Shaft & Hoisting System Market Size (2023 – 2030)

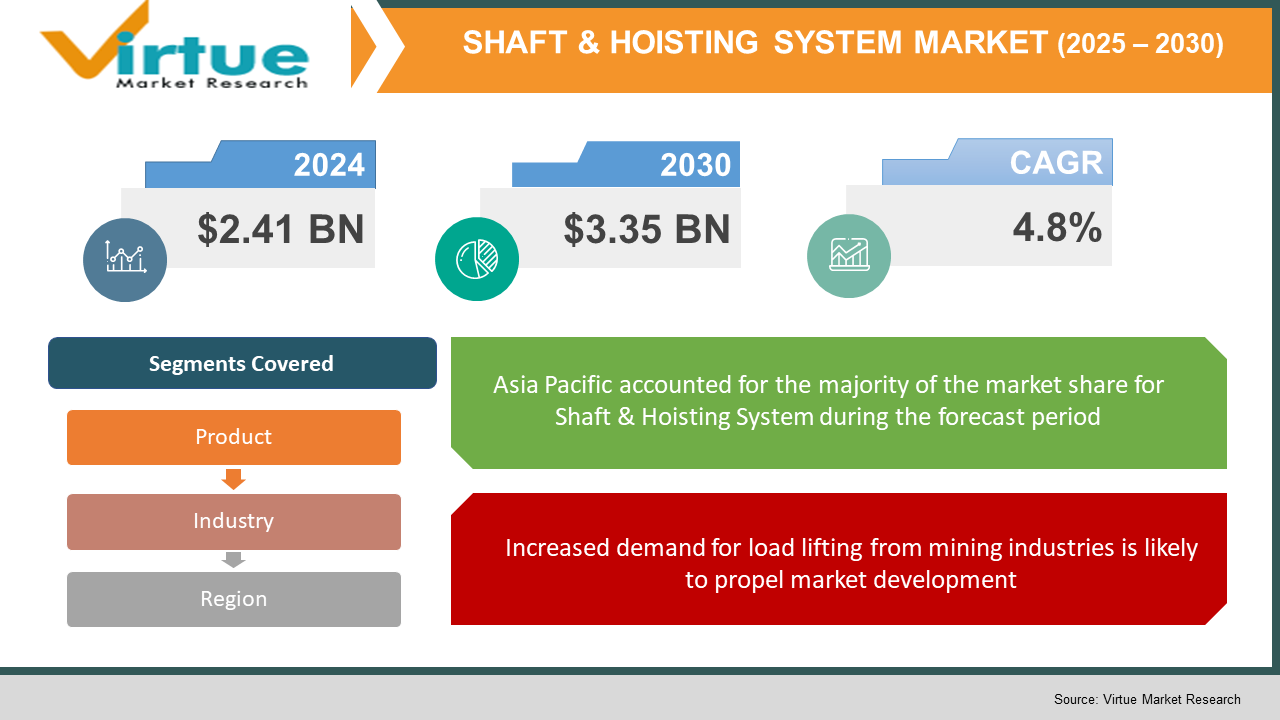

The Global Shaft & Hoisting System Market is valued at USD 2.41 billion in 2023 and is projected to reach a market size of USD 3.35 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.8%.

INDUSTRY OVERVIEW

Men, materials, and ore can be transported from depths ranging from a few hundred metres to more than 3000 meters utilizing a shaft hoisting method that uses a mine hoist. For the transportation of people and goods, vertical shafts and ramps are frequently used in mines. For raising and lowering carriages in the mine shaft, a hoist is used in mining. Before the usage of solid-state converters, the hoists were historically driven by direct current drives, which were controlled by Ward Leonard machines. Modern hoists, on the other hand, are propelled by electric motors and use alternating current drives that are modulated by frequency. Hoists are used on an earthen ridge that is deep and occasionally quite deep. The typical mine where these hoists are located typically extracts from 500 to 2,000 metres below the earth's surface. For instance, a mine in South Africa, which extracts from a depth of almost 3,500 metres below the surface of the earth, holds the record for deepest mining worldwide.

Consequently, a prevalent recurring tendency in mining activities is that payloads are growing and mines are getting deeper. For instance, the biggest transport to date was 60 tons at 20 m/s. Therefore, in order to raise equipment and the associated ropes, miners are requesting large kits with longer hoists and specific designs. Hoist ropes come in a variety of sizes and can raise to 3,000 metres. Modern mining requires high-speed hoisting capabilities that can lift to 60 km/h because of these depths. These specifications demand high-quality hoists so that friction, weight, accelerations, and decelerations won't harm the ropes. Due to all of these, a mining rope for hoisting has a different core construction than a typical crane rope. Additionally, major producers are concentrating more on long-life, high-production, and massive projects to remarkable depths; as a result, it is anticipated that demand for hoist systems will continue to increase. Hoist systems are currently 50 per cent faster than older systems, continuously exceeding previous capacities by 25 to 50 per cent.

