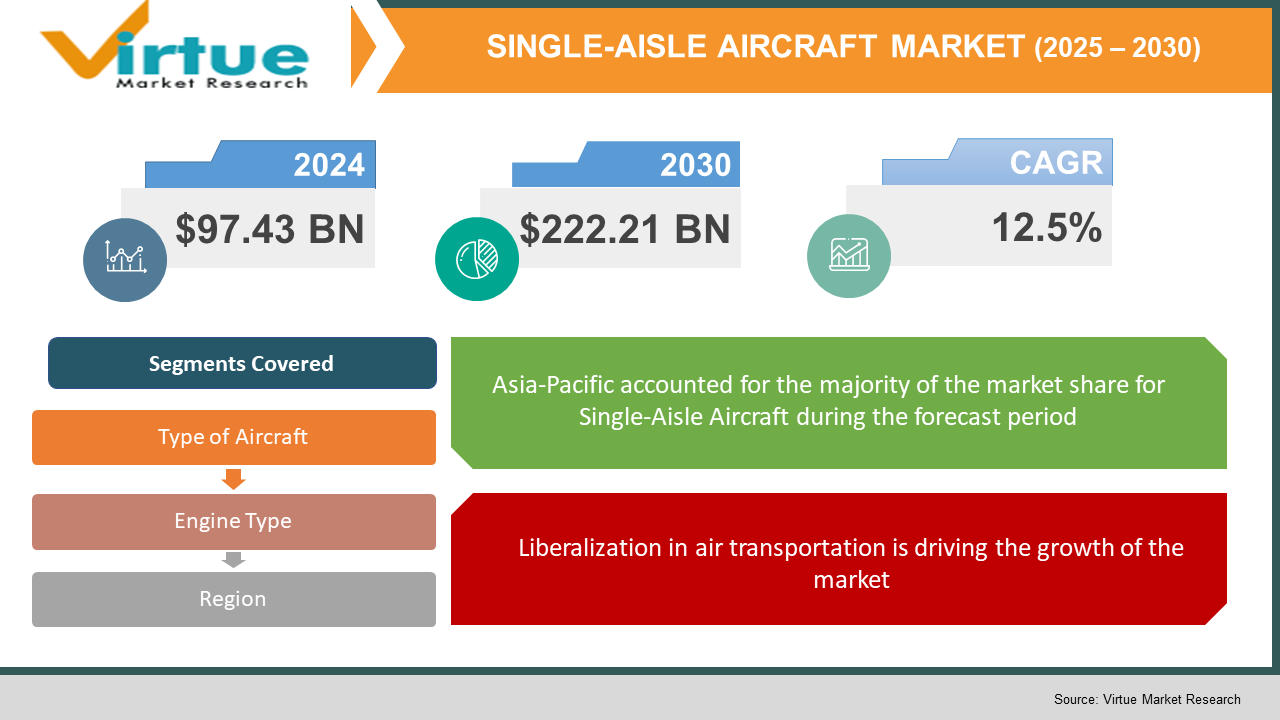

The Global Single-Aisle Aircraft Market is valued at USD 97.43 billion in 2023 and is projected to reach a market size of USD 222.21 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.5%.

A narrow-body plane or single-aisle plane is an airliner organized alongside a single aisle, allowing up to 6-abreast seating in a cabin much less than four meters (13 ft) in width.

Airlines are effectively refining their commercial enterprise models, the Internet is supplying efficiencies for passengers and airways alike, globalization and world exchange are thriving, and producers are launching new airplanes that will fly farther at a decreased cost. About 60 % of the deliveries will be single-aisle jets, making up about 39 % of the 2.1 trillion shipping greenbacks (in 2004 numbers).

Midsize twin-aisle airplanes will account for about 22 % of the deliveries and 45 % of shipping dollars. About three-quarters of the deliveries will go to fleet growth, whilst the relaxation will substitute retiring airplanes. The plane fleet modernization and vacation spot growth plans of the airways are leading to the gradual revival of plane demand, thereby strengthening the order books of plane OEMs. The present order backlog with the plane OEMs is nevertheless high. By the stop of 2021, Airbus stated a backlog of 7,082 jets. Boeing’s backlog was once 5,136 aircraft. These numbers divulge that no matter the discount in demand from the airlines, the deliveries of the business plans will proceed at a healthful charge all through the forecast period.

