Sheep Milk Market (2024 - 2030)

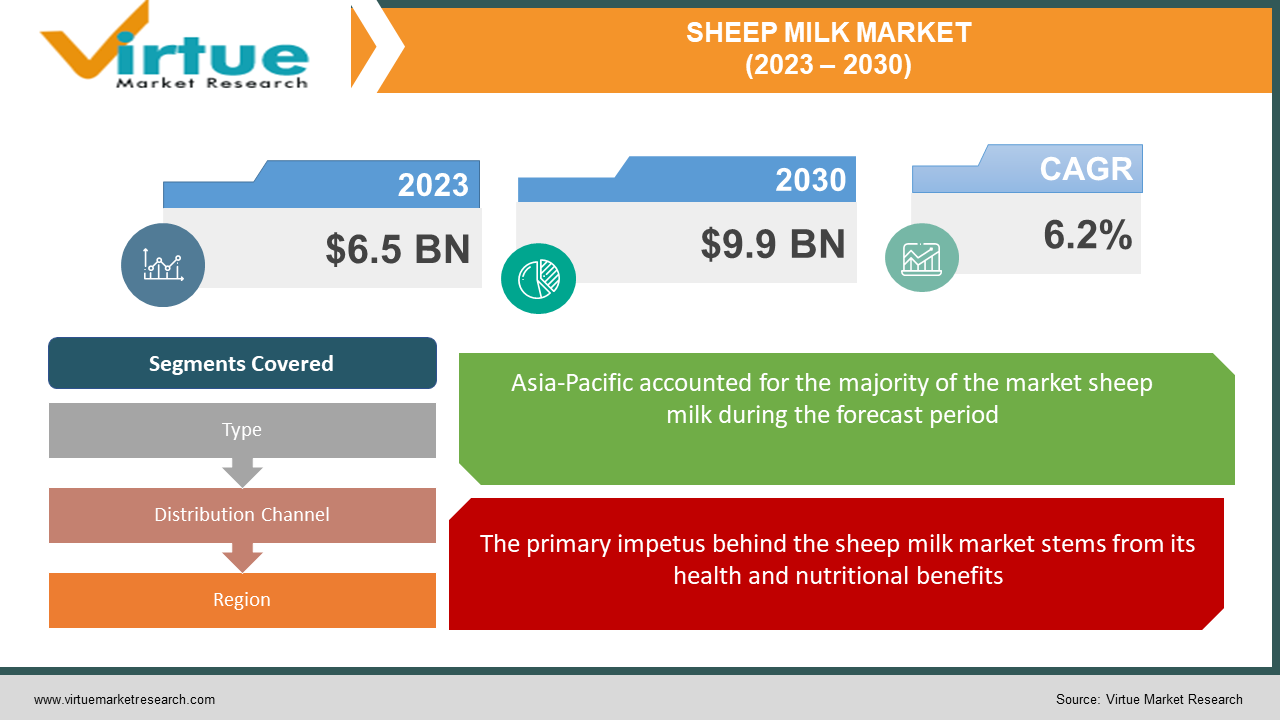

The Global Sheep Milk Market attained a valuation of USD 6.5 Billion in 2023, with estimations foreseeing a market size reaching USD 9.9 Billion by 2030. Throughout the forecast period from 2024 to 2030, the market anticipates a growth rate of 6.2%.

Market Dynamics

The recent progression of the sheep milk market stems from an amplified consumer recognition of its nutritional benefits, distinct taste profile, and suitability for individuals with lactose intolerance. This market encompasses diverse products such as sheep milk cheese, yogurt, and liquid milk, experiencing expansion not only in conventional sheep-rearing territories but also in emerging markets. Health-conscious consumers favor sheep milk due to its higher protein and fat content and an array of vitamins and minerals. The artisanal and premium attributes of many sheep milk products, often crafted by small-scale producers, contribute to the market's allure. Despite the comparatively smaller scale of production compared to cow or goat milk, the market offers niche opportunities for both established and new players.

Key Market Insights:

Unlike the United Kingdom, where sheep's milk production accounts for less than 0.1% globally, various European countries exhibit a stronger presence in sheep's milk production. Greece, notably, leads with around 8.5% contribution to global sheep-specific milk production. Over the past five decades, production for small ruminants like sheep and goats has more than doubled, signalling a growing adoption trend.

