Silk Market Size (2024 – 2030)

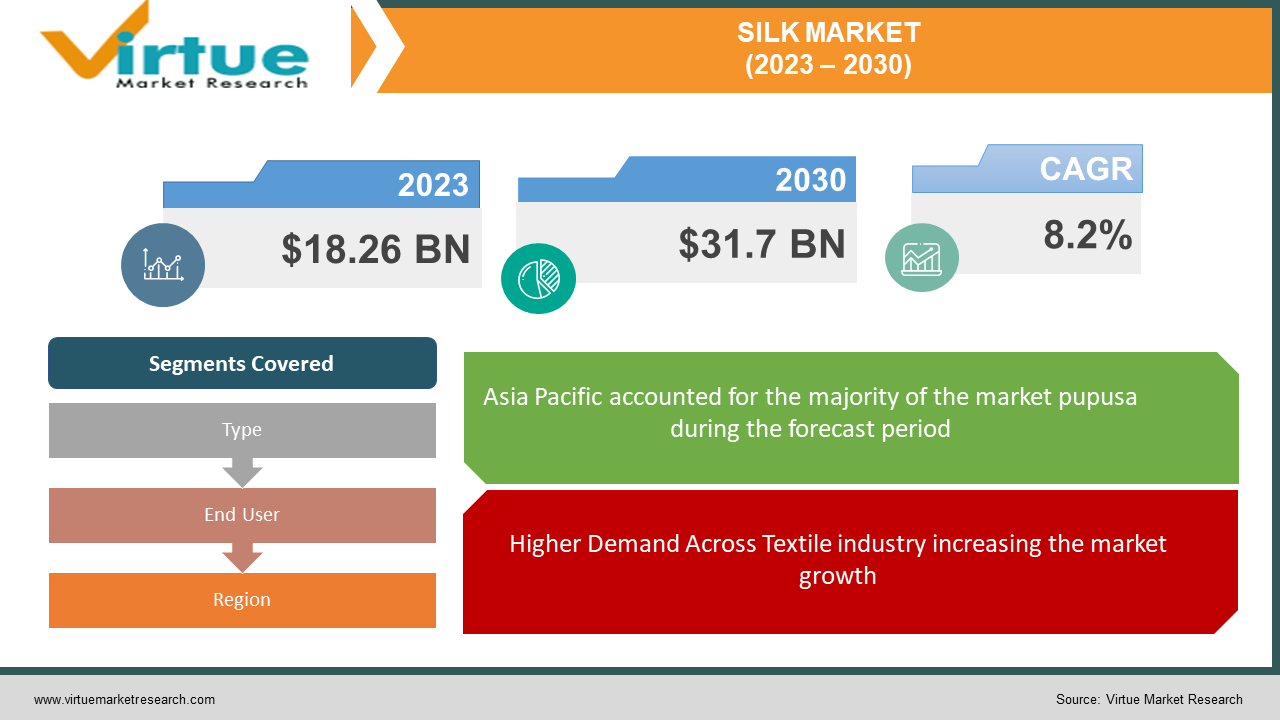

The Silk Market was valued at USD 18.26 Billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 31.7 Billion by 2030, growing at a CAGR of 8.2%.

Silk stands out as an opulent textile renowned for its luxurious characteristics and radiant appearance, garnering widespread acclaim on a global scale. Among the noteworthy attributes of silk fiber are its glossy sheen, sumptuous tactile sensation, durability, lightweight nature, and inherent strength. The textile's production primarily involves various insect species, with a prevailing focus on the silk derived from moth caterpillars for textile purposes. Ongoing research explores alternative silk types characterized by molecular distinctions. Predominantly, silk emanates from the larvae of insects undergoing complete metamorphosis; however, certain species like webspinners and raspy crickets consistently generate silk throughout their entire life spans.

Key Market Insights:

Silk finds extensive application in various clothing categories, including gowns, wedding attire, neckties, and scarves, as well as numerous household items like wall hangings, pillows, upholstery, and draperies. Moreover, its lower conductivity compared to other materials makes it a preferred choice in the production of ties, shirts, haute couture garments, formal dress suits, robes, kimonos, and sundresses. Anticipated increases in demand for silk, driven by these pivotal attributes, are poised to contribute to a thriving global market.

The considerable expense of genuine silk is underscored by the need for approximately 10,000 cocoons to yield silk of such quality. Beyond traditional uses, silk has found unconventional applications in areas such as bicycle tires and medicine. The absorbent nature and low conductivity of silk make it particularly suitable for wear during the summer season, offering comfort, exquisite softness, and a touch of elegance.

Silk Market Drivers:

Higher Demand Across Textile industry increasing the market growth.

