Sensors in Healthcare Applications Market Size (2024 – 2030)

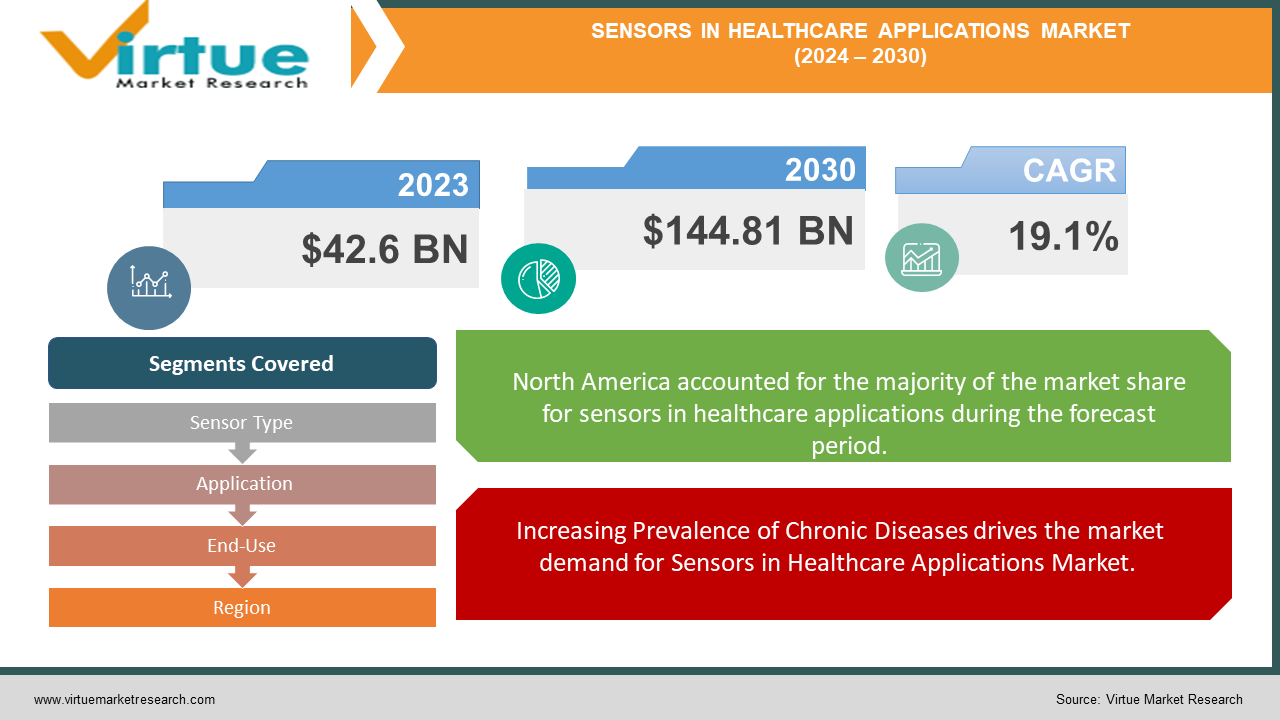

The Global Sensors in Healthcare Applications Market is valued at USD 42.6 Billion and is projected to reach a market size of USD 144.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 19.1%.

A major long-term driver in the sensors in the healthcare applications market is the rise in chronic diseases. Conditions like diabetes, heart disease, and respiratory disorders are becoming more prevalent due to aging populations and lifestyle changes. As a result, there is an increasing need for continuous monitoring solutions, such as glucose sensors, heart rate monitors, and respiratory sensors. These sensors help in tracking patient conditions in real-time, allowing for early detection of health issues and timely intervention.

One key opportunity in the market is the integration of artificial intelligence (AI) and machine learning with sensors in healthcare. AI-powered sensors can analyze large volumes of health data and make predictions about a patient’s condition. For instance, AI can help predict heart attacks by analyzing data from heart rate sensors, or it can assist in detecting early signs of diabetes through continuous glucose monitors. A notable trend in the sensors in healthcare applications market is the move toward non-invasive and minimally invasive technologies. Patients and healthcare providers are increasingly looking for ways to monitor health without causing discomfort or requiring invasive procedures.

