Silica Market Size (2024-2030)

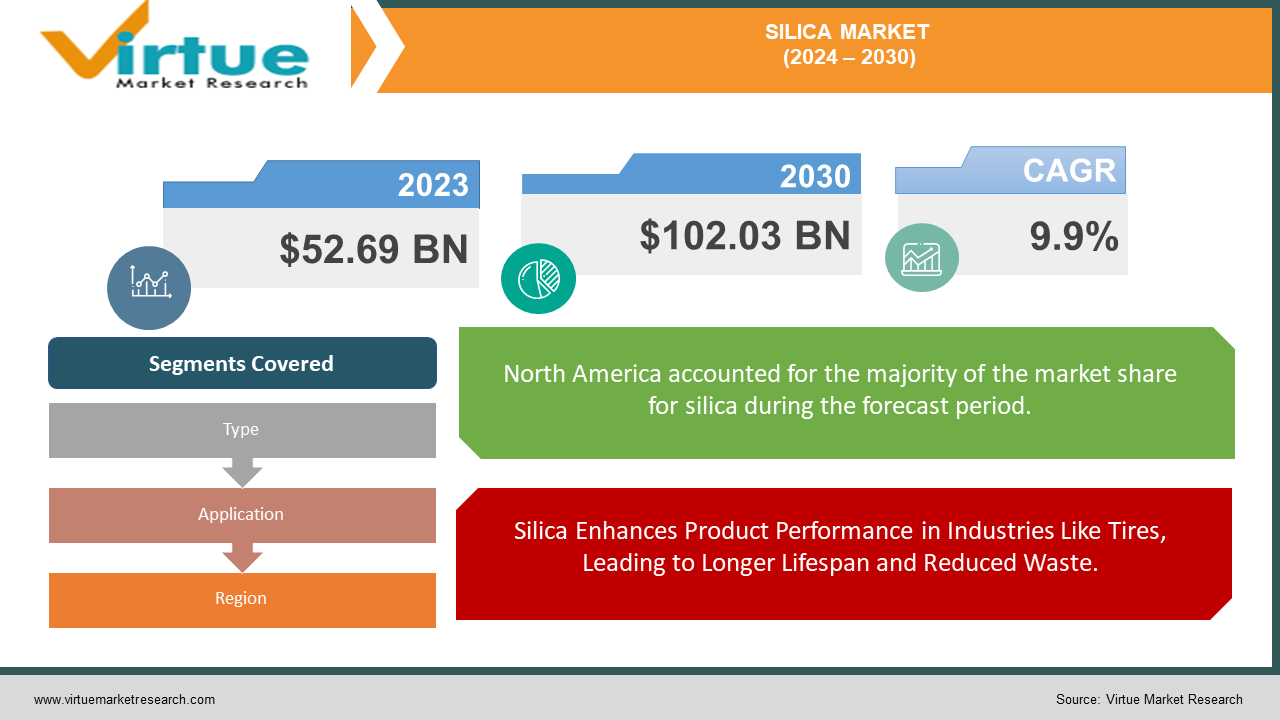

The Silica Market was valued at USD 52.69 billion in 2023 and is projected to reach a market size of USD 102.03 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 9.9%.

The silica market is a substantial and expanding industry with a wide range of applications. It's a key ingredient in construction materials like concrete and mortar, as well as in glass, ceramics, and foundry processes. The demand for silica extends beyond traditional uses, finding its way into high-performance tires, electronics, and even personal care products. This growth is fueled by factors like rising construction activity in developing economies, the need for improved tire performance, and the discovery of new applications for silica's beneficial properties.

Key Market Insights:

Silica isn't confined to a single sector. It's a critical component in construction (concrete, glass), boasting a massive 468.4 million tons used globally in 2022.

The surging construction activity in developing economies like China and India is a major growth factor for silica. This demand is fuelled by infrastructure expansion, which heavily relies on silica-based materials like concrete.

With growing environmental concerns, silica's potential as a sustainable alternative in certain applications is gaining traction. Research into using silica in bioplastics or energy storage could be exciting avenues for future development.

Silica Market Drivers:

Silica Enhances Product Performance in Industries Like Tires, Leading to Longer Lifespan and Reduced Waste.

Silica goes beyond simply being a filler material; it's a game-changer in terms of product performance. In the tire industry, for example, silica plays a crucial role in enhancing wear and tear resistance. This translates to tires that last longer, offering significant cost savings for consumers and reducing the overall environmental impact by minimizing tire waste. As a result, the demand for silica in high-performance tires is expected to remain strong.

The Market Shifts Towards Processed Silica Forms Like Fumed Silica for Tailored Functionality in Various Applications.

