Serology Tests for Chlamydia Market Size (2024 – 2030)

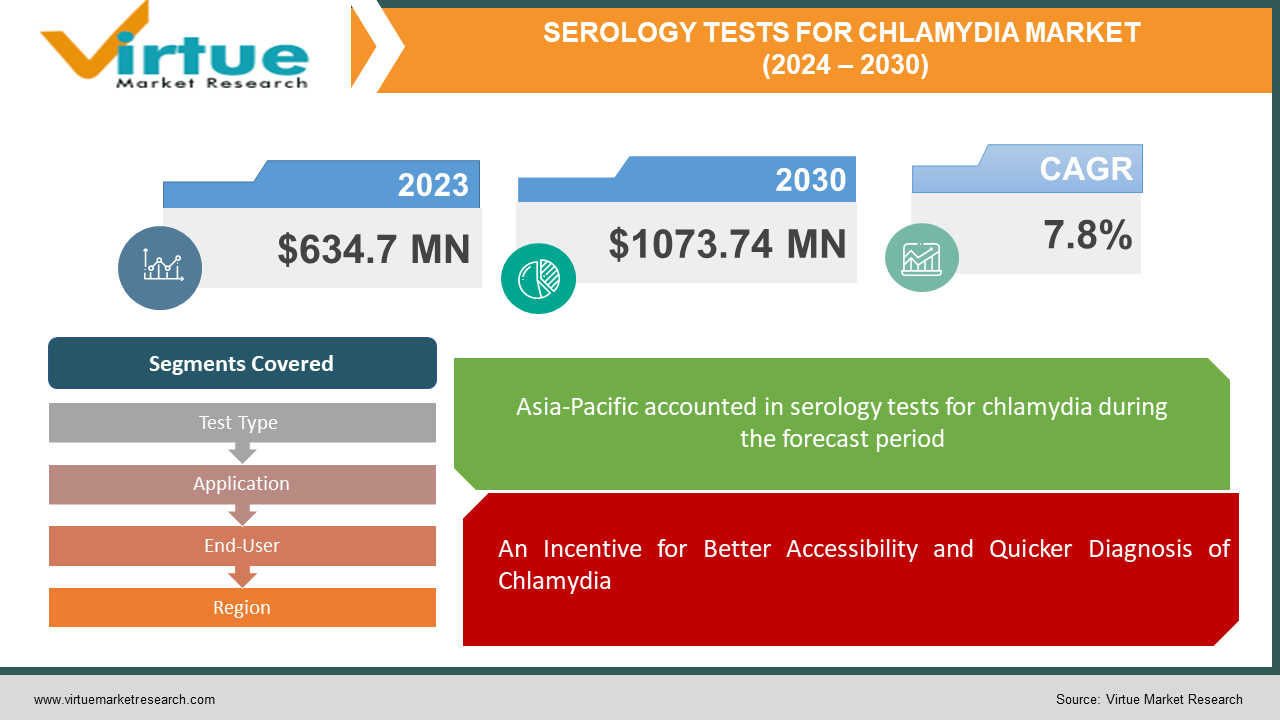

The Global Serology Tests for Chlamydia Market was valued at USD 634.7 million in 2023 and is projected to reach a market size of USD 1073.74 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.8%.

Serology tests are not the best for identifying active infections, even though they can identify antibodies against chlamydia. The body's immune response, which can persist for months or even years following an infection, is monitored by these tests. This makes it challenging to determine whether you are currently battling chlamydia or have already overcome it. Furthermore, many serology tests may not be specific to the strain of chlamydia that causes STDs, which could result in a false positive. Healthcare professionals rely on nucleic acid amplification tests (NAATs) to accurately diagnose chlamydia. NAATs, which are regarded as the gold standard, can identify chlamydia bacteria in urine samples or swabs taken from the urethra, vagina, or cervix. These assays have a high degree of accuracy and can detect traces of microorganisms. See your healthcare practitioner if you suffer from symptoms associated with chlamydia, such as burning when urinating, pelvic pain, or irregular vaginal discharge. They can advise you on the best course of action for testing and treatment.

Key Market Insights:

Currently holding a 60% market share, conventional ELISA and immunofluorescence assays dominate the industry; nevertheless, future growth appears promising due to the possibility of upgraded versions with higher accuracy.

Creating and implementing quick, easy-to-use proof-of-concept tests could help with accessibility concerns in environments with limited resources. According to WHO estimates, 30% of the world's population suffers from limited access or circumstances that call for prompt resolution.