Key Market Insights:

Medtronic - United States, GE Healthcare - United States & Siemens Healthineers – Germany are some example of Sensors in Healthcare Applications Market.

North America & Asia Pacific accounts for approximately 75-80 % of the Sensors in Healthcare Applications Market, driven by the Increasing Prevalence of Chronic Diseases, Growing Adoption of Wearable Health Devices, Shift Toward Telemedicine and Remote Monitoring & Technological Advancements in Sensor Development.

Sensors in Healthcare Applications Market Drivers:

Increasing Prevalence of Chronic Diseases drives the market demand for Sensors in Healthcare Applications Market.

One of the most significant drivers is the rising incidence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders. These diseases require continuous monitoring to manage symptoms and prevent complications. Sensors, such as glucose monitors for diabetes patients or heart rate sensors for cardiovascular health, are becoming essential tools in chronic disease management. As more patients and healthcare providers recognize the value of real-time data for proactive healthcare, the demand for sensor-based solutions is steadily increasing.

Growing Adoption of Wearable Health Devices drives the market demand for Sensors in Healthcare Applications Market.

Wearable technology, such as smartwatches, fitness trackers, and health monitoring devices, is another major driver. Consumers are increasingly adopting wearables to monitor their health metrics, including heart rate, physical activity, sleep patterns, and more. These devices are equipped with sensors that continuously track health data, which can be shared with healthcare providers for more personalized care. This trend not only caters to health-conscious consumers but also serves as a preventive healthcare tool, making wearable sensors highly sought after in the market.

Shift Toward Telemedicine and Remote Monitoring drives the market demand for Sensors in Healthcare Applications Market.

The rise of telemedicine and remote patient monitoring has gained significant momentum, especially after the COVID-19 pandemic. With healthcare providers looking for ways to monitor patients outside of traditional clinical settings, sensors have become essential for tracking vital signs like temperature, oxygen levels, and blood pressure remotely. This shift has led to a surge in demand for various types of sensors that can accurately collect and transmit data from patients to doctors, facilitating timely interventions without the need for in-person visits.

Technological Advancements in Sensor Development drives the market demand for Sensors in Healthcare Applications Market.

Rapid advancements in sensor technology, including improvements in accuracy, miniaturization, and integration with AI and machine learning, are propelling market growth. These innovations allow sensors to gather more precise data while being smaller and less invasive. For instance, AI-integrated sensors can analyze vast amounts of data and make predictions about patient health, improving diagnostics and treatment plans. The ongoing evolution of sensor technology continues to push the boundaries of what is possible in healthcare applications, encouraging further adoption across the sector.

Sensors in Healthcare Applications Market Restraints and Challenges:

One of the major challenges in the healthcare sensors market is the high cost associated with advanced sensor technology. Although sensors have become more sophisticated, their development, production, and integration into medical devices are expensive. This cost is often passed on to healthcare providers and, ultimately, patients. In many cases, the high price of sensor-enabled devices makes them inaccessible to smaller healthcare facilities or patients in lower-income regions, limiting the widespread adoption of these technologies.

Sensors in Healthcare Applications Market Opportunities:

One significant opportunity in the sensors in healthcare applications market lies in the growing demand for remote patient monitoring (RPM). As healthcare shifts towards more patient-centric and decentralized care models, the ability to monitor patients in real-time from their homes has become increasingly valuable. Sensors integrated into wearable devices, smart home technologies, or mobile health platforms enable continuous tracking of vital signs such as heart rate, blood pressure, glucose levels, and oxygen saturation.

This opportunity has been amplified by the rise in chronic diseases such as diabetes, cardiovascular conditions, and respiratory illnesses, where ongoing monitoring is critical for effective disease management. The COVID-19 pandemic further accelerated the adoption of remote healthcare solutions, as healthcare systems were overwhelmed, and patients sought to minimize hospital visits. The convenience of RPM allows doctors to adjust treatments and make timely interventions without requiring in-person consultations, offering significant benefits to both patients and healthcare providers.