COVID-19 impact on the Single-Aisle Aircraft Market

The COVID-19 pandemic affected air passenger visitors globally in 2020, lowering flight undertaking and impacting airline money flows. As a result, most airways were determined to cancel or defer their plane orders. The industrial plane OEMs trimmed their manufacturing costs as the pandemic lowered the demand for new jets. However, the industrial aviation enterprise recovered step by step in 2021, which led to a tremendous amplify in plane deliveries in contrast to 2020. Airbus and Boeing collectively delivered 951 planes in 2021 in contrast to 723 planes in 2020. In addition, passenger site visitor numbers are anticipated to get better by using 2024. Thus, the business aviation enterprise outlook is anticipated to stay superb at some point in the forecast period.

The demand for narrow-body aircraft is estimated to recover faster than for wide-body aircraft as the domestic demand is estimated to return to pre-COVID-19 levels earlier than the international passenger demand.

MARKET DRIVERS:

Economic Growth in air transportation is driving the growth of the market

Increases in the gross home product (GDP) give an explanation for most of the air journey growth. The relaxation of the improvement of tour global is derived from different financial factors, such as worldwide alternate and globalization and enterprise trends, which include declining fares, extra direct service, and accelerated frequencies.

Liberalization in air transportation is driving the growth of the market

Governments proceed to make bigger get admission to the market via doing away with restrictions on carriers in their personal international locations and allowing extra stages of carriers throughout the globe. A reducing regulatory burden frees new and present carriers to enhance their networks, innovate their commercial enterprise models, and pursue one-of-a-kind strategies. Liberalized surroundings create extra possibilities for airways to compete. Competition has traditionally led to lowering fares, growing frequencies, and extra routes all traits that will continue.

MARKET RESTRAINTS:

Congestion and Air-Traffic Delay is restraining the growth of the market

Congestion and prolonged air visitors are the essential difficulties affecting the universal business plane market growth. When demand for airports or airspace exceeds handy capacity, there is lengthen in air traffic. As a result, these delays can be mitigated by using an increasing ability or altering air visitors' demand. An increase in ability is the solution, however, it is a long-term manner that will require huge changes such as facility development, simple manner modifications, and navigational tools improvements. Key aviation offerings carriers are inclined towards enhancing air site visitors controls and improving journey routes to overcome the trouble related to congestion and delay.

SINGLE-AISLE AIRCRAFT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.5% |

|

Segments Covered |

By Type of Aircraft, Engine Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin Corporation, Raytheon Technologies Corporation, Tectron Inc., The Boing Company, Airbus Group, Commercial Aircraft Corporation, Dassault Aviation, Embraer S.A., General Dynamics Corporation, General Electric and others are playing a pivotal role in the market. |

Single-Aisle Aircraft Market - Type of Aircraft:

-

Narrow-Body

-

Wide-Body

-

Regional Aircraft

Based on the type of aircraft, The narrow-body aircraft segment held the largest market share in 2021. The success of the low-cost carrier business model has generated a massive demand for newer generation narrow-body aircraft in recent years due to their advantages like low cost of operation and fuel efficiency in short-haul routes. Technological advancements in newer generation narrow-body aircraft are making them possible to fly longer distances.

Boeing’s B737 and Airbus A320 are two of the most sold aircraft families in aviation history. In 2021, Boeing delivered 263 narrow-body aircraft (43 aircraft delivered in 2020), while Airbus delivered 533 narrow-body aircraft (484 aircraft delivered in 2020). The B737 MAX issues have dampened Boeing’s narrow-body single-aisle jet orders and deliveries. However, with the aircraft coming back to service at the end of 2020, Boeing is again vying to increase its sales share in the segment. With the first deliveries of MC-21 and COMAC C919 models estimated in 2022, the respective Russian and Chinese manufacturers plan to compete with the existing market giants like Airbus and Boeing in the narrow-body aircraft segment. Also, with the domestic demand recovering faster than the international passenger demand, the demand for narrow-body aircraft is estimated to remain high during the forecast period.

Single-Aisle Aircraft Market - By Engine Type:

-

Turbofan

-

Turboprop

By Engine Type, Turboprop is estimated to dominate the market with 60 % of the total market revenue. Turboprop and turbofan engines are each kind of turbine engines that function identically thermodynamically. But turboprops use the exhaust air to flip a propeller which generates its thrust. Turbofans use an aggregate of combusted air and omit air to produce thrust the use of the exhaust air. The engine is the main part which is used in the aircraft which is estimated to rise in the near future during the forecast period.