Serology testing may end up being a more affordable first screening method for determining high-risk candidates for follow-up NAAT testing. Serology tests typically cost between 30 and 50 percent less than NAATs. Improvements in serology tests are necessary to increase their accuracy, especially in identifying active infections. Compared to NAATs' 90%+ accuracy, current infection accuracy can be as low as 60%

Global Serology Tests for Chlamydia Market Drivers:

An Incentive for Better Accessibility and Quicker Diagnosis of Chlamydia

The importance of point-of-care (POC) testing is increasing. Conventional methods of diagnosing chlamydia frequently rely on NAATs, which might take some time to produce results and require laboratory processing. POC tests, on the other hand, are intended to be easily used in a healthcare setting outside of a regular laboratory and to provide results rapidly. The creation and use of POC-formatted chlamydia serology tests may prove advantageous in a few circumstances. In resource-constrained environments, such as outlying clinics or underdeveloped nations, access to advanced laboratory facilities may be restricted. POC tests would make chlamydia diagnosis more accessible in these places by doing away with the requirement for complicated equipment and enabling on-site testing. POC tests may also be helpful in circumstances where getting results quickly is essential. For example, a rapid and simple serology test could give useful information to help healthcare personnel in emergency room situations or for people who need to make treatment decisions right away. POC chlamydia serology tests have the potential to significantly impact the market by addressing accessibility and turnaround time constraints, especially in some contexts where traditional NAATs might not be easily accessible or where expedited results are important.

Utilizing Serology Tests as an Affordable Screening Method for Populations at High Risk:

Their application as an affordable high-risk population screening tool. Because of their excellent accuracy, NAATs are the gold standard for diagnosing chlamydia; nonetheless, their cost can be higher than that of serology tests. One way to take advantage of this cost differential would be to use serology testing as a first line of screening for people who are more likely to have chlamydia infection. As a first screening step, people with a history of unprotected intercourse or several sexual partners may be offered a serology test. If the serology test suggests a possible infection, a follow-up NAAT would be carried out. This two-step method might be a more affordable way to determine whether patients need the more conclusive NAAT test, which could lower the overall healthcare expenditures related to chlamydia testing. It's crucial to remember that serology tests have limits when it comes to identifying active illnesses. The market for chlamydia serology tests could be significantly impacted by their use as an affordable screening tool if developments increase their accuracy in identifying high-risk individuals.

Global Serology Tests for Chlamydia Market Restraints and Challenges:

Barriers are preventing the global market for chlamydia serology testing from expanding. Because of persistent antibodies, serology tests have trouble differentiating between previous and present illnesses, which might produce false positives. Furthermore, certain tests may react to chlamydia strains that are not STI-causing, leading to a false positive. Furthermore, testing may be completely discouraged due to the shame associated with STIs, ignorance of chlamydia, and limits of serology tests. Currently dominating the market are the extremely accurate NAATs, which are preferred for their capacity to identify active diseases. Manufacturers of serology tests should concentrate on enhancing test specificity for the STI strain to strengthen their position, and they should consider integrating their tests with NAATs to create a more all-encompassing strategy. Campaigns to raise public knowledge about chlamydia, the value of testing, and the limits of serology testing can also be helpful. NAATs are probably going to continue to be the dominant technique for diagnosing chlamydia, even though serology tests might find a niche function in some circumstances or conjunction with other tests in the future.

Global Serology Tests for Chlamydia Market Opportunities:

Notwithstanding its drawbacks, there are some prospects in the worldwide market for chlamydia serology tests. Creating quick point-of-care (POC) tests is one tactic. These easy-to-use tests might be helpful when quick answers are required or in places without adequate healthcare infrastructure. Additionally, serology tests may be used as a first screening method for high-risk individuals, assisting in the prioritization of patients for more definitive NAATs. Furthermore, a large reduction in production costs would make them a more appealing choice, particularly in certain areas for preliminary screening. Combination test kits that include a fast antigen test, as well as a serology test, may also provide a balance between cost and information. Lastly, further investigation into enhancing the specificity and accuracy of serology tests may open the door to their wider application in the future.

SEROLOGY TESTS FOR CHLAMYDIA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Test Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Becton Dickinson and Company (BDX), F. Hoffmann-La Roche Ltd, Hologic Inc., Thermo Fisher Scientific Inc |

Global Serology Tests for Chlamydia Market Segmentation: By Test Type

-

Conventional Serology Tests (ELISA, Immunofluorescence)

-

Improved Serology Tests (under development)

The market for chlamydia serology testing worldwide can be divided into test types. Traditional serology tests such as immunofluorescence assays and ELISA are included in the first group. These are the tests that are currently available, but they are not as good for primary diagnosis due to their limitations. The second section is dedicated to the development of enhanced serology testing. Because these tests are meant to be more specific and can differentiate between infections from the past and present, this market has the greatest potential for growth in the future. This might greatly boost their applicability in the context of chlamydia testing.

Global Serology Tests for Chlamydia Market Segmentation: By Application

-

Stand-alone Testing (limited use)

-

Screening Tool for High-Risk Populations

Another way to divide the worldwide market for chlamydia serology tests is by application. The first kind of application is stand-alone testing, in which chlamydia is diagnosed using these assays alone. However, this is only partially useful due to accuracy constraints. Serology tests as a screening tool for high-risk populations are the main topic of the second application category. In this case, the tests would be utilized to determine who is more likely to have chlamydia, and those people would subsequently be referred for follow-up NAAT testing. Because serology tests are being used more widely, this market has the potential to be the biggest and develop the fastest, especially if their accuracy increases.