SENSORS IN HEALTHCARE APPLICATIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.1% |

|

Segments Covered |

By Sensor Type, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medtronic - United States, GE Healthcare - United States, Siemens Healthineers - Germany, Philips Healthcare - Netherlands, Abbott Laboratories - United States, Honeywell International - United States, Texas Instruments - United States, TE Connectivity - Switzerland, STMicroelectronics - Switzerland, Analog Devices - United States, NXP Semiconductors - Netherlands, Smiths Medical - United Kingdom, Omron Corporation - Japan, First Sensor AG - Germany, Sensirion AG - Switzerland, BioTelemetry, Inc. - United States, Renesas Electronics Corporation - Japan, Masimo Corporation - United States, Koninklijke Philips N.V. - Netherlands, Murata Manufacturing Co., Ltd. - Japan |

Sensors in Healthcare Applications Market Segmentation: By Sensor Type

-

Biosensors

-

Temperature Sensors

-

Pressure Sensors

-

Image Sensors

-

Flow Sensors

-

Motion Sensors

-

Humidity Sensors

-

Inertial Sensors

-

Optical Sensors

-

Accelerometers

-

ECG Sensors

-

Others (e.g., Chemical Sensors)

The largest segment of the sensors in healthcare applications market, by sensor type, is the biosensors segment. Biosensors are widely used in diagnostics, patient monitoring, and disease management due to their ability to detect specific biological markers, such as glucose levels in diabetic patients or cardiac biomarkers in cardiovascular diseases. Their application in non-invasive and continuous monitoring systems, including glucose monitoring devices and wearable health monitors, has driven their dominance in the market. The rising prevalence of chronic diseases, along with the growing demand for real-time health data, is pushing the adoption of biosensors across hospitals, home care settings, and wearable technology.

In contrast, wearable sensors represent the fastest-growing segment. The increasing popularity of wearable devices like smartwatches, fitness trackers, and health patches has significantly boosted the demand for these sensors. Wearable sensors offer real-time tracking of vital signs, physical activity, and overall health, making them indispensable in chronic disease management, fitness monitoring, and elderly care. The trend toward telemedicine, coupled with advancements in sensor technology, is further accelerating growth. Their non-invasive nature and ability to offer continuous health insights have made wearable sensors a key driver of innovation in personalized healthcare solutions.

Sensors in Healthcare Applications Market Segmentation: By Application

-

Diagnostic Imaging

-

Patient Monitoring

-

Therapeutics

-

Wearable Devices

-

Surgical Devices

-

Drug Delivery Systems

-

Smart Implants

-

Fitness and Wellness

-

Home Diagnostics

The largest segment of the sensors in healthcare applications market, by application, is patient monitoring. This segment dominates due to the critical need for continuous and real-time monitoring of patients' vital signs, especially in managing chronic conditions such as cardiovascular diseases, diabetes, and respiratory issues. Sensors used in patient monitoring—such as ECG sensors, pressure sensors, and biosensors—enable healthcare professionals to track essential parameters like heart rate, blood pressure, glucose levels, and oxygen saturation. The increasing demand for remote and home-based healthcare solutions, coupled with the rise of telemedicine, has further expanded the reach and significance of patient monitoring applications.

On the other hand, the fastest-growing segment is wearable devices. These applications are witnessing rapid growth due to the surge in consumer demand for health and fitness tracking gadgets like smartwatches, fitness bands, and wearable patches. Wearable sensors monitor physical activity, sleep patterns, heart rate, and more, offering users personalized health data and insights. The increasing focus on preventive healthcare, along with the rising adoption of digital health solutions, is driving the growth of wearable devices in both clinical and consumer markets. Additionally, advancements in sensor technology have made wearables more accurate and multifunctional, further accelerating their adoption in healthcare.

