Shortenings Market Size (2024–2030)

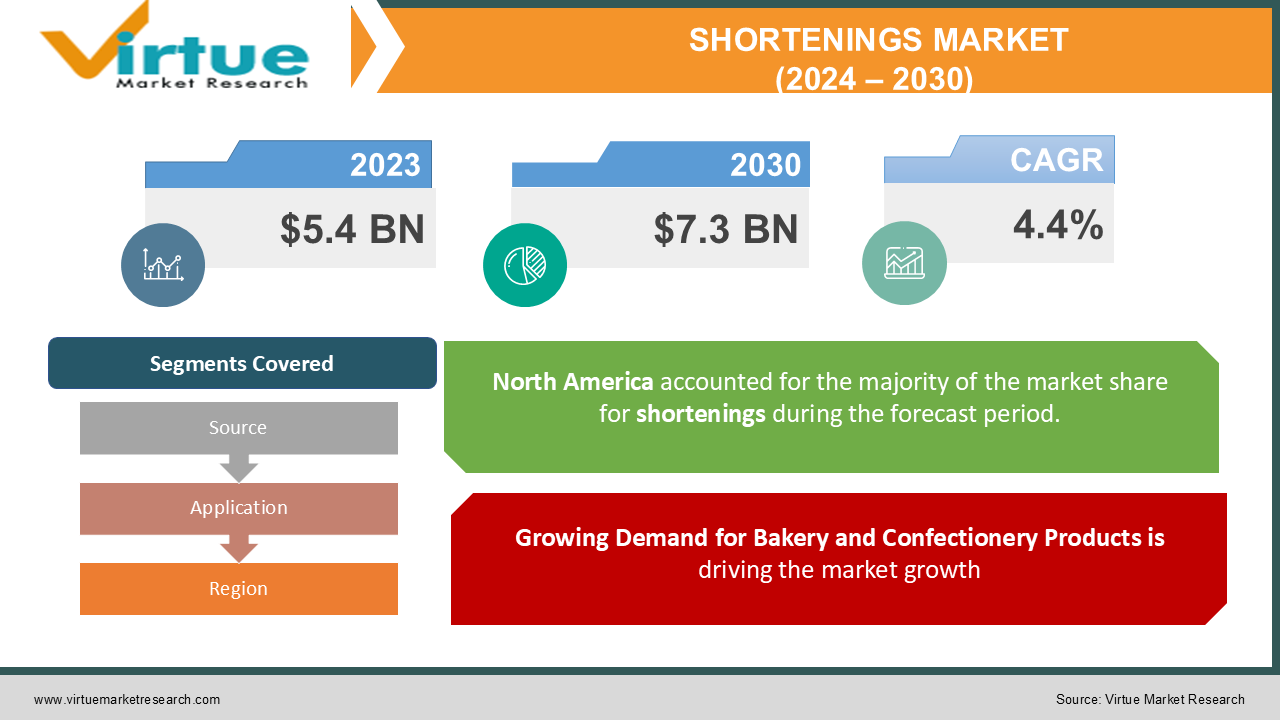

The Global Shortenings Market was valued at USD 5.4 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030, reaching approximately USD 7.3 billion by the end of 2030.

Shortenings, which are solid fats derived from animal or plant sources, are used in a wide range of food products to enhance texture, mouthfeel, and flavor. They are primarily utilized in bakery items, confectioneries, and snacks, playing a key role in achieving the desired consistency and shelf life of these products.

The market is driven by the growing demand for baked goods, especially in emerging markets, as well as the shift towards plant-based shortenings due to health and sustainability concerns. Additionally, the increasing preference for trans-fat-free and non-hydrogenated shortenings is shaping the global market, with manufacturers developing innovative products that cater to the evolving consumer preferences for healthier alternatives.

Key Market Insights:

-

The plant-based shortenings segment is expected to grow at a CAGR of 5.5% during the forecast period, driven by the rising consumer demand for sustainable and healthier food ingredients.

-

Bakery applications account for over 40% of the total market share in 2023, making it the largest application segment, as shortenings are critical in producing flaky, tender baked goods like pastries, biscuits, and cakes.

-

The Asia-Pacific region is expected to see the fastest growth, with a CAGR of 6.3%, due to the increasing consumption of bakery and snack products in countries like China and India.