Single-Aisle Aircraft Market- By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

Geographically, Asia-Pacific is predicted to generate a healthy demand for industrial planes at some point in the forecast period. The increase in air passenger visitors is predominant in the region, and China and India are predicted to be amongst the largest aviation markets in the world at some stage in the forecast period. In 2020, China's three principal state-owned airways canceled the transport of over a hundred planes from Boeing and Airbus, however, saved each and every single order from COMAC in an exhibit guide for the home producer in the course of the pandemic.

Europe will trip the persevering with high-quality results of liberalization. South America will ride multiplied air visitors via liberalization, worldwide trade, and vacationer development. Japan and Korea presently generate much fewer air journeys than their wealth would indicate, and in the lengthy-time period, they ought to exhibit greater sturdy air tour rates. Southwest Asia, Africa, and the Middle East are forecast to develop above the world common over the subsequent 20 years, as their economies and airline industries modernize

Key Players

-

Lockheed Martin Corporation

-

Raytheon Technologies Corporation

-

Tectron Inc.

-

The Boing Company

-

Airbus Group

-

Commercial Aircraft Corporation

-

Dassault Aviation

-

Embraer S.A.

-

General Dynamics Corporation

-

General Electric and others are playing a pivotal role in the market.

For example, according to Boeing's long-term projection for commercial airplanes, in India, extraordinary domestic passenger traffic and rapidly expanding low-cost carriers (LCCs) will drive the requirement for 2,300 new jets valued at $320 billion over the next 20 years.

according to the Commercial Aircraft Corporation of China, Ltd., the Chinese market was projected to witness strong demand for commercial aircraft over the next 20 years.

Air transport is estimated to increase in emerging markets, owing to a rise in per capita income and standards of living. Air Traffic is estimated to dominate the market with over 18 % during the forecast period.

NOTABLE HAPPENINGS IN THE GLOBAL SINGLE-AISLE AIRCRAFT MARKET IN THE RECENT PAST:

-

Expansion - In Feb 2022, Airbus announced that the company delivered the first A330-900 first wide-body aircraft to STARLUX Airlines, a Taiwan-based airline.

-

Expansion - In Jan 2022, Embraer announced that it received an additional order for 20 E-Jets E2s from Azorra, a commercial aircraft lessor. The order includes a combination of E190-E2s and E195-E2s aircraft.

Chapter 1. Single-Aisle Aircraft Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Single-Aisle Aircraft Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Single-Aisle Aircraft Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Single-Aisle Aircraft Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Single-Aisle Aircraft Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Single-Aisle Aircraft Market – By TYPE OF AIRCRAFT

6.1 Introduction/Key Findings

6.2 Narrow-Body

6.3 Wide-Body

6.4 Regional Aircraft

6.5 Y-O-Y Growth trend Analysis By TYPE OF AIRCRAFT

6.6 Absolute $ Opportunity Analysis By TYPE OF AIRCRAFT, 2023-2030

Chapter 7. Single-Aisle Aircraft Market – By ENGINE TYPE

7.1 Introduction/Key Findings

7.2 Turbofan

7.3 Turboprop

7.4 Y-O-Y Growth trend Analysis By ENGINE TYPE

7.5 Absolute $ Opportunity Analysis By ENGINE TYPE, 2023-2030

Chapter 8. Single-Aisle Aircraft Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By TYPE OF AIRCRAFT

8.1.3 By ENGINE TYPE

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By TYPE OF AIRCRAFT

8.2.3 By ENGINE TYPE

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By TYPE OF AIRCRAFT

8.3.3 By ENGINE TYPE

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By TYPE OF AIRCRAFT

8.4.3 By ENGINE TYPE

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By TYPE OF AIRCRAFT

8.5.3 By ENGINE TYPE

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Single-Aisle Aircraft Market – Company Profiles – (Overview, Type of Aircraft Portfolio, Financials, Strategies & Developments)

9.1 Lockheed Martin Corporation

9.2 Raytheon Technologies Corporation

9.3 Tectron Inc.

9.4 The Boing Company

9.5 Airbus Group

9.6 Commercial Aircraft Corporation

9.7 Dassault Aviation

9.8 Embraer S.A.

9.9 General Dynamics Corporation

9.10 General Electric and others are playing a pivotal role in the market.

Download Sample

Choose License Type

2500

4250

5250

6900