Sensors in Healthcare Applications Market Segmentation: By End-Use

-

Hospitals & Clinics

-

Home Healthcare

-

Ambulatory Care Centers

-

Long-term Care Facilities

-

Research & Academic Institutes

-

Diagnostic Laboratories

The largest segment of the sensors in healthcare applications market, by end-use, is hospitals and clinics. These institutions are the primary users of advanced sensor technologies due to the need for continuous patient monitoring, diagnostics, and therapeutic applications. Hospitals rely on sensors for a wide range of purposes, including vital sign monitoring, imaging, and surgical interventions. Sensors such as biosensors, pressure sensors, and temperature sensors play a critical role in ensuring the accuracy of medical procedures and the effective management of patient health. The growing number of hospital admissions, especially for chronic diseases and surgeries, continues to drive the demand for sensor-based technologies in these settings.

However, the fastest-growing segment is home healthcare. As the trend toward remote patient monitoring and in-home care gains momentum, sensors used in home healthcare—such as wearable devices, biosensors, and portable diagnostic tools—are experiencing rapid growth. The shift towards patient-centric care, the increasing prevalence of chronic diseases, and the rising elderly population are key drivers behind this growth. Home healthcare solutions provide convenience and reduce the need for frequent hospital visits, making them increasingly popular. This shift is further fueled by advancements in telemedicine, enabling patients to manage their health conditions from the comfort of their homes with real-time data provided by sensor-enabled devices.

Sensors in Healthcare Applications Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The largest region in the sensors in healthcare applications market is North America. This dominance is driven by the region's well-established healthcare infrastructure, high healthcare expenditure, and the early adoption of advanced medical technologies. North America, particularly the United States, is a leader in the use of sensor-based devices for diagnostics, patient monitoring, and treatment applications. Factors such as the rising prevalence of chronic diseases, the growing demand for remote healthcare services, and the increasing use of wearable health devices contribute to the region's significant market share. Additionally, the presence of key industry players and strong investment in healthcare innovation further solidify North America's leadership in this market.

The fastest-growing region is the Asia-Pacific. This region is experiencing rapid growth due to factors like the increasing healthcare needs of its large population, rising disposable incomes, and expanding healthcare infrastructure. Countries such as China, India, and Japan are witnessing increased adoption of sensor-based healthcare technologies, driven by the growing demand for accessible and affordable healthcare solutions. Additionally, the rise of chronic diseases, an aging population, and government initiatives to modernize healthcare systems are accelerating the growth of the sensors market in the Asia-Pacific. The region's strong potential for wearable devices and telemedicine further fuels its rapid expansion in the healthcare applications sector.

COVID-19 Impact Analysis on Sensors in Healthcare Applications Market:

The COVID-19 pandemic had a significant impact on the sensors in healthcare applications market, driving accelerated adoption of sensor technologies across the healthcare industry. With the surge in demand for remote patient monitoring, telemedicine, and home healthcare, sensors such as biosensors, temperature sensors, and wearable health devices played a crucial role in managing the pandemic. These technologies enabled continuous monitoring of vital signs, such as temperature, oxygen levels, and heart rate, which were essential in diagnosing and managing COVID-19 patients. The pandemic highlighted the need for real-time health data, prompting hospitals and healthcare providers to adopt advanced sensor-based systems for both inpatient and outpatient care.

Latest Trends/ Developments:

One of the latest trends in the sensors in healthcare applications market is the growing integration of artificial intelligence (AI) and machine learning (ML) with sensor technology. AI-driven algorithms are increasingly being used to analyze the vast amounts of data collected by sensors, enabling more accurate diagnostics and predictive healthcare models. For example, AI-enhanced biosensors can now detect early signs of diseases such as cancer and cardiovascular conditions, while wearable devices equipped with AI offer personalized health insights based on real-time monitoring. This trend is improving decision-making in healthcare, allowing for early intervention and more precise treatment plans.