In 2020, COVID-19 had a detrimental impact on the shaft and hoist market, leading to a decline in the shipments of shaft and hoists as well as the income they produced. As a result, during the first half of 2020, there was a decline in the market's growth pattern. The demand is anticipated to rise as a result of the expanding demand from the construction, shipping, and material handling industries, and this trend is anticipated to halt in the second half of the year. The shaft and hoist market's value chain has been severely disrupted by the COVID-19 outbreak. The pandemic-affected nations of the US, China, India, and Japan make up a sizeable portion of the world's shaft and hoist production.

COVD-19 IMPACT ON THE SHAFT & HOISTING SYSTEM MARKET

The COVID-19 period may have three separate effects on the world economy: direct effects on supply and demand, indirect effects on supply chains and markets, and financial effects on businesses and financial markets. Producers will be rewarded following the COVID-19 issue, according to analysts tracking the situation globally. Due to the worldwide transportation and supply chain logistics network being shut down as a result of the lockdown, the COVID-19 pandemic is predicted to have a significant negative impact on the market. Additionally, decreased exploratory activities as a result of decreased commercial demand for oil and natural gas have decreased the demand for hoists. The global market for mining hoists is currently under intense downward pressure from COVID-19. This may be observed in the way that businesses are laying off workers, cutting salaries, and curtailing operations and oil exploration efforts.

MARKET DRIVERS:

Increased demand for load lifting from mining industries is likely to propel market development

A shaft hoisting technique that makes use of a mine hoist allows for the transportation of people, goods, and minerals from depths ranging from a few hundred metres to more than three thousand metres. Vertical shafts and ramps are widely utilised in mines to convey personnel and products. As a result, the mining industry's rising need for load lifting is anticipated to drive market expansion.

The superior quality of the shaft hoisting system offered by the manufacturers is creating a positive outlook for market growth

A crane rope's core is constructed differently from a rope used in mining for lifting. The market for hoist systems is likely to expand in part because large producers are focusing increasingly on long-life, high-production, and enormous projects at incredible depths. Currently, hoist systems outperform prior capacity by 25 to 50% while being 50% quicker than older systems.

MARKET RESTRAINTS:

Due to COVID-19, there is a lack of skilled labour to manage the shaft and hoist system operations which can hamper the growth in this industry.

Shaft and hoist system is enormous, intricate equipment. These systems need to be precisely configured from the installation stage on. The entire production process could be stopped or disastrous incidents could result from a small error in calculation or precision. An operator must be technically proficient in shaft hoist operation to maintain precision. A technical professional is required for hoist maintenance in addition to installation, which raises the cost. Furthermore, software updates for hoists are necessary due to the ongoing advancement of technology and the increase in automation. The effective handling of the new technology necessitates recurring worker training. Governments have limited the number of people who can work at various facilities as a result of the COVID-19 outbreak. As a result, there is no crew available to carry out quality control, inspections, and maintenance tasks. The existing situation has impeded the efficient operation of these systems because shafts and hoists need to be operated by technically proficient professionals.

In 2020, COVID-19 had a negative effect on the hoist market, resulting in decreased shipments of shafts and hoists and the revenues generated from them. As a result, a drop was witnessed in the growth trend of the market during the first half of 2020. This trend is estimated to discontinue in the latter half of the year as the demand is estimated to increase due to the growing demand from the construction and shipping and material handling industry.

High manufacturing and maintenance costs may hinder market expansion.

Shafts and the hoisting system are made up of various parts. Small and medium-sized businesses (SMEs) face financial obstacles when trying to enter the shaft and hoist sector. Hoists have ongoing maintenance expenditures in addition to the initial cost of manufacturing them. To guarantee the equipment operates without a hitch, several variables need to be examined regularly. These considerations include lubricating moving parts and testing emergency safety switches, interlocks, and limiting and signaling systems.

SHAFT & HOISTING SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Product, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

INCO, ABB, SIEMAG TECBERG, GENERAL ELECTRIC, FLSMIDTH, HEPBURN ENGINEERING, INGERSOLL-RAND, SICHUAN MINING MACHINERY, CITIC HIC, HEBI WANFENG MINING MACHINERY, DEILMANN-HANIEL |

SHAFT & HOISTING SYSTEM MARKET – BY PRODUCT

-

Friction Hoist

-

Drum Hoist

-

Blair Multi-rope Hoist

Based on the product, the shaft and hoisting system market is segmented into Friction hoists, Drum hoists and Blair Multi-rope hoists. For coal mining firms, effective, safe, and reliable systems are crucial because mine hoists need a large financial investment. Except for the US, friction hoists are the preferred option due to the majority of coal mines' depths of 600–1200 m. Friction hoists are also less expensive than brand-new drum hoists, and because there are more suppliers, the lead time for delivery might be shorter. Furthermore, a friction hoist is simpler to transport and install than a drum hoist because it has a smaller diameter for the same service.