The textile sector represents the fastest-growing domain for silk applications, playing a pivotal role in the constantly evolving landscape of the textile industry marked by shifting demand and supply dynamics. Silk's inclusion in textiles is attributed to its sheen, opulent tactile sensation, lightweight nature, resilience, and inherent strength. Its versatile use extends to various clothing items, ranging from wedding gowns, gowns, blouses, scarves, to neckties, and finds application in diverse home furnishings like pillows, wall hangings, draperies, and upholstery.

Notably, silk's absorbent properties contribute to exceptional comfort, particularly in warmer climates, while its low conductivity proves beneficial in retaining warmth close to the skin during colder seasons. The spectrum of silk-infused clothing has expanded, encompassing shirts, ties, formal dresses, high-fashion garments, lingerie, pajamas, robes, dress suits, sun dresses, and kimonos. In India, silk holds a significant role in the creation of traditional sarees, reflecting its enduring presence in cultural attire.

Silk Market Restraints and Challenges:

High Material Costs hinder the market.

Ranked among the most costly materials, silk presents unique challenges in terms of maintenance, as silk garments typically require dry cleaning, making them less straightforward to clean. Furthermore, susceptibility to damage from prolonged exposure to sun and water adds to the intricacies of caring for silk items. These factors collectively contribute to elevated costs for end consumers, posing obstacles to the potential growth of the global silk market.

Economic slowdown on pricing results in industries to suffer.

As economic activity experiences a downturn, industries inevitably face challenges. The market insight reports and intelligence services offered by DBMR incorporate anticipated impacts of the economic slowdown on product pricing and accessibility. This strategic foresight enables our clients to maintain a competitive edge, proactively anticipate market trends, project sales and revenue figures, and estimate profit and loss expenditures. By leveraging this comprehensive analysis, clients are empowered to stay one step ahead of competitors in navigating the evolving economic landscape.

Silk Market Opportunities:

Funding in the market is creating opportunities in the market.

Moreover, the swift advancement of the silk industry, fueled by reduced production costs, presents lucrative prospects for market players during the forecast period. Furthermore, the ongoing development of technologically advanced products within sericulture by manufacturers contributes to the continued expansion of the global silk market in the foreseeable future.

SILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Anhui Silk Co., Sichuan Nanchong Liuhe (Group) Corp., Libas Textiles Ltd., Amsilk GmbH, Zhejiang Jiaxin Silk Co., Wujiang Wanshiyi Silk Co. Ltd., Bolt Threads, , Wujiang First Textile Co., Jiangsu Sutong Cocoon and Silk Co., ShengKun Silk Manufacturing Co. |

Silk Market Segmentation: By Type

-

Mulberry Silk

-

Tussar Silk

-

Eri Silk

-

Others

Mulberry silk is anticipated to dominate the market share throughout the forecast period, owing to its remarkable attributes such as flexibility, robust strength, and durability. Widely recognized and extensively utilized, Mulberry silk is a preferred choice for various applications, including the production of scarves, gowns, blouses, clothing, wedding gowns, as well as interior design elements like draperies, cushions, and wall hangings.

Tussar silk, employed as the fundamental material in fabrics, handicrafts, and stitched garments, enjoys popularity among fashion designers for its distinctive characteristics. Sourced from wild silkworms, particularly the Antheraea moth, Tussar silk is cultivated in forested areas and can be identified by its rough and grainy texture. Authentic Tussar silk exhibits a natural shine that reflects light with a warm glow, distinguishing it from other varieties. The cocoons of the Antheraea moth are typically formed by feeding on oak, Jamun, Asan, and Arjun trees.

Eri silk, initially used in crafting men's and women's winter shawls, stands out for its thermal properties, making it an ideal fabric for shrugs. Unlike continuous filaments seen in other silk varieties, Eri silk is a staple fiber. The fabric's texture is characterized by coarseness, fineness, and density, contributing to its strength, durability, and elasticity. With a darker and heavier profile than other silks, Eri silk blends seamlessly with wools and cotton, offering warmth in winter and coolness in summer.

Silk Market Segmentation: By End User

-

Textile

-

Cosmetics

-

Medical

The burgeoning application of silk within textiles represents a rapidly growing segment. Integral to the textile manufacturing sector, which is in a constant state of evolution with changing demand and supply dynamics, silk is valued for its lustrous appearance, opulent feel, lightweight nature, strength, and resilience. Its versatile use extends to various products, encompassing wedding gowns, gowns, blouses, scarves, neckties, as well as home furnishings like cushions, wall hangings, draperies, and upholstery.

While silk has recently been surpassed in strength by a lab-engineered biomaterial, it remains the strongest natural textile globally. Its tensile strength notwithstanding, silk's allure lies not only in its physical robustness but also in its historical significance. Revered for its softness, silk has been a coveted commodity throughout history, shaping legendary trade routes and influencing cultures across the Old World.