Key Players:

-

Medtronic - United States

-

GE Healthcare - United States

-

Siemens Healthineers - Germany

-

Philips Healthcare - Netherlands

-

Abbott Laboratories - United States

-

Honeywell International - United States

-

Texas Instruments - United States

-

TE Connectivity - Switzerland

-

STMicroelectronics - Switzerland

-

Analog Devices - United States

-

NXP Semiconductors - Netherlands

-

Smiths Medical - United Kingdom

-

Omron Corporation - Japan

-

First Sensor AG - Germany

-

Sensirion AG - Switzerland

-

BioTelemetry, Inc. - United States

-

Renesas Electronics Corporation - Japan

-

Masimo Corporation - United States

-

Koninklijke Philips N.V. - Netherlands

-

Murata Manufacturing Co., Ltd. - Japan

Chapter 1. Sensors in Healthcare Applications Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sensors in Healthcare Applications Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sensors in Healthcare Applications Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sensors in Healthcare Applications Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sensors in Healthcare Applications Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sensors in Healthcare Applications Market – By Sensor Type

6.1 Introduction/Key Findings

6.2 Biosensors

6.3 Temperature Sensors

6.4 Pressure Sensors

6.5 Image Sensors

6.6 Flow Sensors

6.7 Motion Sensors

6.8 Humidity Sensors

6.9 Inertial Sensors

6.10 Optical Sensors

6.11 Accelerometers

6.12 ECG Sensors

6.13 Others (e.g., Chemical Sensors)

6.14 Y-O-Y Growth trend Analysis By Sensor Type

6.15 Absolute $ Opportunity Analysis By Sensor Type, 2024-2030

Chapter 7. Sensors in Healthcare Applications Market – By Application

7.1 Introduction/Key Findings

7.2 Diagnostic Imaging

7.3 Patient Monitoring

7.4 Therapeutics

7.5 Wearable Devices

7.6 Surgical Devices

7.7 Drug Delivery Systems

7.8 Smart Implants

7.9 Fitness and Wellness

7.10 Home Diagnostics

7.11 Y-O-Y Growth trend Analysis By Application

7.12 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Sensors in Healthcare Applications Market – By End-Use

8.1 Introduction/Key Findings

8.2 Hospitals & Clinics

8.3 Home Healthcare

8.4 Ambulatory Care Centers

8.5 Long-term Care Facilities

8.6 Research & Academic Institutes

8.7 Diagnostic Laboratories

8.8 Y-O-Y Growth trend Analysis By End-Use

8.9 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 9. Sensors in Healthcare Applications Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Sensor Type

9.1.3 By Application

9.1.4 By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Sensor Type

9.2.3 By Application

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Sensor Type

9.3.3 By Application

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Sensor Type

9.4.3 By Application

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Sensor Type

9.5.3 By Application

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Sensors in Healthcare Applications Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Medtronic - United States

10.2 GE Healthcare - United States

10.3 Siemens Healthineers - Germany

10.4 Philips Healthcare - Netherlands

10.5 Abbott Laboratories - United States

10.6 Honeywell International - United States

10.7 Texas Instruments - United States

10.8 TE Connectivity - Switzerland

10.9 STMicroelectronics - Switzerland

10.10 Analog Devices - United States

10.11 NXP Semiconductors - Netherlands

10.12 Smiths Medical - United Kingdom

10.13 Omron Corporation - Japan

10.14 First Sensor AG - Germany

10.15 Sensirion AG - Switzerland

10.16 BioTelemetry, Inc. - United States

10.17 Renesas Electronics Corporation - Japan

10.18 Masimo Corporation - United States

10.19 Koninklijke Philips N.V. - Netherlands

10.20 Murata Manufacturing Co., Ltd. - Japan

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Sensors in Healthcare Applications Market is valued at USD 42.6 Billion and is projected to reach a market size of USD 144.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 19.1%.

Increasing Prevalence of Chronic Diseases, Growing Adoption of Wearable Health Devices, Shift Toward Telemedicine and Remote Monitoring & Technological Advancements in Sensor Development are the major drivers of Sensors in Healthcare Applications Market.

Hospitals & Clinics, Home Healthcare, Ambulatory Care Centers, Long-term Care Facilities, Research & Academic Institutes, and Diagnostic Laboratories are the segments under the Sensors in Healthcare Applications Market by end-user.

North America is the most dominant region for the Sensors in Healthcare Applications Market.

Asia Pacific is the fastest-growing region in the Sensors in Healthcare Applications Market.