SHAFT & HOISTING SYSTEM MARKET - BY INDUSTRY

-

Coal Mine

-

Iron Ore

-

Non-ferrous Metal Ore

-

Non-metallic Minerals Ore

Based on the industry, the shaft and hoisting system market is segmented into Coal mines, Iron Ore, Non-ferrous Metal Ore and Non-metallic Minerals Ore. Among these, the coal mine industry and iron ore industry are likely to contribute significantly to the market growth since. The growth in the market can be attributed to increased demand for load lifting from mining Industries.

SHAFT & HOISTING SYSTEM MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Shaft & Hoisting System Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. In the upcoming years, it is projected that the Asia Pacific would hold the largest market share and have the fastest growth. Due to the region's heavily populated countries, demand has been steadily rising, which is to blame. Additionally, higher living standards and disposable income have resulted in higher capital expenditures, which include the purchase of automobiles and a rise in LPG consumption both privately and domestically. Due to some of the underserved developing markets, Asia Pacific confirms to be a significant region for important companies. Therefore, growing expenditures made by businesses in the area to expand their market presence are anticipated to improve the market.

Additionally, it is projected that the Middle East, Africa, and Latin America would continue to grow steadily. This is because both regions are placing greater emphasis on the tourism industry, which has caused the governments to concentrate more on alternative forms of income production. Additionally, both of these regions have made significant investments in tourism infrastructure in recent years to strengthen the economy and divert attention from mining operations. Additionally, moderate growth is projected in North America and Europe with only minor changes in demand and market structure. The region is estimated to experience small changes in the upcoming years as a result of the big market players moving their attention to emerging economies.

SHAFT & HOISTING SYSTEM MARKET - BY COMPANIES

Some of the major players operating in the Shaft & Hoisting System Market include:

-

INCO

-

ABB

-

SIEMAG TECBERG

-

GENERAL ELECTRIC

-

FLSMIDTH

-

HEPBURN ENGINEERING

-

INGERSOLL-RAND

-

SICHUAN MINING MACHINERY

-

CITIC HIC

-

HEBI WANFENG MINING MACHINERY

-

DEILMANN-HANIEL

NOTABLE HAPPENING IN THE SHAFT & HOISTING SYSTEM MARKET

-

COLLABORATION- In December 2020, Warrior Met Coal BCE, LLC and Frontier-Kemper Constructors, a division of Tutor Perini Corporation, entered into a contract for the Alabama-based Blue Creek Energy Mine project valued at about $63.7 million. The project entails the excavation and building of the mine shaft, service hoist, and slope hoist.

-

EXPANSION- The sole Russian producer of mine hoists, Uralmashplant (UZTM), supplied a mine hoist to Siberia Polymetals JSC in July 2020. The mine being built at the Korbalikhinsky ore deposit will use the hoist SHPM 54 kn. This machine is the second of its kind produced by UZTM.

Chapter 1. Shaft & Hoisting System Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Shaft & Hoisting System Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Shaft & Hoisting System Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Shaft & Hoisting System Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Shaft & Hoisting System Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Shaft & Hoisting System Market– By PRODUCT

6.1 Introduction/Key Findings

6.2 Friction Hoist

6.3 Drum Hoist

6.4 Blair Multi-rope Hoist

6.5 Y-O-Y Growth trend Analysis By PRODUCT

6.6 Absolute $ Opportunity Analysis By PRODUCT, 2023-2030

Chapter 7. Shaft & Hoisting System Market– By INDUSTRY

7.1 Introduction/Key Findings

7.2 Coal Mine

7.3 Iron Ore

7.4 Non-ferrous Metal Ore

7.5 Non-metallic Minerals Ore

7.6 Y-O-Y Growth trend Analysis By INDUSTRY

7.7 Absolute $ Opportunity Analysis By INDUSTRY, 2023-2030

Chapter 8. Shaft & Hoisting System Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By PRODUCT

8.1.3 By INDUSTRY

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By PRODUCT

8.2.3 By INDUSTRY

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By PRODUCT

8.3.3 By INDUSTRY

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By PRODUCT

8.4.3 By INDUSTRY

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By PRODUCT

8.5.3 By INDUSTRY

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Shaft & Hoisting System Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 INCO

9.2 ABB

9.3 SIEMAG TECBERG

9.4 GENERAL ELECTRIC

9.5 FLSMIDTH

9.6 HEPBURN ENGINEERING

9.7 INGERSOLL-RAND

9.8 SICHUAN MINING MACHINERY

9.9 CITIC HIC

9.10 HEBI WANFENG MINING MACHINERY

9.11 DEILMANN-HANIEL

Download Sample

Choose License Type

2500

4250

5250

6900