Sheep's milk proves exceptional for cheese production due to its suggested higher fat and protein levels, notably casein, and total solids compared to cow's milk, significantly influencing cheese yields.

Moreover, there's burgeoning potential in producing sheep-based yogurt and ultra-heat-treated milk. The burgeoning interest in sheep infant formula indicates potential for premium alternatives catering to toddlers and young children. Adults seeking alternatives to traditional cow's milk products also contribute to a noticeable demand.

Sheep Milk Market Driving Factors:

The primary impetus behind the sheep milk market stems from its health and nutritional benefits. Sheep milk is increasingly acknowledged as a healthier substitute for cow's milk due to its superior nutrient concentration. It contains elevated levels of essential nutrients, including vitamins, minerals, and proteins, compared to cow's milk. Moreover, its lower lactose content and distinct protein structure make it easier to digest, particularly for individuals with lactose intolerance. Additionally, sheep milk offers bioactive compounds like antioxidants and immunoglobulins, believed to yield diverse health advantages. The escalating preference for healthier dietary alternatives has significantly spurred the demand and growth of sheep milk products.

The market's growth is further propelled by the allure of artisanal and specialized sheep milk products.

Typically linked with smaller-scale, artisanal farming practices, sheep milk production emphasizes quality and tradition, resulting in specialty items like sheep cheese and yogurt. These distinctive products, renowned for their unique flavors, textures, and terroir influence, captivate consumers seeking premium and exceptional food offerings. The increasing willingness of consumers to pay premium prices for these specialized products drives the expansion of the sheep milk market. Furthermore, the artisanal nature of sheep milk production resonates with the broader consumer trend favoring local and sustainable agricultural practices, further fuelling market growth.

Challenges and Restraints in the Sheep Milk Market:

The chief challenge confronting the sheep milk market is the limited supply and seasonality of sheep milk. Sheep milk production is inherently constrained compared to cow's milk due to lower milk yields per animal. Moreover, sheep milk production experiences seasonal fluctuations, with peak yields observed during spring and early summer. This seasonality leads to variations in sheep milk availability, posing challenges to ensure a consistent year-round supply. Consequently, manufacturers of sheep milk products encounter hurdles in meeting market demand, necessitating efforts to extend the availability of sheep milk or diversify product lines.

Another hurdle in the sheep milk market pertains to limited consumer awareness and acceptance compared to cow's milk. The widespread familiarity with cow's milk and dairy products contrasts with the relatively unfamiliar sheep milk products, perceived by many consumers as exotic or uncommon. This lack of familiarity poses difficulties for sheep milk producers in attracting and retaining a customer base. To address this, companies operating in the sheep milk market need to invest in marketing and educational initiatives. Elevating awareness about the richness and potential health benefits of sheep milk and creating appealing, high-quality products are essential to encourage consumers to explore and adopt sheep milk as a viable alternative to conventional dairy products.

Opportunities in the Sheep Milk Market:

The sheep milk market offers several opportunities, especially amid the rising demand for alternative dairy products among health-conscious consumers seeking nutritious and lactose-free options. The inherently rich and creamy texture of sheep milk makes it well-suited for crafting premium dairy products like artisanal cheeses and yogurt that command higher price points. Furthermore, the escalating interest in sustainability and ethical farming practices provides an avenue for sheep milk producers to highlight their commitment to environmental and animal welfare considerations, appealing to eco-conscious consumers. Strategies such as diversifying product lines, introducing value-added products, and enhancing production efficiency are pivotal for capitalizing on these opportunities and fostering the growth of the sheep milk market.

SHEEP MILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kerrymaid, New Zealand Sheep Milk Company, Blackwood Valley Dairy Farm, Tiran Group, Spring Sheep, Sheep Milk Company Ltd. |

Sheep Milk Market Segmentation - Type

-

Conventional

-

Organic

The dominant segment in the sheep milk market, constituting 78%, is Conventional sheep milk. Its prominence is due to well-established production methods, wider distribution networks, and lower production costs. The accessibility and competitive pricing of conventional sheep milk cater to a broader consumer base. Conversely, Organic sheep milk, although gaining traction owing to increased demand for sustainable products, currently holds a smaller market share due to the challenges inherent in organic farming and certification processes. This segment, however, experiences a remarkable growth rate of 18.9% annually, driven by consumers' growing preference for healthier and environmentally responsible food choices.