The silica market is witnessing a clear shift in preference towards processed forms of silica, such as fumed silica and precipitated silica. These refined versions offer a wider range of functionalities and specific characteristics that cater to the unique needs of various industries. For instance, fumed silica, with its incredibly high surface area, is ideal for thickening and reinforcing materials in paints and coatings. Precipitated silica, on the other hand, finds application in personal care products due to its light-scattering properties and ability to improve product consistency. As manufacturers continue to seek ways to optimize product performance and functionality, the demand for these specialized silica products is expected to rise steadily.

Growing Focus on Sustainability Creates Opportunities for Silica as a Potential Alternative in Bioplastics and Energy Storage.

With growing environmental concerns taking center stage, silica's potential as a sustainable alternative in certain applications is gaining significant traction. Research into using silica in bioplastics or energy storage could be a potential game-changer. Bioplastics made with silica could offer an eco-friendlier alternative to traditional plastics, while silica's unique properties might pave the way for advancements in energy storage solutions. This focus on sustainability is likely to create exciting new opportunities for the silica market, driving innovation and exploration of its potential in environmentally friendly applications.

Silica Market Restraints and Challenges:

The silica market isn't without its challenges. One major hurdle is price volatility. Silica pricing can fluctuate based on supply and demand, making it difficult for manufacturers to predict costs and plan for the long term. This uncertainty can create a hesitant buying atmosphere.

Environmental regulations also present a challenge. Stringent regulations regarding silica dust and its potential health risks can add complexity to production processes. Companies may need to invest in additional dust control measures to comply, impacting their bottom line.

The emergence of substitute materials is another obstacle. In some applications, like construction aggregates, new materials are being developed and adopted. These substitutes could potentially chip away at silica's market share, especially if they offer similar functionality at a lower cost.

Finally, logistics and transportation costs can be a burden, particularly for lower-value grades of silica. Since silica is a bulky material, transporting it from production sites to points of consumption can be expensive. This can eat into profit margins, especially for companies dealing in lower-priced silica products. Finding ways to optimize transportation and logistics will be crucial for navigating this challenge.

Silica Market Opportunities:

The silica market isn't a stagnant landscape; it's brimming with opportunities for future growth. One exciting area is the exploration of silica's potential in high-tech applications. Research is underway to utilize silica in the development of lithium-ion batteries, a key component for electric vehicles and renewable energy storage. This could significantly expand the use of silica and contribute to a greener future.

Another promising avenue lies in nanotechnology. Scientists are investigating the use of silica nanoparticles, with their unique properties, in various fields. These nanoparticles have the potential to revolutionize drug delivery systems, miniaturize electronics, and even purify water. This opens doors for innovative applications that could improve human health and environmental well-being.

Finally, the growing focus on eco-friendly solutions presents a significant opportunity. Research into using silica in bioplastics or for water filtration could lead to more sustainable alternatives in various industries. By capitalizing on these emerging trends and fostering innovation, the silica market can play a vital role in shaping a more sustainable future.

SILICA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.9% |

|

Segments Covered |

By Product type, End User, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cabot Corporation, Evonik Industries AG, Nouryon, PPG Industries Inc., PQ Corporation, Saint-Gobain, Solvay, U.S. Silica, Wacker Chemie AG, Tokuyama Corporation |

Silica Market Segmentation: By Product Type

-

Natural Silica

-

Fumed Silica

-

Precipitated Silica

-

Silica Gel

By product type, the silica market is segmented into natural silica, fumed silica, precipitated silica, and silica gel. Natural silica is the most dominant segment, accounting for a large portion due to its use in construction materials like concrete. However, the fastest-growing segment is fumed silica, driven by the increasing demand for its unique properties in high-tech applications like lithium-ion batteries and electronics miniaturization.

Silica Market Segmentation: By End User

-

Glass Industry

-

Chemical Industry

-

Food & Beverage Industry

The construction industry reigns supreme in the silica market by End-User sector, driven by the ongoing boom in developing economies. It consumes vast amounts for concrete, mortar, and glass production. The fastest-growing segment is likely electronics, fueled by miniaturization and the demand for high-performance components. Fumed silica, with its insulating and filler properties, is increasingly sought after in this sector.

Silica Market Segmentation: By Application

-

Construction

-

Rubber Industry

-

Electronics

-

Personal Care

-

Paints & Coatings

The construction sector reigns supreme in the silica market by application, accounting for a massive chunk of global consumption due to its use in concrete and glass. However, the fastest-growing segment is expected to be electronics driven by the increasing demand for miniaturized devices. Silica's role as a filler and insulator in electronics makes it a prime candidate for this rapidly growing field.