-

The demand for trans-fat-free shortenings has surged globally, with manufacturers investing in palm oil alternatives and other healthier fats to cater to health-conscious consumers.

-

Innovations in the formulation of shortenings have led to the introduction of new products that offer enhanced functionality, such as better creaming ability, longer shelf life, and improved flavor retention.

Global Shortenings Market Drivers:

Growing Demand for Bakery and Confectionery Products is driving the market growth:

The rapid expansion of the global bakery and confectionery industries is one of the primary drivers of the global shortenings market. As consumer lifestyles become busier, the demand for convenient, ready-to-eat, and indulgent food products like cakes, cookies, pastries, and snack bars has grown significantly. Shortenings, which are essential ingredients in these food products, provide the texture, flakiness, and richness that consumers expect in bakery and confectionery items. In developed markets such as North America and Europe, consumers have developed a strong preference for premium, artisanal baked goods made with high-quality ingredients, which has further boosted the demand for premium shortenings, including those that are non-hydrogenated or trans-fat-free. On the other hand, in emerging markets such as Asia-Pacific and Latin America, the growing middle-class population, increasing urbanization, and rising disposable income levels have contributed to the expansion of bakery chains, supermarkets, and convenience stores offering a wide range of bakery and confectionery products. As more consumers embrace Western eating habits and indulge in snack foods and desserts, the demand for shortenings used in baked goods continues to rise. Furthermore, the rise of home baking, especially during the COVID-19 pandemic, has also contributed to increased consumption of shortenings as consumers look for high-quality fats that provide excellent functionality in home-baked products.

Shift Towards Trans-fat-free and Non-hydrogenated Shortenings is driving the market growth:

The global market for shortenings is undergoing a transformation as consumers become increasingly aware of the health risks associated with trans fats, including their link to heart disease, obesity, and other chronic health conditions. As a result, there has been a significant shift towards trans-fat-free and non-hydrogenated shortenings, which offer the same functionality as traditional shortenings but without the harmful health effects of trans fats. Many countries have introduced regulations to limit or ban the use of partially hydrogenated oils (PHOs), which were once the primary source of trans fats in processed foods, including baked goods and snacks. For example, in 2015, the U.S. Food and Drug Administration (FDA) declared that trans fats were no longer "generally recognized as safe" (GRAS) for human consumption, leading to a nationwide phase-out of PHOs in food products. Similarly, the World Health Organization (WHO) has called for a global elimination of industrially produced trans fats by 2023. This regulatory push has spurred innovation in the shortenings market, with manufacturers developing new formulations using palm oil, coconut oil, and other non-hydrogenated fats to replace PHOs. These new-generation shortenings provide the same functionality in terms of texture, flavor, and shelf stability while aligning with consumer preferences for healthier, cleaner-label products. As more consumers seek out products free from trans fats, the demand for non-hydrogenated shortenings is expected to grow, particularly in health-conscious markets such as North America and Europe.

Rising Popularity of Plant-based Shortenings is driving the market growth:

The plant-based food trend has gained tremendous momentum in recent years, driven by increasing consumer awareness of the environmental and ethical concerns surrounding animal-based food production, as well as the health benefits associated with plant-based diets. This trend is significantly impacting the global shortenings market, as plant-based shortenings, primarily derived from oils such as palm, soybean, and coconut, are gaining popularity as alternatives to traditional animal-based shortenings like lard and butter. Plant-based shortenings are not only favored by vegans and vegetarians but also by flexitarians and mainstream consumers who are looking to reduce their intake of animal products for health or sustainability reasons. Additionally, plant-based shortenings are free from cholesterol and are often perceived as healthier alternatives to animal-based fats, making them a popular choice for food manufacturers looking to develop better-for-you bakery and snack products. The rise of clean-label and organic food trends has further driven demand for plant-based shortenings made from non-GMO, sustainably sourced, and organic ingredients. These shortenings are particularly in demand in the natural and organic food sectors, where consumers prioritize products made with minimal processing and no artificial additives. As the plant-based food movement continues to expand globally, the demand for plant-based shortenings is expected to grow, providing new opportunities for innovation in the market.