The biocompatibility of silk with human skin and tissue has been acknowledged by the scientific community for centuries. Robust research underscores silk's benefits in skincare, including reducing fine lines, enhancing hydration levels, improving elasticity, combating pollution, and accelerating cellular regeneration.

Furthermore, silk scaffolds have demonstrated successful applications in wound healing and tissue engineering, contributing to the development of bone, cartilage, tendon, and ligament tissues. The multifaceted qualities of silk position it not only as a premier textile but also as a material with significant implications in various scientific and medical fields.

Silk Market Segmentation: by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia Pacific region asserts its dominance in the silk market, tracing its historical roots to ancient China where silk fabrication in textiles originated. Initially exclusive to the Emperors of China, silk gradually permeated Chinese culture, expanded geographically and socially through trade, and disseminated across numerous regions in Asia. In antiquity, Chinese silk stood as the most coveted and lucrative luxury item, fostering economic prosperity for civilizations like the ancient Persians through trade. India follows China as the world's second-largest silk producer, contributing around 97% of raw mulberry silk production, with major production states being Andhra Pradesh, Karnataka, Jammu and Kashmir, Tamil Nadu, Bihar, and West Bengal. As of December 2021, India produced 26,587 metric tonnes of silk. The escalating global demand for silk is fueled by a growing population and the emergence of innovative startups. Conversely, North America is poised for substantial growth in the forecast period, emerging as a key hub for the global silk market, given its concentration of major industry players. In Europe, Italy has traditionally held a prominent position as a major importer, processor, and exporter of silk products. Notably, Italy's expertise in silk processing, including finishing, dyeing, and printing, has been pivotal. France, too, features prominently in the European silk market. In Germany, the largest European market for textiles and garments, consumer preferences lean towards natural fibers, with a significant import of silk clothing, accessories (particularly silk pillow coverings), and materials for interior décor.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic exerted adverse effects on the silk industry, primarily attributed to the volatility in raw material prices of silk, a sharp decline in cocoon production, and a shortage of skilled workers. These challenges collectively contributed to disruptions in silk demand, cash flow issues, and a substantial reduction in working capital. The imposition of restrictions by various countries led to the cancellation of import-export orders, thereby significantly impacting the silk market. Consequently, silkworm rearers, silk reelers, weavers, and traders have all experienced the negative repercussions of the pandemic on the industry.

Key Players:

These are top 10 players in the Silk Market: -

-

Anhui Silk Co.

-

Sichuan Nanchong Liuhe (Group) Corp.

-

Libas Textiles Ltd.

-

Amsilk GmbH

-

Zhejiang Jiaxin Silk Co.

-

Wujiang Wanshiyi Silk Co. Ltd.

-

Bolt Threads,

-

Wujiang First Textile Co.

-

Jiangsu Sutong Cocoon and Silk Co.

-

ShengKun Silk Manufacturing Co.

Chapter 1. Silk Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Silk Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Silk Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Silk Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Silk Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Silk Market – By Type

6.1 Introduction/Key Findings

6.2 Mulberry Silk

6.3 Tussar Silk

6.4 Eri Silk

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Silk Market – By End User

7.1 Introduction/Key Findings

7.2 Building

7.3 Industrial

7.4 Other

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Silk Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Silk Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Anhui Silk Co.

9.2 Sichuan Nanchong Liuhe (Group) Corp.

9.3 Libas Textiles Ltd.

9.4 Amsilk GmbH

9.5 Zhejiang Jiaxin Silk Co.

9.6 Wujiang Wanshiyi Silk Co. Ltd.

9.7 Bolt Threads

9.8 Wujiang First Textile Co.

9.9 Jiangsu Sutong Cocoon and Silk Co.

9.10 ShengKun Silk Manufacturing Co.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The textile sector represents the fastest-growing domain for silk applications, playing a pivotal role in the constantly evolving landscape of the textile industry marked by shifting demand and supply dynamics.

Top Players operating in the Silk Market are - Anhui Silk Co, Sichuan Nanchong Liuhe (Group) Corp., Libas Textiles Ltd., amsilk GmbH, Zhejiang Jiaxin Silk Co., Wujiang Wanshiyi Silk Co. Ltd., Bolt Threads, Wujiang First Textile Co., Jiangsu Sutong Cocoon and Silk Co., ShengKun Silk Manufacturing Co.

The COVID-19 pandemic exerted adverse effects on the silk industry, primarily attributed to the volatility in raw material prices of silk, a sharp decline in cocoon production, and a shortage of skilled workers.

The ongoing development of technologically advanced products within sericulture by manufacturers contributes to the continued expansion of the global silk market in the foreseeable future.

North America is poised for substantial growth in the forecast period, emerging as a key hub for the global silk market, given its concentration of major industry players.