Global Serology Tests for Chlamydia Market Segmentation: By End-User

-

Hospitals and Clinics

-

Home Testing Market (potential)

The market for chlamydia serology tests can also be divided based on who the end consumers are. These tests are mostly used by hospitals and clinics now. Nevertheless, the availability of more trustworthy NAATs has restricted their use. The market for home testing is the other possible area. The development of user-friendly point-of-care (POC) diagnostics may pave the way for chlamydia testing to occur at home, particularly in places where access to medical facilities is limited. It's crucial to remember that the home testing market is still merely a prospective one for the future and perhaps not the biggest or fastest-growing one right now.

Global Serology Tests for Chlamydia Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

When it comes to market share, North America leads the world in chlamydia testing, while Asia-Pacific is growing at the fastest rate because of increased STI awareness and population growth. Europe has a developed market, but with better access to healthcare, South America and the Middle East/Africa could increase. Though they have their commercial niche, serology tests are not the recommended approach. Since they are more accurate at identifying current infections, NAATs are more common. A clearer picture is obtained by breaking down the market by test type (NAATs vs. serology) and geography in addition to end users (hospitals, clinics, etc.).

COVID-19 Impact Analysis on the Global Serology Tests for Chlamydia Market:

The market for chlamydia serology testing has been impacted by the COVID-19 epidemic in two different ways. On the downside, fewer people, especially those who depend on serology tests, may have had chlamydia tests during COVID-19 due to lockdowns and the demand for healthcare resources. Additionally, overworked labs might have limited the availability of even these less popular tests. There might be a bright side, though. Point-of-care (POC) serology tests for chlamydia could be developed and used more quickly because of COVID-19's emphasis on rapid testing. These easy-to-use exams would be helpful in places without adequate infrastructure for healthcare. POC serology testing may become available for chlamydia testing since telehealth and home testing became more popular during COVID-19.

Recent Trends and Developments in the Global Serology Tests for Chlamydia Market:

With recent developments, the limitations of chlamydia serology testing are being addressed. To increase accessibility, researchers are creating quick and easy point-of-care (POC) testing. They are also concentrating on increasing test accuracy by focusing on the chlamydia strain that causes STIs. For a more economical and enlightening method, combination testing strategies that combine serology tests with quicker antigen tests are being investigated. Interest in POC serology tests and other home test kits for chlamydia has increased with the popularity of home testing; nevertheless, regulatory obstacles and additional validation are required. Incorporating home testing kits with POC serology tests into telehealth consultations for sexual health could enhance accessibility, particularly for individuals who may be reluctant to see a doctor in person. These developments indicate that serology tests may eventually carve out a more profitable niche, even if NAATs will probably continue to be the dominant force due to their accuracy.

Key Players:

-

Abbott Laboratories

-

Becton Dickinson and Company (BDX)

-

F. Hoffmann-La Roche Ltd

-

Hologic Inc.

-

Thermo Fisher Scientific Inc

Chapter 1. Serology Tests for Chlamydia Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Serology Tests for Chlamydia Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Serology Tests for Chlamydia Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Serology Tests for Chlamydia Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Serology Tests for Chlamydia Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Serology Tests for Chlamydia Market – By Test Type

6.1 Introduction/Key Findings

6.2 Conventional Serology Tests (ELISA, Immunofluorescence)

6.3 Improved Serology Tests (under development)

6.4 Y-O-Y Growth trend Analysis By Test Type

6.5 Absolute $ Opportunity Analysis By Test Type, 2024-2030

Chapter 7. Serology Tests for Chlamydia Market – By Application

7.1 Introduction/Key Findings

7.2 Stand-alone Testing (limited use)

7.3 Screening Tool for High-Risk Populations

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Serology Tests for Chlamydia Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals and Clinics

8.3 Home Testing Market (potential)

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Serology Tests for Chlamydia Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Test Type

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Test Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Test Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Test Type

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Test Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Serology Tests for Chlamydia Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Abbott Laboratories

10.2 Becton Dickinson and Company (BDX)

10.3 F. Hoffmann-La Roche Ltd

10.4 Hologic Inc.

10.5 Thermo Fisher Scientific Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Serology Tests for Chlamydia Market size is valued at $ 634.7 million in 2023.

The worldwide Global Serology Tests for Chlamydia Market growth is estimated to be 7.8% from 2024 to 2030.

The Global Serology Tests for Chlamydia Market is segmented By Test Type (Conventional Serology Tests (ELISA, Immunofluorescence), Improved Serology Tests (under development)); By Application (Stand-alone Testing (limited use), Screening Tool for High-Risk Populations); By End-User (Hospitals and Clinics, Home Testing Market (potential)) and by region.

Better accuracy, point-of-care testing for faster access, home testing kits, and interaction with telehealth systems could all be features of chlamydia serology tests in the future.

The COVID-19 pandemic most likely had a mixed effect on the market for chlamydia serology tests, possibly decreasing testing rates temporarily but also hastening the development of point-of-care diagnostics in the long run.