Global Shortenings Market Challenges and Restraints:

Volatility in Raw Material Prices is restricting the market growth:

One of the most significant challenges faced by the global shortenings market is the volatility in the prices of raw materials used in the production of shortenings, particularly vegetable oils such as palm oil, soybean oil, and sunflower oil. The prices of these oils are highly influenced by factors such as weather conditions, geopolitical events, trade policies, and fluctuations in supply and demand, which can lead to sharp price increases or decreases. For instance, the global palm oil market has experienced price fluctuations due to environmental concerns related to deforestation and land-use change in major palm oil-producing countries like Indonesia and Malaysia. In addition, the imposition of import tariffs, export restrictions, and other trade barriers in key markets can further exacerbate price volatility, impacting the overall cost structure for shortening manufacturers. These price fluctuations can pose a significant challenge for manufacturers, as they may be forced to absorb higher production costs or pass on these costs to consumers, which can affect the affordability and demand for their products. In an increasingly competitive market, manufacturers need to develop strategies to mitigate the impact of raw material price volatility, such as securing long-term supply contracts, diversifying their sourcing options, or investing in alternative raw materials.

Health and Nutrition Concerns is restricting the market growth:

While shortenings play a crucial role in enhancing the texture and shelf life of bakery and confectionery products, they have come under scrutiny for their high content of saturated fats, which are associated with an increased risk of heart disease and other health issues. This is particularly true for shortenings made from partially hydrogenated oils, which contain trans fats, as well as those derived from animal fats, which are high in cholesterol. As consumers become more health-conscious and seek out products that are lower in saturated fat, sugar, and calories, the demand for healthier alternatives to traditional shortenings is growing. However, reformulating shortenings to reduce their saturated fat content without compromising on taste, texture, or functionality presents a significant challenge for food manufacturers. Consumers expect their baked goods and snacks to maintain the same level of quality and indulgence, even when made with healthier fats, and achieving this balance requires ongoing research and innovation. Furthermore, government regulations aimed at reducing the consumption of unhealthy fats, such as trans fats and saturated fats, have added pressure on manufacturers to develop healthier shortening formulations. This regulatory environment, combined with changing consumer preferences, poses a challenge for the traditional shortening market, which must adapt to these demands by offering more health-conscious options.

Market Opportunities:

The global shortenings market offers significant growth opportunities, particularly in the areas of clean-label, non-hydrogenated, and plant-based shortenings. As consumers become more aware of the health and environmental implications of their food choices, they are increasingly seeking out products that are made from natural, minimally processed ingredients and free from artificial additives. This trend presents a major opportunity for manufacturers to develop shortenings that align with these consumer preferences. One of the key opportunities lies in the expansion of the plant-based shortenings segment, which is poised for rapid growth as the demand for plant-based foods continues to rise globally. Plant-based shortenings, derived from oils such as palm, coconut, and sunflower, offer a versatile and sustainable alternative to animal-based fats, appealing to a wide range of consumers, including vegans, vegetarians, and flexitarians. The growing popularity of plant-based diets, combined with the rising demand for sustainable food products, provides a fertile ground for innovation in this segment. Another opportunity is the development of trans-fat-free and non-hydrogenated shortenings. With the global regulatory landscape increasingly favoring the reduction or elimination of trans fats from food products, manufacturers have a unique opportunity to lead the market by offering healthier alternatives that deliver the same functionality as traditional shortenings. These products cater to health-conscious consumers who are looking for clean-label, better-for-you options without compromising on taste or performance.

SHORTENINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.4% |

|

Segments Covered |

By Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated, Archer Daniels Midland Company, Bunge Limited, AAK AB, Associated British Foods plc, Wilmar International Limited, Fuji Oil Holdings Inc., Olenex Holdings B.V., IOI Corporation Berhad, Manildra Group |

Shortenings Market Segmentation: By Source

-

Plant-based Shortenings

-

Animal-based Shortenings

The plant-based shortenings segment is expected to dominate the market, accounting for over 55% of total revenue in 2023. This growth is attributed to the increasing consumer demand for sustainable and health-conscious food products, as well as the rising awareness of the environmental impact of animal-based fats.