Sheep Milk Market Segmentation - Distribution Channels

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others

Supermarkets and Hypermarkets typically hold the largest market share (68%) in the sheep milk distribution segment. Their dominance is attributed to the convenience and availability of sheep milk products within these outlets, offering a broad range of dairy products under one roof. Online Retail is the fastest-growing segment, owed to the surging popularity of e-commerce. Online platforms provide consumers the convenience of purchasing sheep milk products from home, often with home delivery options. This channel also facilitates access to niche and specialty products, including sheep milk items not commonly found in traditional brick-and-mortar stores.

Sheep Milk Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific commands the largest share (41%) in the sheep milk market, driven by its diverse population with varied dietary preferences, including increased dairy consumption. Countries like China and India exhibit growing interest in healthier dairy alternatives like sheep milk, particularly among the expanding middle-class population with higher disposable incomes. Europe emerges as the fastest-growing region due to its strong tradition of sheep milk consumption, coupled with changing consumer preferences favoring healthier and diverse food choices. European markets are increasingly adopting sustainable farming practices, contributing to the growth of organic sheep farming and aligning with environmentally conscious consumers' demands.

COVID-19 Impact on the Sheep Milk Market:

The global sheep milk market faced mixed repercussions during the COVID-19 pandemic. While initial disruptions affected supply chains and production, subsequent phases saw increased consumer focus on health, leading to heightened demand for nutritious dairy alternatives like sheep milk products. The pandemic expedited the shift towards online food shopping, boosting the online retail segment. However, challenges persisted concerning logistics and distribution, reshaping consumer preferences and distribution channels within the sheep milk market.

Recent Trends and Developments:

An emerging trend in the sheep milk market is the growing preference for artisanal and specialty sheep milk products. Consumers are increasingly seeking unique and high-quality dairy options, particularly artisanal sheep milk cheeses and yogurts, driven by a desire for diverse flavors and locally sourced products.

A significant development in the market is the expansion of sustainable and ethical farming practices. Sheep milk producers are adopting organic farming methods and emphasizing animal welfare and eco-friendly initiatives, aligning with the rising demand for sustainably produced dairy goods and driving industry growth.

Major Companies:

-

Kerrymaid

-

New Zealand Sheep Milk Company

-

Blackwood Valley Dairy Farm

-

Tiran Group

-

Spring Sheep

-

Sheep Milk Company Ltd.

Chapter 1. GLOBAL SHEEP MILK MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL SHEEP MILK MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL SHEEP MILK MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL SHEEP MILK MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL SHEEP MILK MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL SHEEP MILK MARKET – By Type

6.1. Convectional

6.2. Organic

Chapter 7. GLOBAL SHEEP MILK MARKET – By Distribution Channel

7.1. Supermarkets and Hypermarkets

7.2. Convenience Stores

7.3. Online Retail

7.4. Other

Chapter 8. GLOBAL SHEEP MILK MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.9. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL SHEEP MILK MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Kerrymaid

9.2. New Zealand Sheep Milk Company

9.3. Blackwood Valley Dairy Farm

9.4. Tiran Group

9.5. Spring Sheep

9.6. Sheep Milk Company Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sheep Milk Market achieved a valuation of USD 6.5 Billion in 2023 and is anticipated to reach USD 9.9 Billion by 2030. Over the forecast period from 2024 to 2030, the market is expected to expand at a CAGR of 6.2%.

The Sheep Milk market is driven by the Health and Nutritional Benefits offered by sheep milk along with the presence of Artisanal and Specialty sheep milk products.

The Global Sheep Milk Market is divided into conventional and organic categories based on type.

Asia-Pacific stands as the most influential region within the Global Sheep Milk Market.

Key players such as Tiran Group, Spring Sheep, and Sheep Milk Company Ltd. are among the leading entities operating within the Global Sheep Milk Market.