Silica Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific currently dominates the silica market, boasting the highest consumption rates. China and India are significant players due to their booming construction industries and growing populations, driving up demand for silica in concrete and glass production. Additionally, the presence of major silica reserves in the region contributes to its market dominance.

North America holds a strong position in the silica market, with a well-established production and consumption base. The construction sector remains a major driver here as well. However, the market is expected to see moderate growth compared to Asia-Pacific due to a more mature construction industry and focus on renovation projects.

COVID-19 Impact Analysis on the Silica Market:

The COVID-19 pandemic rippled through the silica market, disrupting global supply chains and causing temporary shortages. Lockdowns and restrictions on movement hampered production and transportation, leading to price fluctuations. Additionally, the slowdown in construction activities worldwide significantly reduced demand for silica, a key component in concrete and glass. As immediate needs like healthcare took priority, demand from other sectors like automotive and electronics also dipped temporarily.

However, there were pockets of resilience. The demand for silica in essential sectors like food and pharmaceuticals, where it's used in food additives and drug delivery systems, remained relatively stable. As economies reopened and construction activities resumed, the demand for silica began to rebound. This trend is expected to continue, with construction remaining a major driver for the market. Furthermore, the growing focus on sustainability post-pandemic could lead to a surge in exploring silica as a viable eco-friendly alternative in various applications. Overall, despite the challenges posed by COVID-19, the silica market has demonstrated resilience and is poised for recovery alongside the global economy.

Latest Trends/ Developments:

The silica market is witnessing a surge in exploring its potential for sustainable applications. Research is underway to utilize silica in bioplastics, offering an eco-friendly alternative to traditional plastics. Additionally, silica-based materials are being investigated for their water purification capabilities, potentially providing a cost-effective and sustainable solution.

Furthermore, advancements in nanotechnology are unlocking new possibilities for silica nanoparticles. These nanoparticles have the potential to revolutionize drug delivery systems, enabling targeted treatments with fewer side effects. They're also being explored for water purification, offering a novel approach to contaminant removal.

The market is also experiencing a growing demand for high-performance silica, particularly in the automotive and electronics industries. Fumed silica is being used to create lighter and stronger tires, while precipitated silica finds application in miniaturized electronic components. This trend highlights the focus on product efficiency and performance across various sectors.

Finally, major players in the silica market are strategically investing in production facilities, particularly in regions with high growth potential like Asia-Pacific and South America. This reflects the anticipated rise in demand for silica in these regions, driven by their booming construction and industrial sectors. These developments underscore the dynamism of the silica market and its potential to play a significant role in shaping a more sustainable future.

Key Players:

-

Cabot Corporation

-

Evonik Industries AG

-

Nouryon

-

PPG Industries Inc.

-

PQ Corporation

-

Saint-Gobain

-

Solvay

-

U.S. Silica

-

Wacker Chemie AG

-

Tokuyama Corporation

Chapter 1. Silica Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Silica Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Silica Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Silica Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Silica Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Silica Market – By Product Type

6.1 Introduction/Key Findings

6.2 Natural Silica

6.3 Fumed Silica

6.4 Precipitated Silica

6.5 Silica Gel

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Silica Market – By Application

7.1 Introduction/Key Findings

7.2 Construction

7.3 Rubber Industry

7.4 Electronics

7.5 Personal Care

7.6 Paints & Coatings

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Silica Market – By End User

8.1 Introduction/Key Findings

8.2 Glass Industry

8.3 Chemical Industry

8.4 Food & Beverage Industry

8.5 Y-O-Y Growth trend Analysis By End User

8.6 Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 9. Silica Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Silica Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cabot Corporation

10.2 Evonik Industries AG

10.3 Nouryon

10.4 PPG Industries Inc.

10.5 PQ Corporation

10.6 Saint-Gobain

10.7 Solvay

10.8 U.S. Silica

10.9 Wacker Chemie AG

10.10 Tokuyama Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Silica Market was valued at USD 52.69 billion in 2023 and is projected to reach a market size of USD 102.03 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 9.9%.

Construction Juggernaut, Performance Enhancer Beyond Compare, Shifting Preferences Towards Tailored Solutions, Sustainability Focus: A Catalyst for Innovation.

Glass Industry, Chemical Industry, Food & Beverage Industry.

The Asia-Pacific region currently reigns supreme in the Silica Market, boasting the highest consumption rates driven by construction and readily available resources.

Cabot Corporation, Evonik Industries AG, Nouryon, PPG Industries Inc., PQ Corporation, Saint-Gobain, Solvay, U.S. Silica, Wacker Chemie AG, Tokuyama Corporation.