Shortenings Market Segmentation: By Application

-

Bakery

-

Confectionery

-

Snacks

-

Others

The bakery application segment holds the largest market share, contributing 40% of total revenue in 2023. Shortenings are essential in bakery applications for improving the texture, moisture retention, and shelf life of baked goods, making them a key ingredient in the production of items like pastries, cakes, and cookies.

Shortenings Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is the leading region in the global shortenings market, accounting for 38% of total revenue in 2023. This dominance is driven by the well-established bakery and snack industries in the region, as well as the strong consumer preference for premium, trans-fat-free, and non-hydrogenated shortenings.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the global shortenings market. Initially, the market faced supply chain disruptions due to lockdowns, transportation restrictions, and factory shutdowns, which affected the production and distribution of shortenings. However, the pandemic also led to an increase in home baking activities as consumers spent more time at home, leading to a surge in demand for baking ingredients, including shortenings. In particular, the demand for premium and specialty shortenings grew as consumers sought high-quality ingredients for their home-baked goods. The shift toward online shopping also boosted the sales of shortenings through e-commerce platforms, as consumers preferred contactless shopping options. While the food service sector experienced a decline in demand due to restaurant closures and reduced dining-out activities, the retail segment saw a notable increase in sales. As the global economy recovers and consumer habits return to normal, the long-term impact of the pandemic on the shortenings market is expected to include a sustained interest in home baking and an increased preference for online shopping. The demand for clean-label, health-conscious shortenings is also likely to continue growing as consumers become more focused on the nutritional content of the food they consume.

Latest Trends/Developments:

Several trends are shaping the future of the global shortenings market. One of the most prominent trends is the rise of clean-label shortenings, as consumers seek out products made from natural ingredients, free from artificial additives, preservatives, and hydrogenation. This trend is aligned with the broader clean-label movement in the food industry, where transparency and simplicity in ingredients are becoming key purchasing factors for consumers. Another trend is the increased focus on sustainability in the sourcing and production of shortenings. Manufacturers are exploring ways to reduce their environmental impact by sourcing oils from certified sustainable sources, such as RSPO-certified palm oil, and by reducing the carbon footprint of their production processes. This trend is particularly important in markets like Europe and North America, where consumers are becoming more environmentally conscious and are seeking out products that align with their values. The premiumization of bakery and confectionery products is another trend driving innovation in the shortenings market. Consumers are willing to pay more for high-quality, indulgent baked goods and snacks made with premium ingredients, such as organic or non-GMO shortenings. This has led to the development of specialty shortenings that offer enhanced functionality, such as improved creaming ability, extended shelf life, and superior flavor retention.

Key Players:

-

Cargill, Incorporated

-

Archer Daniels Midland Company

-

Bunge Limited

-

AAK AB

-

Associated British Foods plc

-

Wilmar International Limited

-

Fuji Oil Holdings Inc.

-

Olenex Holdings B.V.

-

IOI Corporation Berhad

-

Manildra Group

Chapter 1. Shortenings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Shortenings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Shortenings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Shortenings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Shortenings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Shortenings Market – By Source

6.1 Introduction/Key Findings

6.2 Plant-based Shortenings

6.3 Animal-based Shortenings

6.4 Y-O-Y Growth trend Analysis By Source

6.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Shortenings Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery

7.3 Confectionery

7.4 Snacks

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Shortenings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Source

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Source

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Source

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Source

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Source

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Shortenings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Incorporated

9.2 Archer Daniels Midland Company

9.3 Bunge Limited

9.4 AAK AB

9.5 Associated British Foods plc

9.6 Wilmar International Limited

9.7 Fuji Oil Holdings Inc.

9.8 Olenex Holdings B.V.

9.9 IOI Corporation Berhad

9.10 Manildra Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global shortenings market was valued at USD 5.4 billion in 2023 and is expected to reach USD 7.3 billion by 2030, growing at a CAGR of 4.4% during the forecast period.

The major drivers include the growing demand for bakery and confectionery products, the shift toward trans-fat-free and non-hydrogenated shortenings, and the rising popularity of plant-based shortenings.

The market is segmented by source (plant-based, animal-based) and application (bakery, confectionery, snacks, others).

North America is the dominant region, accounting for 38% of total market revenue in 2023, driven by strong demand for premium and health-conscious food products.

Key players include Cargill, Archer Daniels Midland Company, Bunge Limited, AAK AB, and Wilmar International, among others.